Investment efficiency of concrete manufacturers

Information agency Credinform represents a ranking of the largest Russian manufacturers of cement and concrete items. Manufacturers of cement, concrete and building materials with the largest volume of annual revenue (TOP-10) were selected for the ranking, according to the data from the Statistical Register for the latest available periods (2016 - 2018). They were ranked by return on equity ratio (Table 1). The analysis was based on the data of the Information and Analytical System Globas.

Return on equity (ROE) (%) is net income (annual) to shareholder’s equity.

The ratio determines the efficiency of use of capital invested by the owners of the enterprise, and shows the number of monetary units of net profit earned by each unit invested by the owners of the company.

This indicator is used by investors and business owners to measure their own investments. The higher the ratio, the more profitable is the investment. With negative or zero ROE, it is necessary to analyze the feasibility and effectiveness of investments in the future. In such cases, the ratio value should be compared with other investments.

Too high value of the indicatщк can negatively affect the financial stability of the enterprise, since high profitability also implies higher risks.

To obtain the most complete and objective picture of the financial condition of an enterprise, it is necessary to pay attention to the totality of indicators and financial ratios.

For the most complete and objective view of the financial condition of the enterprise, it is necessary to pay attention to the complex of indicators and financial ratios of the company.

| Name, INN, region | Revenue, billion RUB | Net profit (loss), billion RUB | Return on equity, % | Solvency index Globas | |||

| 2017 | 2018 | 2017 | 2018 | 2017 | 2018 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| Mechel Materials OOO INN 5003064770 Chelyabinsk region |

7,73 7,73 |

9,88 9,88 |

0,54 0,54 |

1,31 1,31 |

106,65 106,65 |

141,45 141,45 |

246 Strong |

| LIMITED LIABILITY COMPANY HENKEL BAUTECHNIK INN 5022031259 Moscow region |

8,39 8,39 |

9,45 9,45 |

1,29 1,29 |

1,43 1,43 |

31,09 31,09 |

28,79 28,79 |

149 Superior |

| Joint Stock Company BetElTrans INN 7708669867 Moscow |

21,17 21,17 |

28,91 28,91 |

0,90 0,90 |

0,97 0,97 |

16,23 16,23 |

16,58 16,58 |

207 Strong |

| RENSTROYDETAL LTD. INN 7806326138 Saint Petersburg |

8,13 8,13 |

11,32 11,32 |

0,01 0,01 |

0,19 0,19 |

1,20 1,20 |

16,55 16,55 |

247 Strong |

| OOO KNAUF GIPS INN 5024051564 Moscow region |

12,90 12,90 |

14,16 14,16 |

2,73 2,73 |

2,30 2,30 |

18,19 18,19 |

13,42 13,42 |

188 High |

| HEIDELBERGCEMENT RUS LIMITED LIABILITY COMPANY INN 5036074848 Moscow region |

10,32 10,32 |

11,31 11,31 |

-0,29 -0,29 |

0,90 0,90 |

-4,48 -4,48 |

12,16 12,16 |

242 Strong |

| JSC SEBRYKOVCEMENT INN 3437000021 Volgograd region |

10,62 10,62 |

10,86 10,86 |

1,85 1,85 |

1,17 1,17 |

17,70 17,70 |

10,44 10,44 |

177 High |

| SLK CEMENT LIMITED LIABILITY COMPANY INN 6633028244 Sverdlovsk region |

10,14 10,14 |

11,22 11,22 |

1,58 1,58 |

1,98 1,98 |

7,74 7,74 |

8,86 8,86 |

203 Strong |

| HOLCIM (RUS) CONSTRUCTION MATERIALS LLC INN 5022050558 Moscow region |

6,84 6,84 |

15,14 15,14 |

-1,77 -1,77 |

1,00 1,00 |

-37,26 -37,26 |

4,11 4,11 |

255 Strong |

| JSC NOVOROSCEMENT INN 2315020195 Krasnodar territory |

6,84 6,84 |

15,14 15,14 |

|

|

|

4,11 4,11 |

215 Strong |

| Total for TOP-10 companies |  11,01 11,01 |

13,77 13,77 |

0,70 0,70 |

1,13 1,13 |

15,81 15,81 |

25,24 25,24 |

|

| Average value for TOP-10 companies |  0,61 0,61 |

0,65 0,65 |

0,01 0,01 |

0,01 0,01 |

24,46 24,46 |

162,49 162,49 |

|

growth of indicator to the previous period,

growth of indicator to the previous period,  decrease of indicator to the previous period

decrease of indicator to the previous period

The average indicator of return on sales ratio of TOP-10 companies is below the average of TOP-1000. In 2018, six companies of TOP-10 increased their figures.

