Trends in cast iron, steel and ferroalloys production

Information agency Credinform represents an overview of trends in the field of cast iron, steel and ferroalloys production.

Enterprises with the largest volume of annual revenue (TOP-10 and TOP-500) were selected for the analysis, according to the data from the Statistical Register for the latest available periods (for 2015 and 2016). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Legal forms and unreliable data

The most spread legal form of enterprises in the industry is a limited liability company. Public joint-stock companies and Non-public joint-stock companies also make a significant part. (Picture 1).

Picture 1. Distribution of TOP-500 companies by legal forms

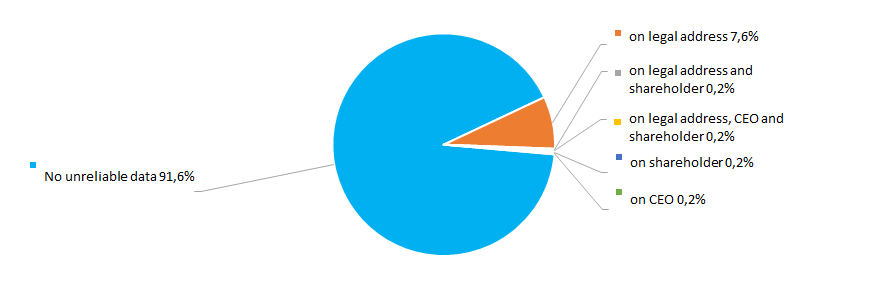

Picture 1. Distribution of TOP-500 companies by legal formsAccording to the results of investigation of the Federal Tax Service of the RF, 8,4% of companies in the industry have records of unreliable data entered into the Unified State Register of Legal Entities. (Picture 2).

Picture 2. Shares of TOP-500 companies, having records of unreliable data in the Unified State Register of Legal Entities

Picture 2. Shares of TOP-500 companies, having records of unreliable data in the Unified State Register of Legal EntitiesSales revenue

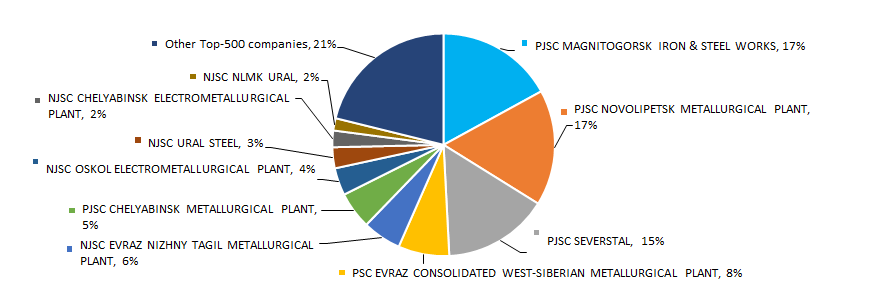

The revenue of 10 industry leaders made 79% of the total revenue of 500 the largest companies in 2016. It points to a sufficiently high level of competition in the industry. PJSC Magnitogorsk Iron & Steel Works became the largest company in terms of revenue in 2016 (Picture 3).

Picture 3. Shares of participation of TOP-10 enterprises in the total revenue of TOP-500 companies for 2016

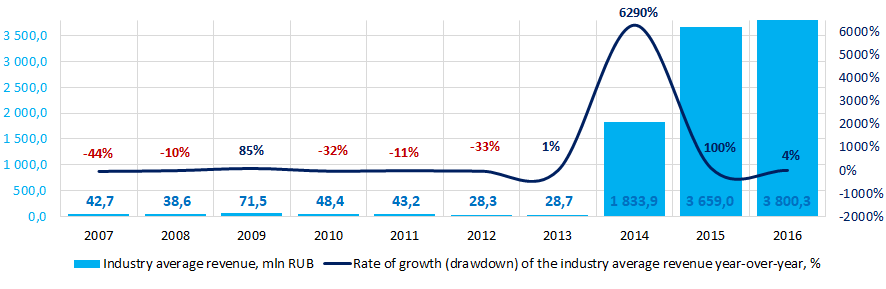

Picture 3. Shares of participation of TOP-10 enterprises in the total revenue of TOP-500 companies for 2016The best results in the industry in terms of revenue for the ten-year period were achieved in 2016. During the crisis periods in the economy in 2007 -2008 and 2010-2012 there was a decline in the industry average indicators. (Picture 4).

