Profit of software developers

Information agency Credinform represents a ranking of the largest Russian software developers. Software developers and companies rendering consultancy services in this business area (TOP-10) with the largest annual revenue were selected for the ranking, according to the latest accounting periods in the Statistical Register (2017 – 2019). Then they were ranked by the net profit ratio (Table 1). The analysis was based on the data from the Information and Analytical system Globas.

Net profit ratio (%) is a relation of net profit (loss) to sales revenue. It is an indicator of the level of sales revenue.

There is no standard value for this ratio. It is recommended to compare companies of the same industry, or change in the ratio of the specific company. Negative value of the ratio is indicative of the net loss, and the high one means the efficiency of the company.

For the most complete and objective view of the financial condition of the enterprise, it is necessary to pay attention to the complex of indicators and financial ratios of the company.

| Name, INN, region | Revenue, million RUB | Net profit (loss), million RUB | Net profit ratio, % | Solvency index Globas | |||

| 2018 | 2019 | 2018 | 2019 | 2018 | 2019 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| V KONTAKTE LTD INN 7842349892 Saint Petersburg |

19 309,1 19 309,1 |

22 629,2 22 629,2 |

7 059,3 7 059,3 |

8 177,0 8 177,0 |

36,56 36,56 |

36,13 36,13 |

189 High |

| MFI SOFT LIMITED INN 5260146265 Nizhnii Novgorod region |

9 524,2 9 524,2 |

16 387,2 16 387,2 |

2 024,7 2 024,7 |

4 595,7 4 595,7 |

21,26 21,26 |

28,04 28,04 |

171 Superior |

| JSC MEGALABS INN 7713556058 Moscow |

15 955,5 15 955,5 |

17 887,6 17 887,6 |

1 911,1 1 911,1 |

4 542,0 4 542,0 |

11,98 11,98 |

25,39 25,39 |

178 High |

| YANDEX LLC INN 7736207543 Moscow |

104 828,1 104 828,1 |

123 748,2 123 748,2 |

28 241,3 28 241,3 |

26 516,1 26 516,1 |

26,94 26,94 |

21,43 21,43 |

170 Superior |

| EPAM SYSTEMS LTD INN 7719232155 Moscow |

11 690,1 11 690,1 |

14 629,4 14 629,4 |

2 037,2 2 037,2 |

1 468,2 1 468,2 |

17,43 17,43 |

10,04 10,04 |

193 High |

| IBS EXPERTISE INN 7713606622 Moscow |

10 336,1 10 336,1 |

12 145,8 12 145,8 |

948,1 948,1 |

1 138,6 1 138,6 |

9,17 9,17 |

9,37 9,37 |

227 Strong |

| SKB KONTUR INN 6663003127 Sverdlovsk region |

12 776,0 12 776,0 |

14 099,4 14 099,4 |

794,8 794,8 |

796,8 796,8 |

6,22 6,22 |

5,65 5,65 |

173 Superior |

| INFORMATION AND TECHNOLOGY SERVICE COMPANY INN 7728654530 Saint Petersburg |

8 527,0 8 527,0 |

11 940,0 11 940,0 |

144,8 144,8 |

465,2 465,2 |

1,70 1,70 |

3,90 3,90 |

269 Medium |

| IBS PLATFORMIX INN 7707507077 Moscow |

13 805,7 13 805,7 |

14 872,4 14 872,4 |

268,8 268,8 |

320,2 320,2 |

1,95 1,95 |

2,15 2,15 |

189 High |

| LIMITED LIABILITY COMPANY SAP CIS INN 7705058323 Moscow |

35 188,7 35 188,7 |

35 575,6 35 575,6 |

540,8 540,8 |

-1 480,6 -1 480,6 |

1,54 1,54 |

-4,16 -4,16 |

265 Medium |

| Average value for TOP-10 |  24 194,1 24 194,1 |

28 391,5 28 391,5 |

4 397,1 4 397,1 |

4 653,9 4 653,9 |

13,47 13,47 |

13,79 13,79 |

|

| Industry average value |  44,8 44,8 |

56,9 56,9 |

5,7 5,7 |

5,0 5,0 |

12,69 12,69 |

8,36 8,36 |

|

improvement compared to prior period,

improvement compared to prior period,  decline compared to prior period

decline compared to prior period

Average value of debt-to-assets ratio of TOP-10 companies is above the average industry one. Five companies improved the standard value in 2019.