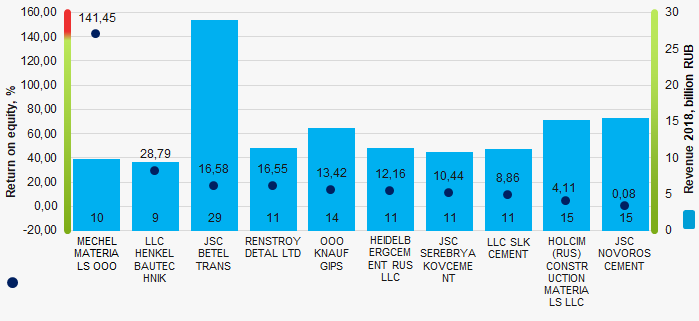

Picture 1. Return on equity ratio and revenue of the largest Russian manufacturers of cement and concrete items (TOP-10)

Picture 1. Return on equity ratio and revenue of the largest Russian manufacturers of cement and concrete items (TOP-10)Over the past 5 years, the average values of return on equity ratio of TOP-1000 have a trend to increase (Picture 2).

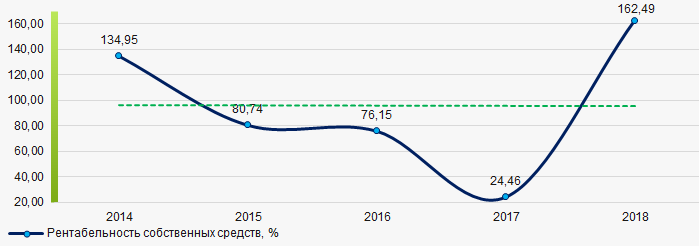

Picture 2. Change in the industry average values of return on equity ratio of TOP-1000 the largest Russian manufacturers of cement and concrete items in 2014 – 2018

Picture 2. Change in the industry average values of return on equity ratio of TOP-1000 the largest Russian manufacturers of cement and concrete items in 2014 – 2018Production and processing of fish in the Far Eastern Federal District of Russia

Information agency Credinform represents an overview of activity trends of the largest marine capture fisheries and seafood processing companies in the Far Eastern Federal District of Russia.

Seafood companies with the largest volume of annual revenue (TOP-500) were selected for the analysis, according to the data from the Statistical Register for the latest available periods (for 2013 – 2018). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Net assets value is an indicator, reflecting the real value of company’s property, is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The indicator of net assets is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

The largest enterprise in the Far Eastern region in terms of net assets is KURILSKII RYBAK NJSC, INN 6511000178, Sakhalin region (in process of reorganization in the form of acquisition of other legal entities, 26.12.2019). In 2018, its net assets amounted to 15,3 billion rubles.

The smallest amount of net assets in the TOP-500 list was hold by TUNAYCHA COMPANY LLC, INN 6504018880, Sakhalin region. The insufficiency of property of this company in 2018 was expressed as a negative value of -2 billion rubles.

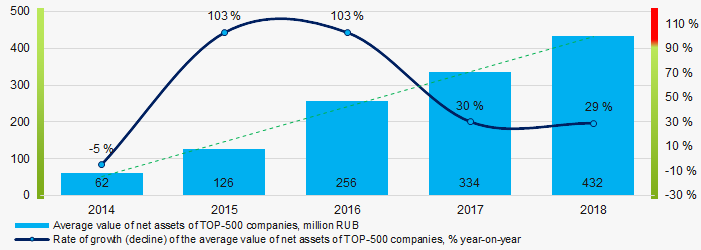

The average values of net assets of TOP-500 enterprises tend to increase over the five-year period (Picture 1).

Picture 1. Change in average indicators of the net asset value of TOP-500 enterprises in 2014 – 2018

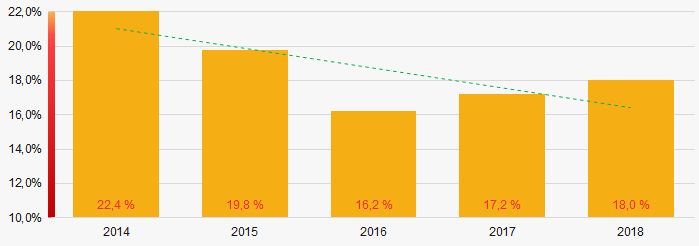

Picture 1. Change in average indicators of the net asset value of TOP-500 enterprises in 2014 – 2018The shares of TOP-500 enterprises with insufficiency of assets have a tendency to decrease in the last five years (Picture 2).

