Economy of Nizhniy Novgorod in crisis years

Information agency Credinform has prepared a review of the activity trends of the companies of real economy of Nizhniy Novgorod during the financial crisis of 2008 – 2009 years.

The largest enterprises (TOP-1000) in terms of annual revenue were selected for the analysis according to the data from the Statistical Register for the period of 2006 – 2011 years. The analysis was based on the data from the Information and Analytical system Globas.

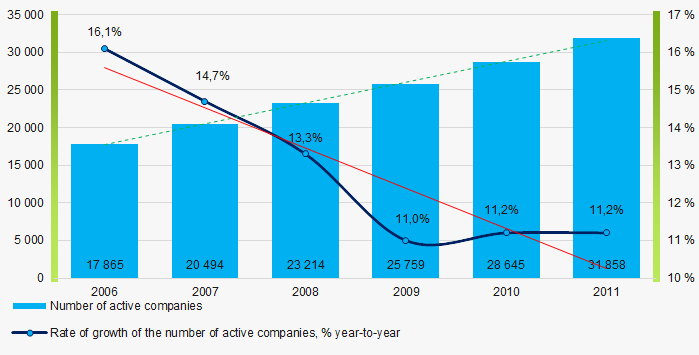

The number of active companies

From 2006 to 2011, the number of active companies increased, but the growth rates decreased especially during the acute phase of the crisis and the period of recovery.

Picture 1. Change in the number of active companies in 2006 – 2011

Picture 1. Change in the number of active companies in 2006 – 2011Net assets are total assets less total liabilities. This indicator reflects the real value of the property of an enterprise. When the company’s debt exceeds the value of its property, the indicator is considered negative (insufficiency of property).

The largest company of real sector of economy in Nizhniy Novgorod in term of net assets was JSC TRANSNEFT – VERKHNYAYA VOLGA, INN 5260900725. In 2011, net assets value of the company amounted to 53 billion RUB. In 2019, the figure increased to 143 billion RUB.

The lowest net assets value among TOP-1000 was recorded for LLC SLADKAYA ZHIZN N.N., INN 5257041777. In 2011, insufficiency of property of the company was indicated in negative value of -1,5 billion RUB. In 2019, this indicator became positive 4,5 billion RUB.

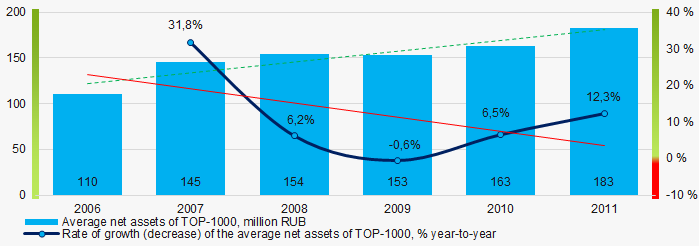

In 2006-2011, the average net assets values of TOP-1000 had a trend to increase, and the growth rates were decreased during the acute phase of the crisis (Picture 2).

Picture 2. Change in average net assets value in 2006 – 2011

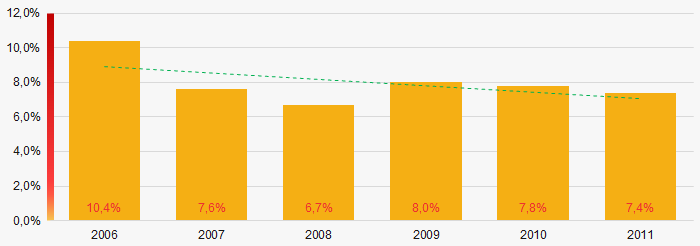

Picture 2. Change in average net assets value in 2006 – 2011The shares of TOP-1000 companies with insufficient property have trend to decrease in 2006-2011(Picture 3).

Picture 3. Shares of companies with negative net assets value in TOP-1000 in 2006 – 2011

Picture 3. Shares of companies with negative net assets value in TOP-1000 in 2006 – 2011 Sales revenue

The largest company of the real sector of economy in Nizhniy Novgorod by revenue was LLC KOMMERCHESKIE AVTOMOBILI – GRUPPA GAZ, INN 5256051148. The revenue volume exceeded 52 billion RUB in 2011, and decreased to 4 billion RUB in 2019.

