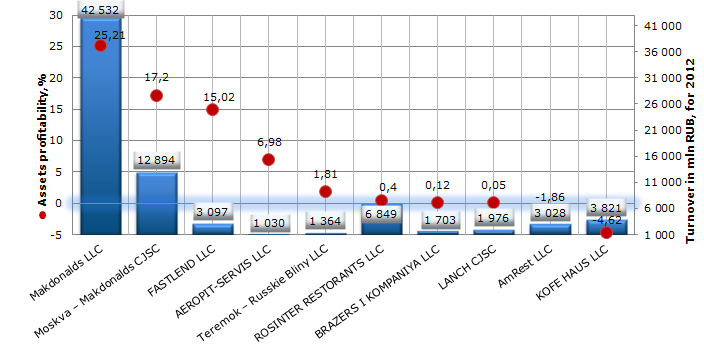

Return on assets of restaurant business

Information agency Credinform prepared a ranking of the return of assets of restaurant business in Russia. The companies with highest volume of revenue were selected for the research according to data from the Statistical Register for the latest available period (for the year 2012). Then, the first 10 enterprises selected by turnover were ranked by decrease in return on assets value.

Return on assets is a financial indicator, which shows how many monetary units of net profit were earned by each unit of total assets; is calculated as the relation of net profit and interests payable to company’s total assets value. This ratio represents the ability of an organization to generate profit, without regard to capital structure. As for all profitability ratios there are no specified values prescribed for the analyzed ratio, because its value varies strongly depending on the branch, where an enterprise operates.

| № | Name, INN | Region | Turnover for 2012, in mln RUB | Return on assets, (%) | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | Makdonalds LLC INN 7710044140 |

Moscow | 42 532 | 25,21 | 138 (the highest) |

| 2 | Moskva – MakdonaldsCJSC INN 7710044132 |

Moscow | 12 894 | 17,2 | 153 (the highest) |

| 3 | FASTLEND LLC INN 7703234453 |

Moscow | 3 097 | 15,02 | 196 (the highest) |

| 4 | AEROPIT-SERVIS LLC INN 5047061576 |

Moscow region | 1 030 | 6,98 | 224 (high) |

| 5 | Teremok – Russkie Bliny LLC INN 7825483150 |

Saint-Petersburg | 1 364 | 1,81 | 201 (high) |

| 6 | RESTORANNAYA OB’EDINENNAYA SET I NOVEISHIE TEHNOLOGII EVROAMERIKANSKOGO RAZVITIYA RESTORANTS LLC INN 7737115648 |

Moscow | 6 849 | 0,4 | 231(high) |

| 7 | BRAZERS I KOMPANIYA LLC INN 7710227312 |

Moscow region | 1 703 | 0,12 | 235 (high) |

| 8 | LANCH ZAO INN 7710215170 |

Moscow region | 1 976 | 0,05 | 550 (satisfactory) |

| 9 | AmRest LLC INN 7825335145 |

Saint-Petersburg | 3 028 | -1,86 | 214 (high) |

| 10 | KOFE HAUS. ESPRESSO I KAPUCHINO BAR LLC INN 7704207300 |

Moscow | 3 821 | -4,62 | 269 (high) |

The dominant position on the Russian restaurant market is held by networks focused mainly on mid-range segment. For the most part these are so called fast food stations.

The first place of the ranking list belongs to the industry leader on turnover Makdonalds LLC with the return on assets 25,21%. The company also got the highest solvency index GLOBAS-i® that characterizes it as more attractive for business cooperation.

Picture. Return on assets of restaurant business, TOP-10

Moskva – Makdonalds CJSC and FASTLEND LLC are on the second and the third places in the ranking with the return on assets values 17,2 and 15,02% respectively. Both companies got the highest solvency index GLOBAS-i® that characterizes them as financially stable.

The return on assets value of RESTORANNAYA OB’EDINENNAYA SET I NOVEISHIE TEHNOLOGII EVROAMERIKANSKOGO RAZVITIYA RESTORANTS LLC and BRAZERS I KOMPANIYA LLC is less than 1 and made only 0,4 and 0,12% respectively. And the ratio values of companies AmRest LLC and KOFE HAUS. ESPRESSO I KAPUCHINO BAR LLC is negative at all. Such results can testify to ineffective administration of assets on the part of enterprise management. However, all four companies got a high solvency index GLOBAS-i®, because the assessment of the company's attraction for business cooperation is comprehensive and takes into account the combination of factors.

The company Lanch CJSC with the return on assets value 0,05% got a satisfactory solvency index GLOBAS-i®, because there are data on non-fulfillment of obligations by the enterprise.

Analyzing results of companies-industry leaders, it may be noted that, unfortunately, the return on assets ratio of most companies in the ranking (7 from 10) couldn’t reach 10%, that can testify of low efficiency of using assets, this is because the service sector is traditionally more profitable, than capital intensive industries. However, because the value under investigation takes into account all assets of an organization, and not only own funds, then often it is less interesting for investors. That is why, for the comprehensive assessment of a situation in the industry it should be considered the combination of financial and non-financial indicators.

Entrepreneurs have referred to venture capital financing

Recently, the news about the capital flight from Russia has remained on the pages of business publications. Investors, first of all foreign, in the period of macroeconomic instability, are in attempt to protect their finances and dispose of so called risky investments to the developing countries. Highly liquid capital, without any delay in the country, loses by that its investment component in the long-term.

It should seem in such conditions, there is no place for risky investments, which are connected with the development of information technologies and high-tech economy sector. However, the situation is not so unique, as it might appear at first sight.

Today in order to hold its business segment, for the development of a new business, companies begin to turn step by step to the practice of venture capital financing. This direction of financial investments is new enough in our country and the potential is very high here.

There are two directions of high risk investments developing today in Russia – corporate venture capital financing and activity of « business angels».

In the first case, organizations establish own venture funds, which they invest in advanced research and development, innovative projects (startups), in firms gained a reputation in the high-tech market. According to conservative estimates, the volume of such investments could reach 34 bln RUB in the Russian market in the nearest time.

The activity of business angels represents the investment of private funds in advanced development. This direction is absolutely new in domestic business environment, first of all because potential investors possessing necessary resources are conservative and don’t know at times where they could invest. At the same time, the government hasn’t lost its scientific potential and has a great amount of engineering talents, who cannot find its benefactors. It is required to increase the information awareness of the market and to explain the rules of the game on it. But it is possible now to talk about its rapid growth: according to the data of the National association of business angels (NABA), the average volume of investments made 928 000 USD in previous year - that is by 63% more than in 2012, and the average quantity of investments of business angels per transaction increased to 232 000 USD.