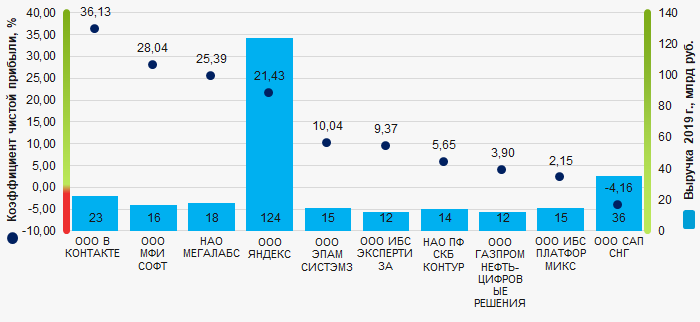

Picture 1. Net profit ratio and revenue the largest software developers in Russia (TOP-10)

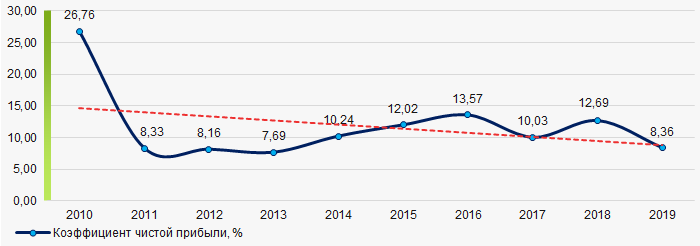

Picture 1. Net profit ratio and revenue the largest software developers in Russia (TOP-10)During the decade, average industry values of net profit ratio had a tendency to decrease. (Picture 2).

Picture 2. Change of industry average values of net profit ratio of software developers in Russia in 2010 – 2019

Picture 2. Change of industry average values of net profit ratio of software developers in Russia in 2010 – 2019Trends in social services

Information agency Credinform has prepared a review of trends of the largest Russian providers of social services.

The largest companies providing social services to the old and disabled people, child care services, social care, etc. (TOP-1000) in terms of annual revenue were selected for the analysis according to the data from the Statistical Register for the latest available periods (2010-2019). The analysis was based on the data of the Information and Analytical system Globas.

Net assets are total assets less total liabilities. This indicator reflects the real value of the property of an enterprise. When the company’s debt exceeds the value of its property, the indicator is considered negative (insufficiency of property).

The largest organization in term of net assets is REPUBLICAN FOUNDATION FOR SUPPORTING SOCIAL AND ECONOMIC PROGRAMS SOZIDANIE, INN 1326178496, the Republic of Mordovia. In 2019, net assets value of the foundation amounted to 1996 million RUB.

The lowest net assets value among TOP-1000 belonged to ZNAYKA KINDERGARTEN LLC, INN 5047152061, Moscow. In 2019, insufficiency of property of the organization was indicated in negative value of -348 million RUB.

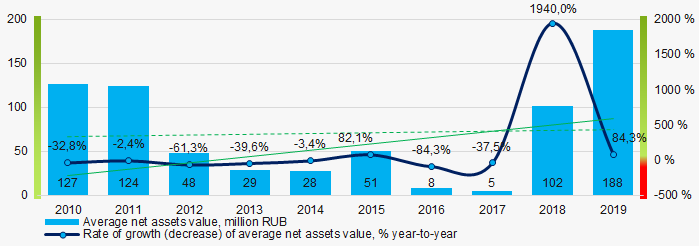

Covering the ten-year period, the average net assets values have a trend to increase with a positive dynamics of the growth rate (Picture 1).

