Federal law regulating debt collection is coming into force

In our article as of 25.04.2016 “New Debt Collection Regulations Introduced in Russia” we particularized the history of the bill. Over the past period the law has been passed and endorsed by the President of the RF on July 3, 2016. The Federal law №230-FL "About protection of the rights and legitimate interests of physical persons when implementing activities for return of the overdue debt and about introduction of amendments to the Federal law "About Microfinancial Activities and the Microfinancial Organizations" will come into force since January 1, 2017.

The law fixes legal basis for return on the overdue debt of physical persons. The fundamental proposition of the law is debt collection being the main activity type of the organization.

Use of physical force or threat of it, personal or property injury, bullying and circumvention are forbidden by law. Collector is entitled to communicate with the debtor maximum twice a week on the phone and meet in person once a week. Moreover, communication with the debtor at night is forbidden. Collectors have no right to hide using phone numbers and e-mails.

Debt collection will be controlled by the Federal bailiffs service, which is endowed with powers to keep the Register of legal entities engaged in collection of overdue debts. According to the law, debt collection without registration in the register is forbidden.

So, activities for forced and unforced collection of debt will be divided between subdivisions of this federal department and debt collection agencies.

In the publication mentioned above we noticed that tough law requirements to legal entities can reverse debt collection market of Russia.

According to the Information and analytical system Globas-i®, the number of companies containing “collection agency” in their names reduces from 890 as of April 2016 to 414 as of December.

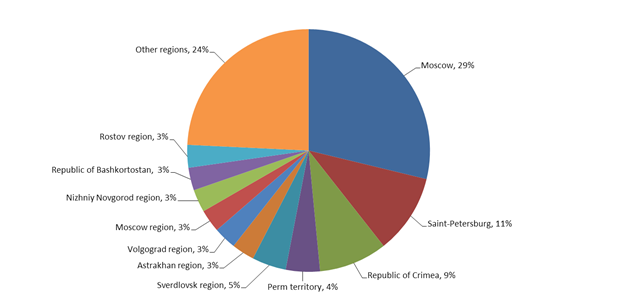

Only 66 companies have registered main activity type directly related to debt collection (OKVED2 82.91) “Activities of collection agencies and credit bureaus”. 79% of them are registered as Limited Liability Company and 21% are individual entrepreneurs. These companies are located in 28 regions of Russia (see Picture 1).

New instrument to recover debts by Banks

The problem with the return of debts of legal and natural persons has prospects to be solved already in the near future. For fighting against debtors the banks resorted extensively to the services of collection agencies for some time ago, for what they were criticized by their customers and attracted the attention of law enforcement bodies. In case of default on obligations or their improper performance by a debtor the parties concerned went to court.

The ability to use extrajudicial procedure of the recovery of money or the reclamation of property from a debtor by creditors (banks) is prescribed by «Fundamentals of legislation of the Russian on notaries» approved by the Supreme Court of the RF on February 11, 1993 under № 4462-1 (ed. from 30.03.2015) and by the Federal Law № 229-FZ from October 2, 2007 «On Enforcement Proceedings» (ed. from 29.06.2015).

In particular, art. 89 of «Fundamentals of Legislation on notaries» points that in case of default an agreement by a pledger on the recovery proceedings against mortgaged property without judicial procedure a notary performs the executive inscription on the pledge agreement or, if the rights of the pledger are certified by a mortgage, the executive inscription is made on the mortgage. In its turn, art. 78 of the Enforcement Law states that a court bailiff can exempt and sell property or transfer it to the claimant on the basis of the executive inscription of a notary.

With the entry into force of the Federal Law №360-FZ from July 3, 2016 «On Amendments to Certain Legislative Acts of the Russian Federation» the opportunity appeared to use more extensively the extrajudicial procedure of the recovery of money and mortgaged property on mortgage agreements concluded before the 7th of March 2012, the basis of which is the executive inscription of a notary. Essentially, the executive inscription of a notary is a way of the enforced collection of indubitable debt extrajudicially without going to court.

In addition, the current legislation does not prescribe any priorities of enforcement documents on a court or executive inscription of a notary. Enforcement proceedings on executive inscriptions of notaries is initiated and carried out per standard procedure.

Most of all the use of the new instrument will affect the activity of collectors, because if before the banks have passed them debts, but now for the repayment of debts banks have got a simple effective instrument convenient for them. In debt repayment cases, it is sufficient for banks to indicate the appropriate item in a contract. In case of the two-month delay it is necessary to get the executive inscription by a notary and, by-passing a court, just go to bailiffs, being charged with appropriate functions for collection on executive inscriptions.

The fact that a bailiff performs the task to return the debt by force is available in the Information and analytical system Globas-i. These data come into the system from the databases of the Federal Bailiff Service, where a bailiff is obliged to make entry of information needed to perform tasks on compulsory execution of judicial acts, acts of other bodies and officials (art. 6.1 of the Federal Law «On Enforcement Proceedings»). Also such information should come from the Federal Register of information about the facts of activity of legal persons, because a debtor is obliged to give notice to creditors on the levy of execution upon his/her property by entering of information about the levy of execution upon such property into the mentioned register.