Rosimushchestvo has prepared changes in timing of dividend payments to state companies and state banks

Rosimushchestvo (Federal Agency for State Property Management) has prepared and submitted for consideration a number of amendments to the decree of the Government of 2006, which regulates the timing of dividend payments to state companies and state banks. New amendments may come into force already in 2015, i.e. by dividend payments for the year 2014.

Rosimushchestvo offers to oblige state companies and state banks to allocate for dividends minimum 25% of consolidated net profit, in the event they report in accordance with International Financial Reporting Standards (IFRS), otherwise it must be paid in accordance with Russian Accounting Standards (RAS).

As of today the Federal Tariffs Service (FTS) de facto takes into account the norm of profit by the tariff making for monopolies, but de jure it is mentioned nowhere.

As the base for calculation of dividends of monopolies the government agency offers to take maximum from two indicators: net profit on financial statement or net profit, taken into account by the FTS by adoption of a tariff. According to the representatives of Rosimushchestvo, such approach will motivate the management of monopolies to more efficient operations, because as of today the management of organizations re-examines the budget several times and total profit value appears to be much less, than the planned one.

However, the FTS hasn’t approved this proposal, believed that it could lead to the rise in tariffs for consumers. The position of the representatives of the FTS comes down to the fact that the question of dividends must be solved not on account of tariffs, but on account of cost saving. Besides that, the representatives of the FTS note potential adverse effects for monopolies, because the profit, taken into account by the FTS, is a forecast and by force of objective reasons it can differ essentially from actual values and not always in favor of monopolies.

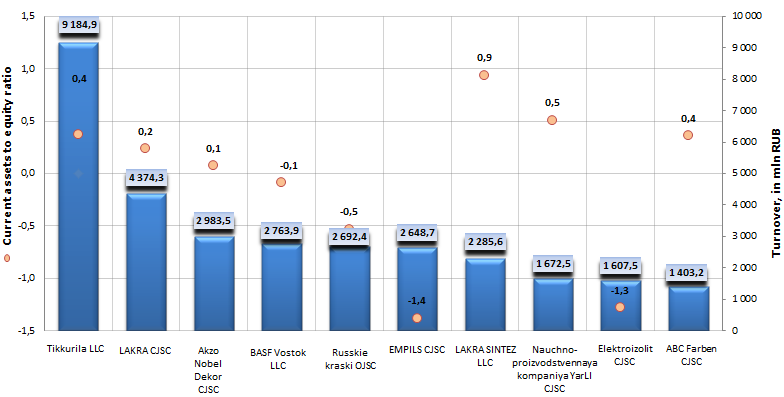

Current assets to equity ratio of manufacturers of paints, varnishes and lacquers in the RF

Information agency Credinform prepared a ranking «Current assets to equity ratio of Russian manufacturers of paints, varnishes and lacquers». The companies with highest volume of revenue were selected for this ranking according to data from the Statistical Register for the latest available period (for the year 2012). Then these enterprises were ranked by decrease in turnover.

Current assets to equity ratio (х) - is calculated as the relation of own current assets of a company to total value of equity. It shows the ability of the enterprise to maintain the current capital level and to finance current assets in case of need with own sources. The recommended value is from 0,2 to 0,5.

High value of the ratio and its stable growth characterizes positively the financial standing of an organization, as well as testifies that its management uses own funds flexible enough.

Some analysts consider as optimal that value of this ratio, which is equal to 0,5. It means that it should be observed the parity principle of investment of own funds in current and non-current assets, what will provide sufficient accounting liquidity. Low value of this ratio means, that significant part of own funds of an organization is focused on the financing of non-current assets, which liquidity is not high. The closer is the ratio value to the optimal one, the more financial opportunities has an enterprise and the more mobile assets are within the equity capital. However, the value of this ratio may change significantly depending on the type of company’s activity and the structure of its assets: the higher is the share of current assets, the lower is the ratio level and, vice versa, if an enterprise rents fixed capital and its property is represented mainly by current assets, the ratio level will be high. Also the ratio level depends to a large extent on the kind of company’s activity. In particular, in asset-intensive industries its normal level should be lower, than in material-intensive, because in these organizations the significant part of own funds is the source of the coverage of fixed capital stock.

