TOP 10 software developers

The global software market is constantly growing, driven by companies' intention to invest in their digital sustainability and development. The Russian software market is no exception, where more than 84 thousand development companies are employed, 65% of which are small businesses. The average return on investment of the largest of them in 2020 shows a growing return on equity and long-term borrowed funds. At the same time, revenue and net profit also increased.

Information agency Credinform has selected for this ranking in Globas the largest companies listed in the Unified Register of Small and Medium Enterprises and engaged in the development, modernization, testing and support of software with the highest annual revenue (TOP 10 and TOP 100), according to the data from the Statistical Register and the Federal Tax Service for the latest available periods (2018 – 2020). They were ranked by the return on investment ratio (Table 1).

Return on investment is calculated as the ratio of net profit to the amount of equity capital and long-term liabilities and demonstrates the return on the equity capital involved in commercial activities and the long-term attracted funds of the organization.

For the most complete and objective view of the financial condition of the enterprise, it is necessary to pay attention to the complex of indicators and financial ratios of the company.

| Name, INN, region | Revenue, million RUB | Net profit (loss), million RUB | Return on investment, % | Solvency index Globas | |||

| 2019 | 2020 | 2019 | 2020 | 2019 | 2020 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| LLC SILIZ INN 7813348809 Saint Petersburg |

1 049,0 1 049,0 |

1 504,2 1 504,2 |

623,5 623,5 |

862,4 862,4 |

187,19 187,19 |

341,72 341,72 |

152 Superior |

| LLC DOMAIN NAME REGISTER REG.RU INN 7733568767 Moscow |

1 049,0 1 049,0 |

1 786,5 1 786,5 |

85,5 85,5 |

292,3 292,3 |

43,94 43,94 |

137,92 137,92 |

191 High |

| LLC VS LABORATORY INN 7810840970 Saint Petersburg |

1 296,5 1 296,5 |

1 490,2 1 490,2 |

16,5 16,5 |

40,1 40,1 |

23,70 23,70 |

36,58 36,58 |

223 Strong |

| LLC SPECIAL TECHNOLOGIES INN 7714343013 Moscow region |

1 287,2 1 287,2 |

1 533,7 1 533,7 |

341,5 341,5 |

326,3 326,3 |

43,36 43,36 |

29,29 29,29 |

236 Strong |

| LLC PRIME FACTORING INN 7705922670 Moscow |

6 791,0 6 791,0 |

6 851,1 6 851,1 |

247,9 247,9 |

75,3 75,3 |

99,58 99,58 |

28,93 28,93 |

237 Strong |

| LLC ADV CONSULTING INN 7706127570 Moscow |

1 805,2 1 805,2 |

2 195,0 2 195,0 |

125,8 125,8 |

194,4 194,4 |

13,10 13,10 |

27,88 27,88 |

216 Strong |

| LLC SCIENTIFIC AND TECHNICAL CENTER PROTEI INN 7825483961 Saint Petersburg |

1 641,8 1 641,8 |

1 583,7 1 583,7 |

72,3 72,3 |

97,0 97,0 |

21,20 21,20 |

137,92 137,92 |

187 High |

| LLC SATEL INN 7731232881 Moscow |

1 589,0 1 589,0 |

1 459,8 1 459,8 |

8,0 8,0 |

75,5 75,5 |

1,44 1,44 |

11,97 11,97 |

208 Strong |

| JSC ELVIS-PLUS INN 7735003794 Moscow |

545,4 545,4 |

1 584,7 1 584,7 |

13,4 13,4 |

26,7 26,7 |

6,28 6,28 |

11,12 11,12 |

181 High |

| LLC NORBIT INN 7702314674 Moscow |

778,8 778,8 |

1 532,8 1 532,8 |

2,2 2,2 |

107,3 107,3 |

-0,81 -0,81 |

-65,73 -65,73 |

239 Strong |

| Average value for TOP 10 |  1 821,0 1 821,0 |

2 152,2 2 152,2 |

153,7 153,7 |

209,7 209,7 |

43,24 43,24 |

58,09 58,09 |

|

| Average value for TOP 100 |  878,6 878,6 |

951,8 951,8 |

107,4 107,4 |

144,2 144,2 |

55,18 55,18 |

59,41 59,41 |

|

| Average industry value |  57,8 57,8 |

65,3 65,3 |

5,3 5,3 |

7,5 7,5 |

9,19 9,19 |

30,45 30,45 |

|

growth of indicator to the previous period,

growth of indicator to the previous period,  fall of indicator to the previous period

