New instrument to recover debts by Banks

The problem with the return of debts of legal and natural persons has prospects to be solved already in the near future. For fighting against debtors the banks resorted extensively to the services of collection agencies for some time ago, for what they were criticized by their customers and attracted the attention of law enforcement bodies. In case of default on obligations or their improper performance by a debtor the parties concerned went to court.

The ability to use extrajudicial procedure of the recovery of money or the reclamation of property from a debtor by creditors (banks) is prescribed by «Fundamentals of legislation of the Russian on notaries» approved by the Supreme Court of the RF on February 11, 1993 under № 4462-1 (ed. from 30.03.2015) and by the Federal Law № 229-FZ from October 2, 2007 «On Enforcement Proceedings» (ed. from 29.06.2015).

In particular, art. 89 of «Fundamentals of Legislation on notaries» points that in case of default an agreement by a pledger on the recovery proceedings against mortgaged property without judicial procedure a notary performs the executive inscription on the pledge agreement or, if the rights of the pledger are certified by a mortgage, the executive inscription is made on the mortgage. In its turn, art. 78 of the Enforcement Law states that a court bailiff can exempt and sell property or transfer it to the claimant on the basis of the executive inscription of a notary.

With the entry into force of the Federal Law №360-FZ from July 3, 2016 «On Amendments to Certain Legislative Acts of the Russian Federation» the opportunity appeared to use more extensively the extrajudicial procedure of the recovery of money and mortgaged property on mortgage agreements concluded before the 7th of March 2012, the basis of which is the executive inscription of a notary. Essentially, the executive inscription of a notary is a way of the enforced collection of indubitable debt extrajudicially without going to court.

In addition, the current legislation does not prescribe any priorities of enforcement documents on a court or executive inscription of a notary. Enforcement proceedings on executive inscriptions of notaries is initiated and carried out per standard procedure.

Most of all the use of the new instrument will affect the activity of collectors, because if before the banks have passed them debts, but now for the repayment of debts banks have got a simple effective instrument convenient for them. In debt repayment cases, it is sufficient for banks to indicate the appropriate item in a contract. In case of the two-month delay it is necessary to get the executive inscription by a notary and, by-passing a court, just go to bailiffs, being charged with appropriate functions for collection on executive inscriptions.

The fact that a bailiff performs the task to return the debt by force is available in the Information and analytical system Globas-i. These data come into the system from the databases of the Federal Bailiff Service, where a bailiff is obliged to make entry of information needed to perform tasks on compulsory execution of judicial acts, acts of other bodies and officials (art. 6.1 of the Federal Law «On Enforcement Proceedings»). Also such information should come from the Federal Register of information about the facts of activity of legal persons, because a debtor is obliged to give notice to creditors on the levy of execution upon his/her property by entering of information about the levy of execution upon such property into the mentioned register.

Allowance order of non-recoverable arrears in payments to the budget

On June, 2016 in our publication we have already discussed the topic of responsibility for accounting mistakes, that is directly associated with accuracy of statutory payments discharge to the budget and possible occurrence of arrears in payments

In this case it is worth mentioning that allowance of payments non-recoverable is regulated by the article 47.2 of the Budget Code of the RF. Non-paid within the established period payments can be considered as non-recoverable in the following cases:

- death or declaration of death of a payer – physical person;

- bankruptcy of a payer – individual entrepreneur – in part of debt because of property insufficiency of a debtor;

- liquidation of an organization – in part of debt because of property insufficiency of a company or disability to pay the debt by founders or participants of a company;

- court decision on expiration of the established period on debt collection including refuse from revival of an expired period of application to the court on debt collection;

- resolution on the termination of enforcement proceedings and on return of an implementing document to a plaintiff. Such rule works if it has been more than 5 years since the date of debt creation, also in cases when debt amount does not exceed requirements to a debtor. The same concerns cases of return of bankruptcy notices by the court or termination of bankruptcy proceedings because of insufficiency of money for compensation of legal expenses for carrying out this procedure.

Debts on administrative fines can be considered non-recoverable at the end of the established by the Government period of execution of a punishment by an administrative procedure (this regulation will come into force since January 1, 2017).

Decision on allowance of debt non-recoverable is taken by an administrator of revenue of the budget based on documents approving above mentioned circumstances.

