Changes in legislation

On March 31, 2020, the State Duma of the RF adopted the Law, according to which the Government of the RF is vested with a right for 2020 to suspend, cancel or defer tax inspections to a later date, extend the due dates for tax payments, including on special tax regimes, as well as extend the due dates for advance payments on transport and land taxes, property tax of organizations introduced by regional and municipal authorities.

In addition, the Government is granted authority to extend the due dates for filing of tax returns and financial accounts, requirements for paying taxes, fees, insurance payments, fines, penalties, as well as the decision lead time to recover taxes, fines and penalties.

The authorities of the constituent territories of the RF got the opportunity throughout the whole year 2020, beginning from January 1, to extend the due dates for paying of unified agricultural tax, unified tax on imputed income, payments on patents, as well as payments within the simplified tax system.

How the Government of the RF and regional authorities will implement in practice the rights granted by this Law, we will find out in the very near future.

TOP-1000 of the Far Eastern companies

In order to reduce interregional inequality of the quality of life, accelerate the rates of economic growth and technological development, as well as to ensure the national safety of the country, in February 2019 the Government of Russia adopted the Spatial development strategy of the Russian Federation until 2025, and defined 12 macroregions. One of them is the Far Eastern region, including Amur, Magadan and Sakhalin regions, Jewish autonomous region, Kamchatka, Primorye and Khabarovsk territories, the Republic of Sakha (Yakutia), and Chukotka autonomous district.

Information agency Credinform has prepared a review of trends of the largest companies of real economy in the Far Eastern region.

The largest enterprises (TOP-1000) in terms of annual revenue were selected for the analysis according to the data from the Statistical Register for the latest available periods (2013-2018). The analysis was based on the data of the Information and Analytical system Globas.

Net assets are total assets less total liabilities. This indicator reflects the real value of the property of an enterprise. When the company’s debt exceeds the value of its property, the indicator is considered negative (insufficiency of property).

The largest company of the Far Eastern economic region in term of net assets is JSC ALROSA, INN 1433000147, the Republic of Sakha (Yakutia). In 2018, net assets value of the company amounted to 334 billion RUB.

The lowest net assets value among TOP-1000 was recorded for LLC RIMBUNAN HIJAU MDF, INN 2721143979, Khabarovsk territory. In 2018, insufficiency of property of the company was indicated in negative value of -14 billion RUB.

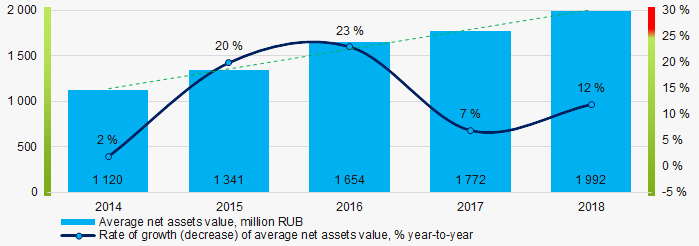

Covering the five-year period, the average net assets values of TOP-1000 companies has a trend to increase (Picture 1).

Picture 1. Change in average net assets value in 2014 – 2018

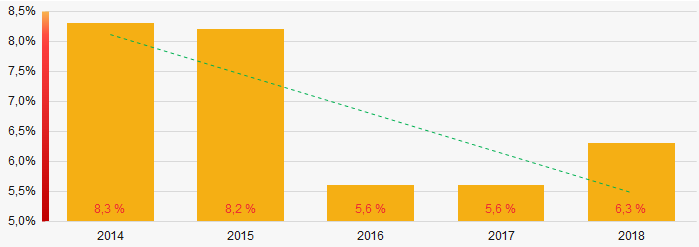

Picture 1. Change in average net assets value in 2014 – 2018The shares of TOP-1000 companies with insufficient property have trend to decrease over the past five years (Picture 2).

