Equity turnover ratio of the largest Russian manufacturers of computers, electronic and optical products

Information agency Credinform offers a ranking of the largest Russian manufacturers of computers, electronic and optical products. The companies with the largest volume of annual revenue (TOP-10) were selected for the ranking, according to the data from the Statistical Register for the latest available periods (for 2016 and 2015). Then they were ranked by equity turnover ratio (Table 1). The analysis is based on data of the Information and Analytical system Globas.

Equity turnover ratio (times) is calculated as a relation of revenue to annual average sum of equity and demonstrates the company’s usage rate of all available assets.

Equity turnover ratio reflects the turnover rate of own capital. The high value of this indicator shows the effectiveness of use of own funds. Accordingly, low ratio value shows inaction of the part of own funds.

The experts of the Information agency Credinform, taking into account the actual situation both in the economy as a whole and in sectors, has developed and implemented in the Information and Analytical system Globas the calculation of practical values of financial ratios that can be recognized as normal for a particular industry. For manufacturers of computers, electronic and optical products the practical value of the equity turnover ratio was from 2,04 in 2016.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention to all combination of indicators and financial ratios.

| Name, INN, region | Revenue, mln RUB | Net profit, mln RUB | Equity turnover ratio, times | Solvency index Globas | |||

| 2015 | 2016 | 2015 | 2016 | 2015 | 2016 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| LLC PK AKVARIUS INN 7701256405 Moscow |

5 877,2 | 9 491,4 | 312,1 | 223,5 | 7,22 | 8,97 | 194 High |

| JSC GAZPROM AVTOMATIZATSIYA INN 7704028125 Moscow |

23 437,9 | 18 074,4 | 155,2 | 175,9 | 9,26 | 6,71 | 209 Strong |

| JSC KOMZ INN 1660004229 The Republic of Tatarstan |

4 225,3 | 9 314,6 | 500,4 | 1 512,0 | 9,13 | 6,33 | 157 Superior |

| JSC NITEL INN 5261001745 Nizhniy Novgorod region |

6 229,1 | 7 931,0 | 639,6 | 655,3 | 3,64 | 3,68 | 153 Superior |

| LLC Technological company SHLYUMBERZHE INN 7709413265 Tyumen region |

25 260,8 | 21 617,3 | 1 847,2 | -3 617,4 | 3,18 | 3,06 | 246 Strong |

| JSC Arzamas instrument-making plant named after Landin INN 5243001742 Nizhniy Novgorod region |

6 858,9 | 9 182,0 | 349,4 | 394,2 | 2,49 | 3,00 | 185 High |

| JSC PLANT KRASNOYE ZNAMYA INN 6229004711 Ryazan region |

7 780,2 | 8 713,4 | 784,6 | 806,9 | 2,89 | 2,34 | 205 Strong |

| JSC Kaluga-based instrument making plant TYPHOON INN 4026005699 Kaluga region |

3 829,3 | 7 928,2 | 531,7 | 468,4 | 1,10 | 2,01 | 199 High |

| LLC SAMSUNG ELECTRONICS RUS KALUGA INN 4025413896 Kaluga region |

45 112,0 | 47 654,9 | 2 740,2 | 6 363,7 | 1,50 | 1,37 | 197 High |

| LLC VLV INN 3906123832 Kaliningrad region |

3 725,6 | 6 865,2 | -8,6 | -17,1 | -718,33 | -380,45 | 331 Adequate |

| Total for TOP-10 companies | 132 336,4 | 146 772,4 | 7 851,9 | 6 965,5 | |||

| verage industrial value for TOP-10 companies | 13 233,6 | 14 677,2 | 785,2 | 696,5 | -67,79 | -34,30 | |

| Average industrial value | 284,6 | 226,0 | 9,0 | 18,2 | 2,19 | 2,04 | |

The average indicator of the equity turnover ratio of TOP-10 companies in 2016 is below the average industrial value. Four from TOP-10 enterprises have increased in 2015 — 2016 the indicators of revenue and net profit compared to the previous period (marked with green color in columns 2 — 5 of the Table 1). Other companies either have decreased their indicators of profit or have got loss (marked with red filling in columns 2 — 5 of the Table 1).

