Ranking of 400 the largest Russian companies

Information agency Credinform prepared а ranking of 400 the largest by total revenue Russian companies. The ranking list includes 400 companies with the highest volume of total revenue according to 2012 financial statements.

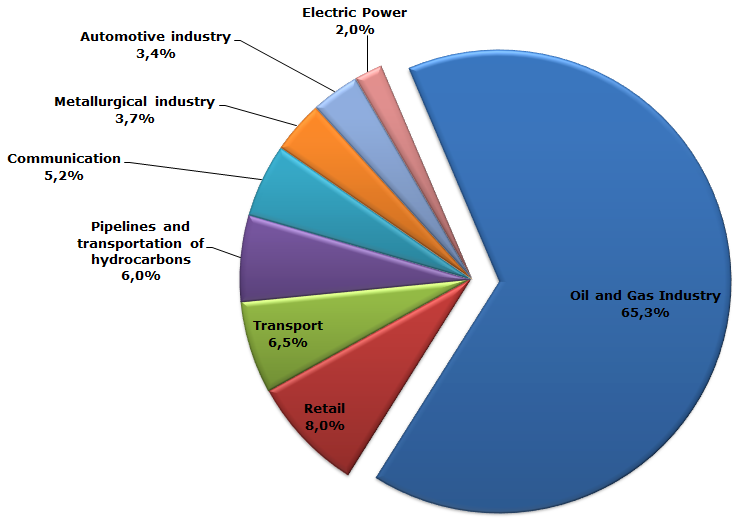

Picture 1. Industry’s structure of TOP-40 the largest companies

Diagram includes data about first 40 companies of ranking list and is based on total revenue. The diagram visually confirms the thesis about the prevalence of oil and gas industry in branch structure of national economy. Companies of mentioned field accumulate 65,3% of total TOP-40 turnover, further are trade companies – 8,0% and transport companies – 6,5%.

| № | Name | Region | Turnover 2012, mln. RUB. | 2011 growth rate, % | Net profit 2012, mln. RUB. | 2011 growth rate, % | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|---|---|

| 1 | JSC Gasprom INN 7736050003 |

Moscow | 3 659 150,8 | 3,5 | 556 340,4 | -36,8 | 157(the highest) |

| 2 | JSC Rosneft Oil Company INN 7706107510 |

Moscow | 2 595 672,3 | 89,2 | 302 500,6 | 27,7 | 145(the highest) |

| 3 | JSC Russian Railways INN 7708503727 |

Moscow | 1 366 015,0 | 6,0 | 14 110,0 | -16,1 | 211(high) |

| 4 | JSC RN Holding INN 7225004092 |

Tyumen region | 1 084 373,3 | 14,3 | 185 586,4 | -23,9 | 244(high) |

| 5 | JSC Gazprom Neft INN 5504036333 |

Saint-Petersburg | 905 513,7 | 9,8 | 84 505,2 | 10,3 | 179(the highest) |

| 6 | LLC Gazprom mezhregiongaz INN 5003021311 |

Moscow | 828 040,8 | 0,9 | -11 541,8 | -3,0 | 236(high) |

| 7 | JSC SURGUTNEFTEGAS INN 8602060555 |

Khanty-Mansijsk Autonomous District-Yugra | 815 574,4 | 8,1 | 160 940,3 | -31,0 | 164(the highest) |

| 8 | JSC Transneft INN 7706061801 |

Moscow | 687 139,6 | 8,6 | 10 652,4 | -4,4 | 162(the highest) |

| 9 | LLC LUKOIL-West Siberia INN 8608048498 |

Khanty-Mansijsk Autonomous District-Yugra | 645 717,5 | 18,4 | 118 831,5 | 18,6 | 197(the highest) |

| 10 | JSC Bashneft INN 274051582 |

Republic of Bashkortostan | 489 213,4 | 1,1 | 46 509,9 | 34,9 | 190(the highest) |

