Margin of safety of marine engineering companies of Saint Petersburg.

A company’s success depends largely on its annual net profit. A positive result is a sign of a company’s successful operation, but it is just a basis for the company’s future financial stability.

Margin of safety indicates the company’s resistance to changes in business environment, which is absolutely vital for assessment of companies and whole sectors of unstable Russian economy.

Information agency Credinform has prepared a ranking of Russian industrial machine engineering companies by their margin of safety. The companies of ship and machine-building industries from Saint Petersburg that are part of the United Shipbuilding Corporation have been selected for the ranking. A number of design centers, ship-repairing and machine-building enterprises throughout Russia are under this holding company’s management. Margin of safety calculation was based on the data from the Information and Analytical system Globas, and the data was ranked in descending order (Table 1).

Margin of safety indicates the possible level of drop in revenue for making net profit and no loss at year-end. The point at which this condition is reached is called the break-even point.

| Name, INN, region | Sales revenue, billion RUB | Margin of safety, % of revenue | Solvency index Globas | ||

| 2016 | 2017 | 2016 | 2017 | ||

| 1 | 2 | 3 | 4 | 5 | 6 |

| Admiralty Shipyard INN 7839395419 Saint Petersburg |

44,93 | 27,08 | 77,53 |  46,34 46,34 |

208 Strong |

| Nevskoe Design and construction office INN 7801074335 Saint Petersburg |

1,25 | 1,06 | 27,81 |  32,67 32,67 |

194 High |

| ST. PETERSBURG MARINE DESIGN BUREAU MALACHITE INN 7810537540 Saint Petersburg |

6,56 | 8,09 | 25,82 |  31,4 31,4 |

193 High |

| CENTRAL MARINE DESIGN BUREAU ALMAZ INN 7810537558 Saint Petersburg |

3,92 | 3,28 | 12,84 |  12,67 12,67 |

187 High |

| CENTRAL DESIGN BUREAU FOR MARINE ENGINEERING RUBIN INN 7838418751 Saint Petersburg |

37,62 | 38,07 | 16,08 |  10,05 10,05 |

209 Strong |

| SEVERNOYE DESIGN BUREAU INN 7805468860 Saint Petersburg |

2,65 | 2,04 | 6,16 |  3,81 3,81 |

222 Strong |

| CKB OSK - ICEBERG INN 7801573983 Saint Petersburg |

0,31 | 0,29 | No |  3,57 3,57 |

259 Medium |

| Baltic Shipyard INN 7830001910 Saint Petersburg |

0,32 | 9,67 | No | No | 231 Strong |

| SREDNE-NEVSKY SHIPYARD INN 7817315385 Saint Petersburg |

5,11 | 6,84 | No | No | 259 Medium |

| Proletarskiy plant INN 7811039386 Saint Petersburg |

1,94 | 3,18 | No | No | 279 Medium |

| SHIPBUILDING PLANT SEVERNAYA VERF INN 7805034277 Saint Petersburg |

13,60 | 19,18 | No | No | 267 Medium |

| Average industry value | 10,74 | 10,79 | 15,11 | 12,77 | |

The enterprises in the Table 1 form the ship industry of Saint Petersburg. The analysis shows that two-thirds of the companies have a margin of safety that is lower than the average industry value, and four companies do not have one at all. Lack of margin of safety for Baltic Shipyard, Sredne-Nevsky Shipyard, Proletarskiy Plant and Shipbuilding Plant Severnaya Verf is caused by their loss as the result for the year. A decrease in revenue of the above-mentioned companies will result in a further growth of net loss.

As a result of margin of safety calculation, specialists of the Information Agency Credinform have pointed out the industry leaders - Admiralty Shipyard, Nevskoe Design and Construction Office, St. Petersburg Marine Design Bureau Malachite. These enterprises have the strongest resistance to changes in economic environment. However, it is necessary to mention that a large margin of safety does not guarantee sustainable development for several years, as in only one year the Admiralty Shipyard had a drop in its margin of safety by over 30%. One of the key factors that influence the margin is decrease in sales revenue caused by drop in the number of orders.

