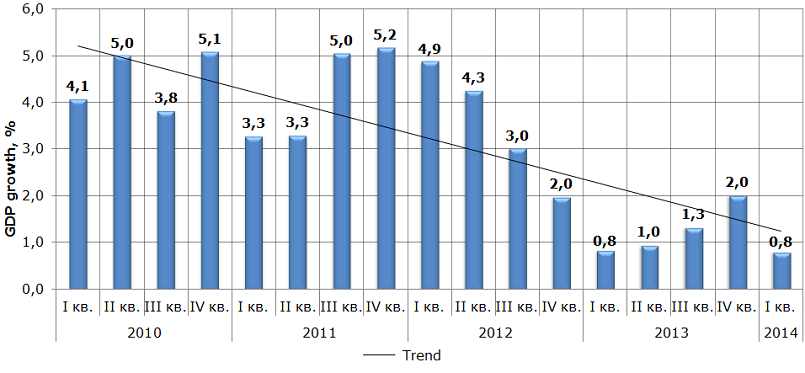

The Russian economy takes a time-out.

The beginning of the year didn’t emphasize any positive trends for the national economic recovery. The GDP of our country increased only 0.8 % in the first quarter of 2014 according to Minister of Economic Development of the Russian Federation Alexey Ulyukaev. Its deceleration began 2 years ago. Following the results of the fourth quarter 2011 the GDP reached its maximum growth, 5.2 %,so far after the financial crisis 2008. Today we are behind the situation when over the last 6 quarters the Russian economy trends to reach the GDP growth rate at the very least of 2%.

The last events in Ukraine and Russia’s actions in connecting Crimea caused greater capital outflow and political sanctions of series of countries, the USA and EC above all, decreased the Russian investment climate. As a result, leading international financial institutions considered the idea of reducing its GDP trend figure in 2014.

Russian departments are also under no illusions. For instance, the Ministry of Finance of the Russian Federation expects the GDP growth of 0.5%, Ministry of Economic Development -0.5% - 1.1%, and there can be even its decreasing in summer season.

Russian GDP growth by quarter, %

If there will be no noneconomic shocks, this negative trend should be changed. There is a gradual economic recovery of the leading global economic drivers such as EC and the USA. Furthermore, the greatest infrastructural projects realizations in Crimea, as well as a number of agreements with China of foreign trade interaction expansion which includes energy resources export are high on the agenda.

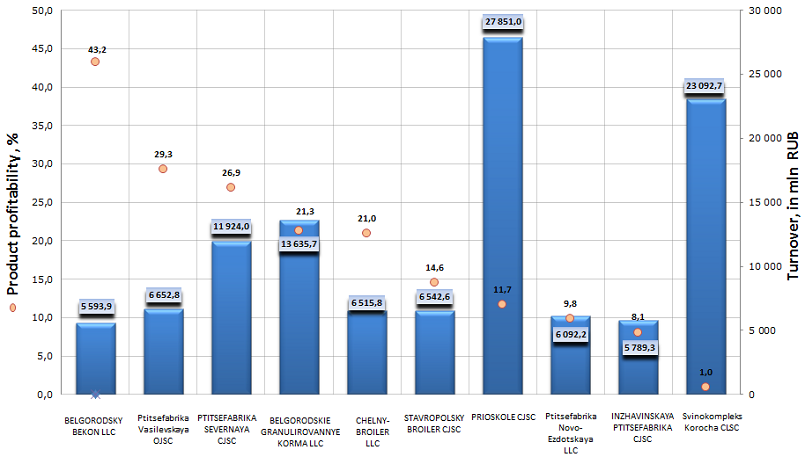

Product profitability of Russian cattle-breeding companies

Information agency Credinform prepared a ranking of Russian cattle-breeding companies.

The companies with highest volume of revenue were selected for this ranking according to data from the Statistical Register for the latest available period (for the year 2012). These enterprises were ranked by decrease in product profitability ratio.

Product profitability (%) is the ratio of sales profit (loss) to its total value (amount of expenses for production, business and administrative expenses). It shows the results of current expenditures, efficiency of financial management. If the ratio value is negative, it testifies that a company has sales loss.

