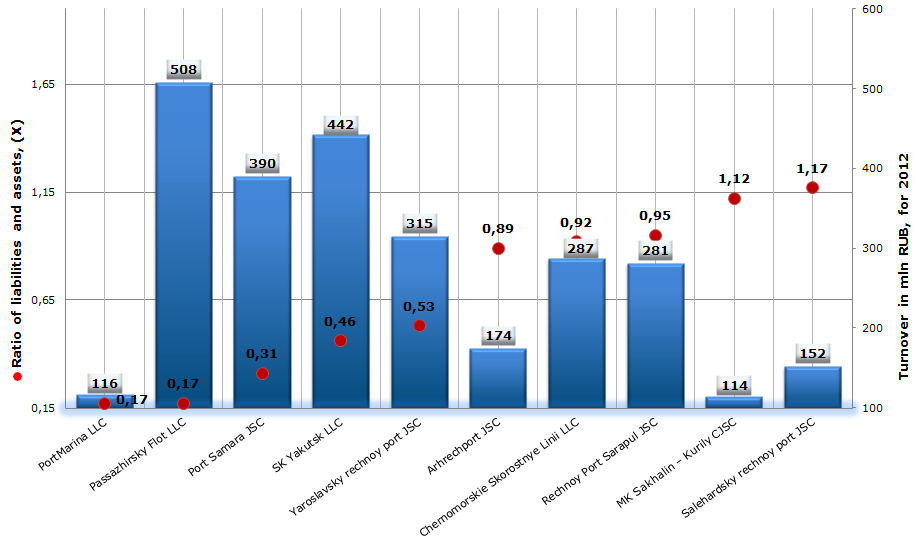

Ratio of liabilities and assets of enterprises offering passenger water transportation services

Information agency Credinform prepared a ranking of the ratio of liabilities and assets of Russian enterprises, offering passenger water transportation services. The companies with highest turnover in this branch were selected for this research according to data from the Statistical Register for the latest available period (for the year 2012). Then, the first 10 enterprises selected by turnover were ranked by increase in value of the ratio of liabilities and assets, and if the value is identical then by increase of solvency index GLOBAS-i®.

The ratio of liabilities and assets presents what share of assets of an enterprise is funded with loans and is calculated as the ratio of total borrowing to total balance. This ratio refers to a group of indexes of financial stability. By the financial stability of an enterprise it is meant such financial standing which guarantees its constant solvency and which is one of key factors of company’s survival and the fundamental base of its stability. There is the recommended value of the mentioned ratio in the economic practice which ranges from 0,2 to 0,5.

| № | Name, INN | Region | Turnover for 2012, mln RUB | Ratio of liabilities and assets (%) | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | PortMarina LLC INN 2540155242 |

Primorski Krai | 116 | 0,17 | 255 (high) |

| 2 | Passazhirsky Flot LLC INN 4723003201 |

Leningrad region | 508 | 0,17 | 259 (high) |

| 3 | Samarsky rechnoy port JSC INN 6317023569 |

Samara region | 390 | 0,31 | 222 (high) |

| 4 | Sudohodnaya kompaniya Yakutsk LLC INN 1435130134 |

The Republic of Sakha Yakutia | 442 | 0,46 | 229 (high) |

| 5 | Yaroslavsky rechnoy port JSC INN 7607001209 |

Yaroslavl region | 315 | 0,53 | 270 (high) |

| 6 | Arhangelsky rechnoy port JSC INN 2901011040 |

Arhangelsk region | 174 | 0,89 | 279 (high) |

| 7 | Chernomorskie Skorostnye Linii LLC INN 2304047188 |

Krasnodar Terrotiry | 287 | 0,92 | 276 (high) |

| 8 | Rechnoy Port Sarapul JSC INN 1827018020 |

The Udmurtian Republic | 281 | 0,95 | 291 (high) |

| 9 | Morskaya Kompaniya Sakhalin – Kurily CJSC INN 6509007063 |

Sakhalin region | 114 | 1,12 | 238 (high) |

| 10 | Salehardsky rechnoy port JSC INN 8901001660 |

The Yamalo-Nenets Autonomous District | 152 | 1,17 | 305 (satisfactory) |

The first and the second places of the ranking belong to PortMarina LLC and Passazhirsky Flot LLC. The companies have the same ratio of liabilities and assets – (0,17), that practically satisfies recommended values. It means that enterprises use effectively enough own and borrowed funds. Both companies got high solvency index GLOBAS-i®.

