The salary growth continues to increase in the 1st quarter of 2014

Despite the essential growth retardation, the situation in the field of employee compensation demonstrates the steady upward trend. The nominal gross salary on average per month in the Russian Federation in the 1st quarter of 2014 amounted to 30 092.1 rubles, having increased on 9.9% by the similar period of the last year.

The salary, higher than the national average, was assessed in 18 entities. The dwellers of the Far North and equivalent areas have the highest salaries (the excess is over 1.8-2.3 times).

Moscow is also on the top with its average salary 56 003.5 rubles (4th place). In St. Petersburg the payroll rate falls behind to Moscow’s by 1.5 times (37 556.8 rubles, 12th place).

According to the 1st quarter of 2014 the minimum salary was assessed in the Altai Krai - 17 908.5 rubles, in the Republic of Dagestan - 17 796.9 rubles and in the Republic of Kalmykia - 17 742.3. It is 4 times less than in regions with the highest payroll rate.

After the Crimea was joined to Russia, two new entities were formed: the Federal City of Sevastopol and the Republic of Crimea. Up to the present, the salary rate data was provided by the State Statistics Service of Ukraine and expressed in rubles it turned out to be 2.5-3 times less than the national average - 11 676.6 and 10 923.9 rubles, respectively. In comparison with the region with the minimum salary (the Republic of Kalmykia), even there will be its underrun: 34.2% for Sevastopol and 38.4% for the Republic of Crimea.

In relative terms the maximum salary growth according to the 1st quarter of 2013 was evidenced in the Republic of Dagestan - 16.4%, the minimum was in the Vologda Region – 4.2%.

Both capitals of Russia have almost the same salary rate growth – Moscow – 9.5%, St. Petersburg – 10.3%.

At the same time, the situation, when the ruble suffered from its devaluation at the beginning of the year, had an impact on the purchase power rate of salaries. In terms of dollars at the rate of the Central Bank the nominal salary in the 1st quarter of the current year decreased on 4.9% by the same period of 2013, Moscow – 5.2%, St. Petersburg – 4.5%.

As a result, the salary rate growth did not compensate the ruble’s devaluation to the major currencies in the majority of regions. The only exception is the Republic of Dagestan where the small runup to 0.8% was evidenced.

| Rank | Region | The nominal gross salary on average per month, 1st quarter of 2014, rub. | Changes by 1st quarter of 2013, % | Changes by 1st quarter of 2013 in terms of dollars at the rate of the Central Bank , % |