Taken as a whole, the financial standing of an organization depends on the outstripping growth of the sum of own current assets in comparison with the growth of tangible assets and equity capital.

| № | Name | Region | Turnover,in mln RUB, for 2012 | Current assets to equity ratio, (х) | Solvency indexGLOBAS-i® |

|---|---|---|---|---|---|

| 1 | Tikkurila LLC INN: 7816424590 |

Saint-Petersburg | 9 184,9 | 0,4 | 195(the highest) |

| 2 | LAKRA CJSC INN: 7726296375 |

Moscow region | 4 374,3 | 0,2 | 226(high) |

| 3 | Akzo Nobel Dekor CJSC INN: 5001027607 |

Moscow region | 2 983,5 | 0,1 | 180(the highest) |

| 4 | BASF Vostok LLC INN: 7710317252 |

Moscow region | 2 763,9 | -0,1 | 201(high) |

| 5 | Russkie kraski OJSC INN: 7605015012 |

Yaroslavl region | 2 692,4 | -0,5 | 202(high) |

| 6 | EMPILS CJSC INN: 6167008343 |

Rostov region | 2 648,7 | -1,4 | 284(high) |

| 7 | LAKRA SINTEZ LLC INN: 7702177932 |

Moscow region | 2 285,6 | 0,9 | 251(high) |

| 8 | Nauchno-proizvodstvennaya kompaniya YarLI CJSC INN: 7602003918 |

Yaroslavl region | 1 672,5 | 0,5 | 207(high) |

| 9 | Elektroizolit CJSC INN: 5042000530 |

Moscow region | 1 607,5 | -1,3 | 225(high) |

| 10 | ABCFarben CJSC INN: 3618003426 |

Voronezh region | 1 403,2 | 0,4 | 232(high) |

Picture 1. Current assets to equity ratio and turnover of the largest Russian manufacturers of paints, varnishes and lacquers (TOP-10)

Cumulative turnover of the first 10 largest Russian paint enterprises made 31 616,6 mln RUB, following the results of the latest published financial statement, that is higher by 26,7%, than the indicator of the previous year, and makes 46% of the revenue of TOP-100 companies of the branch.

The most optimal values of the analyzed ratio, providing sufficient accounting liquidity among the largest manufacturers of varnish-and-paint goods, were shown by following enterprises: Tikkurila LLC (0,4), Nauchno-proizvodstvennaya kompaniya YarLI CJSC (0,5) and ABC Farben CJSC (0,4).

In Russia the concern Tikkurila is the leader of the domestic market, started its activity in the 1980s with the export of industrial coatings from Finland. In the 1990s Tikkurila became the first western company, presented the tinting system in Russia. In 1995 Tikkurila opened the first European paint plant in Russia.

Nauchno-proizvodstvennaya kompaniya YarLI CJSC (0,5) – develops and manufactures paints, varnishes and lacquers of different purpose and is engaged in basic and applied research in the field of the technology of paint materials and coatings. The major part of paint materials, produced by NPK YarLI CJSC, is in competition with an increased inflow of imported (first of all West-European) paints, varnishes and lacquers in the market.

ABC Farben CJSC (0,4) – is one of the largest enterprises-manufacturers of paints, varnishes and lacquers, producing environmentally-friendly products, with using of the latest developments of scientific and technological progress in its field.

Also the company LAKRA CJSC (0,2) felt within the recommended range of current assets to equity ratio – supplies the market with universal and special enamels and paints, decorative plaster, foams and sealants, means of surface protection, as well as ancillary and collateral materials for building and repair.

The rest producers from TOP-10 exceeded recommended values of current assets to equity ratio.

However, according to the independent estimation of solvency, developed by the Information agency Credinform, all TOP-10 enterprises got a high and the highest solvency index GLOBAS-i®, what guarantees that they can pay off their loan liabilities in time and fully. Risk of default in the nearest time is highly improbable, organizations are attractive objects for investment, especially considering high potential of the Russian market.