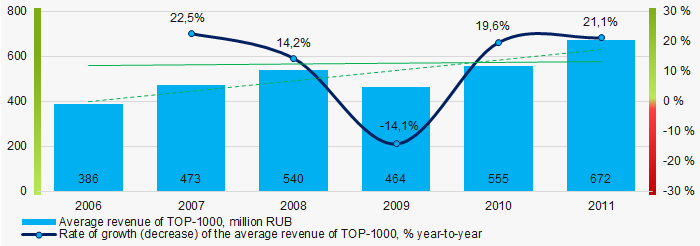

In general, there was a trend to increase in revenue with increasing growth rate (Picture 4).

Picture 4. Change in average revenue in 2006 – 2011

Picture 4. Change in average revenue in 2006 – 2011Profit and loss

The largest company in term of net profit was JSC TRANSNEFT – VERKHNYAYA VOLGA, INN 5260900725. The company’s profit slightly exceeded 6 billion RUB in 2011, and decreased to 941 million RUB in 2019.

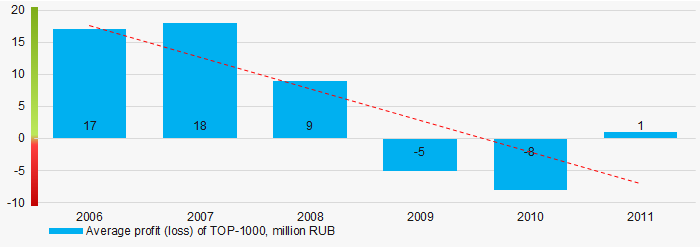

During the period of 2006 – 2011, the average profit figures of TOP-1000 companies had a trend to decrease with the losses during the acute phase of the crisis and the period of recovery (Picture 5).

Picture 5. Change in average profit (loss) in 2006- 2011

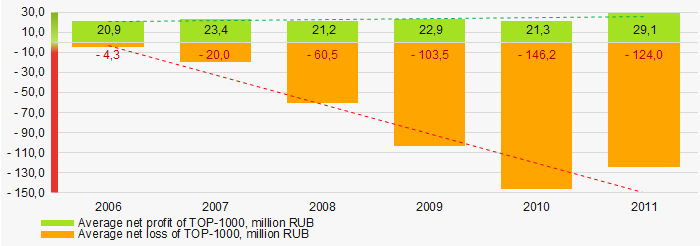

Picture 5. Change in average profit (loss) in 2006- 2011In 2006 – 2011, the average net profit figures of TOP-1000 companies had a trend to increase with the increasing net loss. Maximum losses were recorded during the acute phase of the crisis and the period of recovery (Picture 6).

Picture 6. Change in average net profit and net loss of ТОP-1000 in 2006 – 2011

Picture 6. Change in average net profit and net loss of ТОP-1000 in 2006 – 2011Key financial ratios

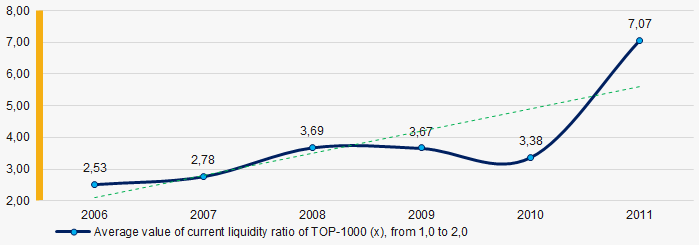

In 2006 – 2011, the average values of the current liquidity ratio were above the recommended one – from 1,0 to 2,0, with a trend to increase. (Picture 7).

Current liquidity ratio (current assets to short-term liabilities) shows the sufficiency of company’s assets to repay on short-term liabilities.

Picture 7. Change in average values of current liquidity ratio in 2006 – 2011

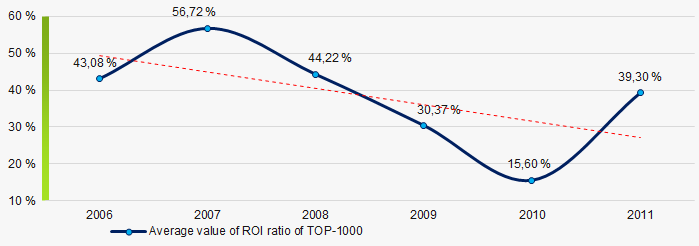

Picture 7. Change in average values of current liquidity ratio in 2006 – 2011At the period of 2006 – 2011, there was a general trend to decrease in the average ROI values (Picture 8).

