Receivables turnover of housing and utility enterprises

Information agency Credinform has prepared the ranking of housing and utility enterprises in Russia.

Companies with the highest volume of revenue were selected for this ranking according to the data from the Statistical Register for the latest available period (2014). The enterprises were ranked by increase in receivables turnover ratio (Table 1).

Receivables turnover is a proportion of the average short- and long-term receivables for the period to sales revenue. It shows the average number of days required for debt recovery. The less is the number, the faster receivables turn to the monetary funds, therefore, liquidity of working capital increases. The ratio shows the efficiency of resources usage by the enterprise by taking the time factor into account.

For the most comprehensive and fair view on the company’s financial condition it is necessary to pay attention not only to the average values in the industry, but also to the whole presented set of financial indicators and ratios of the enterprise.

| № | Name, INN | Region | Revenue 2013, th RUB | Revenue 2014, th RUB | Revenue 2014 to 2013, % | Inventory turnover, days | Solvency index Globas-i |

|---|---|---|---|---|---|---|---|

| 1 | TSN YASHMA (Partnership of real estate owners) INN 5246030332 |

Nizhny Novgorod region | 2 521 214 | 2 739 081 | 109 | 0,06 | 305 Satisfactory |

| 2 | TSZH DOM NA TRUBNIKOVSKOM (Housing cooperative) INN 7704243740 |

Moscow | 6 195 270 | 6 926 446 | 112 | 30,22 | 186 The highest |

| 3 | PAO HOUSING MAINTENANCE OFFICE OF THE YUZHNOE BUTOVO DISTRICT INN 7727702615 |

Moscow | 2 611 630 | 2 560 126 | 98 | 52,86 | 224 High |

| 4 | STATE UNITARY MOSCOW ENTERPRISE ON OPERATION OF HIGH-ALTITUDE AND RESIDENTIAL BUILDINGS INN 7704010270 |

Moscow | 2 728 064 | 2 772 019 | 102 | 65,05 | 250 High |

| 5 | LLC MUNICIPAL MANAGING COMPANY – KRASNODAR INN 2311104687 |

Krasnodar territory | 3 892 295 | 3 834 603 | 99 | 74,82 | 255 High |

| 6 | LLC DEAPRTMRNT OF HOUSING AND PUBLIC UTILITIES OF TOLYATTI INN 6321300279 |

Samara region | 1 166 379 | 2 909 506 | 249 | 87,58 | 298 High |

| 7 | PAO LYUBERTSY MUNICIPAL HOUSING TRUST INN 5027130207 |

Moscow region | 2 608 416 | 2 635 383 | 101 | 97,51 | 178 The highest |

| 8 | LLC PIC-KOMFORT INN 7701208190 |

Moscow | 2 980 475 | 3 448 666 | 116 | 99,90 | 250 High |

| 9 | LLC ADMINISTRATION OF HOUSING AND PUBLIC UTILITIES OF PETROPAVLOVSK-KAMCHATSKY INN 4101122429 |

Kamchatka territory | 4 910 727 | 4 500 547 | 92 | 117,15 | 345 Satisfactory |

| 10 | LLC ZHILSERVIS INN 4202047190 |

Kemerovo region | - | 4 720 676 | - | - | 340 Satisfactory |

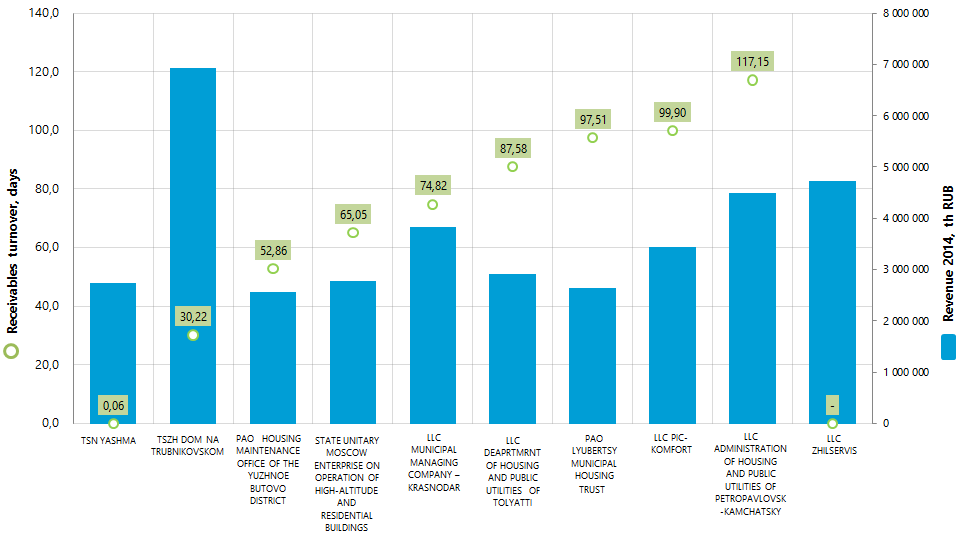

Receivables turnover of the largest housing and utility enterprises (TOP-10) varies from 0,06 days (TSN YASHMA) to 117,15 days (LLC ADMINISTRATION OF HOUSING AND PUBLIC UTILITIES OF PETROPAVLOVSK-KAMCHATSKY ). There was no calculation of index for LLC ZHILSERVIS because of the fact that the company was founded in 2014 and there are no financial accounts for the previous periods.