Picture 4. Change in the industry average indicators of revenue of companies in the field of cast iron, steel and ferroalloys production in 2007 – 2016

Picture 4. Change in the industry average indicators of revenue of companies in the field of cast iron, steel and ferroalloys production in 2007 – 2016Profit and loss

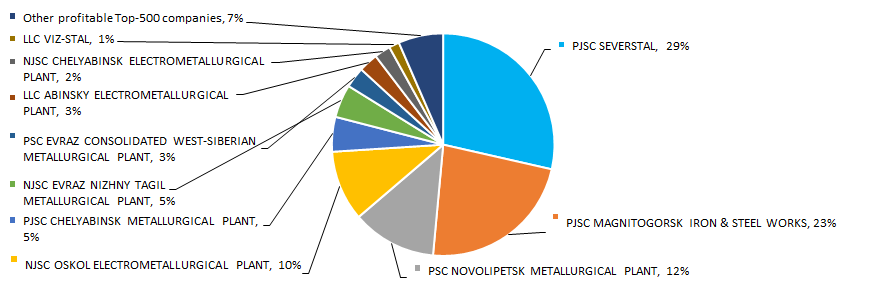

The volume of profit of 10 industry leaders made 93% of the total profit of TOP-500 companies in 2016. The leading position in terms of profit volume in 2016 is taken by PJSC SEVERSTAL (Picture 5).

РPicture 5. Shares of participation of TOP-10 enterprises in the total volume of profit of TOP-500 companies for 2016

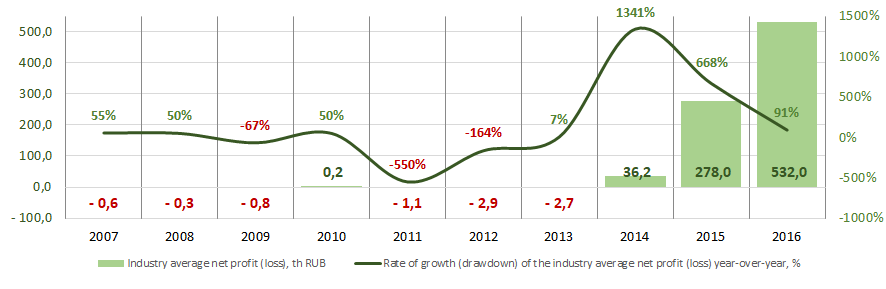

РPicture 5. Shares of participation of TOP-10 enterprises in the total volume of profit of TOP-500 companies for 2016Industry average values of the profit indicators of companies in the industry for the ten-year period are not stable. Decrease in indicators was observed in 2007 - 2009, 2011 - 2013 against the background of crisis phenomena in the economy. In recent years, there has been a significant growth in indicators, which correlates with revenue figures. The industry showed the best results in 2016 (Picture 6).

Picture 6. Change in the industry average indicators of profit of companies in the field of cast iron, steel and ferroalloys production in 2007 – 2016

Picture 6. Change in the industry average indicators of profit of companies in the field of cast iron, steel and ferroalloys production in 2007 – 2016There were 128 loss-making enterprises observed in 2015 among TOP-500 companies. In 2016 their number increased to 115 or by 10%. At the same time, the average size of their loss increased by 52%. For the rest of TOP-500 companies the average profit margin increased by 53% for the same period (Picture 7).