Picture 2. Shares of companies with negative net assets value in TOP-1000

Picture 2. Shares of companies with negative net assets value in TOP-1000Sales revenue

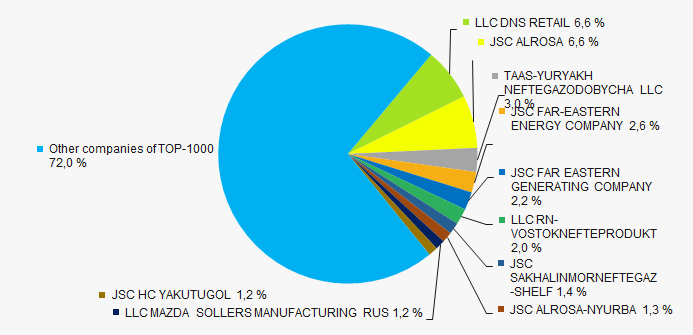

In 2018, total revenue of 10 largest companies of the region was almost 45% of TOP-1000 total revenue (Picture 3). This testifies high level of concentration of capital.

Picture 3. Shares of TOP-10 companies in TOP-1000 total profit for 2018

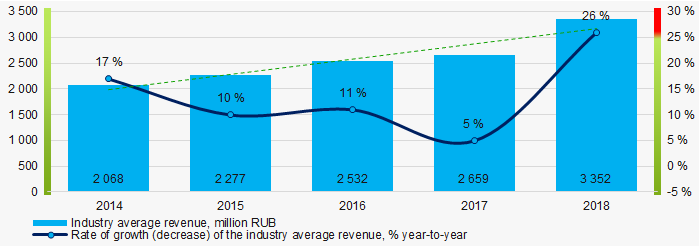

Picture 3. Shares of TOP-10 companies in TOP-1000 total profit for 2018In general, there is a trend to increase in revenue (Picture 4).

Picture 4. Change in industry average net profit in 2014 – 2018 годах

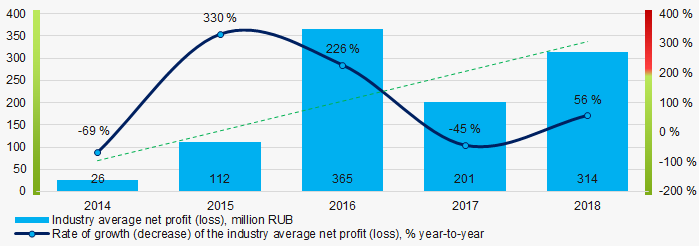

Picture 4. Change in industry average net profit in 2014 – 2018 годахProfit and loss

The largest company in term of net profit is Taas-Yuryakh Neftegazodobycha LLC, INN 1433015633, the Republic of Sakha (Yakutia). In 2018, the company’s profit of 54 billion RUB was recorded.

Covering the five-year period, there is a trend to increase in average profit of TOP-1000 companies (Picture 5).

Picture 5. Change in industry average profit values in 2014 – 2018

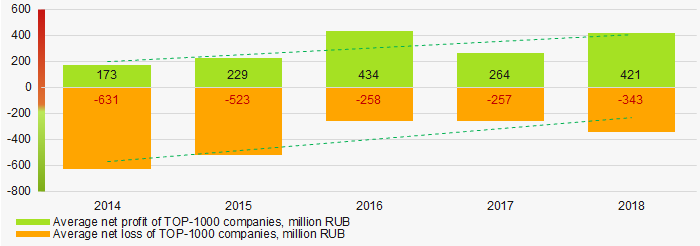

Picture 5. Change in industry average profit values in 2014 – 2018Covering the five-year period, the average net profit values of TOP-1000 companies have the increasing trend with the decreasing average net loss value (Picture 6).

Picture 6. Change in average net profit and net loss of ТОP-1000 in 2014 – 2018

Picture 6. Change in average net profit and net loss of ТОP-1000 in 2014 – 2018Key financial ratios

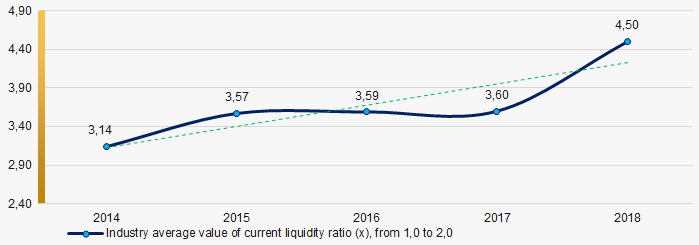

Covering the five-year period, the average values of the current liquidity ratio were significantly above the recommended one - from 1,0 to 2,0 with a trend to increase (Picture 7).

