Net profit of the largest clothes manufacturers

Information Agency Credinform has prepared the ranking of the largest Russian clothes manufacturers, except companies, engaged in tailoring of special clothes, which is used in industry and military service.

The largest enterprises of the industry in terms of revenue were selected according to the data from the Statistical Register for the latest available period (for the year 2014). The enterprises were ranked by decrease in annual revenue. Total net profit/loss is specified for all companies of the ranking.

Net profit (loss) is a net retained profit (uncovered loss) of the reporting period, remained after income tax and other similar mandatory payments.

In most cases, net profit is used to increase current assets of the enterprise, create funds and reserves and also for reinvesting in production.

Net profit could be considered as a result of company’s activity for a period, in which it was made. The net profit index obviously demonstrates the sum of funds, received after all tax, salary and other statutory payments.

Increase of net profit shows well done work for a certain period and conversely, decrease in indicators and its negative values show the necessity of precautions against bankruptcy.

For the most full and fair opinion about the company’s financial condition, not only the average values of the indicators should be taken into account, but also the whole set of financial indicators and ratios.

| № | Name | Region | Revenue, mln RUB, 2014 | Net profit / loss, mln RUB, 2014 | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | CJSC GLORIA JEANS CORPORATION INN 6166034397 |

the Rostov region | 27 815,8 | 2 602,1 | 138 the highest |

| 2 | LLC NTO Consult INN 4207048574 |

the Kemerovo region | 1 245,5 | 236,6 | 167 the highest |

| 3 | JSC SLAVYANKA INN 6027014530 |

the Pskov region | 1 047,5 | 431,2 | 167 the highest |

| 4 | JSC SINAR INN 5406014187 |

the Novosibirsk region | 845,3 | 9,0 | 200 high |

| 5 | CJSC Industrial and Commercial Company Elegant INN 6152001000 |

the Rostov region | 757,1 | 5,5 | 222 high |

| 6 | CJSC Odejda i moda INN 3728026176 |

the Ivanovo region | 735,5 | 10,2 | 187 the highest |

| 7 | OJSC BOLSHEVICHKA INN 7708029923 |

Moscow | 715,2 | 117,4 | 184 the highest |

| 8 | LLC Valentin Yudashkin INN 7730041122 |

Moscow | 609,8 | -75,2 | 282 high |

| 9 | LLC BTK Trikotazh INN 7839476724 |

Moscow | 528,3 | 168,9 | 245 high |

| 10 | LLC Hosiery-Knitting Factory INN 2130079012 |

the Republic of Chuvashia | 519,5 | 0,3 | 253 high |

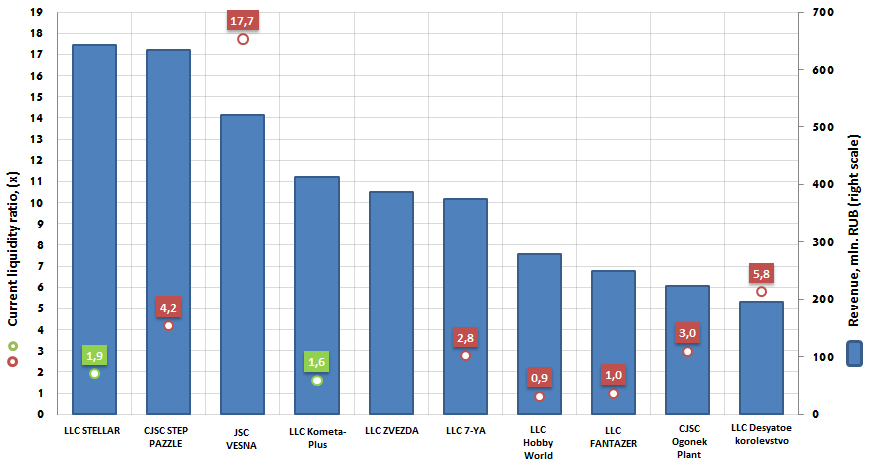

Net profit volume of the largest clothes manufacturers (top-10) varies from 2602,1 mln RUB (CJSC GLORIA JEANS CORPORATION) to -75,2 mln RUB (LLC Valentin Yudashkin). As it can be seen from the diagram, GLORIA JEANS CORPORATION is the absolute leader in clothes manufacture. The company is significantly ahead of its nearest competitors by annual revenue as well as by net profit.

Picture. Revenue and net profit/loss of the largest clothes manufacturers (top-10)

According to the latest financial statements (2014), the annual revenue of market leaders (Top-10) amounted to 34,8 bln RUB, that is 0,3% higher than total revenue of Top-10 companies in 2013. In view of inflation, the marked turnover growth cannot be considered as positive result; the enterprises face with actual market volume reduction in monetary terms.

Despite this, all Top-10 companies of the have the highest and high solvency index, that shows the ability of enterprises to meet their obligations in time and fully; the risk of nonfulfillment is low.

For the last reporting period the net profit of GLORIA JEANS CORPORATION, the leader of the domestic tailoring sphere, increased by 6,3%, from 2,4 bln RUB to 2,6 bln RUB.