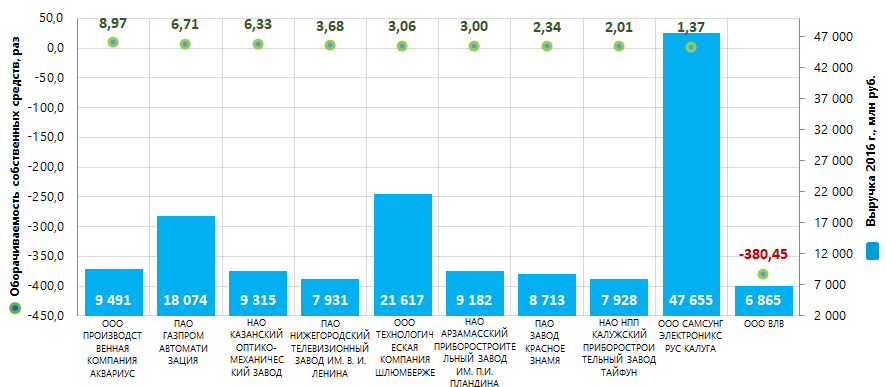

Picture 1. Equity turnover ratio and revenue of the largest Russian manufacturers of computers, electronic and optical products (TOP-10)

Picture 1. Equity turnover ratio and revenue of the largest Russian manufacturers of computers, electronic and optical products (TOP-10)The industry average values of the equity turnover ratio were above the practical value of 2016 with decreasing tendency over the past ten years (Picture 2).

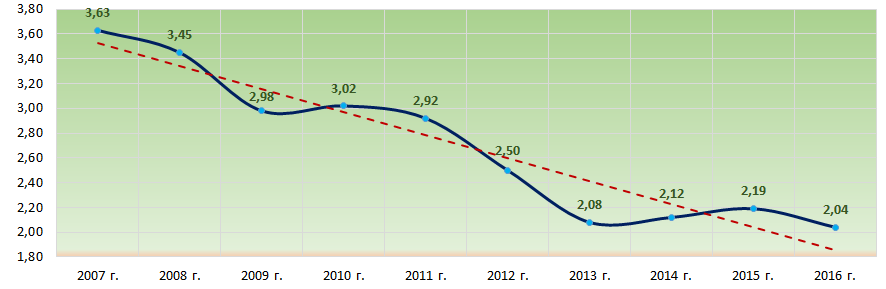

Picture 2. Change in the average industry values of the equity turnover ratio of largest Russian manufacturers of computers, electronic and optical products (in 2007 — 2016)

Picture 2. Change in the average industry values of the equity turnover ratio of largest Russian manufacturers of computers, electronic and optical products (in 2007 — 2016)Nine out of TOP-10 companies have got from strong to superior solvency index Globas , that demonstrates their ability to repay their debt obligations in time and fully.

LLC VLV has got adequate solvency index Globas, because of loss andnon-compliance of indicators of liquidity and financial stability to normal recommended values. The forecast for index development is stable.

Trends in activity of the largest companies of the Moscow region real economy

Information Agency Credinform presents a review of trends in activity of the largest companies of the Moscow region real economy.

The enterprises with the highest volume of annual revenue (TOP-10 and TOP-1000) within the non-financial sector of the Moscow region have been selected for the ranking, according to the data from the Statistical Register for the latest available accounting periods (2014-2016). the analysis was based on the data from the Information and Analytical system Globas.

