Legislative changes

New amendments of the Tax Code of the Russian Federation came into force in April of this year. The amendments has significantly increased penalties for refusal to provide documentation at the request of supervisory authorities outside framework of tax audits.

As explained in the Federal Tax Service of the Russian Federation, until 2021, taxpayers were held liable under Article 129.1 of the Tax Code of the Russian Federation "Unlawful failure to report information to a tax authority" in case of refusal to provide documents on transactions in absence of a tax audit. Administrative fines in the amount of 5 thousand rubles were imposed in such cases.

However, with the changes adopted by the Federal law No. 6-FZ dated 17.02.2021, in paragraph 2 of article 93.1 Tax Code of the Russian Federation "Request of documents (information) on taxpayer, fee payer, insurance payer and tax agent or information about specific transactions," it became possible to prosecute under article 126 of the Tax Code "Failure to provide a tax authority with information necessary for implementation of tax control" for failure to submit documents on transactions, regardless of a tax audit. This article implies a 200 rubles fine for each document that was not submitted.

A package of transaction documentation may include: contract, accounts, invoices, payment documents, acts of rendering services or work performed and other types of documentation. Their total number, depending on the size and duration of the transaction, can be several dozen. Thus, such penalties can also multiply increase.

Information about tax violations of counterparties is available to the users of the Information and Analytical system Globas in "Taxes and fees" section of a company report.

TOP 1000 of the largest companies in Chelyabinsk

Information agency Credinform represents a review of activity trends among the companies in Chelyabinsk.

The largest companies with the highest annual revenue (TOP 1000) were selected for the ranking, according to the data from the Statistical Register and the Federal Tax Service for the latest available periods (2016 – 2020). The selection and analysis of companies were based on the data of the Information and Analytical system Globas.

Net assets are total assets less total liabilities. This indicator reflects the real value of the property of an enterprise. When the company’s debt exceeds the value of its property, the indicator is considered negative (insufficiency of property).

The largest company in term of net assets is JSC CHELYABINSK METALLURGICAL PLANT, INN 7450001007, production of cast iron, steel and ferroalloys. n 2020, net assets value of the company exceeded 54 billion RUB.

The lowest net assets value among TOP 1000 belonged to LLC OTELSTROY, INN 7451264986, activities of hotels and other places for temporary residence. In 2020, insufficiency of property of the enterprise was indicated in negative value of -1,7 billion RUB.

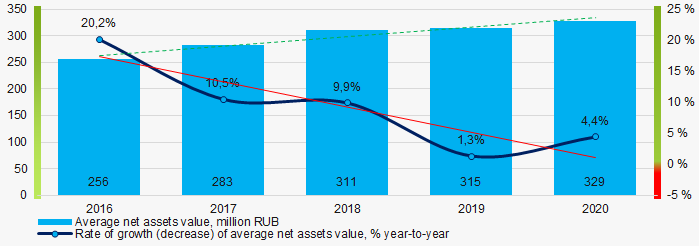

Covering the five-year period, the average net assets values of TOP 100 have a trend to increase with the decreasing growth rate (Picture 1).

Picture 1. Change in average net assets values in 2016 – 2020

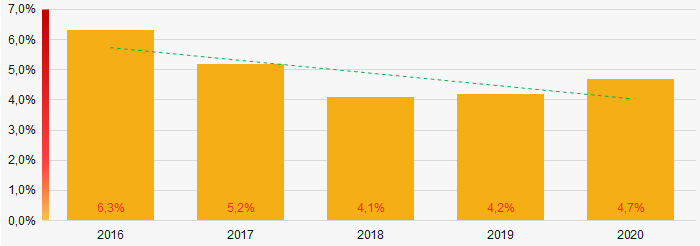

Picture 1. Change in average net assets values in 2016 – 2020Over the past five years, the share of companies with insufficient property had a positive trend to decrease (Picture 2).

Picture 2. Shares of TOP 1000 companies with negative net assets value in 2016-2020

Picture 2. Shares of TOP 1000 companies with negative net assets value in 2016-2020Sales revenue

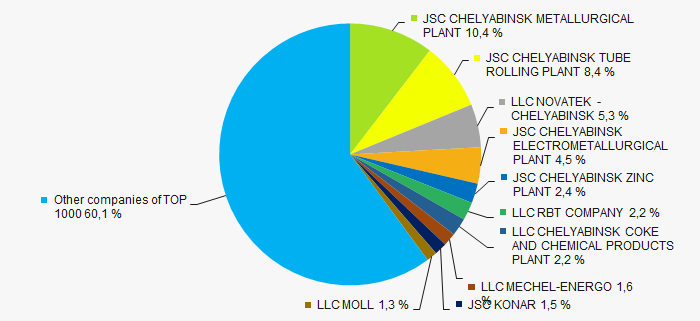

In 2020, the revenue volume of ten largest companies was about 40% of total TOP 1000 revenue (Picture 3). This is indicative of a relatively high level of capital concentration among companies in Chelyabinsk.