Trends in activity of hotels

Information agency Credinform has observed trends in the activity of the largest companies of the real sector of economy in Voronezh region

Enterprises with the largest volume of annual revenue (TOP-1000), were selected for the analysis, according to the data from the Statistical Register for the latest available periods (for 2013-2017). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Net assets is an indicator, reflecting the real value of company's property, is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The indicator of net assets is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

| № in TOP-1000 Name, INN, main type of activity |

Net assets value, billion RUB | Solvency index Globas | ||||

| 2013 | 2014 | 2015 | 2016 | 2017 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 1 JSC MINUDOBRENIYA INN 3627000397 Manufacture of fertilizers and nitrogen compounds |

22728 22728 |

28299 28299 |

39839 39839 |

43807 43807 |

47029 47029 |

209 Strong |

| 2 JSC ILYUSHIN FINANCE Co. INN 3663029916 Financial leasing (leasing/subleasing) |

22352 22352 |

19100 19100 |

18960 18960 |

16533 16533 |

17430 17430 |

289 Medium |

| 3 JSC Liski-Fitting INN 3652000930 Manufacture of tubes, pipes, hollow profiles and related fittings, of steel |

7993 7993 |

10945 10945 |

13369 13369 |

14477 14477 |

14605 14605 |

207 Strong |

| 4 JSC Voronezh Synthetic Rubber INN 3663002167 Manufacture of synthetic rubber in primary forms |

3583 3583 |

3404 3404 |

9874 9874 |

10588 10588 |

11369 11369 |

179 High |

| 5 JSC VORONEZH AIRCRAFT INN 3650000959 Manufacture of helicopters, aeroplanes and other aircraft |

3415 3415 |

9112 9112 |

10469 10469 |

10568 10568 |

9720 9720 |

273 Medium |

| 996 WOODVILLE LIMITED INN 3602006598 Manufacture of wooden building constructions and millwork Bankruptcy proceedings |

40 40 |

49 49 |

50 50 |

53 53 |

-1402 -1402 |

550 Insufficient |

| 997 JSC VIDEOPHONE INN 3661000333 Renting and operating of own or leased untenanted real estate Process of being wound up, 07.08.2017 |

505 505 |

511 511 |

517 517 |

518 518 |

-1906 -1906 |

600 Insufficient |

| 998 JSC CHERNOZEM COMMUTER PASSENGER COMPANY INN 3664108409 Passenger rail transport, interurban |

-2563 -2563 |

-3146 -3146 |

-2739 -2739 |

-2704 -2704 |

-2703 -2703 |

275 Medium |

| 999 JSC UZ-DAEWOO AUTO-VORONEZH INN 6451119803 Wholesale of motor cars and light motor vehicles Process of being wound up, 25.05.2017 |

263 263 |

288 288 |

291 291 |

-4951 -4951 |

-5146 -5146 |

273 Medium |

| 1000 KELLOGG RUS LLC INN 3661048688 Manufacture of preserved rusks, crackers and other rusk bakery products, pastry, cakes, fancy cakes, pies and biscuits |

-4927 -4927 |

-5702 -5702 |

-7608 -7608 |

-7778 -7778 |

-8414 -8414 |

260 Medium |

— growth of the indicator to the previous period,

— growth of the indicator to the previous period,  — decline of the indicator to the previous period.

— decline of the indicator to the previous period.

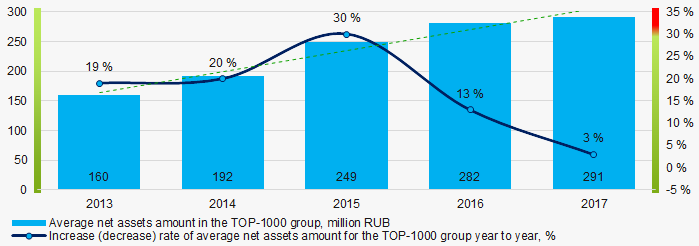

For a five-year period average amount of net assets of TOP-1000 companies has increasing tendency (Picture 1).