Net assets

It is an indicator of fair value of corporate assets that is calculated annually as assets on balance less company’s liabilities. Net assets value is negative (insufficiency of property) if liabilities are larger than the assets.

| No. in TOP-1000 | Name | Net asset value, billion RUB* | Solvency index Globas | ||

| 2014 | 2015 | 2016 | |||

| 1. | GAZPROM INTERREGIONGAS LLC Wholesale of solid, liquid and gaseous fuel |

407,3 | 449,6 | 575,7 | 215 Strong |

| 2. | T PLUS PJSC Production of electric power |

122,8 | 125,5 | 145,6 | 205 Strong |

| 3. | MARS LLC Production of chocolate and sugar confectionery |

66,3 | 81,0 | 82,7 | 183 Superior |

| 4. | AUCHAN LLC Retail sale of mostly food products |

43,6 | 51,2 | 59,5 | 237 Strong |

| 5. | MACHINE-BUILDING PLANT PJSC Nuclear fuel production |

32,9 | 40,0 | 44,9 | 147 Superior |

| 996. | MULTIFLEX NJSC Production of plastic packaging |

-1,3 | -2,8 | -5,1 | 320 Adequate |

| 997. | EURASIA M4 JOINT VENTURE NJSC Leasing and management of own or rented non-residential real estate |

-5,4 | -9,2 | -9,0 | 256 Medium |

| 998. | KASHIRSKI MALL NJSC Leasing and management of own or rented non-residential real estate |

-7,6 | -14,0 | -10,1 | 267 Medium |

| 999. | CROCUS INTERNATIONAL NJSC Leasing and management of own or rented non-residential real estate |

-13,5 | -26,3 | -11,8 | 213 Strong |

| 1000. | FORD SOLLERS HOLDING LLC Production of motor vehicles |

5,5 | 4,0 | -19,2 | 334 Adequate |

*) – growth or decline values compared to prior period are highlighted green and red respectively in columns 4 and 5.

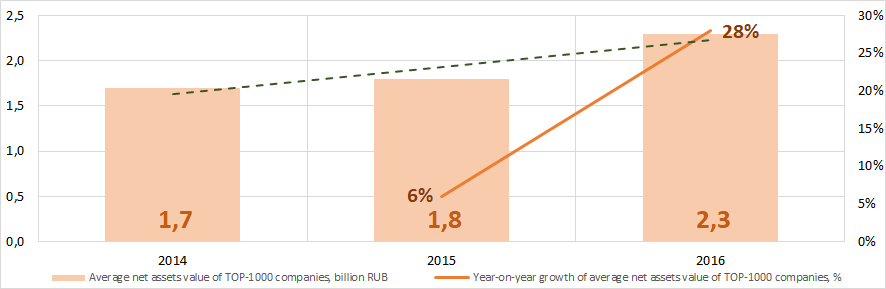

Picture 1. Change in average net asset value of the largest real economy companies of Moscow region in 2014 – 2016

Picture 1. Change in average net asset value of the largest real economy companies of Moscow region in 2014 – 2016Sales revenue

