Legislation amendments

According to the Central Bank of the Russian Federation as at October 12, 2021, there were registered 225 organizations in the Unified State Register of Insurance Entities. As at October 1, 2016 there were 390 of that kind of organizations.

According to the Central bank of the Russian Federation Decree No. 5885-U dated 16.08.2021 the list of information contained in the Register was expanded. Now, there must be information on:

- insurance companies, mutual insurance companies, insurance brokers;

- members of the mutual insurance companies;

- directors, chief accountants, internal auditors, auditors, actuaries;;

- founders, shareholders and participants who own more than 1% of the votes of the total number of voting shares or equities;

- persons who control or have significant influence over organization;

- branches representative offices and other separate business units;

- foreign insurance organization.

The direction set the time limit for including information in the Register:

- within five business days from the decision date of granting a license;

- no later than one business day from the decision date of granting a license to the foreign insurance organization;

- no later than one business day from the decision date of license reissuance, license exchange, license copy issue, license restriction, license suspension, license renewal, license revocation, provisional administration appointment or its termination.

Information in the Register is to be amended no later than five business days from the date when confirmation of the amendments in the license documents were received.

The Central Bank of the Russian Federation must on a daily basis post on its website on the Internet the information contained in the Register as at the previous business day:

- full corporate name,

- surname, name and patronym (for individual entrepreneurs),

- insurance entity address contained in the Unified State Register of Legal Entities or in the Unified State Register of Individual Entrepreneurs,

- license, is it active, suspended or restricted.

The Central Bank of the Russian Federation is obligated to keep the Register in the electronic form.

The Decree was officially published 28.09.2021 and came into force.

TOP 10 natural gas producers

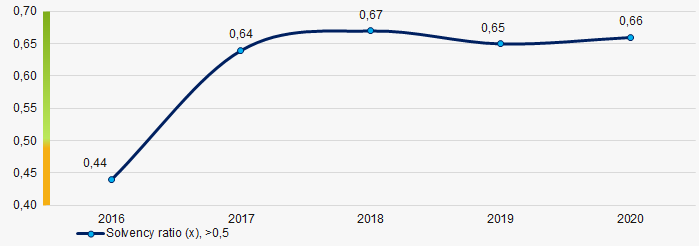

During the energy crisis in Europe, Russia is increasing its foreign gas supplies. Eight of the ten leading gas producing companies in the country are included in Gazprom Group. Analysis of the solvency ratio shows, on average, a low dependence of TOP 10 enterprises on external loans in 2020, with declining revenues and growing profits.

Information agency Credinform has selected for this ranking in Globas the largest Russian producers of natural gas and condensate. Companies with the largest volume of annual revenue (TOP 10) were selected for the ranking, according to the data from the Statistical Register and the Federal Tax Service for the latest available periods (2018 - 2020). They were ranked by solvency ratio (Table 1).

Solvency ratio (х) is calculated by dividing total equity by total assets. Shows the dependence of the company on external loans. The recommended value is >0,5.

The value of the ratio below the minimum one indicates a strong dependence on external sources of funds, which, if the market conditions deteriorate, can lead to a liquidity crisis and an unstable financial position of the company.

For the most complete and objective view of the financial condition of the enterprise, it is necessary to pay attention to the complex of indicators and financial ratios of the company.

| Name, INN, region | Revenue, million RUB | Net profit (loss), million RUB | Solvency ratio (x), >0,5 | Solvency index Globas | |||

| 2019 | 2020 | 2019 | 2020 | 2019 | 2020 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| JSC GAZPROM DOBYCHA TOMSK INN 7019035722 Tomsk region |

42 540 42 540 |

32 891 32 891 |

5 375 5 375 |

4 423 4 423 |

0,67 0,67 |

0,73 0,73 |

253 Medium |

| LLC GAZPROM DOBYCHA ORENBURG INN 5610058025 Orenburg region |

88 019 88 019 |

73 041 73 041 |

1 267 1 267 |

-309 -309 |

0,69 0,69 |

0,68 0,68 |

272 Medium |

| LLC GAZPROM DOBYCHA NOYABRSK INN 8905026850 Yamal-Nenets autonomous district |

62 531 62 531 |

81 025 81 025 |

1 283 1 283 |

4 367 4 367 |

0,22 0,22 |

0,62 0,62 |

237 Strong |

| LLC NOVATEK-YURKHAROVNEFTEGAZ INN 8903021599 Yamal-Nenets autonomous district |

171 960 171 960 |

137 716 137 716 |

4 239 4 239 |

1 930 1 930 |

0,63 0,63 |

0,61 0,61 |

256 Medium |

| JSC SEVERNEFTEGAZPROM INN 8912001990 Yamal-Nenets autonomous district |

51 742 51 742 |

44 073 44 073 |

4 408 4 408 |

5 950 5 950 |

0,68 0,68 |

0,54 0,54 |

157 Superior |

| LLC NOVATEK-TERKOSALENEFTEGAZ INN 8911020768 Yamal-Nenets autonomous district |

113 459 113 459 |

111 813 111 813 |

11 683 11 683 |

7 683 7 683 |

0,57 0,57 |

0,52 0,52 |

203 Strong |

| LLC GAZPROM DOBYCHA URENGOI INN 8904034784 Yamal-Nenets autonomous district |

303 918 303 918 |

270 016 270 016 |

16 322 16 322 |

15 816 15 816 |

0,52 0,52 |

0,49 0,49 |

191 High |

| LLC GAZPROM DOBYCHA NADYM INN 8903019871 Yamal-Nenets autonomous district |

209 533 209 533 |

211 011 211 011 |

2 390 2 390 |

4 777 4 777 |

0,30 0,30 |

0,41 0,41 |

217 Strong |

| LLC GAZPROM DOBYCHA YAMBURG INN 8904034777 Yamal-Nenets autonomous district |

333 793 333 793 |

277 478 277 478 |

1 700 1 700 |

9 021 9 021 |

0,33 0,33 |

0,40 0,40 |

202 Strong |

| LLC GAZPROM DOBYCHA ASTRAKHAN INN 3006006420 Astrakhan region |

94 612 94 612 |

78 928 78 928 |

982 982 |

237 237 |

0,37 0,37 |

0,35 0,35 |

281 Medium |

| Average value for TOP 10 |  147 211 147 211 |

131 799 131 799 |

4 965 4 965 |

5 390 5 390 |

0,50 0,50 |

0,54 0,54 |

|

| Industry average value (oil and gas extraction) |  15 939 15 939 |

10 749 10 749 |

2 421 2 421 |

1 798 1 798 |

0,65 0,65 |

0,66 0,66 |

|

growth of indicator to the previous period,

growth of indicator to the previous period,  fall of indicator to the previous period

fall of indicator to the previous period

The average 2020 value of solvency ratio of TOP 10 was above the industry average one. Six of TOP 10 companies had decrease in 2020, while in 2019 the decrease was recorded for four companies.

Two of ten companies gained revenue and four ones gained net profit in 2020.

The decrease in average revenue was 10%, and there was 33% fall of the industry average value.

The average profit of TOP 10 have increased almost 9%. However, on average in the industry, the decrease was recorded by almost 26%.

The industry average values of solvency ratio have raised for three periods during the past 5 years. The highest value was recorded in 2018 and the lowest one was in 2016 (Picture 1).

Picture 1. Change in the average values of solvency ratio of natural gas producers in 2016 - 2020

Picture 1. Change in the average values of solvency ratio of natural gas producers in 2016 - 2020