The dynamics of the ruble-dollar rate as a mirror of the Russian economy

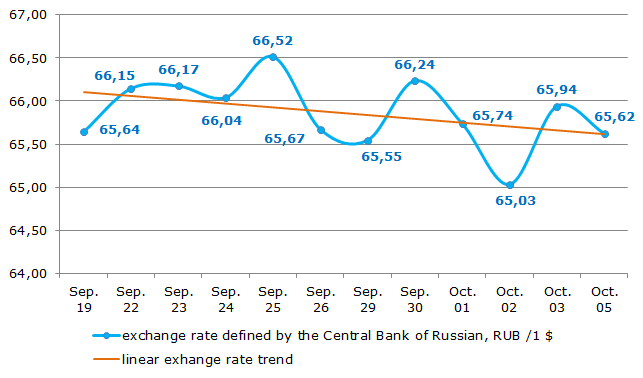

According to the Central Bank of the Russian Federation, for the recent 2 weeks (from September 19 to October 05, 2015) the exchange rate varied from RUB 65,03 to 66,52 to US dollar (see Figure 1). However considering all the volatility of the rate the linear trend during the stated period was showing the descending curve. It gives evidence of several movements towards appreciation. Nevertheless, the strengthening of the ruble-dollar rate cannot be characterized as a stable, due to the fact that too short a time was taken for the evaluation.

Figure 1. Ruble-dollar rate for the period of September 19 – October 05, 2015

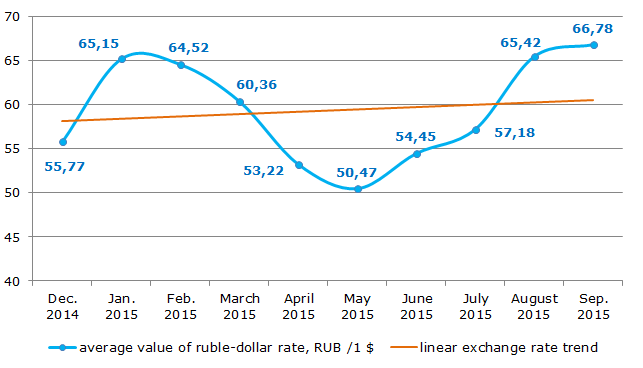

The analysis of the average values for the period from December, 2014 to September, 2015 showed that there was a fluctuation in exchange rate in the range of RUB 50,47 – 66,78 to US dollar (Figure 2). Moreover, the average value rate curve has delicately mirrored the Russian economic environment in the whole: the January leap was a continuing reaction to the situation in December, 2014. Then from February to May, 2015 there was an appreciation of the ruble, the economy was recovering and the analysts were expecting the improvement of the business activity.

Figure 2. Monthly average value of the ruble-dollar rate for the period of December, 2014 – September, 2015

Beginning from May, 2015, the ruble started weakening gradually. In September, 2015 its average value reached RUB 66,78 for a US dollar. In that time the expectations of the experts concerning sanctions’ ending, increase in world oil market prices and improvements in the Russian economy weren’t satisfied. For example, in the end of the second quarter of 2015, the economic experts started talking about the recession in the industry and in the third quarter – about stagnation. Probably the declining ruble being influenced by different factors made it possible to soften the negative tendencies in the economy and to deny the sharp income decrease and consequently the fall-off GDP volume.

According to experts of the Information Agency Credinform, the ruble in the whole is influenced by different factors. The key factors are: geopolitical tensions; international sanctions; the environment of the American and Chinese economies; decrease in world oil market price; negative tendencies in the Russian economy; risk of deficit in currency liquidity etc.

Recently the media has proposed different ways of the ruble appreciation. There are 9 methods offered by the experts of the Sberbank CIB:

- not to buy gold,

- to put pressure on the exporters,

- interventions of the Central Bank of Russia,

- interventions of the Ministry of Finance,

- verbal interventions,

- currency repurchase agreement,

- currency repurchase agreement,

- rate increase,

- capital flow control.