Picture 1. Change in TOP-1000 average indicators of the net asset amount in 2013 – 2017

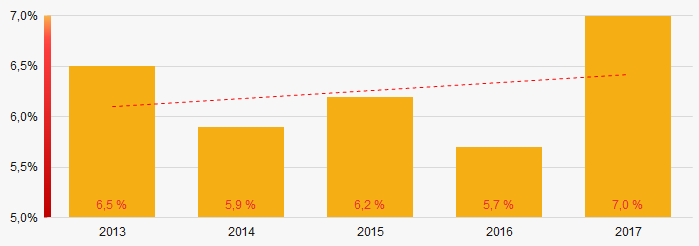

Picture 1. Change in TOP-1000 average indicators of the net asset amount in 2013 – 2017Share of companies with insufficiency of property in the TOP-1000 has increasing trend for the last five years (Picture 2).

Picture 2. Shares of companies with negative values of net assets in TOP-1000 companies

Picture 2. Shares of companies with negative values of net assets in TOP-1000 companiesSales revenue

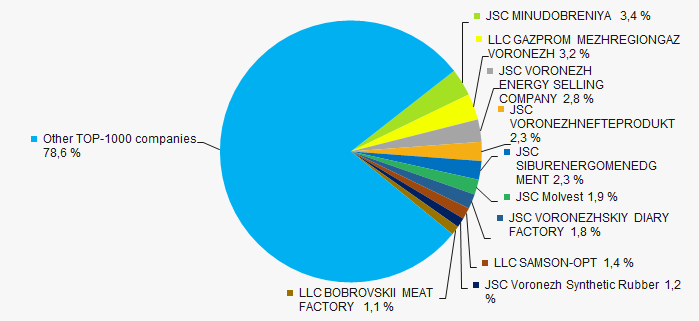

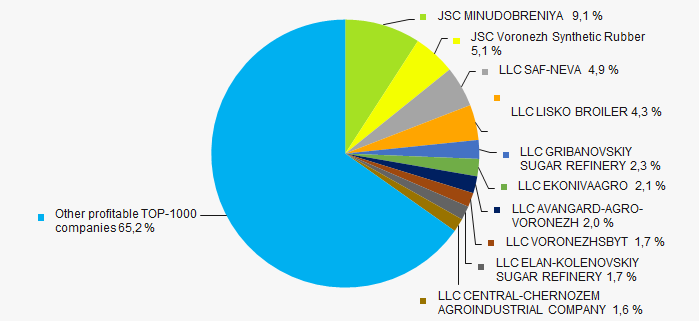

The revenue volume of 10 leaders of the industry made 21% of the total revenue of TOP-1000 companies in 2017(Picture 3). It demonstrates low level of productive concentration in Voronezh region.

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 companies for 2017

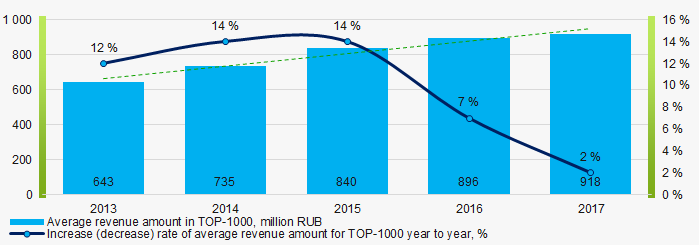

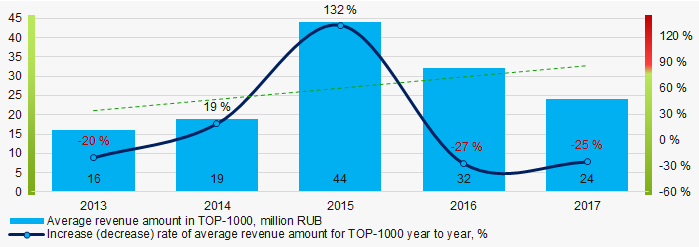

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-1000 companies for 2017In general, an increasing tendency in revenue volume is observed (Picture 4).

Picture 4. Change in the average revenue of TOP-1000 companies in 2013 – 2017

Picture 4. Change in the average revenue of TOP-1000 companies in 2013 – 2017Profit and losses

The profit volume of 10 leading enterprises in 2017 made 35% of the total profit of TOP-1000 companies (Picture 5).

