Bank guarantee – the new tool of providing the tax revenues

In order to provide additional tax payments, legislator, following the international experience, added new article 74.1 «Bank guarantee» in The Tax Code of the Russian Federation by the Federal Law as of 23.07.2013 N 248-FZ. The article entered into force on 1st October 2013.

The meaning of innovation is quite transparent and economically reasonable: bank gives tax authorities the warranty for the fulfillment of tax obligations by a taxpayer. If the taxpayer fails the payment of all his taxes and penalties in due time, in accordance with the conditions, which were made between the bank and the taxpayer, bank undertakes to fulfill these obligations in full. The guarantee must be provided by the bank, which is included in the list of credit institutions, which meet the set requirements for acceptance of bank guarantees. Such list is carried by the Ministry of Finance of Russian Federation and is publicly available.

Prior to the introduction of the bank guarantee, the taxpayer for postponement of tax payments and guarantee of tax revenues could use the pledge of property, warranty. Besides penalties may be assessed on taxpayer, the operations on bank accounts may be suspended and property could be seized. Thus, bank guarantee will be the new tool of state policy for culture regulation and increase of providing the tax revenues to the treasury.

One of the main criterion, by which bank can enter the list of commissioners for adoption of a bank guarantee, will be the existence of own funds (capital) in amount of at least one billion RUB. Banks should also follow the mandatory standards of The Central Bank of the Russian Federation at all reported periods. Thereby, in this sphere will work large credit institutions and it is quite reasonable. After all if the bank loses its license, the taxpayer will be in a difficult situation because the State won’t get its taxes, moreover it will be connected by financial obligations with a bankrupt bank.

The economic effect for a businessman will be in the fact that bank guarantee will let him pay taxes in those periods when it isn't profitable to withdraw money from a turn, thereby slowing down the commercial process.

Information agency Credinform is preparing to release an independent index of banks financial stability, which will indicate the risk level of cooperation with credit agencies. The index will also consider the possibility of the credit institution to provide bank guarantees.

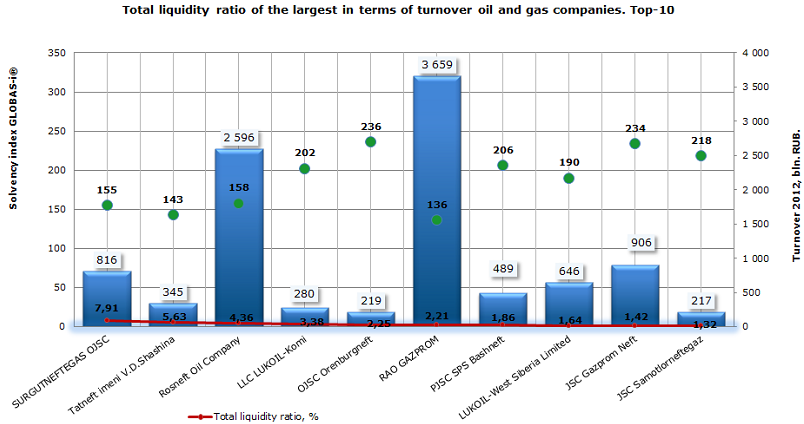

Total liquidity ratio of oil and gas companies

Information agency Credinform prepared a ranking of total (current) liquidity ratio for oil and gas companies. The ranking list includes industry’s largest Russian companies with mentioned activity type and is based on turnover as stated in the Statistics register, with the reference period of 2012. The selected companies were ranked first in terms of turnover, then the total liquidity ratio.

Total liquidity ratio is calculated as the ratio of current assets to current liabilities of the company. This reflects the company's ability to put out its short-term liabilities from current assets only. In Russian practice a normal range of 2 to 3 is considered.

| № | Name, INN | Region | Total (current) liquidity ratio, % | Turnover 2012, bln. RUB. | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | SURGUTNEFTEGAS OJSC, INN 8602060555 | Khanty-Mansijsk Autonomous District | 7,91 | 815,57 | 155 (top) |

| 2 | Tatneft imeni V.D.Shashina, INN 1644003838 | Republic of Tatarstan | 5,63 | 344,56 | 143 (top) |

| 3 | Rosneft Oil Company, INN 7706107510 | Moscow | 4,36 | 2595,67 | 158 (top) |

| 4 | LLC LUKOIL-Komi, INN 1106014140 | Komi Republic | 3,38 | 279,88 | 202 (high) |