|---|---|---|---|---|

| The Russian Federation | 30 092,1 | 9,9 | -4,9 | |

| 1 | Chukotka Autonomous Okrug | 70 969,0 | 9,1 | -5,6 |

| 2 | Yamalo-Nenets Autonomous Okrug | 69 638,0 | 7,8 | -6,7 |

| 3 | Nenets Autonomous Okrug | 63 120,4 | 8,1 | -6,4 |

| 4 | Moscow | 56 003,5 | 9,5 | -5,2 |

| 5 | Magadan Region | 55 046,8 | 4,3 | -9,7 |

| 6 | Khanty-Mansi Autonomous Okrug | 54 139,2 | 8,9 | -5,7 |

| 7 | Sakhalin Region | 52 545,2 | 14,8 | -0,6 |

| 8 | Tyumen Region | 51 061,9 | 9,1 | -5,6 |

| 9 | Kamchatka Territory | 49 448,4 | 13,0 | -2,2 |

| 10 | Sakha Republic (Yakutia) | 45 834,8 | 15,3 | -0,2 |

| 11 | Murmansk Region | 39 770,5 | 9,4 | -5,3 |

| 12 | St. Petersburg | 37 556,8 | 10,3 | -4,5 |

| 13 | Komi Republic | 37 253,0 | 8,5 | -6,1 |

| 14 | Moscow Region | 36 095,6 | 9,4 | -5,3 |

| 15 | Khabarovsk Territory | 33 366,7 | 8,6 | -6,0 |

| 16 | Arkhangelsk Region | 33 168,8 | 12,4 | -2,7 |

| 17 | Krasnoyarsk Territory | 31 845,1 | 10,5 | -4,3 |

| 18 | Primorye Territory | 30 483,6 | 11,7 | -3,4 |

| 19 | Amur Region | 30 015,8 | 7,1 | -7,3 |

| 20 | Leningrad Region | 29 982,5 | 9,2 | -5,5 |

| 21 | Tomsk Region | 29 807,7 | 9,9 | -4,9 |

| 22 | Irkutsk Region | 29 692,5 | 12,3 | -2,8 |

| 23 | Republic of Karelia | 28 110,6 | 10,0 | -4,8 |

| 24 | Sverdlovsk Region | 27 844,2 | 8,4 | -6,2 |

| 25 | The Republic of Khakassia | 27 327,4 | 11,5 | -3,5 |

| 26 | Jewish Autonomous Region | 27 305,7 | 9,8 | -5,0 |

| 27 | Trans-Baikal Territory | 26 817,3 | 9,5 | -5,3 |

| 28 | Chelyabinsk Region | 26 033,8 | 12,3 | -2,8 |

| 29 | The Republic of Buryatia | 26 028,3 | 13,7 | -1,6 |

| 30 | Kaluga Region | 25 918,2 | 8,2 | -6,3 |

| 31 | The Republic of Tatarstan | 25 807,0 | 10,2 | -4,6 |

| 32 | Kaliningrad Region | 25 794,3 | 14,6 | -0,8 |

| 33 | Novosibirsk Region | 25 420.9 | 9.1 | -5.6 |

| 34 | Kemerovo Region | 25 315,5 | 7,0 | -7,4 |

| 35 | The Tyva Republic | 25 229,2 | 13,8 | -1,5 |

| 36 | Vologda Region | 25 136.9 | 4.2 | -9.9 |

| 37 | Perm Territory | 25 116,6 | 13,9 | -1,4 |

| 38 | Omsk Region | 24 441,6 | 8,8 | -5,9 |

| 39 | Krasnodar Territory | 24 402,4 | 11,0 | -3,9 |

| 40 | Samara Region | 24 124,2 | 13,3 | -1,9 |

| 41 | Nizhny Novgorod Region | 23 989,6 | 12,9 | -2,3 |

| 42 | Tula Region | 23 817,2 | 13,5 | -1,8 |

| 43 | Novgorod Region | 23 344,2 | 10,2 | -4,6 |

| 44 | Yaroslavl Region | 23 077,0 | 10,0 | -4,8 |

| 45 | Tver Region | 22 655,5 | 10,5 | -4,3 |

| 46 | Belgorod Region | 22 249,6 | 9,3 | -5,4 |

| 47 | Astrakhan Region | 22 187,9 | 11,0 | -4,0 |

| 48 | Orenburg Region | 22 151,1 | 12,6 | -2,5 |

| 49 | Udmurtia | 21 989,9 | 13,6 | -1,7 |

| 50 | The Republic of Bashkortostan | 21 964,0 | 7,0 | -7,4 |

| 51 | Volgograd Region | 21 922,6 | 14,8 | -0,6 |

| 52 | Ryazan Region | 21 909,0 | 9,8 | -4,9 |

| 53 | Voronezh Region | 21 700,8 | 9,5 | -5,3 |

| 54 | The Chechen Republic | 21 490,8 | 12,6 | -2,5 |

| 55 | The Republic of Ingushetia | 21 375,5 | 13,8 | -1,5 |

| 56 | Rostov Region | 21 372,8 | 8,4 | -6,2 |

| 57 | Lipetsk Region | 21 062,1 | 8,4 | -6,2 |

| 58 | Kursk Region | 20 956,7 | 11,9 | -3,2 |

| 59 | Vladimir Region | 20 862,6 | 11,5 | -3,5 |