Picture 5. Share of participation of TOP-10 companies in the total volume of profit of TOP-1000 companies for 2017

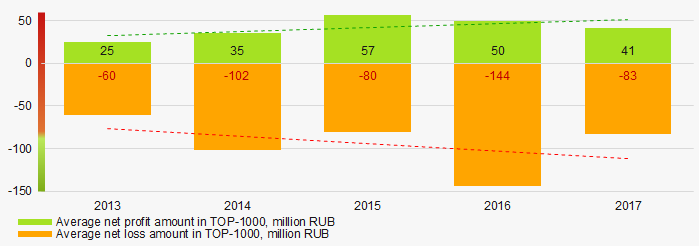

Picture 5. Share of participation of TOP-10 companies in the total volume of profit of TOP-1000 companies for 2017In general, the average values of profit indicators of TOP-1000 companies tend to increase over a five-year period (Picture 6).

Picture 6. Change in the average indicators of profit and loss of TOP-1000 companies in 2013 – 2017

Picture 6. Change in the average indicators of profit and loss of TOP-1000 companies in 2013 – 2017Over a five-year period, the average values of net profit indicators of TOP-1000 companies tend to increase. Besides, the average value of net loss decreases (Picture 7).

Picture 7. Change in the average indicators of net profit and loss of TOP-1000 companies in 2013 – 2017

Picture 7. Change in the average indicators of net profit and loss of TOP-1000 companies in 2013 – 2017Key financial ratios

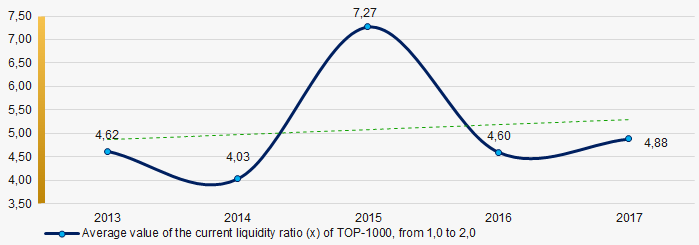

Over the five-year period the average indicators of the current liquidity ratio of TOP-1000 were above the range of recommended values – from 1,0 up to 2,0 with increasing tendency (Picture 8).

The current liquidity ratio (the relation of the amount of current assets to short-term liabilities) shows the sufficiency of company’s funds for repayment of its short-term liabilities.

Picture 8. Change in the average values of the current liquidity ratio of TOP-1000 companies in 2013 – 2017

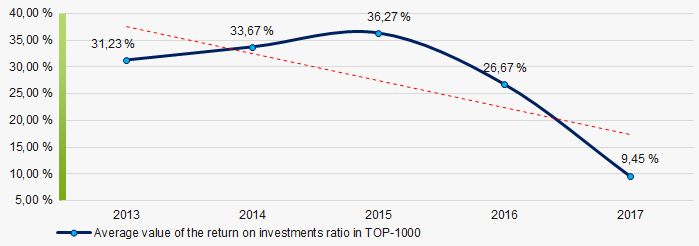

Picture 8. Change in the average values of the current liquidity ratio of TOP-1000 companies in 2013 – 2017Sufficiently high level of average values of the indicators of the return on investment ratio with decreasing tendency has been observed for five years (Picture 9).

The ratio is calculated as the relation of net profit to the sum of own capital and long-term liabilities and demonstrates the return on the equity involved in the commercial activity of own capital and the long-term borrowed funds of an organization.

Picture 9. Change in the average values of the return on investment ratio of TOP-1000 companies in 2013 – 2017

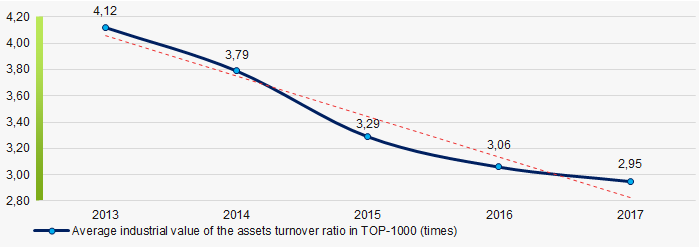

Picture 9. Change in the average values of the return on investment ratio of TOP-1000 companies in 2013 – 2017Asset turnover ratio is calculated as the relation of sales revenue to the average value of total assets for a period and characterizes the efficiency of use of all available resources, regardless of the sources of their attraction. The ratio shows how many times a year a complete cycle of production and circulation is made, yielding profit.