Picture 3. The share of TOP 10 companies in total 2020 revenue of TOP 1000

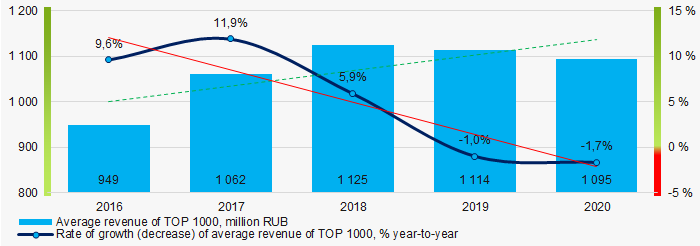

Picture 3. The share of TOP 10 companies in total 2020 revenue of TOP 1000 In general, there is a trend to increase in revenue with the decreasing growth rate (Picture 4).

Picture 4. Change in average revenue in 2016 – 2020

Picture 4. Change in average revenue in 2016 – 2020Profit and loss

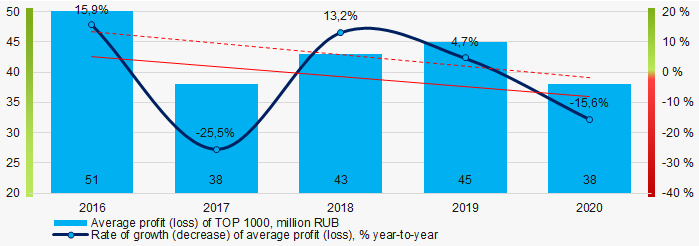

In 2020, the largest organization in term of profit was JSC CHELYABINSK TUBE ROLLING PLANT, INN 7449006730, production of steel pipes, hollow sections and fittings. The company’s profit almost exceeded 24 billion RUB. Covering the five-year period, there is a trend to decrease in average net profit and growth rate (Picture 5).

Picture 5. Change in average profit (loss) values of TOP 1000 in 2016 – 2020

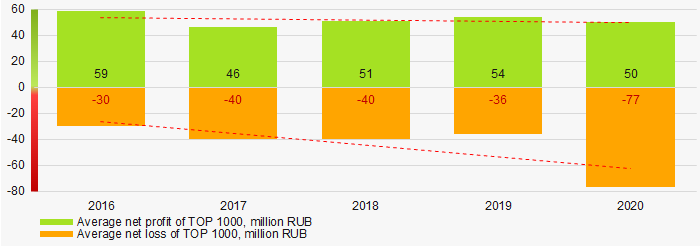

Picture 5. Change in average profit (loss) values of TOP 1000 in 2016 – 2020For the five-year period, the average profit of TOP 1000 have the decreasing trend with the increasing net loss (Picture 6).

Picture 6. Change in average net profit and net loss of ТОP 1000 in 2016 - 2020

Picture 6. Change in average net profit and net loss of ТОP 1000 in 2016 - 2020Key financial ratios

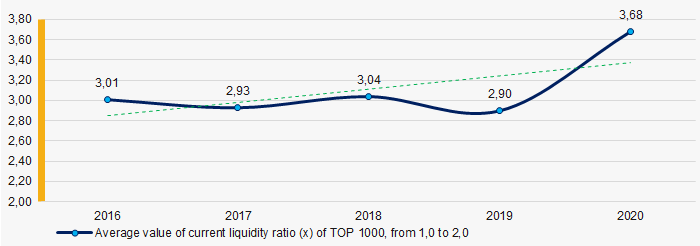

Covering the five-year period, the average values of the current liquidity ratio were above the recommended one - from 1,0 to 2,0 with a trend to increase (Picture 7).

Current liquidity ratio (current assets to short-term liabilities) shows the sufficiency of company’s assets to repay on short-term liabilities.

Picture 7. Change in industry average values of current liquidity ratio of TOP 1000 in 2016 – 2020

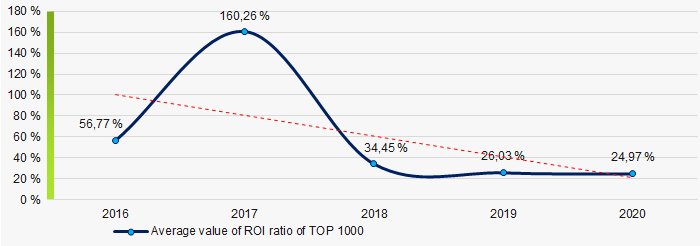

Picture 7. Change in industry average values of current liquidity ratio of TOP 1000 in 2016 – 2020Covering the five-year period, the average values of ROI ratio had a trend to decrease (Picture 8).

ROI ratio is calculated as net profit to sum of shareholders equity and long-term liabilities, and shows the return of equity involved in commercial activities and long-term borrowed funds.