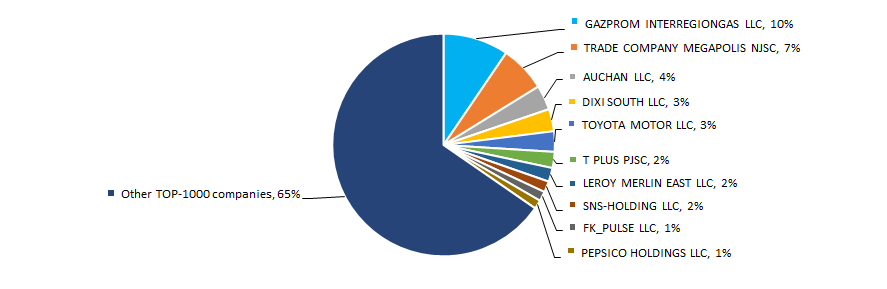

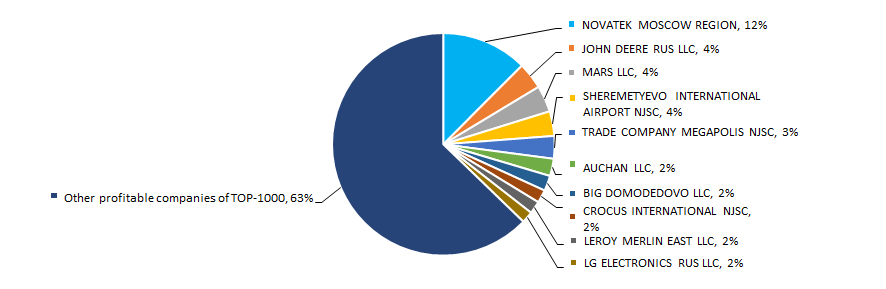

In 2016 sales revenue of 10 industry leaders within the real economy of Moscow region amounted to 35% of total revenue of TOP-1000 companies (Picture 2).

Picture 2. TOP-10 by their share in 2016 total revenue of TOP-1000 companies

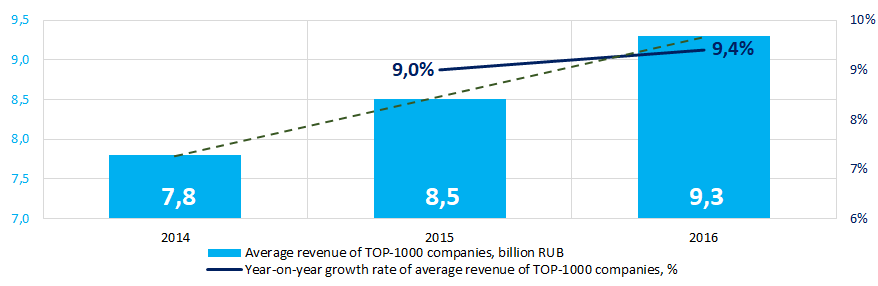

Picture 2. TOP-10 by their share in 2016 total revenue of TOP-1000 companiesRevenue volume tends to increase (Picture 3).

Picture 3. Change in average revenue of real economy companies of Moscow region in 2014– 2016

Picture 3. Change in average revenue of real economy companies of Moscow region in 2014– 2016Profit and loss

In 2016 profit of 10 industry leaders of real economy in Moscow region amounted to 37% of total profit of TOP-1000 companies (Picture 4).

Picture 4. TOP-10 companies by their share in 2016 total profit of TOP-1000 companies

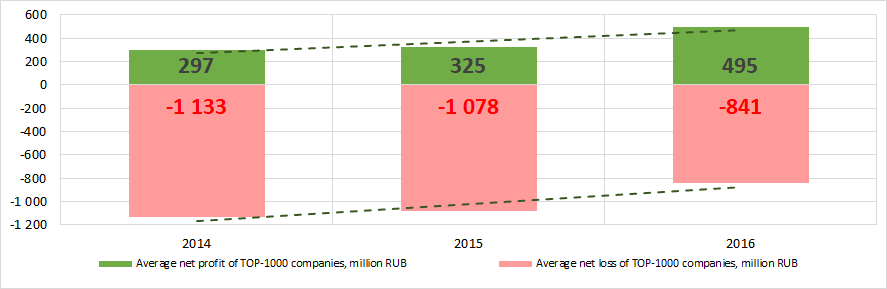

Picture 4. TOP-10 companies by their share in 2016 total profit of TOP-1000 companiesAverage profit values of TOP-1000 companies for three years tend to increase, and average loss value is decreasing (Picture 5).