Current liquidity ratio (current assets to short-term liabilities) shows the sufficiency of company’s assets to repay on short-term liabilities.

Picture 7. Change in industry average values of current liquidity ratio in 2014 – 2018

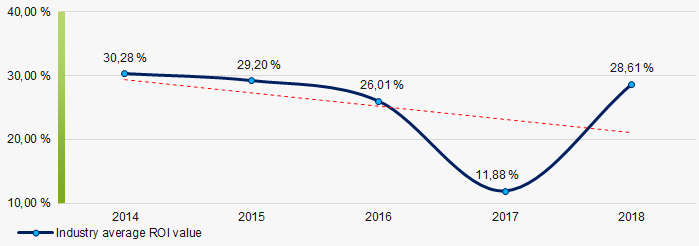

Picture 7. Change in industry average values of current liquidity ratio in 2014 – 2018During four out of five years, relatively high level of average ROI values was recorded with a trend to decrease (Picture 8).

ROI ratio is calculated as net profit to sum of shareholders equity and long-term liabilities, and shows the return of equity involved in commercial activities and long-term borrowed funds

Picture 8. Change in average values of ROI ratio in 2014 – 2018

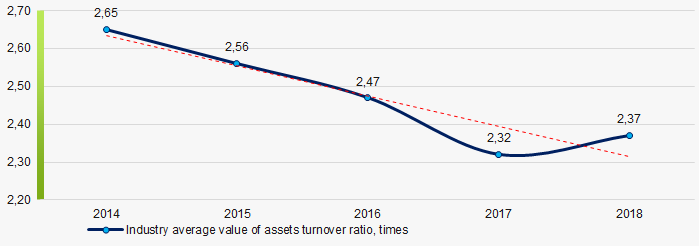

Picture 8. Change in average values of ROI ratio in 2014 – 2018 Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

Covering the five-year period, business activity ratio demonstrated the decreasing trend (Picture 9).

Picture 9. Change in average values of assets turnover ratio in 2014 – 2018

Picture 9. Change in average values of assets turnover ratio in 2014 – 2018Small enterprises

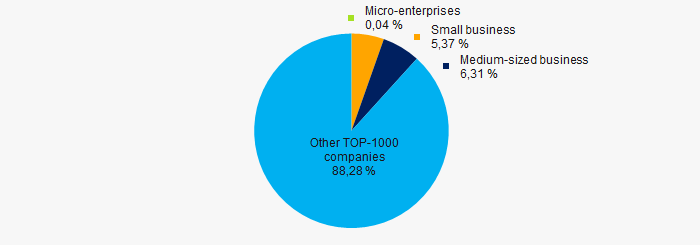

47% companies of TOP-1000 are registered in the Register of small and medium-sized enterprises of the Federal Tax Service of the Russian Federation. At the same time, their share in total revenue of TOP-1000 is about 12% that is significantly lower than the national average figure (Picture 10).

Picture 10. Shares of small and medium-sized enterprises in TOP-1000

Picture 10. Shares of small and medium-sized enterprises in TOP-1000Main regions of activity

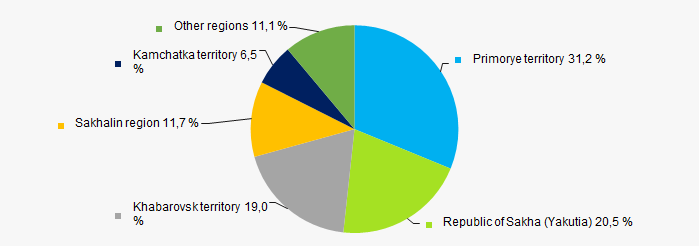

Companies of TOP-1000 are registered in 9 regions and located quite unequally. Almost 52% companies largest in term of turnover are concentrated in Primorye territory and the Republic of Sakha (Yakutia) (Picture 11).