This business activity ratio showed a tendency to decrease for a five-year period (Picture 10).

Picture 10. Change in the average values of the assets turnover ratio of TOP-1000 companies in 2013 – 2017

Picture 10. Change in the average values of the assets turnover ratio of TOP-1000 companies in 2013 – 2017Production structure

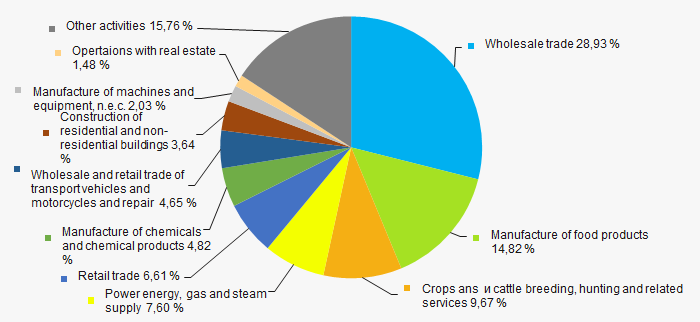

The largest share in the total revenue of TOP-1000 is owned by companies, specializing in wholesale and manufacture of food products (Picture 11).

Picture 11. Распределение видов деятельности в суммарной выручке компаний ТОП-1000

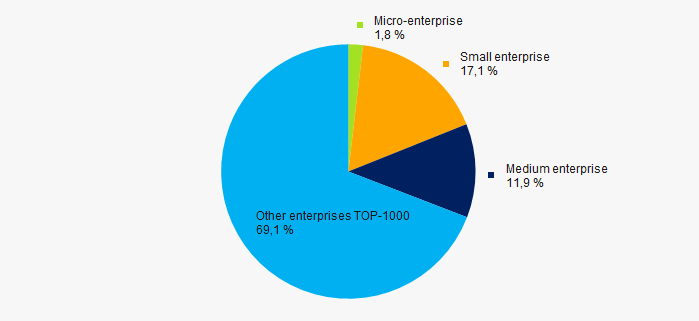

Picture 11. Распределение видов деятельности в суммарной выручке компаний ТОП-100073% of TOP-1000 companies are registered in the Register of small and medium enterprises of the Federal Tax Service of the RF. Besides, share of the companies in the total revenue of TOP-1000 amounts to 31% that is above the average indicator for the country (Picture 12).

Picture 12. Shares of small and medium enterprises in TOP-1000 companies

Picture 12. Shares of small and medium enterprises in TOP-1000 companiesMain regions of activities

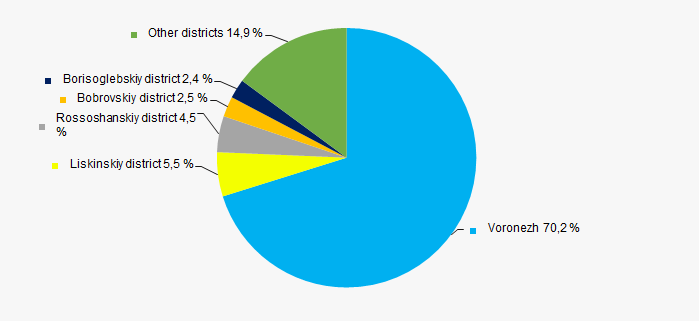

TOP -1000 companies are unequally distributed on Voronezh region territory and registered in 34 districts. 70% of the largest companies in terms of revenue volume are concentrated in the center of Voronezh region – Voronezh city (Picture 13).

Picture 13. Distribution of TOP-1000 companies by districts of Voronezh region

Picture 13. Distribution of TOP-1000 companies by districts of Voronezh regionFinancial position score

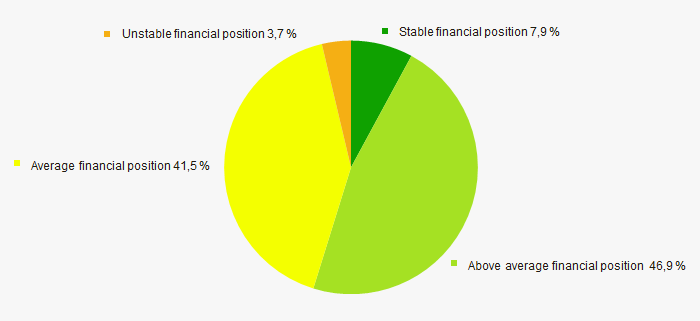

An assessment of the financial position of TOP-1000 companies shows that the largest number is in stable and an above the average financial position. (Picture 14).

