The Bank of Russia will be obliged to transfer to the budget 75% of its net profit

Within the mobilization of additional income sources to the country’s budget, the Government of the RF introduced a draft bill in the State Duma of the RF, which obliges the Bank of Russia (CB of the RF) to transfer 75% of its net profit to the government revenues on a regular basis.

Today a norm, prescribed in the federal law about the CB of the RF, sets the size of assignments to the budget in the amount of 50% of net profit of the regulator for a financial year, however, it is suspended till the 1st of January 2016. In spite of 50% the CB of the RF has to transfer 75% of revenue, remaining after payment of tax and duties, at year-end 2013 and 2014.

Earlier the proposed bill was passed by the Government Commission for Legislative Drafting Activities.

According to the annual accounts of the Bank of Russia, the revenue of the CB made 129,3 bln RUB at year-end 2013, against 247,3 bln RUB in 2012. Now therefore, the CB of the RF reduced the profit more than in 1,9 times in the previous year. It is worth emphasizing, that in 2012 the sale of shares of Sberbank (the Savings Bank of the RF) had an positive effect on proceeds of the CB, which allowed it to raise additional incomes on the financial market in the amount of 149,7 bln RUB.

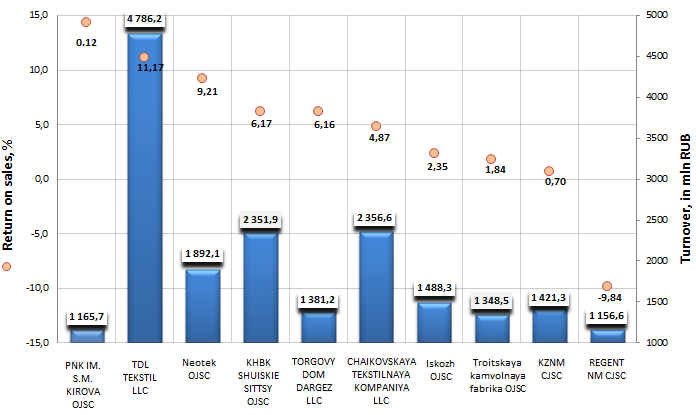

Return on sales of textile enterprises

Information agency Credinform offers to get acquainted with the ranking of Russian textile enterprises. The companies with the highest volume of revenue involved in this activity were selected by the experts according to the data from the Statistical Register for the latest available period (for the year 2012). Then, the first 10 enterprises selected by turnover were ranked by decrease in return on sales ratio.

Return on sales ratio (the relation of operating income (before-tax income) to turnover) is an indicator of the pricing policy of a company and presents its ability to monitor its costs. Negative value of the ratio testifies that expenses of an enterprise exceed revenues from sales of products, what is an unfavorable trend.

Recommended or specified values are not determined for the mentioned ratio, because the indicator varies strongly depending on the branch, where each concrete enterprise conducts business. The company should be assessed relying on industry-average indicators.

| № | Name, INN | Region | Turnover for 2012, in mln RUB | Return on sales, % | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | PRYADILNO-NITOCHNY KOMBINAT IM. S.M. KIROVA OJSC INN 7825666563 |

Saint-Petersburg | 1166 | 14,32 | 206 (high) |

| 2 | TDL TEKSTIL LLC INN 3730010504 |

Ivanovo region | 4786 | 11,17 | 196 (the highest) |

| 3 | Neotek OJSC INN 7736600070 |

Moscow | 1892 | 9,21 | 287 (high) |

| 4 | KHLOPCHATOBUMAZHNY KOMBINAT SHUISKIE SITTSY OJSC INN 3706008060 |

Ivanovo region | 2352 | 6,17 | 288 (high) |

| 5 | TORGOVY DOM DARGEZ LLC INN 7706406478 |

Moscow | 1381 | 6,16 | 215 (high) |

| 6 | CHAIKOVSKAYA TEKSTILNAYA KOMPANIYA LLC INN 5920015180 |

Perm territory | 2357 | 4,87 | 225 (high) |

| 7 | Neftekamskoe proizvodstvennoe ob’edinenie iskusstvennyh kozh OJSC INN 264005146 |

Republic of Bashkortostan | 1488 | 2,35 | 226 (high) |

| 8 | Troitskaya kamvolnaya fabrika OJSC INN 5046005770 |

Moscow | 1348 | 1,84 | 234 (high) |

| 9 | Kotovskii zavod netkanyh materialov CJSC INN 6820028830 |

Tambov region | 1421 | 0,7 | 229 (high) |

| 10 | REGENT NETKANYE MATERIALY CJSC INN 7722508646 |

Moscow | 1157 | -9,84 | 335 (satisfactory) |

Basing on obtained results among ten the largest enterprises, it can be drawn a conclusion about high enough profitability of textile manufacture in Russia. Thuswise eight companies from TOP-10 list have the value of the return on sales ratio being above 1.

Return on sales of textile enterprises in Russia, TOP-10

The lead in the ranking was taken by PRYADILNO-NITOCHNY KOMBINAT IM. S.M. KIROVA OJSC (14,32%) and TDL TEKSTIL LLC (11,17%). Both enterprises showed the value of the return on sales above 10%, consequently, more than 10% of revenue is accounted for by profit on sales of these organizations, what can be considered as a good result. The company TDL TEKSTIL LLC is also the largest one on turnover in the branch following the results of the year 2012.

REGENT NETKANYE MATERIALY CJSC is the only one from TOP-10 the largest companies, which showed a negative value of the return on sales, what testifies to surplus costs. According to the combination of financial and non-financial indicators, the enterprise got a satisfactory solvency index GLOBAS-i®, what points to that it cannot pay off its loan liabilities in time and fully.

Now therefore, for the retention of market stability and the assurance of opportunities for further development the enterprises should pay more attention to the return on sales, as well as manage their liability structure more efficiently.

See also: Return on sales of travel agencies