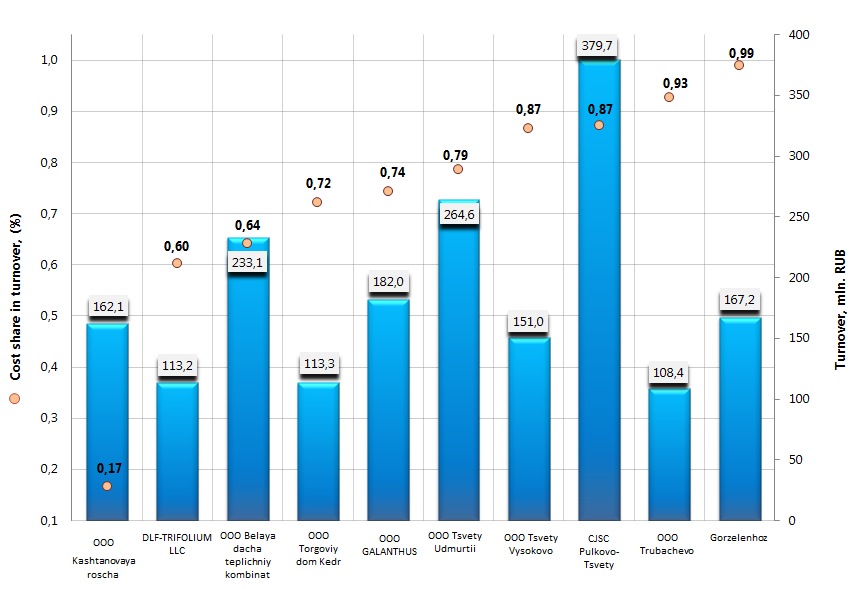

Products cost of enterprises engaged in ornamental horticulture

Information agency Credinform prepared a ranking of companies engaged in ornamental horticulture. Companies with the mentioned activity type and the highest volume of revenue were selected for this ranking according to the data from the Statistical Register for the latest available period (for the year 2013). The enterprises of were ranked by decrease in products cost share in the turnover.

The cost price is a cost (expenses) for raw materials, fuel, energy, labor and other. It is an important qualitative indicator reflecting how much the company costs on production and marketing. The lower is the cost price, the higher are profit and profitability. Normative values for this indicator are not specified. For evaluating the effectiveness of cost management, it is necessary to look through the percentage of the cost price in the company's turnover.

| № | Name, INN | Region | Turnover 2013, mln. RUB | Productscos, mln. RUB | Cost price share in turnover, (%) | Solvency index Globas-i® |

|---|---|---|---|---|---|---|

| 1 | ООО Kashtanovaya roscha INN: 5025017037 |

Moscow region | 162, 06 | 27,00 | 16,7% | 248 (the highest) |

| 2 | DLF-TRIFOLIUM Limited Liability Company INN: 7715833236 |

Moscow | 113,20 | 68,20 | 60,3% | 269 (high) |

| 3 | ООО Belaya dacha teplichniy kombinat INN: 5027228964 |

Moscow region | 233,11 | 149,66 | 64,2% | 195 (the highest) |

| 4 | ООО Torgoviy dom Kedr INN: 1655178526 |

the Republic of Tatarstan | 113, 30 | 81,79 | 72,2% | 292 (high) |

| 5 | OOO GALANTHUS INN: 4026006318 |

Kaluga region | 181, 97 | 135,26 | 74,3% | 181 (the highest) |

| 6 | ООО Tsvety Udmurtii INN: 1827011427 |

the Republic of Udmurtia | 264,64 | 208,34 | 78,7% | 184 (the highest) |

| 7 | ООО Tsvety Vysokovo INN: 4414010191 |

Kostroma region | 151,01 | 130,95 | 86,7% | 240 (the highest) |

| 8 | CJSC Pulkovo-Tsvety INN: 7810081963 |

Saint-Petersburg | 379,70 | 331,35 | 87,3% | 217 (the highest) |

| 9 | ООО Trubachevo INN: 7014052499 |

Tomsk region | 108,43 | 100,54 | 92,7% | 262 (high) |

| 10 | Municipal agricultural decorative enterprise "Gorzelenhoz" INN: 711026380 |

the Kabardino-Balkarian Republic | 167,24 | 165,65 | 99,0% | 253 (high) |

The average cost price share in the turnover of the Russian ornamental plant nurseries is 73,20%. That shows high expenses on production and can be an indicator of an outdated industrial base.