Picture 14. Distribution of TOP-1000 companies by financial position score

Picture 14. Distribution of TOP-1000 companies by financial position scoreSolvency index Globas

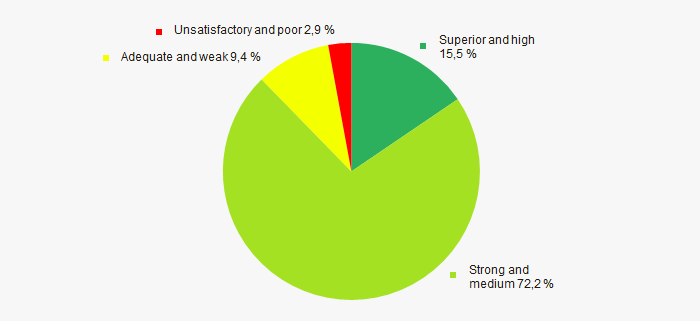

Most of TOP-1000 companies have got from Medium to Superior Solvency index Globas, that points to their ability to repay their debts in time and fully (Picture 15).

Picture 15. Distribution of TOP-1000 companies by solvency index Globas

Picture 15. Distribution of TOP-1000 companies by solvency index GlobasIndustrial production index

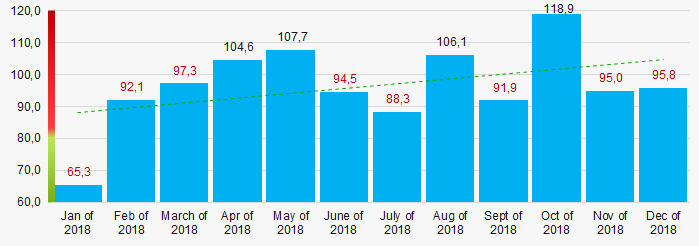

According to the data from the Federal State Statistics Service, during 12 months of 2018 increasing tendency is observed for the industrial production index of the enterprises of Voronezh region (Picture 16). Besides, the average indicator of index from month to month amounted to 96,5%.

Picture 16. Industrial production index of manufacture of the enterprises of Voronezh region in 2018, month to month (%)

Picture 16. Industrial production index of manufacture of the enterprises of Voronezh region in 2018, month to month (%) According to the same data, share of the enterprises of Voronezh region in revenue volume from sale of goods, products, works services countrywide for 2018 was 0,62%.

Conclusion

Comprehensive assessment of the activity of largest real economy enterprises of Voronezh region, taking into account the main indexes, financial indicators and ratios, demonstrates the presence of favorable trends (Table 2).

| Trends and assessment factors for TOP-1000 | Share of factor, % |

| Rate of increase (decrease) of average amount of net assets |  10 10 |

| Increase / decrease of share of companies with negative values of net assets |  -10 -10 |

| Level of capital concentration |  10 10 |

| Increase (decrease) rate of average revenue amount |  10 10 |

| Increase (decrease) rate of average net profit (loss) amount |  10 10 |

| Increase / decrease of average net profit amount of TOP-1000 companies |  10 10 |

| Increase / decrease of average net loss amount of TOP-1000 companies |  -10 -10 |

| Increase / decrease of average industrial values of the current liquidity ratio |  5 5 |

| Increase / decrease of average industrial values of the return on investments ratio |  -10 -10 |

| Increase / decrease of average industrial values of the assets turnover ratio, times |  -10 -10 |

| Share of small and medium enterprises in the industry in terms of revenue volume more than 22% |  10 10 |

| Regional concentration |  -10 -10 |

| Financial position (major share) |  10 10 |

| Solvency index Globas (major share) |  10 10 |

| Industrial production index |  5 5 |

| Average value of factors |  2,7 2,7 |

— positive trend (factor),

— positive trend (factor),  — negative trend (factor).

— negative trend (factor).