Picture 11. Distribution of TOP-1000 revenue across the Far Eastern economic region

Picture 11. Distribution of TOP-1000 revenue across the Far Eastern economic regionFinancial position score

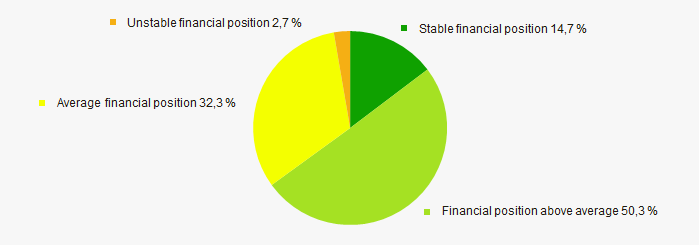

Assessment of the financial position of TOP-1000 companies shows that the majority of them have financial position above average (Picture 12).

Picture 12. Distribution of TOP-1000 companies by financial position score

Picture 12. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

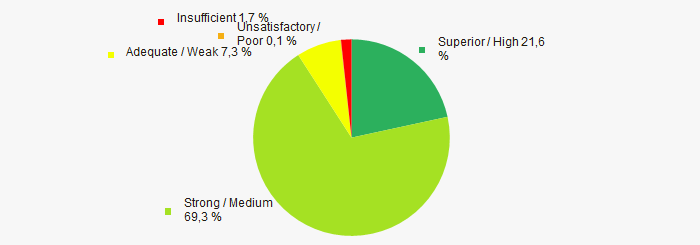

Most of TOP-1000 companies got Superior / High and Strong / Medium index Globas. This fact shows their ability to meet their obligations fully and by the due date (Picture 13).

Picture 13. Distribution of TOP-1000 companies by solvency index Globas

Picture 13. Distribution of TOP-1000 companies by solvency index GlobasIndex of industrial production

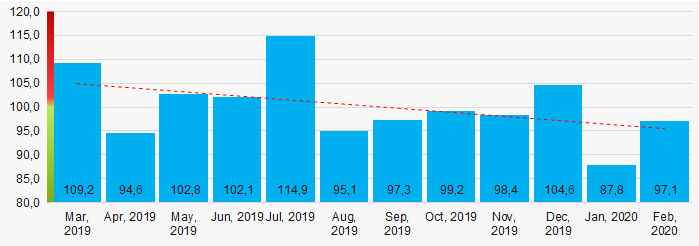

According to the Federal State Statistics Service (Rosstat), during 12 months of 2019 - 2020, the trend to decrease of industrial production indexes is observed (Picture 14). The average month-to-month figure was 100,3%.

Picture 14. Index of industrial production in the Far Eastern economic region in 2019 - 2020, month-to-month (%)

Picture 14. Index of industrial production in the Far Eastern economic region in 2019 - 2020, month-to-month (%)According to the same data, the share of companies of the Far Eastern economic region in the volume of revenue from sales of products, goods, works and services in 2019 was 2,838% countrywide. This figure is higher that that of 2018 with 2,763%.

Conclusion

Complex assessment of activity of the largest companies of real economy sector of the Far Eastern economic region, taking into account the main indexes, financial ratios and indicators, demonstrates the prevalence of positive trends (Table 1).

| Trends and evaluation factors | Relative share of factors, % |

| Rate of growth (decline) in the average size of net assets |  10 10 |

| Increase / decrease in the share of enterprises with negative values of net assets |  10 10 |

| Level of competition / monopolization |  5 5 |

| Rate of growth (decline) in the average size of revenue |  10 10 |

| Rate of growth (decline) in the average size of profit (loss) |  10 10 |

| Growth / decline in average values of companies’ net profit |  10 10 |

| Growth / decline in average values of companies’ net loss |  10 10 |

| Increase / decrease in average values of total liquidity ratio |  5 5 |

| Increase / decrease in average values of return on investment ratio |  -10 -10 |

| Increase / decrease in average values of asset turnover ratio, times |  -10 -10 |

| Share of small and medium-sized businesses in the region in terms of revenue being more than 22% |  -10 -10 |

| Regional concentration |  -5 -5 |

| Financial position (the largest share) |  10 10 |

| Solvency index Globas (the largest share) |  10 10 |

| Industrial production index |  -5 -5 |

| Dynamics of the share of revenue in total revenue across the RF |  10 10 |

| Average value of relative share of factors |  3,8 3,8 |

positive trend (factor),

positive trend (factor),  negative trend (factor).

negative trend (factor).