Picture 5. Change in average profit and loss of the largest real economy companies of Moscow region in 2014 – 2016

Picture 5. Change in average profit and loss of the largest real economy companies of Moscow region in 2014 – 2016Key financial ratios

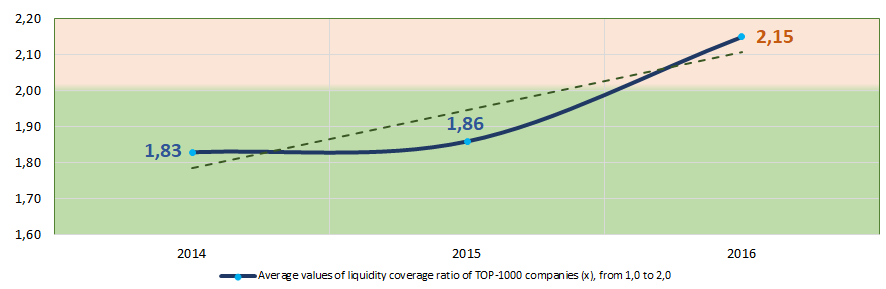

During 2014 – 2016 average values of liquidity coverage ratio of TOP-1000 companies were higher or within the recommended value – from 1,0 to 2,0 (Picture 6).

Liquidity coverage ratio (a ratio of current assets to current liabilities) reveals the sufficiency of a company’s funds for meeting its short-term liabilities.

Picture 6. Change in average values of liquidity coverage ratio of real economy companies of Moscow region in 2014 – 2016

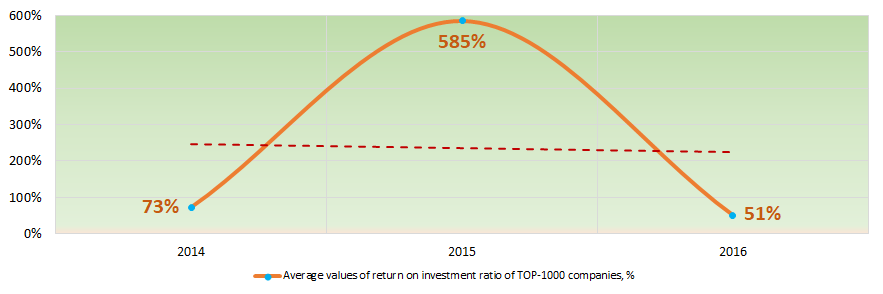

Picture 6. Change in average values of liquidity coverage ratio of real economy companies of Moscow region in 2014 – 2016The return on investment ratio was not stable during these three years, tending to decrease (Picture 7). It is a ratio of net profit to shareholders’ equity and noncurrent liabilities, and it demonstrates benefit from shareholders’ equity engaged in business activity and long-term raised funds of the company.

Picture 7. Change in average values of return on investment ratio of real economy companies of Moscow region in 2014 – 2016

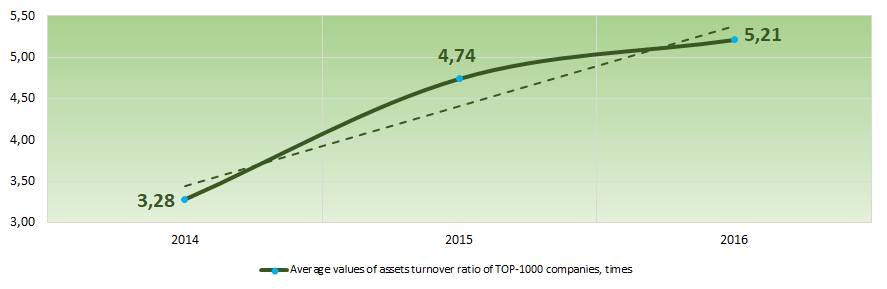

Picture 7. Change in average values of return on investment ratio of real economy companies of Moscow region in 2014 – 2016Assets turnover ratio is a ratio of sales revenue to average total assets for the period, and measures resource efficiency regardless of the sources. the ratio indicates the number of profit-bearing complete production and distribution cycles per annum.

During three years, this activity ratio tended to increase in general (Picture 8).