| 11 | ZAO Tander INN 2310031475 |

Krasnoyarsk Territory | 477 464,8 | 36,2 | 18 878,8 | 214,9 | 210(high) |

| 12 | ZAO Trade House PEREKRIOSTOK INN 7728029110 |

Moscow | 419 821,6 | n.a. | 1 367,6 | n.a. | 260(high) |

| 13 | ZAO TC Megapolis INN 5003052454 |

Moscow Region | 381 845,2 | 20,8 | 8 714,7 | 27,8 | 181(the highest) |

| 14 | JSC Tatneft imeni V.D.Shashina INN 1644003838 |

Republic of Tatarstan (Tatarstan) | 344 563,3 | 8,2 | 66 707,4 | 21,5 | 133(the highest) |

| 15 | LLC LUKOIL-Nizhegorodnefteorgsintez INN 5250043567 |

Nizhny Novgorod Region | 326 188,7 | 1,7 | 27 765,5 | -3,4 | 174(the highest) |

| 16 | LLC STROYGAZMONTAZH INN 7729588440 |

Moscow | 324 697,9 | 31,9 | 29 649,2 | 104,0 | 231(high) |

| 17 | JSC Mining and Metallurgical Company "NORILSK NICKEL" INN 8401005730 |

Krasnoyarsk Territory | 288 554,5 | -6,6 | 70 136,6 | -37,5 | 157(the highest) |

| 18 | JSC Rostelecom INN 7707049388 |

Saint-Petersburg | 282 904,3 | 31,8 | 32 674,4 | 0,3 | 178(the highest) |

| 19 | JSC Vimpel-Communications INN 7713076301 |

Moscow | 280 300,6 | 7,4 | 36 329,2 | -11,9 | 237(high) |

| 20 | LLC LUKOIL-Komi INN 1106014140 |

Komi Republic | 279 879,2 | 14,6 | 37 596,7 | -8,2 | 217(high) |

| 21 | JSC Mobile TeleSystems INN 7740000076 |

Moscow | 270 828,7 | 9,7 | 44 706,2 | -15,4 | 199(the highest) |

| 22 | LLC VOLKSWAGEN Group Rus INN 5042059767 |

Kaluga Region | 258 762,8 | 34,7 | 10 513,4 | 466,6 | 201(high) |

| 23 | LLC LUKOIL Permnefteorgsintez INN 5905099475 |

Perm Territory | 256 666,0 | 7,5 | 35 958,1 | 15,6 | 169(the highest) |

| 24 | LLC Gazprom transgaz Yugorsk INN 8622000931 |

Khanty-Mansijsk Autonomous District-Yugra | 255 917,7 | 8,8 | 1 447,2 | -1 519,5 | 223(high) |

| 25 | JSC Megafon INN 7812014560 |

Moscow | 254 453,0 | 12,4 | 43 379,0 | -2,9 | 206(high) |

| 26 | LLC LUKOIL-Yolgogradneftepererabotka INN 3448017919 |

Volgograd Redion | 248 686,3 | 15,8 | 32 456,3 | 14,3 | 157(the highest) |

| 27 | JSC SIBUR Holding INN 7727547261 |

Saint-Petersburg | 243 329,0 | 2,0 | 52 567,6 | -44,4 | 214(high) |

| 28 | JSC Magnitogorsk Iron & Steel Works INN 7414003633 |

Chelyabinsk Region | 243 059,0 | -1,7 | 7 925,0 | -568,4 | 215(high) |

| 29 | JSC Novolipetsk Steel INN 4823006703 |

Lipetsk Region | 240 122,7 | 8,6 | 25 151,8 | -27,4 | 182(the highest) |

| 30 | LLC Ashan INN 7703270067 |

Moscow Region | 232 602,5 | 13,4 | 10 084,5 | 17,2 | 206(high) |

| 31 | LLC Toyota Motor INN 7710390358 |

Moscow Region | 227 666,9 | 25,9 | 13 385,0 | 125,3 | 145(the highest) |

| 32 | JSC Severstal INN 3528000597 |

Vologda Region | 223 610,7 | -12,1 | 14 637,9 | -867,0 | 242(high) |

| 33 | JSC Orenburgneft INN 5612002469 |

Orenburg Region | 218 522,6 | 9,2 | 66 967,7 | -5,6 | 238(high) |

| 34 | JSC Samotlorneftegaz INN 8603089934 |

Khanty-Mansijsk Autonomous District-Yugra | 217 411,0 | 19,1 | 29 000,5 | 22,2 | 188(the highest) |