| 60 | Altai Republic | 20 655,5 | 9,8 | -4,9 |

| 61 | Penza Region | 20 496,3 | 11,1 | -3,9 |

| 62 | Smolensk Region | 20 347,0 | 12,6 | -2,5 |

| 63 | Saratov Region | 20 332,6 | 8,2 | -6,4 |

| 64 | Stavropol Territory | 20 193,6 | 10,3 | -4,5 |

| 65 | Kirov Region | 19 557,2 | 11,1 | -3,9 |

| 66 | Kostroma Region | 19 525,9 | 10,5 | -4,3 |

| 67 | Ulyanovsk Region | 19 468,0 | 12,0 | -3,0 |

| 68 | Kurgan Region | 19 436,6 | 11,9 | -3,1 |

| 69 | The Republic of North Ossetia–Alania | 19 417,9 | 10,7 | -4,2 |

| 70 | Pskov Region | 19 260,8 | 7,2 | -7,2 |

| 71 | The Republic of Adygea | 19 220,7 | 9,2 | -5,5 |

| 72 | Oryol Region | 19 090,3 | 10,9 | -4,0 |

| 73 | Bryansk Region | 19 082,3 | 11,7 | -3,3 |

| 74 | The Chuvash Republic | 19 071,7 | 9,5 | -5,2 |

| 75 | Ivanovo Region | 18 910,9 | 10,7 | -4,2 |

| 76 | Tambov Region | 18 750,5 | 10,4 | -4,5 |

| 77 | The Mari El Republic | 18 623,4 | 11,6 | -3,4 |

| 78 | The Kabardino-Balkar Republic | 18 503,3 | 9,4 | -5,3 |

| 79 | The Karachay–Cherkess Republic | 18 455,9 | 15,1 | -0,4 |

| 80 | The Republic of Mordovia | 17 992,6 | 9,3 | -5,4 |

| 81 | Altai Territory | 17 908,5 | 9,4 | -5,3 |

| 82 | The Republic of Dagestan | 17 796,9 | 16,4 | 0,8 |

| 83 | The Republic of Kalmykia | 17 742,3 | 11,7 | -3,3 |

| 84 | Sevastopol (according to the State Statistics Service of Ukraine. expressed at the rate of the Central Bank) | 11 676,6 | 8,7 | -5,9 |

| 85 | the Republic of Crimea (according to the State Statistics Service of Ukraine. expressed at the rate of the Central Bank) | 10 923,9 | 11,1 | -3,8 |

The ratio of liabilities and assets of Russian textile enterprises

Information agency Credinform prepared a ranking of Russian textile enterprises.

The companies with highest volume of revenue were selected for this ranking according to data from the Statistical Register for the latest available period (for the year 2012). These enterprises were ranked by increase in value of the ratio of liabilities and assets.

The ratio of liabilities and assets (х) is the relation of long-term and short-term borrowings to total assets. It shows what share of assets of an enterprise is funded through borrowings.

Recommended value: from 0,2 to 0,5. If the ratio is equal to zero, then it testifies that an organization has no liabilities. If the ratio is above 1, it means that a company has on its books the value of liabilities higher, than its assets, what in terms of financial management should be considered as company's development policy being risky enough.

However, it should be understood, that recommended values can differ essentially as well for enterprises of different branches, as for organizations of the same industry.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention not only to industry-average indicators in the branch, but also to all presented combination of financial indicators and company’s ratios.

| № | Name | Region | Turnover,in mln RUB, for 2012 | Solvency index GLOBAS-i® | Ratio of liabilities and assets, (х) |

|---|---|---|---|---|---|

| 1 | Neftekamskoe proizvodstvennoe ob’edinenie iskusstvennyh kozh OJSC INN: 0264005146 |