Picture 7. Number of loss-making companies, average value of loss and profit of TOP-500 enterprises in 2015 – 2016

Picture 7. Number of loss-making companies, average value of loss and profit of TOP-500 enterprises in 2015 – 2016Key financial ratios

Over the ten-year period the average industry indicators of the total liquidity ratio were during 8 years below the interval of recommended values – from 1,0 to 2,0. (marked in yellow in the Picture 8).

The total liquidity ratio (the relation of the amount of current assets to short-term liabilities) shows the sufficiency of company’s funds for repayment of its short-term liabilities.

Solvency ratio (the relation of the amount of own capital to the balance sum) shows the company's dependence on external borrowings. Recommended value is > 0.5. The value of the ratio below the minimum value means a strong dependence on external sources of funds’ receipt.

The experts of the Information agency Credinform, taking into account the actual situation both in the economy as a whole and in sectors, has developed and implemented in the Information and analytical system Globas the calculation of practical values of financial ratios that can be recognized as normal for a particular industry. For companies in the field of the extraction of cast iron, steel and ferroalloys production the practical value of the solvency ratio is from 0 to 0,61 in 2016.

Over the ten-year period the industry average indicators of the ratio were below the recommended value and in the range of practical values, except for the period from 2011 to 2013, when negative values were observed (Picture 8).

However, starting from 2014, the figures of both coefficients has improved significantly.

Picture 8. Change in the industry average values of the total liquidity and solvency ratios of companies in the field of cast iron, steel and ferroalloys production in 2007 – 2016

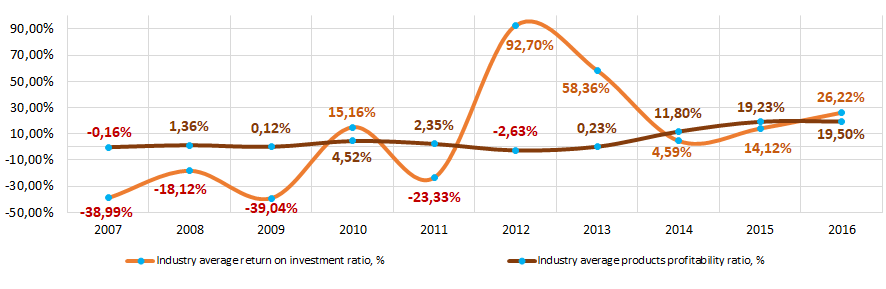

Picture 8. Change in the industry average values of the total liquidity and solvency ratios of companies in the field of cast iron, steel and ferroalloys production in 2007 – 2016For the last ten years, the instability of return on investment ratio was observed. In periods of crisis phenomena in the economy (from 2007 to 2009 and in 2011), the indicators decreased up to negative values (Picture 9). The ratio is calculated as the relation of net profit to the sum of own capital and long-term liabilities and demonstrates the return on the equity involved in the commercial activity and the long-term borrowed funds of an organization.

Within the same period the products profitability ratio was rather stable (Picture 9). The highest indicators were since 2014. The ratio is calculated as the relation of profit from sales to expenses for ordinary activity. In general, profitability reflects the economic efficiency of production.

Picture 9. Change in the industry average values of the return on investment and products profitability ratios of companies in the field of cast iron, steel and ferroalloys production in 2007 – 2016

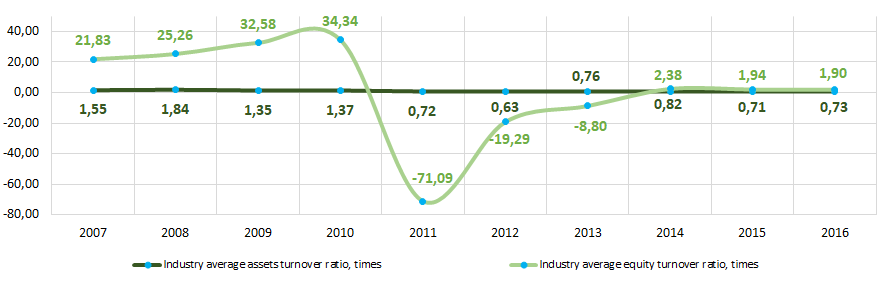

Picture 9. Change in the industry average values of the return on investment and products profitability ratios of companies in the field of cast iron, steel and ferroalloys production in 2007 – 2016Indicators of the asset turnover ratio over a ten-year period demonstrate trend to decline (Picture 10).