| 5 | OJSC Orenburgneft, INN 5612002469 | Orenburg region | 2,25 | 218,52 | 236 (high) |

| 6 | RAO GAZPROM, INN 7736050003 | Moscow | 2,21 | 3659,15 | 136 (top) |

| 7 | PJSC SPS Bashneft, INN 0274051582 | Republic of Bashkortostan | 1,86 | 489,21 | 206 (high) |

| 8 | LUKOIL-West Siberia Limited, INN 8608048498 | Khanty-Mansijsk Autonomous District | 1,64 | 645,72 | 190 (top) |

| 9 | JSC Gazprom Neft, INN 5504036333 | St. Petersburg | 1,42 | 905,51 | 234 (high) |

| 10 | JSC Samotlorneftegaz, INN 8603089934 | Khanty-Mansijsk Autonomous District | 1,32 | 217,41 | 218 (high) |

The role of the oil and gas sector in the economy remains high. Thus, according to the data of the Ministry of Energy, the share of oil revenues in the national budget in 2012 was 50 %, while the contribution to GDP was about 1/3, and in exports - about 2/3.

The top three is represented by the following companies: SURGUTNEFTEGAS OJSC with total liquidity ratio of 7.91 %, Tatneft imeni V.D.Shashina (5.63 %) and Rosneft Oil Company (4.36 %). All three companies have total liquidity ratio exceeding the standard values, which may indicate the unsustainable capital structure. But at the same time, according to the year-end 2012, these companies have demonstrated excellent financial results, and the three leaders got the highest solvency index GLOBAS -i ®, which characterizes them as financially stable.

Total liquidity ratio of the largest in terms of turnover oil and gas companies. Top-10

Only two companies can boast of overall liquidity ratios in the terms of standard: OJSC Orenburgneft (the value is 2.25 %) and industry leader in terms of 2012 turnover - RAO GAZPROM (2.21 %). Companies were assigned the high index and the highest solvency index GLOBAS -i ®.

The companies PJSC SPS Bashneft, LUKOIL-West Siberia, JSC Gazprom Neft and JSC Samotlorneftegaz have the value slightly less than the norm, but higher than zero, that is why it is nothing to speak of the high financial risk. All four companies were assigned a high index and the highest solvency index GLOBAS -i ®, which is also characterized their ability to repay the debts timely and fully.

In international practice, the standard values for total liquidity ratio slightly deviate from Russian ones. Depending on the industry, the normal value of the index is from 1.5 to 2.5. The Top-10 oil companies in terms of 2012 turnover in the world, ranked by the current liquidity ratio are below.

| № | Name | Country | Total (current) liquidity ratio, % | Turnover 2012, bln. RUB. |

|---|---|---|---|---|

| 1 | RAO GAZPROM | Russia | 2,21 | 3 659 |

| 2 | PETROLEO BRASILEIRO S.A. | Brazil | 1,7 | 4 183 |

| 3 | ENI SPA | Italy | 1,43 | 5 160 |

| 4 | TOTAL S.A. | France | 1,38 | 7 310 |

| 5 | ROYAL DUTCH SHELL PLC | Germany | 1,18 | 14 194 |

| 6 | JX HOLDINGS, INC. | Japan | 1,13 | 3 619 |

| 7 | STATOIL ASA | Norway | 1,12 | 3 935 |

| 8 | PETROLEOS DE VENEZUELA S A | Venezuela | 1,05 | 3 780 |

| 9 | PETROCHINA COMPANY LIMITED | China | 0,72 | 10 611 |

| 10 | SAUDI ARABIAN OIL COMPANY (ARAMCO) | Saudi Arabia | no data | 9 719 |

It should be noted the Russian leader, RAO GAZPROM, is also included in the world Top-10. Moreover, the domestic manufacturer tops the list, having the maximum value of the total liquidity ratio among the represented companies, satisfying both domestic and international regulations. Gazprom also holds the ninth place in terms of turnover among the largest oil and gas companies in the world by the end of 2012.

Brazilian company PETROLEO BRASILEIRO SA with the current ratio of 1.7% and Italian company ENI SPA with 1.43 %, which is slightly smaller than the existing international standards, are also included in top three of the list. Both companies are ahead of Gazprom in terms of turnover, ranking 6th and 5th positions in the world respectively.

Rosneft Oil Company is on the 11th place in terms of turnover. However, due to the purchase of TNK-BP in 2012, the company's position may change. As a result of this transaction, Rosneft has become the largest company in the world in terms of oil extraction.