fall of indicator to the previous period

The average 2020 value of return on investment ratio of TOP 10 is lower than of TOP 100 and the industry average one. In 2020, the decrease of figures was recorded for three companies of TOP 10. In 2019, the fall was observed in seven companies. The best result was demonstrated by LLC SILIZ engaged in developing and controlling games for social networks.

At the same time, eight companies gained revenue and seven companies gained net profit in 2020.

The increase in revenue was 18% and 8% for TOP 10 and TOP 100 respectively, while the industry average value climbed almost 13%.

The average profit of TOP 10 have increased 36%, TOP 100’s one jumped 34%, and on average in the industry, almost 42% growth was recorded.

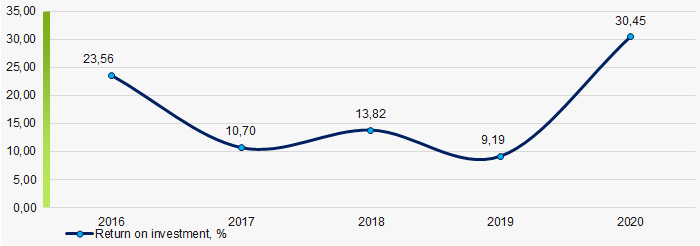

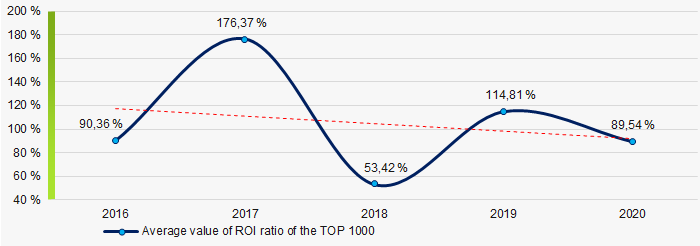

In general, the industry average return on investment values have raised for two periods during the past 5 years. The highest value was recorded in 2020 and the lowest one was in 2019 (Picture 1).

Picture 1. Change in the average return on investment values of software developers in 2016 - 2020

Picture 1. Change in the average return on investment values of software developers in 2016 - 2020TOP 1000 companies in Omsk

The need to build new scientific and industrial centers in Russia is one of the most relevant topics today. Continuing the cycle of publications about the largest cities of Russia, we offer a review of companies of one of the largest Siberian cities – Omsk. Positive trends prevail in activities of the largest companies in the period from 2016 to 2020, such as: decrease in the share of companies with insufficient property, increase in net assets, revenue and net profit. Among negative trends are increase in the average net loss value, decrease in asset turnover.

Information agency Credinform selected the largest companies of the city in terms of annual revenue for the last reporting periods available in the State Statistics bodies and the Federal Tax Service (2016-2020) (TOP 1000) for the analysis based on the data from the Information and Analytical system Globas.

Net assets is a ratio that reflects the real value of the company's property that is calculated annually as the difference between the assets on the company's balance sheet and its debt obligations. Net asset ratio is negative (insufficient property) if the company's debt exceeds the value of its property.

The largest company in the TOP 1000 in terms of net assets is JSC GAZPROMNEFT-OMSK REFINERY PLANT, INN 5501041254, production of petroleum products. In 2020, net assets amounted to more than 327 billion RUB.

STROYPRODUCT LLC had the smallest net assets in the TOP 1000, INN 5501093407, retail sale of unfrozen products, including beverages and tobacco products in non-specialized stores. The insufficiency of property in 2020 was expressed by a negative value of -443 million RUB.