| 35 | ZAO Vankorneft INN 2437261631 |

Krasnoyarsk Territory | 215 819,0 | -5,2 | 34 469,5 | -64,1 | 277(high) |

| 36 | JSC Mosenergosbyt INN 7736520080 |

Moscow | 213 460,6 | -1,2 | 1 519,6 | -65,3 | 223(high) |

| 37 | LLC Gazprom dobycha Yamburg INN 8904034777 |

Yamal-Nenets autonomous District | 205 698,1 | 50,3 | 1 598,4 | 5,6 | 225(high) |

| 38 | LLC LUKOIL-Reservnefteproduct INN 7709825967 |

Moscow | 202 446,2 | 30,4 | 3 400,5 | 69,7 | 204(high) |

| 39 | JSC Concern Rosenergoatom INN 7721632827 |

Moscow | 200 526,1 | -0,4 | -1 848,7 | -36,5 | 244(high) |

| 40 | LLC METRO Cash & Carry INN 7704218694 |

Moscow | 186 232,7 | n.a. | 13 214,0 | n.a. | 250(high) |

| Total for top-40 | 21 098 452,3 | 18,5 | 2 238 788,6 | -15,6 | - | ||

According to the results of 2012, total turnover of TOP-40 the largest companies amounted to 21 098 452,3 mln.RUB. That is 18,5% more in comparison with the same period of last year. However the dynamic of total financial results of companies’ activity – net profit, is not so good. Last year total gross margin of TOP-40 ranking companies reduced by 15.6%, this could testify of the economic crisis rise. This fact is confirmed by decrease in growth rates of industrial production and gross domestic product.

According to the results of 2013, it is possible to assume with a high degree of probability that net profit of the largest companies will also decrease, as main macroeconomic indicators of the current year will obviously be even worse, than previous. The corporate debt grows, financial risks increase. The management should carefully choose the investment programs, as lack of resources is quite probable.

However, it should be mentioned, that all companies of TOP-40 list have high and the highest solvency index GLOBAS-i® of the agency Credinform. The companies guarantee repayment of the debts. The risk of debt default is minimum or below average. Enterprises are competitive and have a steady consumer demand in their segments. From the investment point of view, the cooperation with the companies from the ranking list seems to be favorable and quite reasonable.

Russians will be limited to use cash

It’s not a secret that amount of the cash turnover in developed countries is significantly limited. There are many reasons for it, among which: under non-cash money turnover the transparence of economy rises, shady reciprocal payments decrease, this leads to increase of tax performance, decline in service charge for infrastructure on issue and upkeep of bank notes and coins, it is easier to steel the money from your purse than virtual one; it’s convenient to use cards. Cardholders are offered all kinds of bonuses and discounts in worldwide trade and hotel chains.

Our country gradually turns from cash to non-cash turnover. Development of acquiring infrastructure, ATMs, mobile self-service offices, so-called «electronic money» works towards this change. However, according to the senior vice-president of the Central Bank of Russia Georgy Luntovsky, the interest of cash payment amounts more than 90% of all money turnover. Certainly, this is surplus and economically unjustified.

In order to drive the situation from the dead-lock, the Ministry of Finance produced a document that will decrease cash payments by law. According to the bill, quantitative restriction on cash payments between individuals and legal persons with the sum more than 600 thousand rubles, with the following reduction to 300 thousand rubles is to be imposed from 2014. Moreover, the companies with the turnover that exceeds 600 thousand rubles would be obliged to take bank cards everywhere.

Central Bank’s Governor Elvira Nabiullina endorsed the initiative of the colleagues from the Government, but stated that it is necessary to give the right to set limitations on eligible sum of cash payments to a megacontroller.

Apart from obvious advantages of corresponding innovations, some experts express apprehensions for the fact that now even in big cities, not considering province, the network of taking the plastic cards is underdeveloped. There is also a problem of protection of virtual money against fraudsters that develop different schemes of their theft up to chip-reading devices. All other things being equal, we should admit though that electronic money are protected more than cash in one’s own pocket, and offered innovations would just speed up the change of the companies, including retail networks, over to non-cash payment.