Liabilities and assets in construction

Information agency Credinform represents a ranking of the largest construction companies having a potential opportunity to carry out a tax monitoring. The companies engaged in construction of buildings and structures meeting the new criteria for tax monitoring with the largest volume of annual revenue (TOP-10 and TOP-100) were selected for the ranking, according to the data from the Statistical Register and the Federal Tax Service for the latest available periods (2017 - 2019). They were ranked by the ratio of assets and liabilities (Table 1). The selection and analysis was based on the data of the Information and Analytical system Globas.

Liabilities to assets ratio shows the share of assets financed by loans. The standard value for this ratio is from 0.2 to 0.5

Sales revenue and net profit show the scale of the company and the efficiency of its business, and the ratio of liabilities and assets indicates the risk of insolvency of the company.

Exceeding the upper standard value indicates excessive debt load, which can stimulate development, but negatively affects the stability of the financial position. If the value is below the standard value, this may indicate a conservative strategy of financial management and excessive caution in attracting new borrowed funds.

In order to get the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention to all combination of indicators and financial ratios.

| Name, INN, region | Revenue, million RUB | Net profit (loss), million RUB | Ratio of liabilities and assets (x), from 0,2 to 0,5 | Solvency index Globas | |||

| 2018 | 2019 | 2018 | 2019 | 2018 | 2019 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| MONARCH INN 7714950480 Moscow |

18 910 18 910 |

17 436 17 436 |

127 127 |

116 116 |

0,95 0,95 |

0,98 0,98 |

233 Strong |

| OOO MIP-STROI #1 INN 7701394860 Moscow |

56 995 56 995 |

53 932 53 932 |

10 10 |

99 99 |

0,98 0,98 |

0,98 0,98 |

272 Medium |

| JSC PIK-Industries INN 7729755852 Moscow |

26 948 26 948 |

44 616 44 616 |

1 792 1 792 |

1 263 1 263 |

1,01 1,01 |

0,98 0,98 |

275 Medium |

| RENAISSANCE HEAVY INDUSTRIES LLC INN 7802772445 Moscow |

37 662 37 662 |

42 884 42 884 |

4 732 4 732 |

2 079 2 079 |

0,83 0,83 |

0,94 0,94 |

245 Strong |

| Fodd INN 7729355935 Moscow |

19 640 19 640 |

23 853 23 853 |

262 262 |

314 314 |

0,97 0,97 |

0,92 0,92 |

176 High |

| JSC VOSTOKNEFTEZAVODMONTAZH INN 0277015293 Republic of Bashkortostan |

11 047 11 047 |

18 231 18 231 |

82 82 |

405 405 |

0,89 0,89 |

0,88 0,88 |

208 Strong |

| PIK GROUP INN 7713011336 Moscow |

25 343 25 343 |

24 572 24 572 |

15 137 15 137 |

306 306 |

0,74 0,74 |

0,75 0,75 |

233 Strong |

| RENAISSANCE CONSTRUCTION LTD INN 7708185129 Moscow |

44 512 44 512 |

25 720 25 720 |

1 290 1 290 |

2 676 2 676 |

0,94 0,94 |

0,74 0,74 |

201 Strong |

| OOO ENERGO-STROI INN 7801174139 Saint Petersburg |

8 713 8 713 |

24 118 24 118 |

229 229 |

1 640 1 640 |

0,92 0,92 |

0,74 0,74 |

171 Superior |

| LENSPETSSMU INN 7802084569 Saint Petersburg |

15 270 15 270 |

17 182 17 182 |

4 374 4 374 |

6 441 6 441 |

0,68 0,68 |

0,71 0,71 |

217 Strong |

| Average value for TOP-10 |  26 504 26 504 |

29 254 29 254 |

2 804 2 804 |

1 534 1 534 |

0,89 0,89 |

0,86 0,86 |

|

| Average value for TOP-100 |  8 802 8 802 |

7 789 7 789 |

30 30 |

-289 -289 |

0,81 0,81 |

0,81 0,81 |

|

growth of indicator to the previous period,

growth of indicator to the previous period,  decrease of indicator to the previous period

decrease of indicator to the previous period

The average indicator of the ratio of liabilities and assets of TOP-10 and TOP-100 is above the standard value. Indicators of six companies show the positive dynamic to move toward the standard value in 2019.

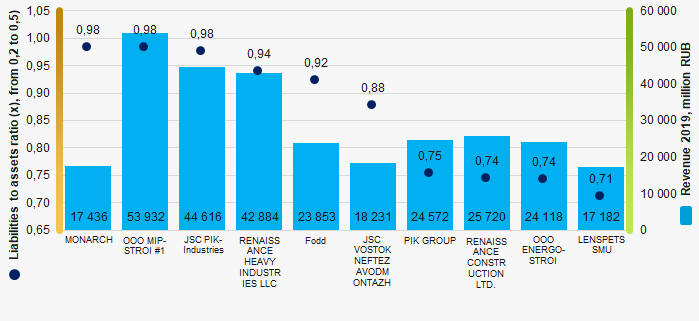

Picture 1. Ratio of liabilities and assets, and revenue of the largest construction companies (TOP-10)

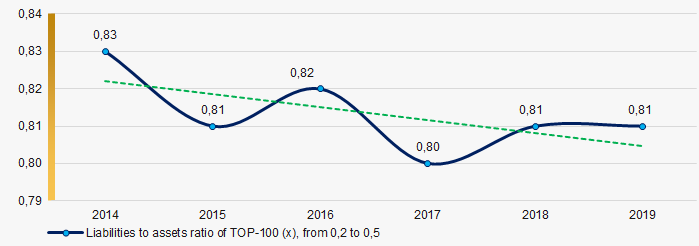

Picture 1. Ratio of liabilities and assets, and revenue of the largest construction companies (TOP-10)Over the past 6 years, the industry average values of the ratio of liabilities and assets of TOP-100 have a positive trend to move toward the standard value (Picture 2).

Picture 2. Change in the industry average values of the ratio of liabilities and assets of the TOP-100 largest construction companies in 2014 – 2019

Picture 2. Change in the industry average values of the ratio of liabilities and assets of the TOP-100 largest construction companies in 2014 – 2019Legislation amendments

The Federal Law dated 29.12.2020 No. 476-FZ introduced the amendments to the Law «On audit activities» concerning the conditions for the mandatory audit of financial statements.

According to the amendments, starting from January 1, 2021, the financial indicators below, exceeding the threshold values of which is the basis for conducting the mandatory audit, were increased:

- revenue - from 400 to 800 million RUB;

- assets of the balance sheet - from 60 to 400 million RUB.

Thus, the opportunities for accounting under the simplified procedure by small businesses that have this right are expanded, with the exception of companies with the indicators listed above.

In addition, nonprofit organizations are exempt from the mandatory audit if at least one of the following conditions is met:

- compliance with the above limits on revenue and assets of the balance sheet;

- founded as funds with property, including cash, not exceeding 3 million RUB;

- nonprofit organizations which are consumer cooperative societies, the activities of which are regulated by the Federal Law dated 19.06.1992 No. 3085-1 "On consumer cooperation (consumer societies, their unions) in Russian Federation".

According to data of the Information and Analytical system Globas, in Russia, there are more than 6 thousand small businesses that meet the updated financial criteria for conducting the mandatory audit of 2019 financial statements.