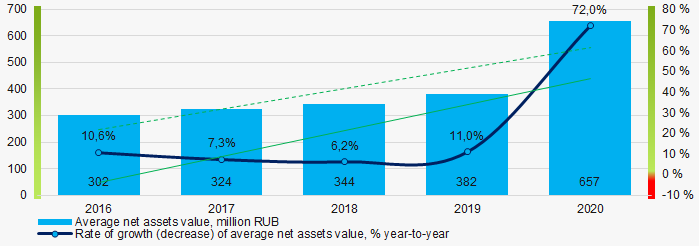

During the five-year period, average net assets of TOP 1000 companies and their growth rates tend to increase (Picture 1).

Picture 1. Change in average net assets of the TOP 1000 companies in 2016-2020

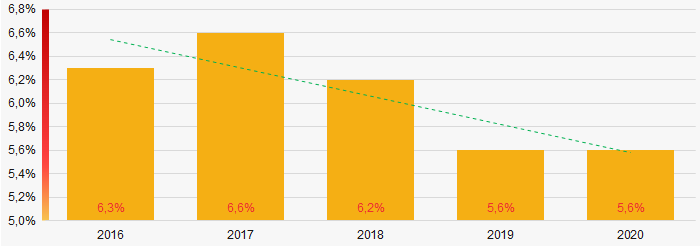

Picture 1. Change in average net assets of the TOP 1000 companies in 2016-2020Shares of companies with property insufficiency in the TOP 1000 had a positive downward trend over the past five years (Picture 2).

Picture 2. Shares of the TOP 1000 companies with negative net assets in 2016-2020

Picture 2. Shares of the TOP 1000 companies with negative net assets in 2016-2020Sales revenue

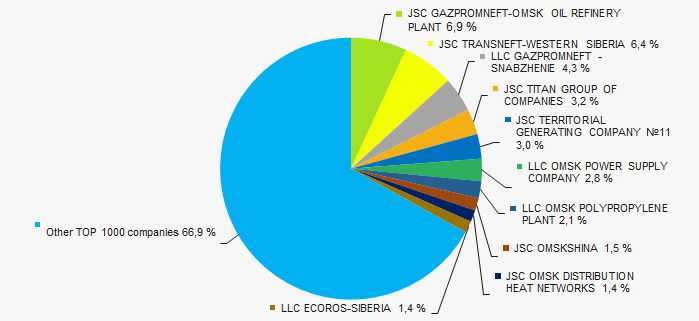

Revenue of the TOP 10 companies in 2020 amounted to 33% of the total revenue of the TOP 1000 companies. (Pictures 3). This indicates a relatively high level of capital concentration among Omsk companies.

Picture 3. Shares of the TOP 10 companies in the total revenue in 2020 TOP 1000

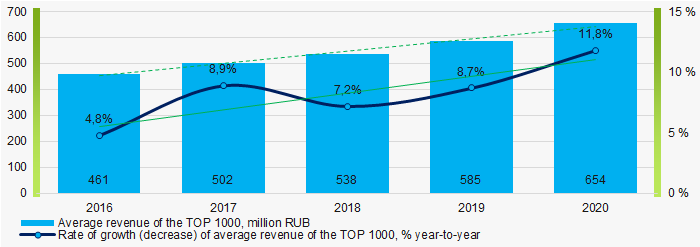

Picture 3. Shares of the TOP 10 companies in the total revenue in 2020 TOP 1000In general, there is a trend in revenue and growth rates increasing. (Picture 4).

Picture 4. Change in average revenue values of the TOP-1000 companies in 2016-2020

Picture 4. Change in average revenue values of the TOP-1000 companies in 2016-2020Profit and loss

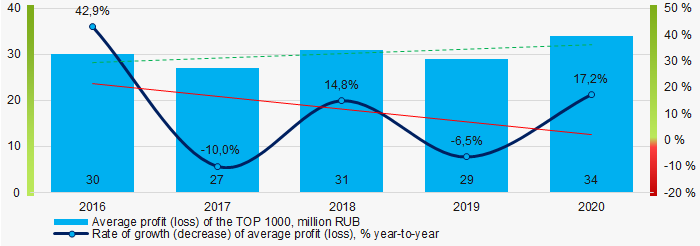

The largest company in the TOP 1000 in terms of net profit in 2020 is NAO TRANSNEFT-WESTERN SIBERIA, INN 5502020634, transportation of oil through pipelines. The profit amounted to over 5,9 billion RUB. Covering the five-year period average profit of the TOP 1000 companies tends to increase, with decreasing growth rates (Picture 5).