Asset turnover ratio is calculated as the relation of sales proceeds to the average value of total assets for a period and characterizes the efficiency of use of all available resources, regardless of the sources of their attraction. The coefficient shows how many times a year a complete cycle of production and circulation is made, yielding profit.

Equity turnover ratio is calculated as the relation of revenue to average annual amount of equity and shows the intensity of use of the whole part of assets.

There is a significant decrease in the indicators of this ratio since 2011 (Picture 10).

Picture 10. Change in the industry average values of the activity ratios of companies in the field of cast iron, steel and ferroalloys production in 2007 – 2016

Picture 10. Change in the industry average values of the activity ratios of companies in the field of cast iron, steel and ferroalloys production in 2007 – 2016Production structure

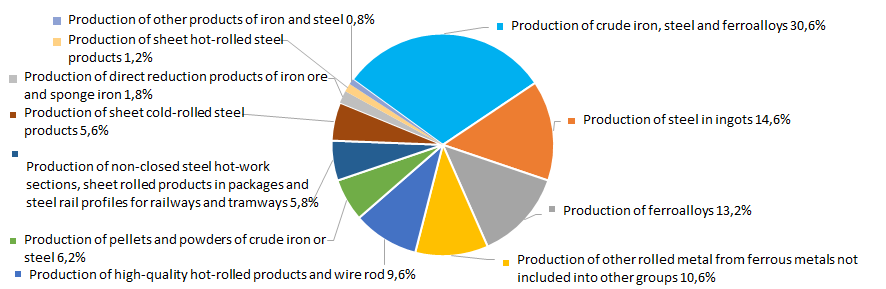

A third of companies in the TOP-500 have a broad specialization in cast iron, steel and ferroalloys production (Picture 11).

Picture 11. Distribution of TOP-500 companies by types of output

Picture 11. Distribution of TOP-500 companies by types of outputDynamics of business activity

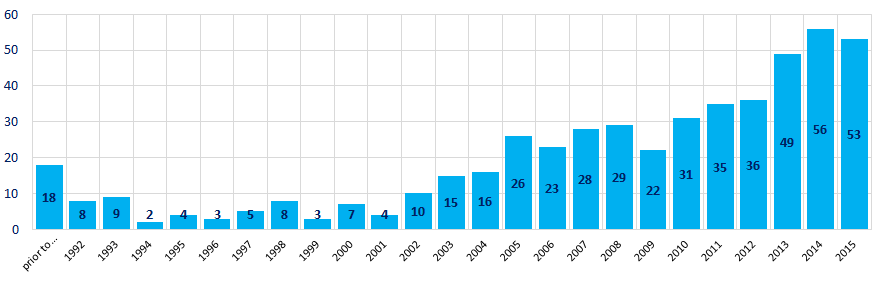

Over the 25-year period, the registered companies from TOP-500 list are unequally distributed by the year of foundation. The largest number of enterprises in the industry was established in 2014 (Picture 12).

