Top-10 of the largest Russian companies engaged in electric power transmission by revenue

Information agency Credinform has prepared a ranking of the largest Russian companies engaged in electric power transmission. On the base of the Information and Analytical system Globas, Тоp-10 companies engaged in electric power transmission and technological connection to distribution systems were selected by the experts in terms of the maximum revenue for 2019. Then the experts made the analysis of financial position of each enterprise and assessed the market condition.

The electric-power industry in Russia is the sector of economy, which assumes the existence of a system of economic relations arising in various processes related to electric power - production, transmission, management, sale and consumption. The main aim of the industry is providing of electrification based on rationality in production and use of electric power.

The market of electric power in Russia has the complex structure and organizations in the industry are divided into:

- power generating companies (electric power generation);

- distributors (electric power sale);

- grid companies (electric power transmission).

The ranking includes only grid companies, in other words, according to the Credinform data, the actual activities of the companies are electric power transmission and technological connection to distribution systems.

According to the Information and Analytical system Globas, Тоp-10 companies in terms of 2018 annual revenue take only 58.2% of the market (989,5 billion RUB), this testifies the high concentration in the field of electricity transmission and the difficult situation for new market participants.

| № | Name | 2019 revenue, billion RUB | 2019 net profit, billion RUB | Solvency index | |

| 1 | JSC FEDERAL GRID COMPANY OF UNIFIED ENERGY SYSTEM Moscow |

242,7 | + 1,0 % | 58,1 | 150 Superior |

| 2 | JSC MOSCOW UNITED ELECTRIC GRID COMPANY Moscow |

160,3 | + 2,5 % | 6,6 | 178 High |

| 3 | JSC IDGC of Centre and Volga Region Nizhniy Novgorod |

96,3 | + 2,6 % | 5,1 | 194 High |

| 4 | JSC INTERREGIONAL DISTRIBUTION GRID COMPANY OF CENTRE Moscow |

94,5 | + 0,7 % | 0,214 | 251 Medium |

| 5 | JSC INTERREGIONAL DISTRIBUTION GRID COMPANY OF URALS Yekaterinburg |

94,0 | + 4,9 % | 2,1 | 203 Strong |

| 6 | JSC LENENERGO Saint Petersburg |

82,3 | + 7,8 % | 12,7 | 199 High |

| 7 | JSC Rosseti Tyumen Surgut |

63,4 | + 8,3 % | - 0,533 | 258 Medium |

| 8 | JSC Interregional Distribution Grid Company of Volga Saratov |

62,8 | - 1,1 % | 2,6 | 194 High |

| 9 | JSC Interregional Distribution Grid Company of Siberia Krasnoyarsk |

57,4 | + 3,4 % | - 0,735 | 276 Medium |

| 10 | JSC KUBAN POWER AND ELECTRIFICATION Krasnodar |

51,0 | + 9,9 % | 2,4 | 214 Strong |

It is remarkable that, top-10 of grid companies are the subsidiaries of JSC «ROSSETI». «ROSSETI» holding, excluding the share in JSC FEDERAL GRID COMPANY OF UNIFIED ENERGY SYSTEM, is the operator of energy networks and related equipment. In fact, the holding controls 15 interregional distribution grid companies. In other words, these are the power lines, which we see in urban infrastructure.

The largest grid company in Russia is JSC FEDERAL GRID COMPANY OF UNIFIED ENERGY SYSTEM, the 2019 annual revenue of the company amounted to 242,7 billion RUB. The company is located in Moscow and it accounts for more than 14 % of the revenue of all industry organizations. The net profit of the company amounted to 58,1 billion RUB, in comparison with the revenue this indicates about the company's profitability. Within the year the company's turnover increased by 1% and industry volume by 10.07%.

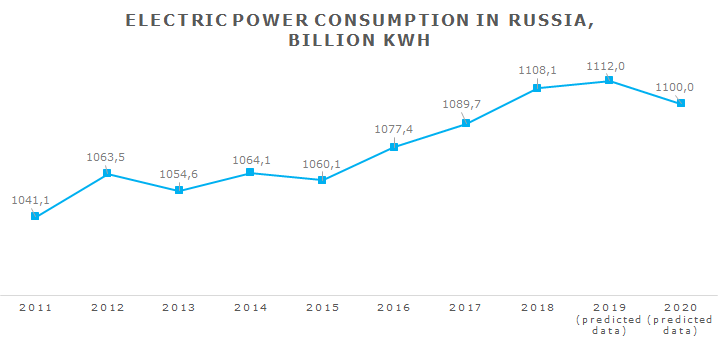

The increase in revenue of many grid companies in Russia is connected with increase in electricity consumption (Picture 1). From 2010 to 2018 electricity consumption increased by 9% and according to the preliminary results for 2019, the current trend is expected to continue. As for 2020 forecasts, in connection with the coronavirus pandemic, a sharp decrease in overall electricity consumption is expected.

Picture 1. The dynamics of electric power consumption in Russia during 2010-2020, billion kWh

Picture 1. The dynamics of electric power consumption in Russia during 2010-2020, billion kWhSource: Unified interdepartmental statistical information system (UISIS), estimated data by Credinform

Using the tool ‘Analysis of industry’ in the Information and Analytical system Globas, it is possible to find out another reason for the increase in revenue of top-10 grid companies. The industry volume is constantly growing and in 2018 it amounted to more than 1,6 trillion RUB. The growth of top-10 revenue in 2019 indicates about the projected growth of industry volumes.