By the order of the Federal Tax Service of Russia of 15.08.2016 №СА-7-8/438@ the procedure of making decisions on allowance of debt non-recoverable to the budget systems of the RF was approved. The order is registered in the Ministry of Justice of Russia on 19.10.2016 №44088.

By the order the list of documents is defined, that is reason to take a decision on allowance of debt non-recoverable. Also debt considering and preparation decision of Commission on receipt and retirement of assets, founded in a regional tax authority, procedures are established. Corresponding enactment on allowance of debt non-recoverable is approved by a head of tax authority and directed to a subdivision of tax authority – administrator of revenue of the budget.

For information

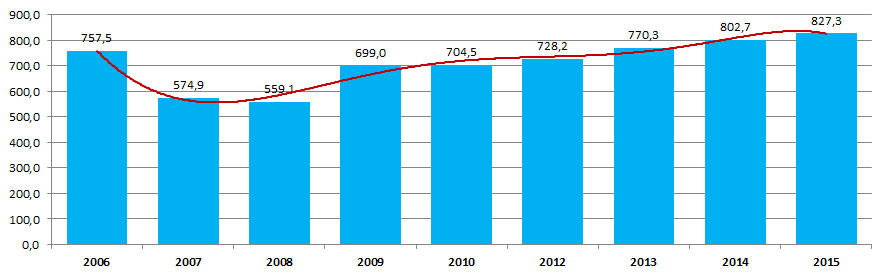

According to the data of the Federal Tax Service of Russia, debt on tax and fees, fines and tax sanctions to the budget system of the RF in nominal terms is growing since 2009 (Picture 1).

*-) data for 2011 are not presented in original source

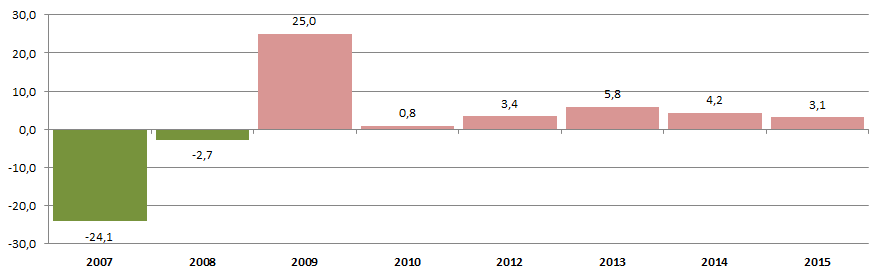

Besides, lately the tendency of decrease in the debt growth is observed. (Picture 2).

*-) data for 2011 are not presented in original source

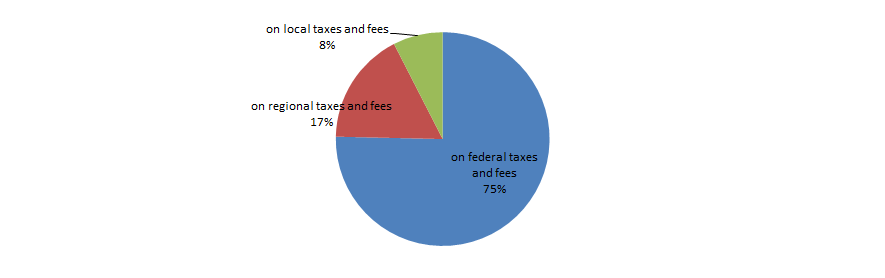

Debt to the federal budget takes the largest part (Picture 3).

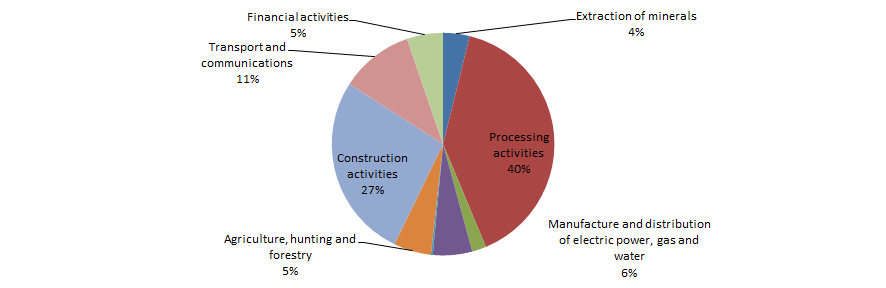

In the industry section the largest part takes debt of processing industry enterprises (Picture 4).