ROI ratio is calculated as net profit to sum of shareholders equity and long-term liabilities, and shows the return of equity involved in commercial activities and long-term borrowed funds.

Picture 8. Change in average values of ROI ratio in 2006 – 2011

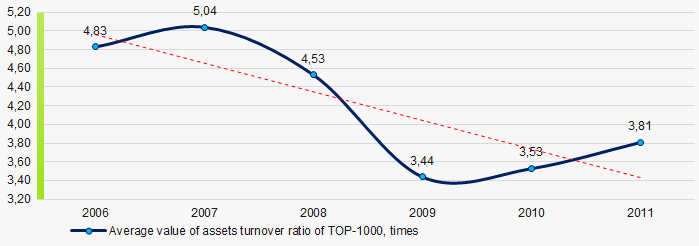

Picture 8. Change in average values of ROI ratio in 2006 – 2011Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

In 2006 – 2011, there was a trend to decrease of this ratio, especially during the acute phase of the crisis and the period of recovery (Picture 9).

Picture 9. Change in average values of assets turnover ratio in 2006 – 2011

Picture 9. Change in average values of assets turnover ratio in 2006 – 2011Small enterprises

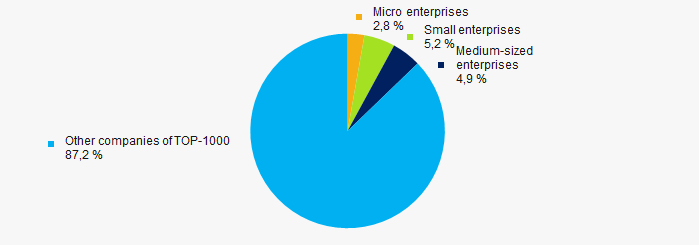

77% companies of TOP-1000 are registered in the Register of small and medium-sized enterprises of the Federal Tax Service of the Russian Federation. Their share in total revenue of TOP-1000 was 13% in 2011 (Picture 10).

Picture 10. Shares of small and medium-sized enterprises in 2011

Picture 10. Shares of small and medium-sized enterprises in 2011Financial position score

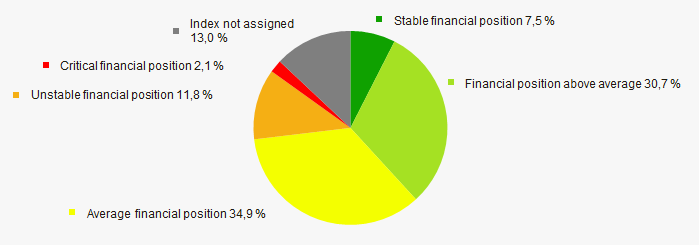

According to the assessment, the financial position of most of TOP-1000 companies is average in 2020 (Picture 11).

Picture 11. Distribution of TOP-1000 companies by financial position score in 2020

Picture 11. Distribution of TOP-1000 companies by financial position score in 2020Solvency index Globas

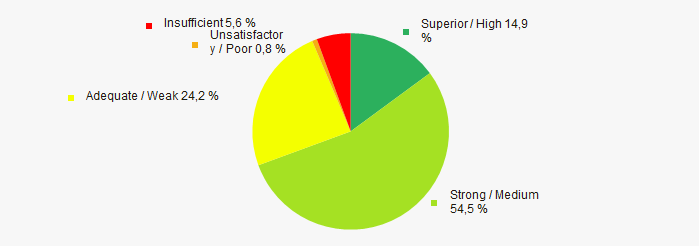

In 2020, most of TOP-1000 companies got Superior / High and Strong / Medium index Globas. This fact shows their ability to meet their obligations fully and by the due date (Picture 12).

Picture 12. Distribution of TOP-1000 companies by solvency index Globas

Picture 12. Distribution of TOP-1000 companies by solvency index GlobasConclusion

Complex assessment of activity of the largest companies of real economy sector of Nizhniy Novgorod, taking into account the main indexes, financial ratios and indicators, demonstrates the prevalence of positive trends in 2006 - 2011 (Table 1).