Picture 2. Shares of enterprises with negative values of net assets in TOP-500

Picture 2. Shares of enterprises with negative values of net assets in TOP-500Sales revenue

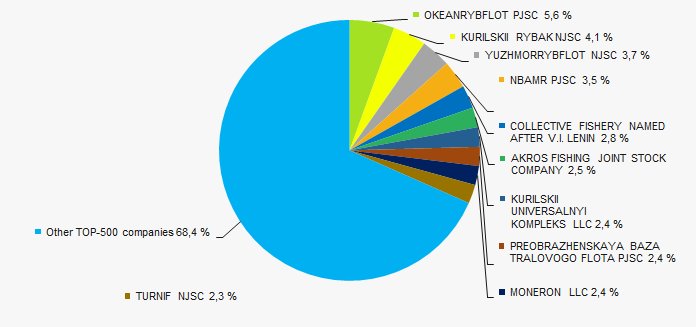

The revenue volume of 10 leading companies in 2018 made almost 32% of the total revenue of TOP-500. (Picture 3). It points to a high level of intra-industry competition in the region.

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-500 enterprises for 2018

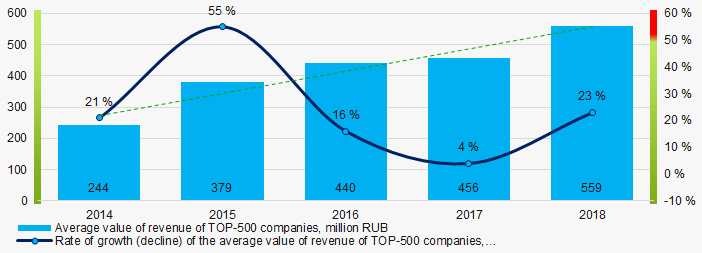

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-500 enterprises for 2018In general, there is a trend towards an increase in sales result (Picture 4).

Picture 4. Change in the average revenue of TOP-500 companies in 2014 – 2018

Picture 4. Change in the average revenue of TOP-500 companies in 2014 – 2018Profit and losses

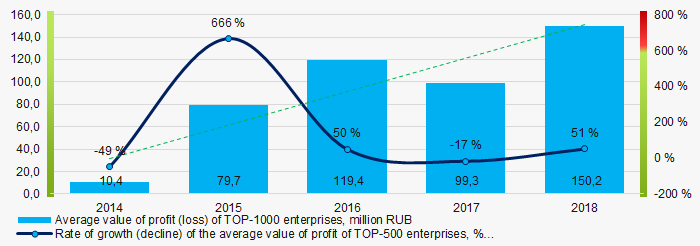

The largest company of the industry in terms of net profit value is KURILSKII UNIVERSALNYI KOMPLEKS LLC, INN 6501231095, Sakhalin region (in process of reorganization by spin-off, 04.09.2019). The company's profit amounted to 13,2 billion rubles for 2018.

The profit of TOP-500 enterprises trend to increase over the five-year period (Picture 5).

Picture 5. Change in the average indicators of net profit (loss) of TOP-500 companies in 2014 – 2018

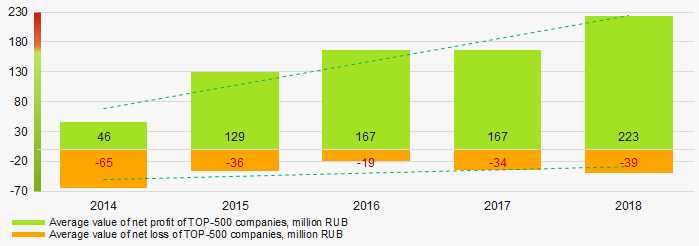

Picture 5. Change in the average indicators of net profit (loss) of TOP-500 companies in 2014 – 2018Average values of net profit’s indicators of TOP-500 companies trend to increase for the five-year period, at the same time the average value of net loss decreases. (Picture 6).