Picture 1. Change in industry average net assets value in 2010 – 2019

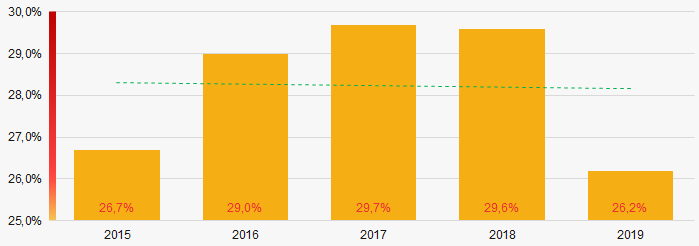

Picture 1. Change in industry average net assets value in 2010 – 2019In general, for the past five years, organizations with insufficient property had significant shares in the TOP-1000 with a trend to some decrease (Picture 2).

Picture 2. Shares of TOP-1000 companies with negative net assets value in 2015-2019

Picture 2. Shares of TOP-1000 companies with negative net assets value in 2015-2019Sales revenue

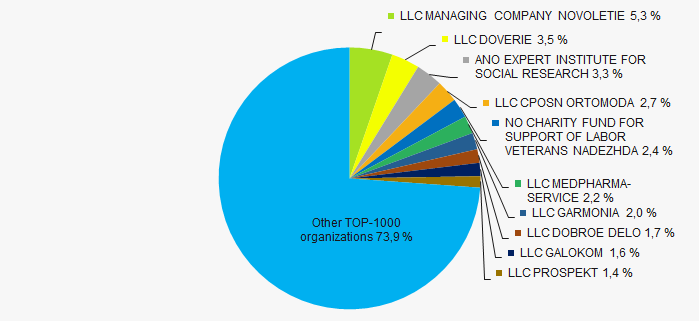

In 2019, the revenue volume of 10 largest organizations of the industry was 26% of total TOP-1000 revenue (Picture 3). This is indicative of relatively high level of competition in the sector.

Picture 3. The share of TOP-10 organizations in total 2019 revenue of TOP-1000

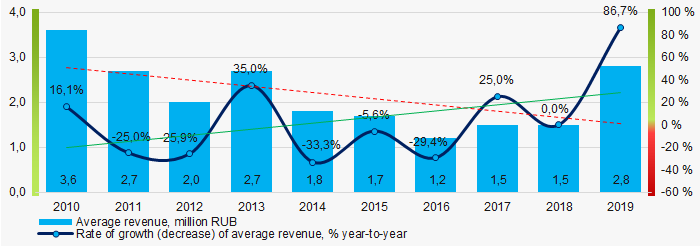

Picture 3. The share of TOP-10 organizations in total 2019 revenue of TOP-1000In general, there is a trend to decrease in revenue with positive dynamics of the growth rate (Picture 4).

Picture 4. Change in industry average net profit in 2010 – 2019

Picture 4. Change in industry average net profit in 2010 – 2019Profit and loss

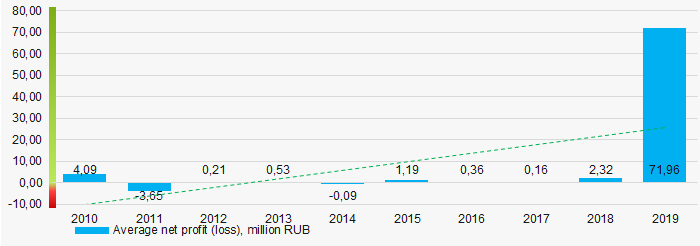

The largest organization in term of net profit is LLC MANAGING COMPANY NOVOLETIE, INN 5904182219, Perm territory. Its profit for 2019 reached 521 million RUB.

Covering the ten-year period, there is a trend to increase in average net profit (Picture 5).

Picture 5. Change in industry average net profit (loss) values in 2010 – 2019

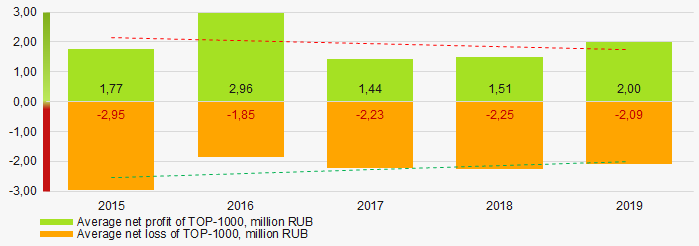

Picture 5. Change in industry average net profit (loss) values in 2010 – 2019For the five-year period, the average net profit values of TOP-1000 have the decreasing trend with the decreasing net loss (Picture 6).