Picture 12. Distribution of TOP-500 companies by years of their foundation

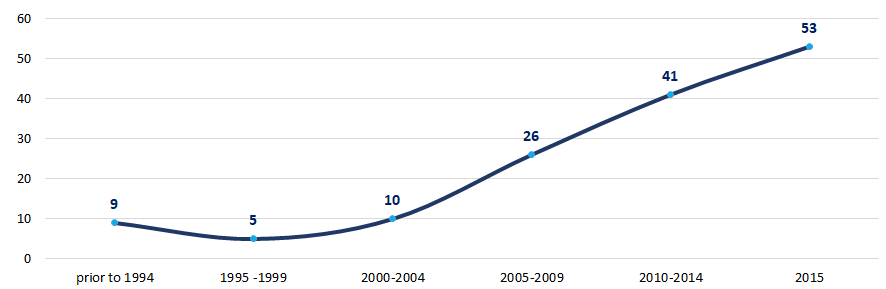

Picture 12. Distribution of TOP-500 companies by years of their foundationBusiness took the greatest interest to cast iron, steel and ferroalloys production in the period after 2010. (Picture 13).

Picture 13. Average number of TOP-500 companies registered within the year, by periods of their foundation

Picture 13. Average number of TOP-500 companies registered within the year, by periods of their foundationMain regions of activity

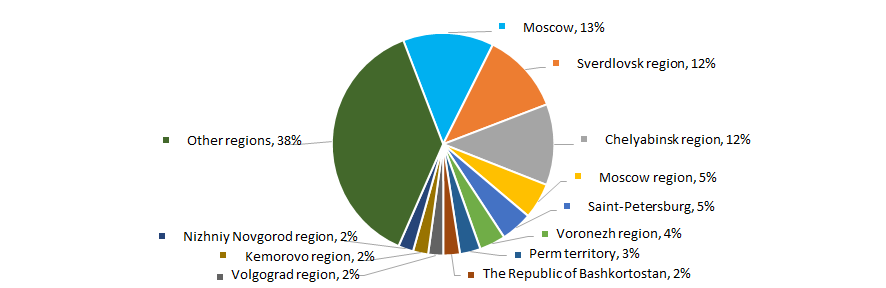

The companies of the industry are unequally distributed across the country. Their largest number is registered in Moscow, Sverdlovsk and Chelyabinsk regions (Picture 14). On one hand, this may be connected with the tendency to register head offices of companies in the country's largest financial center. On the other hand, Sverdlovsk and Chelyabinsk are regions with a historically established foundry infrastructure.

TOP-500 companies are registered in 60 regions of Russia.

Picture 14. Distribution of TOP-500 companies by regions of Russia

Picture 14. Distribution of TOP-500 companies by regions of RussiaThe great majority of companies in the industry is concentrated in the Central Federal District of the country (Picture 15).

Picture 15. Distribution of TOP-500 companies by federal districts of Russia

Picture 15. Distribution of TOP-500 companies by federal districts of RussiaThe share of companies with branches or representative offices from TOP-500 enterprises is 6,6%.

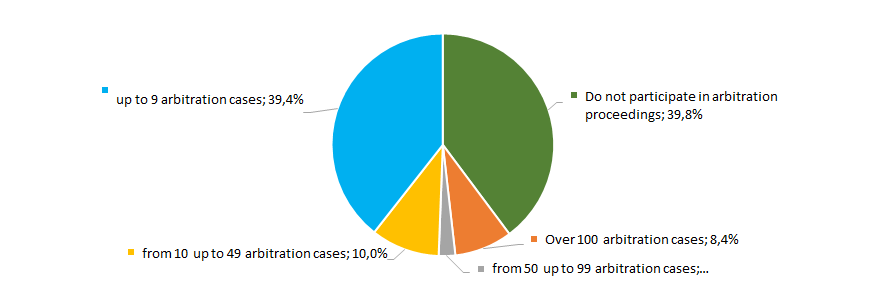

Activity of participation in arbitration proceedings

The majority of companies of the industry either do not participate in arbitration processes at all, or participate not actively (Picture 16).