Picture 5. Change in average profit (loss) ratios of TOP-100 companies in 2016-2020.

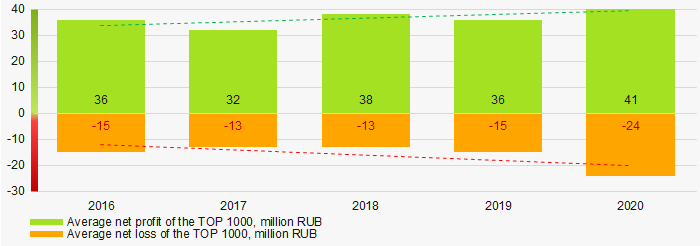

Picture 5. Change in average profit (loss) ratios of TOP-100 companies in 2016-2020.Covering the five-year period, average values of net profit of the TOP 1000 companies are increasing, while average net loss is also growing (Picture 6).

Picture 6. Changes in average values of net profit and net loss ratios of the TOP 1000 companies in 2016-2020

Picture 6. Changes in average values of net profit and net loss ratios of the TOP 1000 companies in 2016-2020Key financial ratios

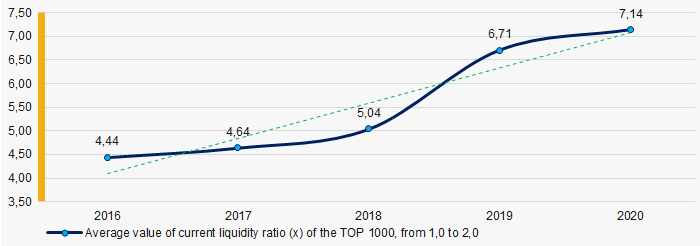

Covering the five-year period total liquidity ratio average values of the TOP 1000 were significantly exceeding the range of recommended values - from 1.0 to 2.0 with a trend to increase. (Picture 7).

Сurrent liquidity ratio (current assets to short-term liabilities) shows sufficiency of a company’s assets to settle short-term liabilities.

Picture 7. Changes in average values of total liquidity ratio of the TOP-1000 companies in 2016-2020.

Picture 7. Changes in average values of total liquidity ratio of the TOP-1000 companies in 2016-2020.Covering the five years period investments profitability ratio average values of the TOP 1000 has been at a high level with a trend to decrease (Picture 8).

This ratio is calculated as ratio of net profit to amount of equity and long-term liabilities and demonstrates return on equity involved in commercial activities and long-term funds raised by organization.

Picture 8. Change in investments profitability ratio average values of the TOP 1000 in 2016-2020.

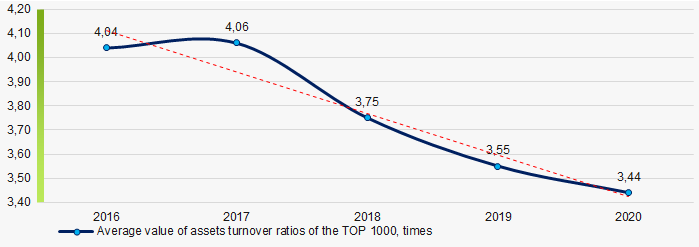

Picture 8. Change in investments profitability ratio average values of the TOP 1000 in 2016-2020.Asset turnover ratio is calculated as ratio of sales revenue to average value of total assets for a period and implicates the efficiency of use of all available resources, regardless of the sources they were raised. The ratio shows how many times per year the full cycle of production and turnover is performed generating the corresponding effect in the form of profit.

During the five-year period values of the said business activity ratio showed a trend to decrease (Picture 9).

Picture 9. Change in asset turnover ratio average values of the TOP-1000 in 2016-2020.