Picture 6. Change in average net profit and net loss of ТОP-1000 in 2015 – 2019

Picture 6. Change in average net profit and net loss of ТОP-1000 in 2015 – 2019Key financial ratios

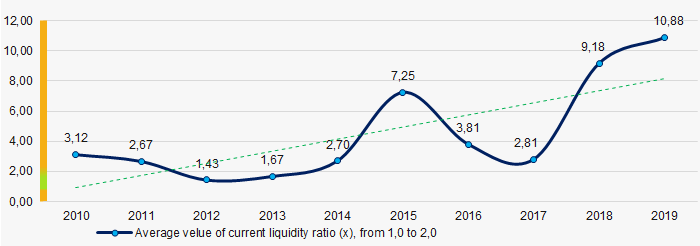

Covering the ten-year period, the average values of the current liquidity ratio were mainly out of the recommended one - from 1,0 to 2,0 with a trend to increase (Picture 7).

Current liquidity ratio (current assets to short-term liabilities) shows the sufficiency of company’s assets to repay on short-term liabilities.

Picture 7. Change in industry average values of current liquidity ratio in 2010 – 2019

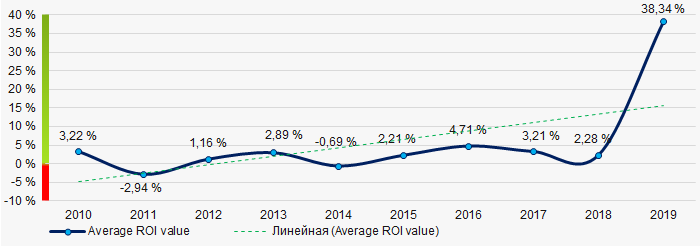

Picture 7. Change in industry average values of current liquidity ratio in 2010 – 2019 Covering the ten-year period, the average values of ROI ratio have a trend to increase (Picture 8).

ROI ratio is calculated as net profit to sum of shareholders equity and long-term liabilities, and shows the return of equity involved in commercial activities and long-term borrowed funds.

Picture 8. Change in industry average values of ROI ratio in 2010 – 2019

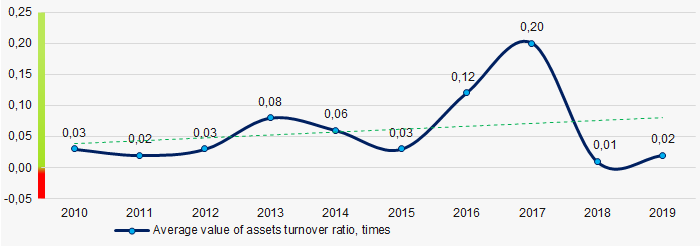

Picture 8. Change in industry average values of ROI ratio in 2010 – 2019Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

Covering the ten-year period, business activity ratio demonstrated the increasing trend (Picture 9).

Picture 9. Change in average values of assets turnover ratio in 2010 – 2019

Picture 9. Change in average values of assets turnover ratio in 2010 – 2019Small business

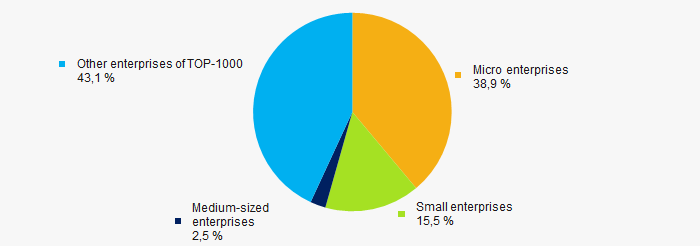

67% of TOP-1000 organizations are registered in the Register of small and medium-sized enterprises of the Federal Tax Service of the Russian Federation. Their share in total revenue of TOP-1000 is 57% that is over three times above the national average in 2018-2019 (Picture 10).