Picture 1. Revenue and receivables turnover of the largest housing and utility enterprises (TOP-10)

Annual revenue of the TOP-10 market leaders according to the data of financial account for the latest period (2014) was more than 37 bln RUB, that is 9% higher than in the previous period (among comparable range of enterprises).

Receivables turnover of the market leader according to revenue TSZH DOM NA TRUBNIKOVSKOM is 30,22 days. At that, the average value in the industry is 253,4 days. Consequently, all TOP-10 enterprises have values much less than the average value in the industry that is characteristic of the most powerful enterprises in the meaning of resources usage of taking the time factor into account.

7 participants of the TOP-10 list have got the highest and high solvency index Globas-i, that shows the ability to pay the debts in time and to the full extent, risk of non-fulfillment is minimal.

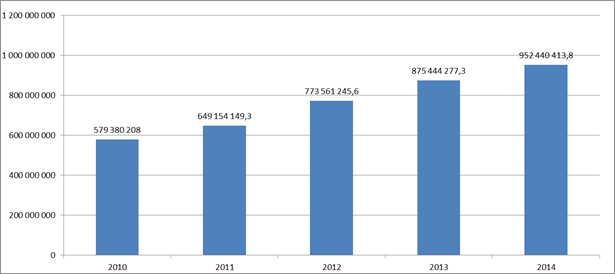

Totally in the housing and utilities service industry growing of problems is observed, connected with increase in receivables. For example, from 2010 to 2014, according to the Federal State Statistics Service (Rosstat), value of this index has grown in one and a half. (Picture 2).

Picture 2. Receivables turnover of the Russian organizations providing housing and utility services according to Rosstat (th RUB)

Technology parks in Russia: to be or not?

Innovations today are the most important factor in formation of the national competitiveness. Innovativeness is a feature of developed economies. Therefore, the establishment of a national innovation and investment sector should be on one of the first places among the methods of increasing the economic development of the state. First of all, the formation of such a system helps the innovative projects to be implemented and found by customers. For this purpose structures, contributing to a more close cooperation between science and industry were created in Russia: industrial, industrial and technology parks, innovation and technology centers and innovation-industrial complex.

Among the tools allowing the import substitution, as well as localizing production, increasing non-raw material export of the domestic economy, the Russian government considers industrial technology parks (technoparks). Under the technoparks the property complex combining the industry facilities, business centers, exhibition sites and corresponding industry are meant. Since the main objective of the technopark is to develop and introduce new technologies into production, it must include a scientific and research basis, which is based on scientific and research institutes and educational institutions. Perhaps that is why the first technopark in Russia were opened in all university cities.

Innovation and technology centers (ITC) are also connected with the technoparks. They were opened on the basis of industrial enterprises to ensure communication of small business and industry. Their main feature is maintenance of established small innovative enterprises that have passed the difficult stage of creation, formation and survival in the initial period of their activity. Significant support was provided by the state. Later, there was an interlacing of these types of infrastructures and further development led to the formation of innovative-industrial complexes (IIC). ITC differs from IIC by the scale of production.

The practice has shown that a greater effect is achieved when the parks are created at the industrial enterprises. They are called industrial parks (IP). According to preliminary estimates, total industrial output of industrial parks residents exceeded 480 billion RUB (following the results of 2015). The IP is a production facility managed by a professional management company and developed under a single concept. The concept is in selection of production areas and premises size and format according to certain task groups of tenants, as well as in specialization of individual parts or the entire facility with any branch of industry.

IP attractiveness is caused by the following factors:

- ability to form a stable industrial relations in the territory of the IP;

- "single window" principle while cooperation with enterprises of the park and flexible approach to the definition of the contract conditions;

- lease of land, buildings and facilities with the possibility of buy-out in the future;

- •rent reduction for companies investing in repair of rented buildings and facilities;

- services of infrastructure companies: energy and water supply, security and landscaping;

- information and consulting services, assistance in the implementation of R&D, training and retraining, assistance in finding investment and obtaining credits;

- subsidies from the state allow borrowing at 5% per annum for the subjects of the state, creating parks;

- return of a part of the tax payments for residents of technology parks allows to reimburse the cost of creating industrial parks infrastructure;

- VAT exemption of goods manufactured not in Russia, for example, on import of components and raw materials for production of medicines, etc.

Realizing the economic benefits, the regional authorities are interested in the creation of technoparks in their territories. For example, the Far Eastern federal district plans to launch 7 technoparks, Crimea and Sevastopol plan 4. According to the Ministry of industry and trade, 49 industrial parks and 22 industrial technoparks will be created up to 2020. It is expected that the annual total volume of industrial production will increase by 312 billion RUB.

Currently, the Russian Government approved the support for 15 new industrial technoparks. Projects in woodworking, metallurgy, transport and agricultural machinery, machine tools, pharmaceutical will be launched on their territories. 4,2 billion RUB will be allocated as a support.

Reference Information:

- industrial parks in Russia, total - 78

- industrial enterprises in them, belonging to foreigners from 25 countries - 205

- transfers to the budgets of all levels - about 40 billion RUB

- industrial technoparks - 16

- companies located on their territories - 930

- industry sectors: biotechnology and new materials, laser technology, mechanical engineering, medical industry, tool-making, chemical industry, electronics

- engineering centers - 30