In 2019 the significant growth of revenue by 8,3% (in comparison with 2018 Top-10 list) demonstrated JSC Rosseti Tyumen, which took the seventh place instead of ninth. However, the net loss for the last two years indicates about financial problems of the business, this is also proved by the solvency index, which is approaching the average value.

The only company in top-10 list, which demonstrated the reduction in revenue in 2019, is JSC Interregional Distribution Grid Company of Volga, the company took the eighth place instead of the seventh (in comparison with 2018). However, the highest solvency index shows that the company is still financially reliable.

The ranking shows that the field of electric power transmission is still strategically important for the country; this is confirmed by the growth of electric power consumption. The industry volumes are constantly growing, which also testifies the profitability of this market. However, considering the fact that top-10 companies take more than 90% of the market, this industry won’t be a priority for new entrepreneurs due to too high concentration of the industry.

Consequences for the economy caused by coronavirus-related measures

It is fair to say with confidence that the quarantine and self-isolation regimes associated with the coronavirus pandemic have affected the world economy in the most negative way. Leaders of states limited economic activity by promising to provide support to affected entrepreneurs and private individuals.

The Government of Russia and the Central Bank of Russia have been instructed to develop measures that will help businesses and citizens to overcome the consequences of a forced economic cessation.

The shock from stopping activities was first experienced by small and medium-sized enterprises. Even if the restrictions are lifted by mid-May, not everyone will be able to open and resume work. 1,5 months is a sufficient period for changing consumer preferences. Customers have already switched to competitors in online stores or have redefined priorities. The customer base is lost, but most importantly, the supply chain is extremely difficult to restore. Shops selling consumer goods have a chance to recover, as pent-up demand for goods and everyday necessities is accumulating. Supermarkets and grocery stores, as well as e-commerce, will remain profitable. IT companies developing software for remote work, training and managing production processes will grow.

Forced suspension of activity and the lack of real state support create the risk of entrepreneurs leaving for the shadow economy. During the time of self-isolation, entrepreneurs will be convinced that there is no need to rent an expensive premises, bear the costs of its maintenance, pay salaries to support staff and huge taxes. Entrepreneurs optimize their business: they liquidate offices and will hire staff to order. Due to widespread reductions, it will not be a problem to find qualified personnel in the labor market.

The closure of industries across the country is launching a process that is dangerous with long-term consequences. The total shutdown of enterprises causes a colossal drop in energy consumption, which leads to a drop in profits for power engineers and all companies associated with this industry, from generating companies to sellers of electric automatic machines. As a result, one should expect an increase in tariffs, which will negatively affect industrial enterprises. Other non-tax payments, such as excise taxes or business permits, will increase. For a deficit-free budget, the price of oil should be at least 45 USD or more. In conditions of low oil prices, the simplest solution to eliminate the budget deficit is to increase mandatory payments.

It is hoped that artificially blocking supplies and closing borders will give impetus to revise the supply chains towards their reduction. Large enterprises manufacturing high value-added products will conclude that it is advantageous to produce components in their country. Violation of obligations under the contract due to non-delivery on time from abroad of auxiliary products of low redistribution leads to the loss of reputation, customers and money. Localization is the only sure way to secure production by abandoning minor benefits. Cost will be less important than reliability of supply. Russian companies will be able to receive orders from large metallurgical and chemical enterprises, from the sphere of woodworking and automotive industry. New facilities will be created. Enterprises will expand the product line: the wider the range, the higher the competitiveness.

But there will be more negative consequences. The business will not recover in the same volume. Entrepreneurs will not develop infrastructure for business, because they do not know when a new crisis will come, therefore they will be careful. The number of fraudulent companies and “businessmen” wishing to solve their problems and enrich themselves through the honest working companies will increase.

Consumer demand will not recover, as consumers lose their jobs. No domestic demand - no incentive to recover. Imports will decline due to the unfavorable exchange rate.

Due to lower consumption, freight traffic will decrease.

The entertainment and tourism industries will not reach the pre-crisis level any time soon, as consumer preferences will shift towards the most necessary things.

Jobs in big cities will be reduced. Dismissed people will return to their hometowns. In summer and autumn, they will be able to find seasonal work on sowing and harvesting. Huge residential complexes built for citizens arriving from regions will be without buyers. At the same time, the state plans to allocate 150 billion rubles to developers, for which it will be able to buy unclaimed housing.

Large enterprises with state support will be the most stable. It is doubtful that the measures taken by the Government to support small and medium-sized enterprises will compensate even to a small extent the damage from restrictive measures related to the coronavirus - damage not only to entrepreneurs, but also to the entire economy of the country. According to various estimates, GDP will drop to 10%. The Central Bank of Russia and the Ministry of Economic Development are more optimistic and forecast a decrease of 1.5-2%.

After 2008, it took 2.5 years to overcome the effects of the crisis. The current crisis may be longer. Anticipating more serious consequences, some countries put the viability of the national economy a priority and did not impose severe restrictions. Looking at the statistics of diseases COVID-19 today, Sweden and Belarus are far from the forefront of the victims.

For the period of restrictive measures and overcoming their consequences, business needs to be exempted from taxes, instead of deferred payment. Reducing the tax burden, reducing the number of inspections and eliminating the conflicting requirements of regulatory bodies could certainly help still working companies.