| Trends and evaluation factors | Relative share of factor, % | Possible forecast |

| Dynamics of the number of active companies |  10 10 |

|

| Rate of growth of the number if active companies |  -10 -10 |

During the acute phase of the crisis and the period of recovery, rate of growth of the active companies may be decreased |

| Dynamics of the average net assets value |  10 10 |

|

| Rate of growth (decline) in the average size of net assets |  -10 -10 |

During the acute phase of the crisis and the period of recovery, rate of growth of the active companies may be decreased |

| Increase / decrease in the share of enterprises with negative values of net assets |  10 10 |

|

| Dynamics of the average revenue |  10 10 |

|

| Rate of growth (decline) in the average size of revenue |  10 10 |

During the acute phase of the crisis, rate of growth of the active companies may be decreased. |

| Dynamics of the average profit |  -10 -10 |

During the acute phase of the crisis, the average profit may be decreased |

| Growth / decline in average values of companies’ net profit |  10 10 |

|

| Growth / decline in average values of companies’ net loss |  -10 -10 |

During the acute phase of the crisis and the period of recovery, net loss may be increased |

| Increase / decrease in average values of total liquidity ratio |  5 5 |

|

| Increase / decrease in average values of return on investment ratio |  -10 -10 |

During the acute phase of the crisis and the period of recovery, return on investment ratio may by decreased |

| Increase / decrease in average values of asset turnover ratio, times |  -10 -10 |

Business activity may by decreased during the acute phase of the crisis, and will be slowly increased during the period of recovery |

| Share of small and medium-sized businesses in terms of revenue being more than 20% |  -10 -10 |

|

| Financial position (the largest share) |  5 5 |

|

| Solvency index Globas (the largest share) |  10 10 |

|

| Average value of relative share of factors |  0,6 0,6 |

positive trend (factor),

positive trend (factor),  negative trend (factor).

negative trend (factor).

Legislation amendments

The significant changes to the Laws «On Lotteries» and «On State regulation of activities to organize and conduct gambling, and amending certain legislative acts of the Russian Federation» were made by two Laws No. 242-FZ of 20.07.2020 and No. 270-FZ of 31.07.2020.

In general, the amendments reinforce the requirements to the lottery and gambling companies.

Thus, the lottery companies are now obligated to disclose information not only to the lottery organizers, but also to the State supervisory authorities. Among such information is data on:

- beneficial owners,

- individuals and legal entities, which are shareholders or members of the lottery and gambling companies,

- members of the board of directors or the supervisory board,

- executive board members,

- persons serving as single executive body,

- persons who have significant, direct or indirect influence on the decisions of corporate bodies

and also the documents confirming the above information.

The term «beneficial owners» corresponds to the relevant description defined by the Federal Law No. 115-FZ of 07.08.2001 «On Countering money laundering and the financing of terrorism». Thus, the beneficial owners of the lottery and gambling companies are understood to be individuals who ultimately, directly or indirectly, or through third parties, own (i.e. have more than 25% of share capital) a legal entity or have the ability to control its activities.

The ban on acting as a shareholder, member, beneficial owner, member of the board of directors or the supervisory board, executive board member, single executive body of the lottery and gambling companies is set for persons who have outstanding criminal records for financial crimes, crimes against the state authorities or for intentional crimes of medium gravity, serious and the gravest crimes.

Among legal entities which cannot act as shareholders and members, persons with significant, direct or indirect influence on the decisions, single executive bodies of the lottery and gambling companies are legal entities registered in the states or territories with the preferential taxation or territories that do not disclose information on financial transactions (offshore zones) and included in the list approved by the Ministry of Finance of the Russian Federation.

The amendments will come into force on October 19, 2020.

Besides, the list of events with the possibility of accepting bets by bookmakers and betting houses will be cut. The requirements for equipment in service areas of the bookmaker's offices, betting houses, their processing centers and the service areas for gambling participants have been tightened. The specifics of suspension and revocation of licenses on organization and conduction of gambling at bookmaker's offices or betting houses are clarified. Such licenses should be reissued until September 29, 2021, i.e. within 1 year from the date of entry into force of the Federal Law No. 270-FZ of 31.07.2020.

Gambling organizers, which make bets on sports events in the bookmaker’s offices, are required to make purpose-oriented allocations to invest the development of children's and youth sports. The basis for these allocations are agreements on provision of information about conducting sport competitions with professional sport entities, which, in turn, are required to post the list of concluded agreements, data on received funds in the form of purpose-oriented allocations from gambling in the reporting calendar year and data on allocation of funds on the official websites.

All information related to the lottery and gambling companies (including historical data) is available in the Information and Analytical system Globas.