Cost of the largest enterprises engaged in production farm goods, Top-10

The Top-4 is presented with the following companies: ООО Kashtanovaya roscha (0.17%), DLF-TRIFOLIUM Limited Liability Company (0,60%), ООО Belaya dacha teplichniy kombinat (0,64%), ООО Torgoviy dom Kedr (0,72%). The companies shown acceptable values of production costs relative to their turnover. This result demonstrates the balanced products cost. The enterprises got high and the highest solvency index Globas-i® in terms of financial and non-financial factors set; that characterizes them as financially stable.

The rest of the Top-10 companies have shown the value of the index above the average (73,20%), that indicates that enterprises of the industry should be more rational in approach to their own costs management to improve competitiveness.

Economy continues to decline, but a short-lived growth is possible

Following the results of the first five months of 2015 the overall situation in the Russian economy is characterized by a decrease in the main macroeconomic indicators compared to the same period of 2014. According to the Federal State Statistics Service (Rosstat) and estimates of the Ministry of Economic Development (MED), the index of industrial production in Russia decreased by 2,3% in the period from January to May 2015, freight turnover - by 2,1%, of which railway transport - by 0,4%; the volume of paid services for people - by 1,4%. The unemployment rate grew by 5,7% for the first five months of the current year. The Consumer Price Index, according to MED and the Central Bank of the RF, made 8,5% for January-June 2015.

A more serious decline was shown by physical volumes of output on the basic types of economic activity - by 4,0%; investments in fixed assets – 4,8%; the scope of work on the type of activity "Construction" – 6,1%; retail trade turnover – 7,7%; the real average monthly salary of one employee – 8,8%; export - by 29,3%, import - by 38,3%. As a positive result on this background it may be marked only the index of agricultural output, which rose by 3,3%, and the growth in the volume of communication services by 1.0%.

At the same time, based on data of MED and Rosstat, economists assert that the decline rates of economic indicators are slowing. For example, Russia's GDP in 2015 has been declining from month to month (seasonal factor was not taken into account): in January compared to the previous month – by 1,5%, in February - by 0,9%, in March – 0,8%, in April – 0,6%, in May, according to preliminary estimates, - 0,4%.

The slowdown in the fall of GDP in Russia, according to analysts, was contributed finally by current inflationary developments, which led to a sharp rise in prices, and a weak ruble. According to estimates of the experts of the Information agency Credinform, manufacturing increased the volume of shipped goods of own production in monetary terms due to raising prices on their products. For the period from January to May 2015 the increase made 13,9% compared to the same period of the last year. The highest growth was marked in the manufacture of food products, including beverages and tobacco – 24,7%; in chemical industry – 28,5%, and metallurgical production – 31,6%.

Illustrative is also the turnover of organizations on the types of economic activity. The increase in the first five months of 2015 compared to the same period in 2014 amounted to 8,2%. The significant increase in turnover occurred in fishing industry - by 70,1%; metallurgical production – 35,1%; chemical industry – 27,4%; water transport activity – 27,1%; in agricultural sector – 25,9%; manufacture of pulp, ground wood, paper, cardboard and articles thereof – 25,3%; in production of food, including beverages and tobacco – 20,5%; mining – 16,4%, and others.

Moreover, MED and a part of banking experts believe that the economic growth of Russia is possible in the second half of 2015. This will be contributed either by an increase in private consumption, or by a rise in private investment demand. In this and in another case there are internal risks of capital outflows and an increase in pressure on the ruble by possible fluctuations in the external environment. However, the trends of the first scenario are already observed, for example, reduction in food prices. Currently there is a drop in wholesale gasoline prices, and generally in August 2015 the experts expect deflation.