GLORIA JEANS is a vertically integrated retailer, the leader of fast fashion segment in Russia and Ukraine.

GLORIA JEANS specializes on design, manufacture and sale of fashion clothes, shoes and accessories for adults and children under Gloria Jeans and Gee Jay trademarks.

The majority of companies on the Russian market purchase products from vendors, offering finished collections. As a rule, they are Hong Kong, Japanese, American and French companies. GLORIA JEANS makes design by itself and has an extensive sourcing department worldwide. Own design and merchandising centers are situated not only in Russia, but also in Sao Paulo, Shanghai, Istanbul and Hong Kong.

Shop network consists of more than 600 stores in Russia and Ukraine. Each of them strengthens the Gloria Jeans brand. According to the McKinsey consulting company, 95% of Russians know the brand.

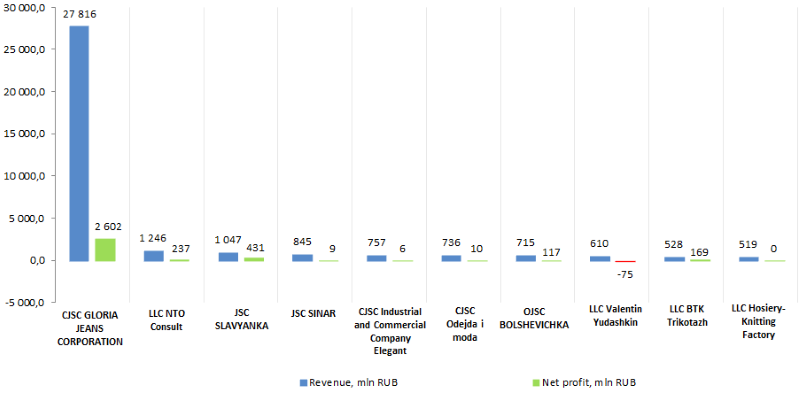

Current liquidity ratio of the largest toys manufacturers

Information Agency Credinform has prepared the ranking of the largest Russian toys manufacturers.

Top-10 enterprises, ranged by decrease in revenue, were selected according to the data from the Statistical Register for the latest available period (for the year 2014); the liquidity ratio was calculated for each company (if data are available).

The current liquidity ratio (х) is a ratio of total working capital and short-term liabilities. It shows the sufficiency of funds to repay the obligations, execution date of which comes earlier than 12 months.

The recommended value: from 1,5 to 2,5. It should be understood, that actual data may significantly vary from the presented normative range for enterprises of different and same industries.

There are highly liquid, low liquid and illiquid values (assets). The easier and faster you can exchange the asset, taking into account its full cost, the more liquid is the asset. The liquidity of the product is the speed of its implementation using nominal price without additional discounts.

The ratio shows the ability of the company to meet its current (short-term) obligations using only current assets and characterizes not only company’s current solvency, but also the solvency in case of emergency. The higher is the rate, the better is the solvency of the company.

Both low and high ratios have negative effect. The ratio lower than 1 indicates about high financial risk, which is connected with the fact, that the company is not able to consistently pay its current bills. The ratio more than 3 may testify about the irrational capital structure; overly cautious financial strategy, which may lead to loss of the share in market. However it should be considered, that the ratio value may significantly vary, it depends on the area of activity, structure and quality of the assets etc.

It should be noted, that the ratio doesn’t always give a full picture. Usually the enterprises, which easily receive money from the payment bills, and with low inventory stocks, may safely operate with a lower ratio value, than the companies with high inventory stocks and sales of goods on credit.

For the most full and fair opinion about the company’s financial condition, not only the average values of the indicators should be taken into account, but also the whole set of financial indicators and ratios.

| № | Name | Region | Revenue, mln. RUB, 2014 | Current liquidity ratio, (х) | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | LLC STELLAR INN 6165021405 |

Rostov region | 642,8 | 1,9 | 190 the highest |

| 2 | CJSC STEP PAZZLE INN 7720249869 |

Moscow region | 633,4 | 4,2 | 197 the highest |

| 3 | JSC VESNA INN 4346008642 |

Kirov region | 520,7 | 17,7 | 168 the highest |

| 4 | LLC Kometa-Plus INN 6714015660 |

Smolensk region | 412,1 | 1,6 | 290 high |

| 5 | LLC ZVEZDA INN 5025025461 |

Moscow region | 386,7 | - | 337 satisfactory |

| 6 | LLC 7-YA INN 7602033398 |

Yaroslavl region | 374,8 | 2,8 | 219 high |

| 7 | LLC Hobby World INN 7708812210 |

Moscow | 278,6 | 0,9 | 366 satisfactory |

| 8 | LLC FANTAZER INN 7728557047 |

Moscow | 249,4 | 1,0 | 320 satisfactory |

| 9 | CJSC Ogonek Plant INN 7724003577 |

Moscow | 223,9 | 3,0 | 229 high |

| 10 | LLC Desyatoekorolevstvo INN 7713321088 |

Moscow region | 195,2 | 5,8 | 187 the highest |