Picture 10. Shares of revenue of small and medium-sized enterprises in TOP-1000

Picture 10. Shares of revenue of small and medium-sized enterprises in TOP-1000Main regions of activity

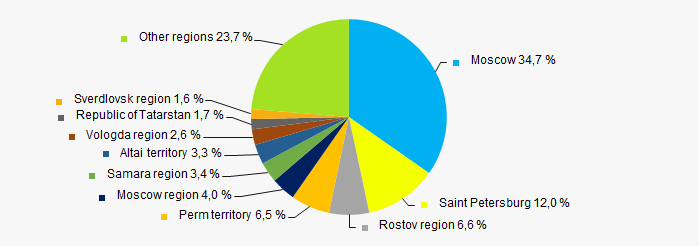

Organizations of TOP-1000 are registered in 74 regions of Russia, and unequally located across the country. Over 46% of organizations largest by revenue are located in Moscow and Saint Petersburg (Picture 11).

Picture 11. Distribution of TOP-1000 revenue by regions of Russia

Picture 11. Distribution of TOP-1000 revenue by regions of RussiaFinancial position score

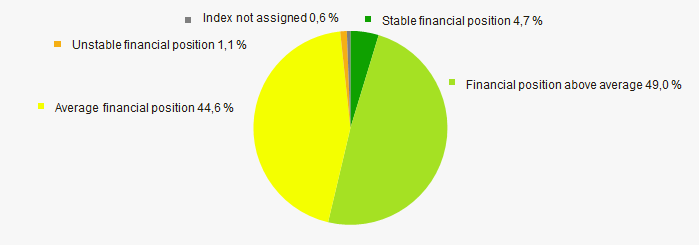

Assessment of the financial position of TOP-1000 organizations shows that the majority of them have financial position above average (Picture 12).

Picture 12. Distribution of TOP-1000 companies by financial position score

Picture 12. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

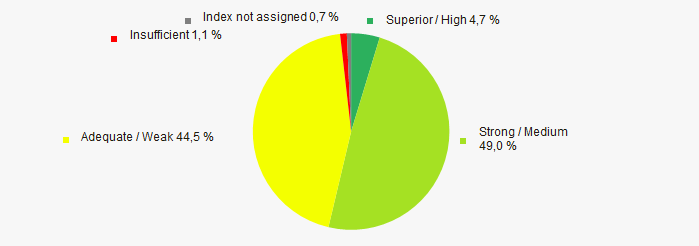

Most of TOP-1000 organizations got Superior / High and Strong / Medium index Globas. This fact shows their ability to meet their obligations fully (Picture 13).

Picture 13. Distribution of TOP-1000 companies by solvency index Globas

Picture 13. Distribution of TOP-1000 companies by solvency index GlobasConclusion

Complex assessment of activity of the largest Russian providers of social services, taking into account the main indexes, financial ratios and indicators, demonstrates the prevalence of positive trends (Table 1).

| Trends and evaluation factors | Relative share of factors, % |

| Dynamics of the average net assets value |  10 10 |

| Rate of growth (decline) in the average size of net assets |  10 10 |

| Increase / decrease in the share of enterprises with negative values of net assets |  5 5 |

| Level of competition / monopolization |  10 10 |

| Dynamics of the average revenue |  -10 -10 |

| Rate of growth (decline) in the average size of revenue |  10 10 |

| Rate of growth (decline) in the average size of profit (loss) |  10 10 |

| Growth / decline in average values of companies’ net profit |  -10 -10 |

| Growth / decline in average values of companies’ net loss |  10 10 |

| Increase / decrease in average values of total liquidity ratio |  5 5 |

| Increase / decrease in average values of return on investment ratio |  10 10 |

| Increase / decrease in average values of asset turnover ratio, times |  10 10 |

| Share of small and medium-sized businesses in terms of revenue being more than 20% |  10 10 |

| Regional concentration |  -10 -10 |

| Financial position (the largest share) |  10 10 |

| Solvency index Globas (the largest share) |  10 10 |

| Average value of relative share of factors |  5,6 5,6 |

positive trend (factor),

positive trend (factor),  negative trend (factor).

negative trend (factor).