Picture 16. Distribution of TOP-500 companies by participation in arbitration proceedings

Picture 16. Distribution of TOP-500 companies by participation in arbitration proceedingsReliability index

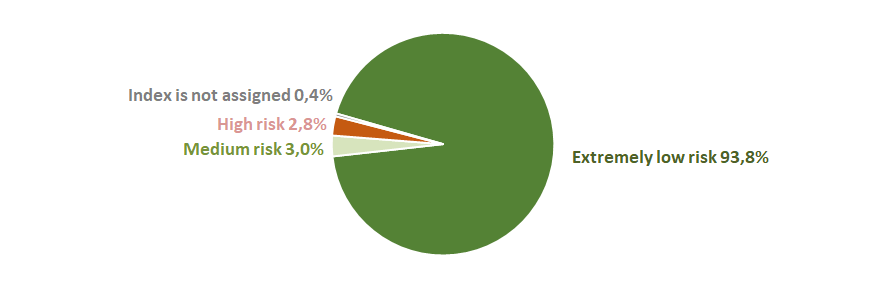

In terms of the presence of signs of «fly-by-night companies» or unreliable organizations, the great majority of enterprises of the industry demonstrate an extremely low risk of cooperation (Picture 17).

Picture 17. Distribution of TOP-500 companies by reliability index

Picture 17. Distribution of TOP-500 companies by reliability indexFinancial position score

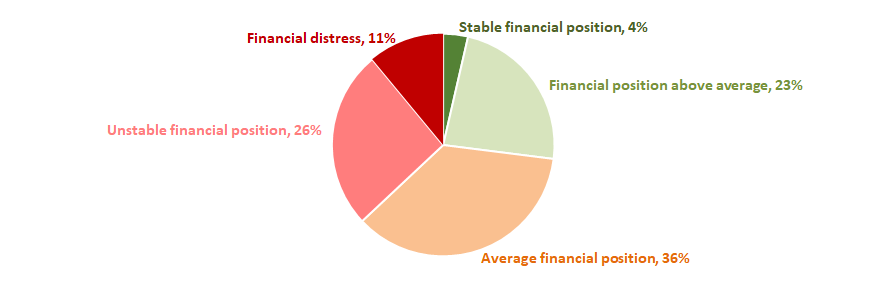

An assessment of the financial position of companies in the industry shows that the more than a third of enterprises are in an unstable and critical financial situation, and the same number are stable (Picture 18).

Picture 18. Distribution of TOP-500 companies by financial position score

Picture 18. Distribution of TOP-500 companies by financial position scoreLiquidity index

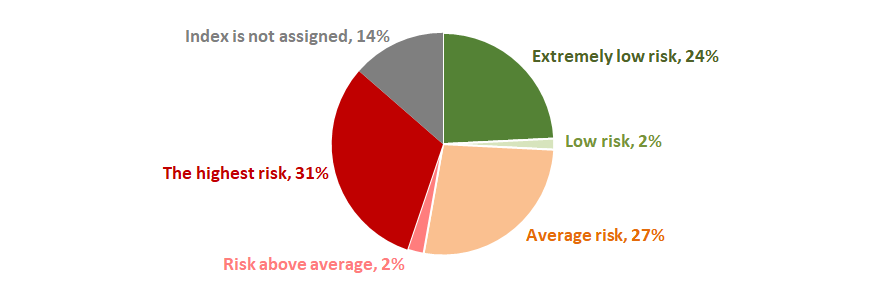

Almost a third of companies of the industry (31%) show the highest level of bankruptcy risk in the short-term period (Picture 19).

Picture 19. Distribution of TOP-500 companies by liquidity index

Picture 19. Distribution of TOP-500 companies by liquidity indexSolvency index Globas

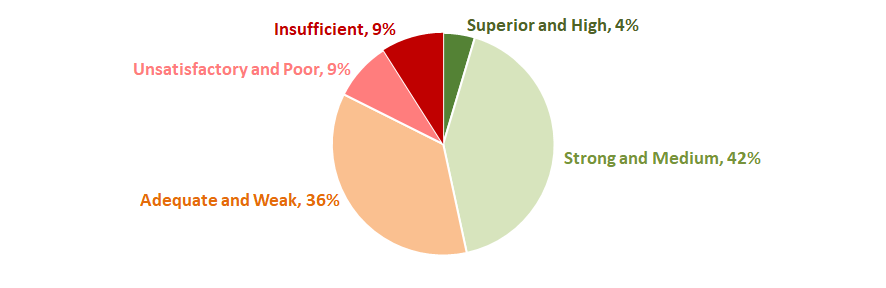

Over a third of the companies from 500 the largest enterprises have got Adequate Solvency index Globas. Almost half of companies have got Superior and High Solvency index Globas (Picture 20).