Picture 8. Change in industry average values of ROI ratio of TOP 1000 in 2016 - 2020

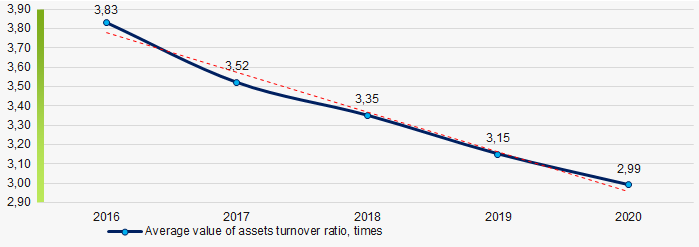

Picture 8. Change in industry average values of ROI ratio of TOP 1000 in 2016 - 2020Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

Covering the five-year period, business activity ratio demonstrated the decreasing trend (Picture 9).

Picture 9. Change in average values of assets turnover ratio of TOP 1000 in 2016 – 2020

Picture 9. Change in average values of assets turnover ratio of TOP 1000 in 2016 – 2020Small business

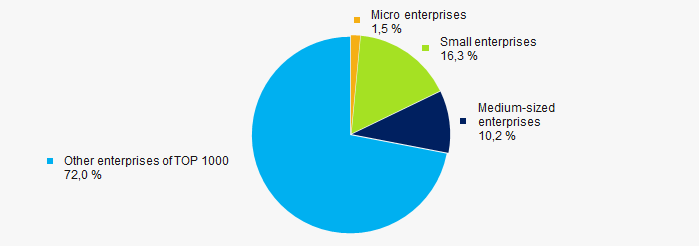

84% of companies of TOP 1000 are registered in the Register of small and medium-sized enterprises of the Federal Tax Service of the Russian Federation. In 2020, their share in total revenue of TOP 1000 is 28%, higher than the average country values in 2018-2019 (Picture 10).

Picture 10. Shares of small and medium-sized enterprises in TOP 1000

Picture 10. Shares of small and medium-sized enterprises in TOP 1000Financial position score

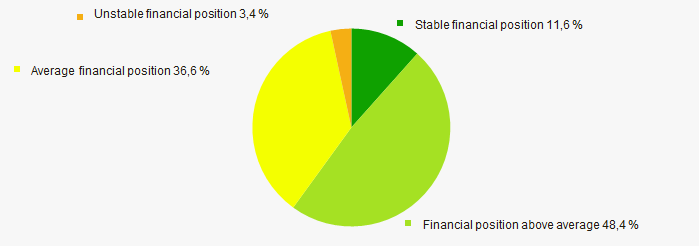

Assessment of the financial position of TOP 1000 companies shows that the financial position of the majority of them is above average (Picture 11).

Picture 11. Distribution of TOP 1000 companies by financial position score

Picture 11. Distribution of TOP 1000 companies by financial position scoreSolvency index Globas

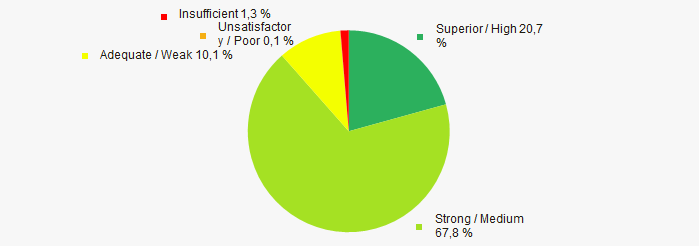

Most of TOP 1000 companies got Superior / High and Strong / Medium indexes Globas. This fact shows their limited ability to meet their obligations fully (Picture 12).

Picture 12. Distribution of TOP 1000 companies by solvency index Globas

Picture 12. Distribution of TOP 1000 companies by solvency index GlobasConclusion

Complex assessment of activity of largest companies in Chelyabinsk, taking into account the main indexes, financial ratios and indicators, demonstrates the prevalence of negative trends in their activities in 2016 - 2020 (Table 1).

| Trends and evaluation factors | Relative share of factors, % |

| Dynamics of the average net assets value |  10 10 |

| Rate of growth (decrease) in the average size of net assets |  -10 -10 |

| Increase (decrease) in the share of enterprises with negative values of net assets |  10 10 |

| Level of competition / monopolization |  -5 -5 |

| Dynamics of the average revenue |  10 10 |

| Rate of growth (decrease) in the average size of revenue |  -10 -10 |

| Dynamics of the average profit (loss) |  -10 -10 |

| Rate of growth (decrease) in the average profit (loss) |  -10 -10 |

| Growth / decline in average values of companies’ net profit |  -10 -10 |

| Growth / decline in average values of companies’ net loss |  -10 -10 |

| Increase / decrease in average values of total liquidity ratio |  5 5 |

| Increase / decrease in average values of return on investment ratio |  -10 -10 |

| Increase / decrease in average values of asset turnover ratio, times |  -10 -10 |

| Share of small and medium-sized businesses in terms of revenue being more than 20% |  10 10 |

| Financial position (the largest share) |  10 10 |

| Solvency index Globas (the largest share) |  10 10 |

| Average value of relative share of factors |  -1,3 -1,3 |

positive trend (factor),

positive trend (factor),  negative trend (factor)

negative trend (factor)