Picture 6. Change in the average values of indicators of net profit and net loss of TOP-500 companies in 2014 – 2018

Picture 6. Change in the average values of indicators of net profit and net loss of TOP-500 companies in 2014 – 2018Key financial ratios

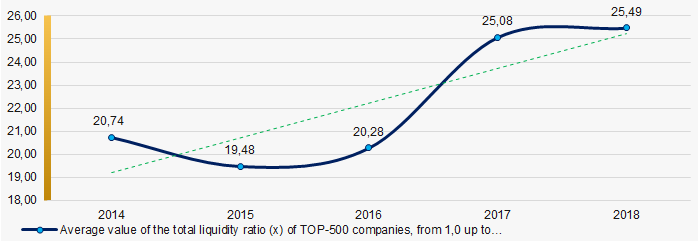

Over the five-year period the average indicators of the total liquidity ratio of TOP-500 enterprises were well above the range of recommended values - from 1,0 up to 2,0, with a tendency to increase (Picture 7).

The total liquidity ratio (the relation of the amount of current assets to short-term liabilities) shows the sufficiency of company’s funds for repayment of its short-term liabilities.

Picture 7. Change in the average values of the total liquidity ratio of TOP-500 companies in 2014 – 2018

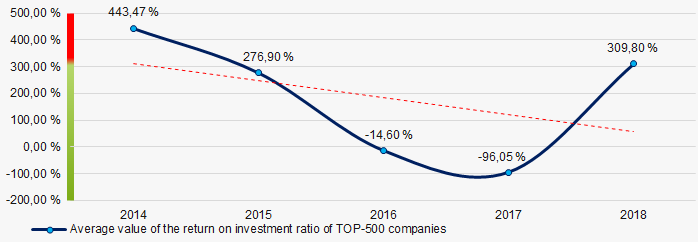

Picture 7. Change in the average values of the total liquidity ratio of TOP-500 companies in 2014 – 2018There has been a downward trend in average values of the return on investment ratio over the course of five years (Picture 8).

The ratio is calculated as the relation of net profit to the sum of own capital and long-term liabilities and demonstrates the return on the equity of own capital involved in the commercial activity and the long-term borrowed funds of an organization.

Picture 8. Change in the average values of the return on investment ratio of TOP-500 companies in 2014 – 2018

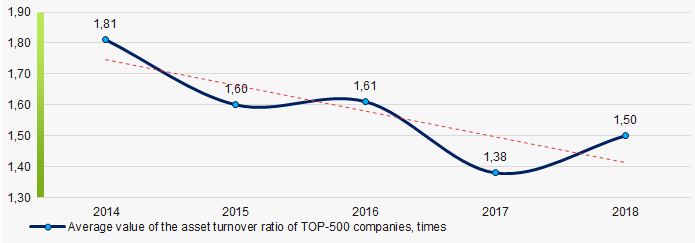

Picture 8. Change in the average values of the return on investment ratio of TOP-500 companies in 2014 – 2018 Asset turnover ratio is calculated as the relation of sales proceeds to the average value of total assets for a period and characterizes the efficiency of use of all available resources, regardless of the sources of their attraction. The ratio shows how many times a year a complete cycle of production and circulation is made, yielding profit.

This ratio of business activity showed a tendency to decrease over the five-year period (Picture 9).

Picture 9. Change in the average values of the asset turnover ratio of TOP-500 companies in 2014 – 2018

Picture 9. Change in the average values of the asset turnover ratio of TOP-500 companies in 2014 – 2018Small business

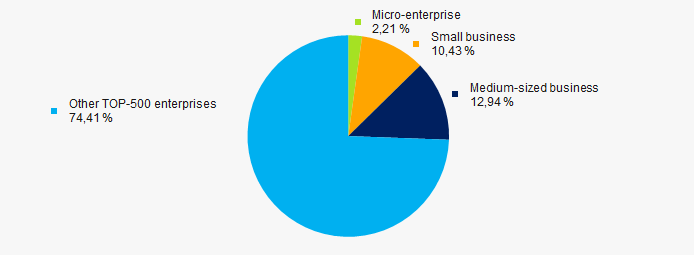

41% of TOP-500 companies are registered in the Register of small and medium-sized enterprises of the Federal Tax Service of the RF. At the same time, their share in the total revenue of TOP-500 amounts to 25,6%, that is higher than the national average (Picture 10).