Ratio of liabilities and assets of enterprises offering passenger water transportation services, TOP-10

The value of the ratio of two companies in the ranking list, ОАО Samarsky rechnoy port JSC and Sudohodnaya kompaniya Yakutsk LLC, is within the recommended values, what indicates that enterprises approach effectively their budgeting. Both companies got high solvency index GLOBAS-i®, that characterizes them as financially stable.

The ratios of liabilities and assets of Arhangelsky rechnoy port JSC, ООО Chernomorskie Skorostnye Linii LLC and Rechnoy Port Sarapul JSC are essentially higher than recommended values, but not above 1. Such ratio points at coming trend to equalization of the amounts of loans, credits and accounts payable to all assets of enterprises. Herewith companies got high solvency index GLOBAS-i®, that testifies of company’s ability to repay its financial liabilities in time and fully.

The value of the ratio of liabilities and assets of companies Morskaya Kompaniya Sakhalin – Kurily CJSC and Salehardsky rechnoy port JSC is more than 1. It means that enterprises misappropriate borrowed funds. Their management should follow closely the ratio of assets and all their loans and credits, because the substantial surplus of liabilities can dent the financial stability of the enterprise. However, Morskaya Kompaniya Sakhalin – Kurily CJSC got high solvency index GLOBAS-i®, that characterizes it as financially stable and confirms once again the rule, that it should be considered financial and non-financial factors for objective assessment of a company.

Foreign name brands

Have you ever guessed many brands, describing themselves on Russian market as products with European or American history, are virtually Russian? It’s most likely that you are even the proud owner of such article, being unsuspicious of it.

As it happens, Russian consumers are seriously susceptible to foreign sonorous names, especially if they are supported by a beautiful legend. This was set up as far back as during USSR-times, when imported goods were a big shortage and available not for many people. Imported article built a certain public image for its owner. That is why after the dissolution of the USSR, the consumers swept away from shelves everything that even remotely resembled the foreign born. Therewith, foreign goods had always higher price in comparison with domestic products.

Domestic manufacturers decided to avail themselves of consumer's love of all foreign and make a pretty penny out of it. Only a couple of details: foreign sonorous name, beautiful legend, rememberable slogan (Italy style, Germany quality, English traditions etc.) and the consumer is ready by himself to pay much more.

All foreign name brands can be divided into two groups. To the first one belong companies which don't conceal its Russian origin, but herewith have foreign sonorous name. Production of such enterprises has usually adequate price-quality relationship. Companies of the second group are more sophisticated, with the purpose to earn larger profit they disseminate active the myths and legends of the foreign born of their products. In both cases most of goods are manufactured in China, where specialized factories exist which produce absolutely identical goods made-to-order by manufacturers, but with different labels and packages. It is fair to say that not many articles manufactured in China are of low quality, in most cases goods are produced in large plants, with observance of all standards. Certainly there are examples of low-quality goods, but, as a rule, these brands don’t exist for a long time.

Here is far from being the whole list of brands, describing themselves as foreign, but virtually being Russian:

| Brand | Company - brand owner | Products | ТМ |

|---|---|---|---|

| Vitek | GOLDER-ELEKTRONIKS LLC | Household appliances |  |

| Scarlett | Arima Holding Corp (joint Russian-Chinese enterprise, registered in offshore area of British Overseas Territories) | Household appliances |  |

| Bork | BORK Electronic Gmbh (single shareholder is from Russia - Biryulin Maksim Vasilevich) | Premium Household appliances |  |

| Greenfield, Tess, Jardin | Orimi Treid LLC | Tea, coffee |    |

| Carlo Pazolini | Carlo Pazolini Group, registered in Italy, CEO – Iliya Reznik | Medium-medium high footwear |  |

| Ralf Ringer | Ralf Ringer CJSC | Footwear |  |

| Tervolina | TERVOLINA LLC | Footwear |  |

| Mascotte | Moskot-Shuz LLC | Footwear |  |

| befree, ZARINA, LOVE REPUBLIC | MalonFashnGrupJSC | Clothing |    |

| Erich Krause | Ofis Premier CJSC | Office goods |  |

| Savage, People, Lawine | Savazh LLC | Clothing |   |

With the help of the information and analytical system GLOBAS-i®, developed by the Information Agency Credinform, you will find all information on any Russian company you are interested in, as well as you will be able to check it for due diligence and solvency by using of independent indexes, worked out by the company's analytics.