Republic of Bashkortostan | 1 488 | 0,32 | 211(high) |

| 2 | JSC "Troitskaya Kamvolnaya Fabrika" INN: 5046005770 |

Moscow | 1 348 | 0,66 | 209(high) |

| 3 | Neotek OJSC INN: 7736600070 |

Moscow | 1 892 | 0,68 | 292(high) |

| 4 | "Merinos Carpet and Carpet Wares" CJSC INN: 6165125323 |

Rostov region | 1 079 | 0,77 | 247(high) |

| 5 | TORGOVY DOM DARGEZ LLC INN: 7706406478 |

Moscow | 1 381 | 0,93 | 217(high) |

| 6 | Kompaniya Nafta-Him LLC INN: 7716206076 |

Moscow region | 1 510 | 0,94 | 194(the highest) |

| 7 | PRYADILNO-NITOCHNY KOMBINAT IM. S.M. KIROVA OJSC INN: 7825666563 |

Saint-Petersburg | 1 166 | 0,95 | 206(high) |

| 8 | AVANGARDLLC INN: 7826741774 |

Saint-Petersburg | 1 648 | 0,97 | 220(high) |

| 9 | Kotovskii zavod netkannyh materialov CJSC INN: 6820028830 |

Tambov region | 1 421 | 0,97 | 229(high) |

| 10 | JSC "REGENT NON MATERIALS" INN: 7722508646 |

Moscow | 1 157 | 1,13 | 340(satisfactory) |

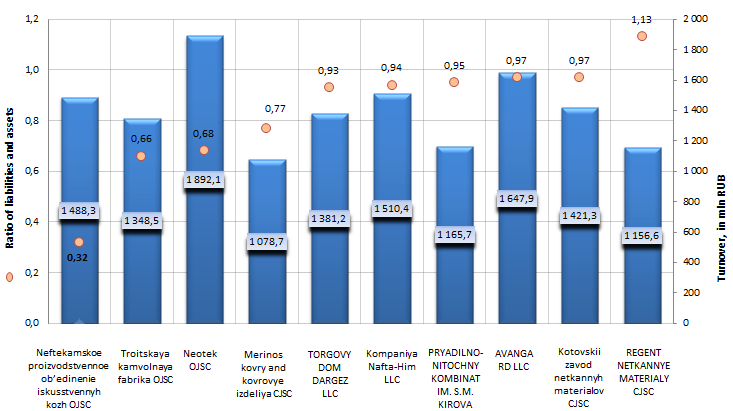

Picture 1. Ratio of liabilities and assets and turnover of the largest Russian textile enterprises (TOP-10)

Cumulative turnover of the first 10 largest textile enterprises of Russia made, according to last published financial statement, 14 090,6 mln RUB or 24,3% from sales revenue of TOP-100 companies in the same branch. This points to that this sector of the economy is fragmented, that there are no clear-cut monopolists.

Following organizations among TOP-10 on sales revenue showed the most optimal ratio values, supporting acceptable relation of liabilities to balance sheet assets: Neftekamskoe proizvodstvennoe ob’edinenie iskusstvennyh kozh OJSC (0,32), JSC "Troitskaya Kamvolnaya Fabrika" (0,66), Neotek OJSC (0,68), "Merinos Carpet and Carpet Wares" CJSC (0,77).

Neftekamskoe proizvodstvennoe ob’edinenie iskusstvennyh kozh OJSC (Iskozh) is the leader and the largest manufacturer and supplier of manmade materials for automotive, footwear and fancy goods industries, as well as for furniture and clothing trade in Russia and CIS countries.

JSC "Troitskaya Kamvolnaya Fabrika" is the leader of Russian textile industry on output of yarn for hand and machine knitting and different kinds of combed sliver (tops). Besides of that the factory produces covers with wool and artificial fillers.

Neotek OJSC is engaged in manufacturing and realization of cotton fabrics, furniture and textile products for household use through its own network of trade representations.

"Merinos Carpet and Carpet Wares" CJSC is one of the largest factories in Russia on production of carpets and rugs.

The rest companies from TOP-10 exceeded recommended values of the ratio, the value of liabilities on the books - over half from the value of assets.

However, according to the independent estimation of solvency, developed by the Information agency Credinform, all TOP-10 enterprises (except JSC "REGENT NON MATERIALS") got a high and the highest solvency index GLOBAS-i®, what guarantees that they can pay off their loan liabilities in time and fully. Risk of default in the nearest time is highly improbable; organizations are attractive objects for investment, especially considering high potential of the Russian market.

Satisfactory index by JSC "REGENT NON MATERIALS" may be largely due to the fact that liabilities exceed the value of assets on the books of the company.