Picture 10. Shares of proceeds of small and medium-sized enterprises in TOP-500 companies

Picture 10. Shares of proceeds of small and medium-sized enterprises in TOP-500 companiesMain regions of activity

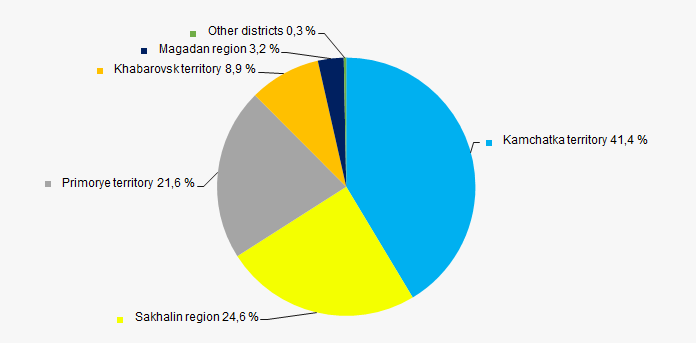

The TOP-500 companies are registered in all 8 regions of the federal district and distributed unequal across the territory, in accordance with the geographical location of seafood production sites. Almost 88% of enterprises with the largest volume of revenue in the industry are concentrated in Kamchatka and Primorye territories and in Sakhalin region (Picture 11).

Picture 11. Distribution of the revenue of TOP-500 companies by the regions of the Far Eastern Federal District of Russia

Picture 11. Distribution of the revenue of TOP-500 companies by the regions of the Far Eastern Federal District of RussiaFinancial position score

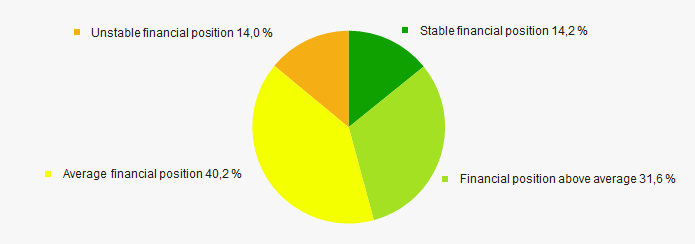

An assessment of the financial position of TOP-500 companies shows that most of them are in average financial position (Picture 12).

Picture 12. Distribution of TOP-500 companies by financial position score

Picture 12. Distribution of TOP-500 companies by financial position scoreSolvency index Globas

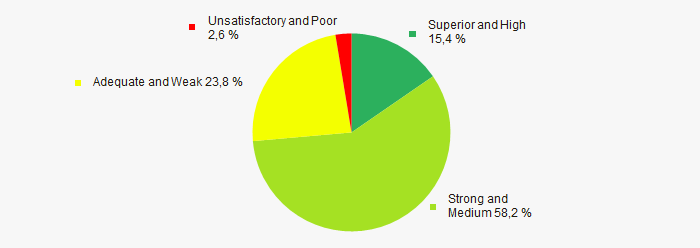

The vast majority of TOP-500 companies got Superior/High or Strong/Medium Solvency index Globas, that points to their ability to pay off their debts in time and fully (Picture 13).

Picture 13. Distribution of TOP-500 companies by solvency index Globas

Picture 13. Distribution of TOP-500 companies by solvency index GlobasConclusion

A comprehensive assessment of activity of the largest marine capture fisheries and seafood processing companies in the Far Eastern Federal District, taking into account the main indices, financial indicators and ratios, points to the prevalence of positive trends (Table 1).

| Trends and evaluation factors of TOP-500 companies | Specific share of factor, % |

| Rate of growth (decline) in the average size of net assets |  10 10 |

| Increase / decrease in the share of enterprises with negative values of net assets |  10 10 |

| Level of competition / monopolization |  10 10 |

| Rate of growth (decline) in the average size of revenue |  10 10 |

| Rate of growth (decline) in the average size of profit (loss) |  10 10 |

| Growth / decline in average values of net profit of companies |  10 10 |

| Growth / decline in average values of net loss of companies |  10 10 |

| Increase / decrease in average values of total liquidity ratio |  5 5 |

| Increase / decrease in average values of return on investment ratio |  -10 -10 |

| Increase / decrease in average values of asset turnover ratio, times |  -10 -10 |

| Share of small and medium-sized enterprises in the industry in terms of revenue being more than 22% |  10 10 |

| Regional concentration |  5 5 |

| Financial position (the largest share) |  5 5 |

| Solvency index Globas (the largest share) |  10 10 |

| Average value of factors |  6,1 6,1 |

positive trend (factor),

positive trend (factor),  negative trend (factor).

negative trend (factor).