Picture 9. Change in asset turnover ratio average values of the TOP-1000 in 2016-2020.Small enterprises

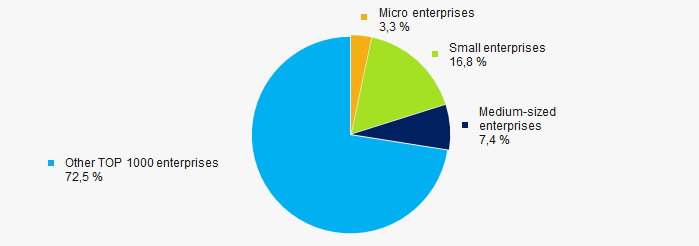

85% of the TOP 1000 companies are registered in the Unified Register of Small and Medium-Sized Enterprises of the Federal Tax Service of the Russian Federation. At the same time, the share of their revenue in the total volume of the TOP 1000 in 2020 is 27.5%, which is higher than the national average in 2018 - 2019. (Picture 10).

Picture 10. Revenue shares of small and medium-sized enterprises in the TOP-1000

Picture 10. Revenue shares of small and medium-sized enterprises in the TOP-1000Financial position score

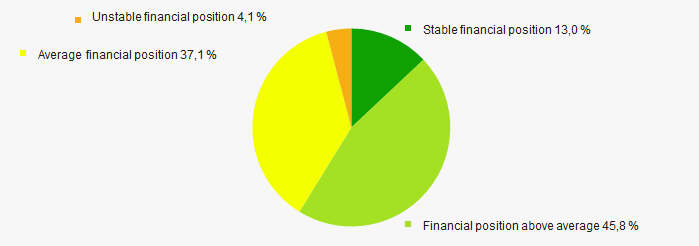

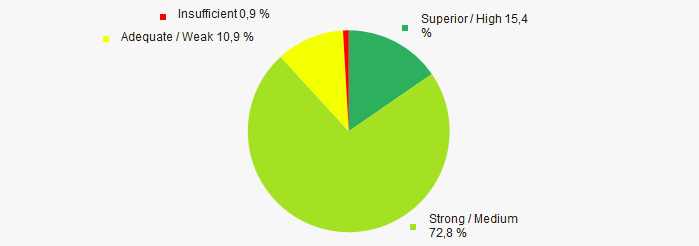

Financial position assessment of the TOP 1000 companies shows that the largest part of them is in financial position above average. (Picture 11).

Picture 11. Distribution of the TOP 1000 companies by financial position score

Picture 11. Distribution of the TOP 1000 companies by financial position scoreGlobas Solvency Index

The vast majority of TOP-100 companies are assigned superior and high Globas Solvency Index, which indicates their ability to repay their debt obligations on time and fully (Picture 12).

Picture 12. Distribution of the TOP 1000 companies according to the Globas Solvency Index

Picture 12. Distribution of the TOP 1000 companies according to the Globas Solvency Index Conclusion

Comprehensive assessment of activities of the largest Omsk companies, that takes into account main indexes, financial indicators and ratios, indicates predominance of positive trends in their activities in the period from 2016 to 2020. (Table 1).

| Trends and evaluation factors | Share of factor, % |

| Dynamics of average net assets value |  10 10 |

| Growth (decline) rate in average size of net assets |  10 10 |

| Increase / decrease in share of enterprises with negative values of net assets |  10 10 |

| The level of capital concentration (monopolization) |  -5 -5 |

| Dynamics of average revenue |  10 10 |

| Growth (decline) rate in average size of revenue |  10 10 |

| Dynamics of the average profit (loss) |  10 10 |

| Rate of growth (decline) in the average size of profit (loss) |  -10 -10 |

| Growth / decline in average values of companies’ net profit |  10 10 |

| Increase / decline in average values of net loss |  -10 -10 |

| Increase / decrease in average values of overall liquidity ratio |  5 5 |

| Increase / decrease in average values of return on investment ratio |  -5 -5 |

| Increase / decrease in average values of asset turnover ratio, times |  -10 -10 |

| Share of small and medium-sized enterprises in terms of revenue exceeding 20% |  10 10 |

| Financial position (the largest share) |  10 10 |

| Globas Solvency Index (the largest share) |  10 10 |

| Average value of factors share |  4,1 4,1 |

positive trend (factor),

positive trend (factor),  negative trend (factor)

negative trend (factor)