Picture 8. Change in average values of assets turnover ratio of the largest real economy companies of Moscow region in 2014 – 2016

Picture 8. Change in average values of assets turnover ratio of the largest real economy companies of Moscow region in 2014 – 2016Structure of production and services

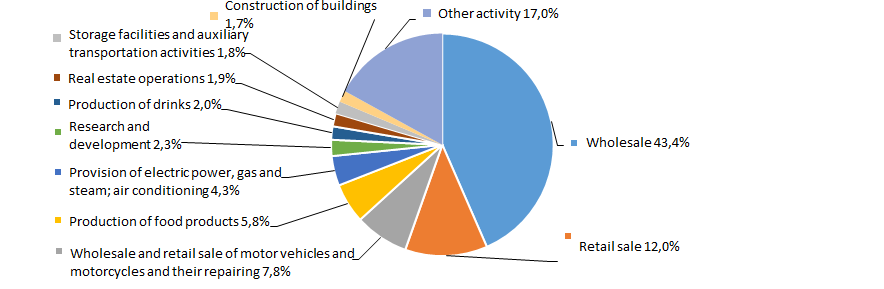

Wholesale and retail trade companies have the largest share in total revenue of TOP-1000 companies (Picture 9).

Picture 9. Types of activity by their share in total revenue of TOP-1000, %

Picture 9. Types of activity by their share in total revenue of TOP-1000, %Financial position score

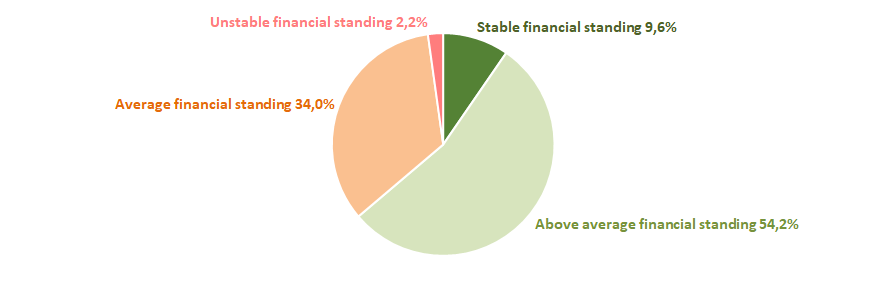

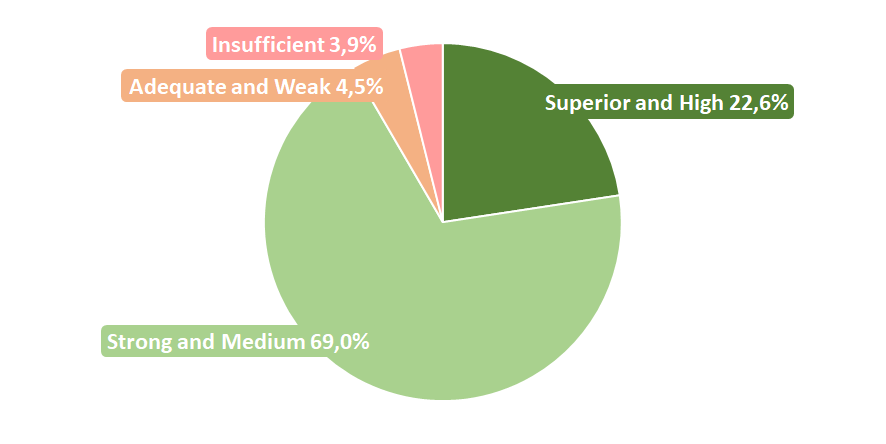

Assessment of financial state of TOP-1000 companies indicates that over a half of the companies have an above average financial standing (Picture 10).

Picture 10. TOP-1000 companies by their financial position score

Picture 10. TOP-1000 companies by their financial position scoreSolvency index Globas

The most of TOP-1000 companies have got a superior, high, strong and medium Solvency index Globas, that indicates their capability to meet liabilities timely and in full (Picture 11).

Picture 11. TOP-1000 companies by Solvency index Globas

Picture 11. TOP-1000 companies by Solvency index GlobasTherefore, a comprehensive assessment of the largest real economy companies of Moscow region that considers key indexes, financial figures and ratios, is indicative of positive trends in the sector.