Picture 20. Distribution of TOP-500 companies by Solvency index Globas

Picture 20. Distribution of TOP-500 companies by Solvency index GlobasThus, a comprehensive assessment of enterprises on cast iron, steel and ferroalloys production, taking into account the main indices, financial indicators and ratios, points to unfavorable trends in this field of activity up to 2013. However, in recent years, the situation in the industry has begun to improve.

Return on investment of the largest Russian manufacturers of cast iron, steel and ferroalloys

Information agency Credinform presents the ranking of the largest Russian manufacturers of cast iron, steel and ferroalloys. The largest companies (TOP-10) in terms of annual revenue volume were selected for the ranking, according to the data from the Statistical register for the latest accounting periods (2016 and 2015). Then they were ranked by the return on investment ratio in 2016 (Table 1). Analysis was based on the data of the Information and Analytical system Globas.

Return on investment (%) is calculated as a ratio of net profit (loss) to the value of net assets. The indicator characterizes the level of profitability per rouble, receiving from investments, e.g. amount of monetary units required by an enterprise for receiving one monetary unit of net profit. With the help of the ratio it is necessary to evaluate the reasonability of the borrowed funds raising at a certain percent.

Normative values for profitability indicators are not provided, because they vary depending on the industry in which an enterprise operates. The indicators of each particular company should be considered in comparison with industrial indicators.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention to all combination of company’s indicators and financial ratios.

| Name, INN, region | Revenue, bln RUB | Revenue, bln RUB | Return on investment, % | Solvency index Globas | |||

| 2015 | 2016 | 2015 | 2016 | 2015 | 2016 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| AO OEMK INN 3128005752 Belgorod region |