There are no recommended or specified values prescribed for the mentioned ratio, because it varies strongly depending on the branch, where each concrete enterprise conducts business. The company should be assessed relying on industry-average indicators of the sector, where it operates, as well as on other enterprises of this industry.

| № | Name | Region | Turnover,in mln RUB, for 2012 | Product profitability, % | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | BELGORODSKY BEKON LLC INN: 3123341888 |

Belgorod region | 5 593 906 000 | 43,2 | 231(high) |

| 2 | Ptitsefabrika Vasilevskaya OJSC INN: 5809022198 |

Penza region | 6 652 779 000 | 29,3 | 214(high) |

| 3 | PTITSEFABRIKA SEVERNAYA CJSC INN: 4706002688 |

Leningrad region | 11 924 024 000 | 26,9 | 197(the highest) |

| 4 | BELGORODSKIE GRANULIROVANNYE KORMA LLC INN: 3116003662 |

Belgorod region | 13 635 668 000 | 21,3 | 216(high) |

| 5 | CHELNY-BROILER LLC INN: 1639025000 |

Republic of Tatarstan | 6 515 808 000 | 21,0 | 146(the highest) |

| 6 | STAVROPOLSKY BROILER CJSC INN: 2623016651 |

Stavropol territory | 6 542 575 000 | 14,6 | 259(high) |

| 7 | PRIOSKOLE CJSC INN: 3123100360 |

Belgorod region | 27 851 007 000 | 11,7 | 203(high) |

| 8 | Ptitsefabrika Novo-Ezdotskaya LLC INN: 3126011038 |

Belgorod region | 6 092 206 000 | 9,8 | 236(high) |

| 9 | INZHAVINSKAYA PTITSEFABRIKA CJSC INN: 6805006976 |

Tambov region | 5 789 342 000 | 8,1 | 279(high) |

| 10 | Svinokompleks Korocha CLSC INN: 3110009570 |

Belgorod region | 23 092 689 000 | 1,0 | 228(high) |

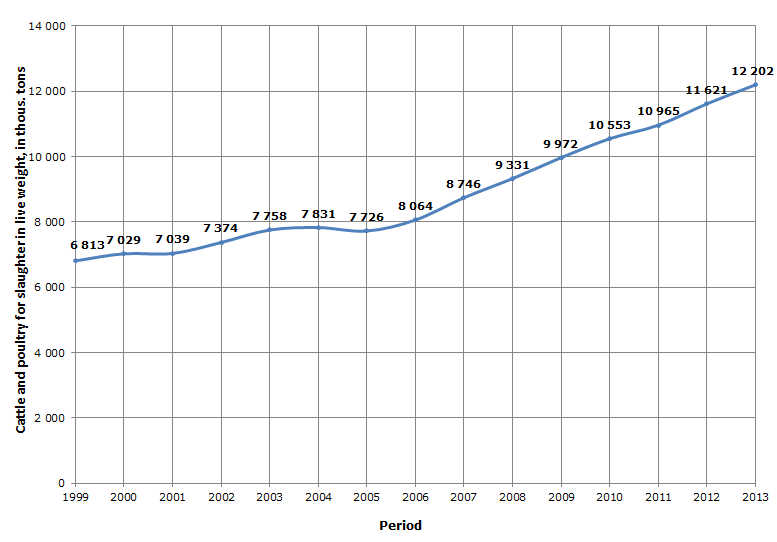

Picture 1. Cattle and poultry production for slaughter in live weight, in thous. tons

Cattle-breeding field is developing on the fast track lately. Not so long ago our market depended on import by 70% and more, today the tide is turning – imported products are being superseded by meat of domestic manufacture. Since 1999 the increment of production made 79%, at the end of the previous year the market was supplied with 12 202 thous. tons of cattle and poultry in live weight.

Picture 2. Product profitability and turnover of the largest cattle-breeding companies in Russia (TOP-10)

Cumulative turnover of the first 10 largest cattle-breeding companies of Russia made 113 609 mln RUB at year-end 2012, that is by 36,7% higher, than the indicator of previous year and makes above one third of sales revenue of TOP-100 companies.

The average value of product profitability ratio of TOP-100 is 23%.

It should be noted that among TOP-100 agricultural enterprises of cattle-breeding sector poultry enterprises dominate.

By the analysis of the largest enterprises of the industry only 3 companies from TOP-10 showed the profitability above the average. BELGORODSKY BEKON LLC (43,2%) is one of five the largest complexes of the country, manufacturing 60 thous. tons of meat per annum in live weight. At the present time the organization includes 5 commercial pig-breeding complexes for 4800 heads of breeding pig in each, 1 pedigree complex for 2400 heads of breeding pig, complex for mixed feed manufacture.

Ptitsefabrika Vasilevskaya OJSC (29,3%) is a part of the group «Cherkizovo», focuses on farm poultry raising and output under the brand of the trademark «Vasilevka» of cooled, environmentally friendly poultry meat in the mid-range segment in Penza and Penza region.

PTITSEFABRIKA SEVERNAYA CJSC (26,9%) is the largest poultry plant of the North-West, supplies high-quality products to Saint-Petersburg and neighbour regions.

Other enterprises in the TOP-10 list showed profitability of sales from 1% to 21,3%.

According to the independent estimation of solvency of companies, developed by the Information agency Credinform, all industry leaders got a high and the highest solvency index, what guarantees that organizations can pay off their credit debts in time and fully. Occurrence of bankruptcy in the nearest time is highly improbable, organizations are attractive objects for investment, especially taking into account the potential of the Russian market.