The evaluation of the stated methods shows that the restrictive or proscriptive measures should be taken. The refusal of buying gold, decline in oil output, in particular putting pressure on the exporters, rate increase, capital flow control will lead to even a greater worsening of the country’s economy and to repulsion of investors. The latter is important seeing that in present conditions the economic driver might be not a consumer demand, but investments. Other financial instruments should be used carefully, in order not to cripple the country’s economy.

On the other hand, the weak ruble is sort of positive instrument to stimulate the Russian economy, due to the fact that it promotes the concentration of monetary means in Russia. For example, Russian products appear to be more rival according to value; the effectiveness of investments in the Russian economy has increased; export benefit; negative trends generated the detailed income and expense estimation and the improvement of the financial flows; the tourist movement has increased; Russian citizens give preference to vacation in Russia etc. Therefore the country’s leadership and the leading economists advise the business community and the citizens to prepare for living under the conditions of the low oil price and consequently for the prevailing ruble and US dollar rate.

On individuals bankruptcy

Today the entering into force of «The Law on bankruptcy of individuals» is widely discussed. Strictly speaking, the issue is the Federal Law №476-FL with intricate name «On Amendments to the Federal Law 'On Insolvency (Bankruptcy)' and Certain Legislative Acts of the Russian Federation to Regulate Rehabilitation Procedures for Individual Debtors" of 29 December 2014.

The original Law must have come into force after July 1, 2015. However, due to unavailability of courts to trial of, as it was suggested, significant quantity of cases on bankruptcy of individuals, its commencement was postponed to October 1, 2015.

Amendments were made to some articles of the Criminal and Town Planning/Urban Planning Codes of the Russian Federation, and to the Federal Laws, concerning insolvency (bankruptcy), and mortgage.

In case of inability to fully satisfy the requirements of one or several bankruptcy creditors on statutory payment, a person is obliged to apply to the court for bankruptcy. The amount of debt must be not less than 500 th RUB. Individual’s bankruptcy cases may be initiated by subjects, bankruptcy creditors and other authorized bodies.

Unlike bankruptcy cases of legal entities and individual entrepreneurs, the individual’s bankruptcy cases will be considered by general jurisdiction courts. By initiated case the court obligatorily appoints a finance manager, who is charged with obligations similar to court-appointed manager. According to the results of case proceeding, the trial courts may take decisions on restructuring of debt or realization of property or settlement agreement. Court has right to make determination on temporary restriction of exit from the Russian Federation, ban to open bank accounts and manage commercial organizations. Real estate, jewelry and luxury items at the cost of more than 100 th RUB must be sold in a public sale. However, under the court decision the debtor cannot be deprived of a sole real estate. Moreover, the debtor can keep daily used items amounting to 30 th RUB.

After closing the bankruptcy case the debtor has no right to undertake credit or loan obligations during 5 years without the reference to a bankruptcy fact.

By amendments it was established:

- criteria of individual’s insolvency;

- peculiarities of consideration the validity for bankruptcy petition;

- project preparation and presentation on restructuring of the debt plan, its content and procedure for implementing, including cases of application for new credit or purchase of goods by instalment;

- peculiarities of determination the proceedings оn individual’s bankruptcy due to the settlement agreement or in case of the debtor`s death.

Following the experts, the provisions of the Law may apply to about half a million debtors. The mortgage credit debtors in foreign currency may be mostly interested in bankruptcy procedure when the amount of debt exceeds the market price of realty.

According to the financial analysts, the amendments will not have much impact on banking activity, and debt collection loses sense after the court receives the bankruptcy petition, when the claimant has to get into the bankruptcy proceeding.

However, the integration of the individuals bankruptcy proceeding may face difficulties on the first stage connected with restructuring of courts, lack of professionals – financial managers.

After some time, as far as all procedures get fixed, the Law let ease tension in society because of increasing volume of «lost debts» and broaden the possibilities of debt collection.

Reportedly, for the first few days of forcing the Law, first petitions on individuals’ bankruptcy are filed in courts. It should not be expected that decisions of general jurisdiction courts on individuals’ bankruptcy cases will be published by operation of the Law on personal data.