76,0 | 79,5 | -1,7 | 30,4 | -5,36 | 298,01 | 180 High |

| JSC SEVERSTAL INN 3528000597 Vologda region |

278,6 | 305,3 | 40,1 | 84,7 | 32,87 | 58,22 | 170 Superior |

| CHELYABINSK METALLURGICAL PLANT OAO INN 7450001007 Chelyabinsk region |

96,1 | 107,1 | 4,0 | 15,0 | 17,08 | 38,70 | 350 Adequate |

| JSC NLMK-URAL INN 6646009256 Sverdlovsk region |

30,0 | 35,6 | -0,3 | 2,2 | -9,09 | 37,63 | 251 Medium |

| JSC MAGNITOGORSK IRON & STEEL WORKS INN 7414003633 Chelyabinsk region |

314,1 | 339,1 | 30,7 | 68,0 | 21,21 | 33,80 | 145 Superior |

| AO CHEMK INN 7447010227 Chelyabinsk region |

48,5 | 48,1 | 5,8 | 7,0 | 38,68 | 31,78 | 173 Superior |

| JSC NOVOLIPETSK STEEL INN 4823006703 Lipetsk region |

318,6 | 335,2 | 49,9 | 36,4 | 15,21 | 11,56 | 150 Superior |

| JSC EVRAZ CONSOLIDATED WEST SIBERIAN METALLURGICAL PLANT INN 4218000951 Kemerovo region |

140,9 | 148,1 | 21,3 | 8,9 | 26,47 | 9,94 | 162 Superior |

| JSC EVRAZ NIZHNY TAGIL METALLURGICAL PLANT INN 6623000680 Sverdlovsk region |

108,2 | 111,9 | 2,4 | 14,3 | 1,51 | 8,14 | 180 High |

| JSC URAL STEEL INN 5607019523 Orenburg region |

51,9 | 60,6 | 2,9 | 0,3 | 10,06 | 1,08 | 192 High |

| Total for TOP-10 | 1 463,0 | 1 570,6 | 155,2 | 267,1 | |||

| Average value for TOP-10 | 146,3 | 157,1 | 15,5 | 26,7 | 14,86 | 52,89 | |

| Average value for the industry | 0,3 | 0,5 | 3,7 | 3,7 | 14,12 | 26,22 | |

Average industry value of the return on investment ratio of the TOP-10 companies is above average in 2016. All the TOP-10 companies in 2016 have positive values of the ratio. Four companies out of TOP-10 companies in 2016 decreased indicators of net profit or revenue in comparison to the previous period (marked with red filling in columns 3 and 5 of Table 1).

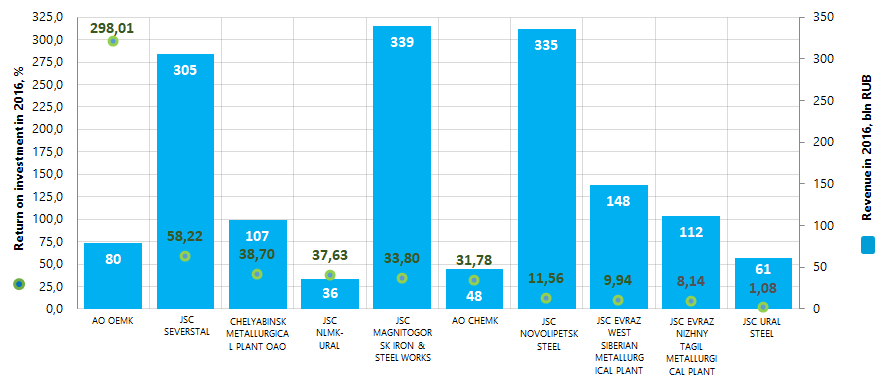

Picture 1. Return on investments and revenue of the largest Russian manufacturers of cast iron, steel and ferroalloys (TOP-10)

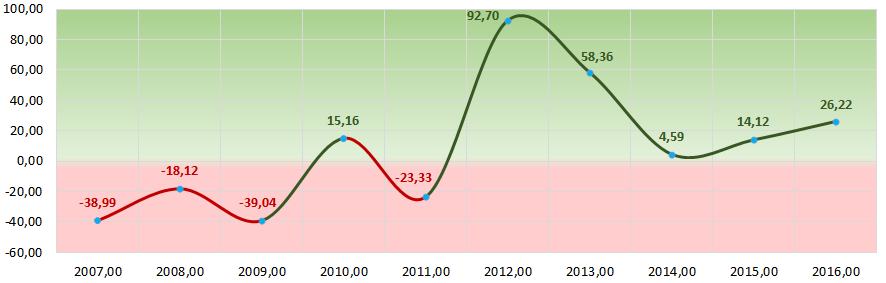

Picture 1. Return on investments and revenue of the largest Russian manufacturers of cast iron, steel and ferroalloys (TOP-10)Average industrial indicators of the return on investment ratio for the last ten years demonstrate an increasing tendency. It may show gradual increase of profitability of companies in this field of activity (Picture 2).

Picture 2. Change of average industrial values of the return on investment ratio of the Russian manufacturers of cast iron, steel and ferroalloys in 2007 – 2016

Picture 2. Change of average industrial values of the return on investment ratio of the Russian manufacturers of cast iron, steel and ferroalloys in 2007 – 2016 Nine companies out of TOP-10 have got from superior to medium solvency indexes Globas that shows their ability to pay the debts in time and fully.

CHELYABINSK METALLURGICAL PLANT OAO has got adequate solvency index Globas, due to the information about bankruptcy claims and open enforcement orders. The forecast for index development is negative.