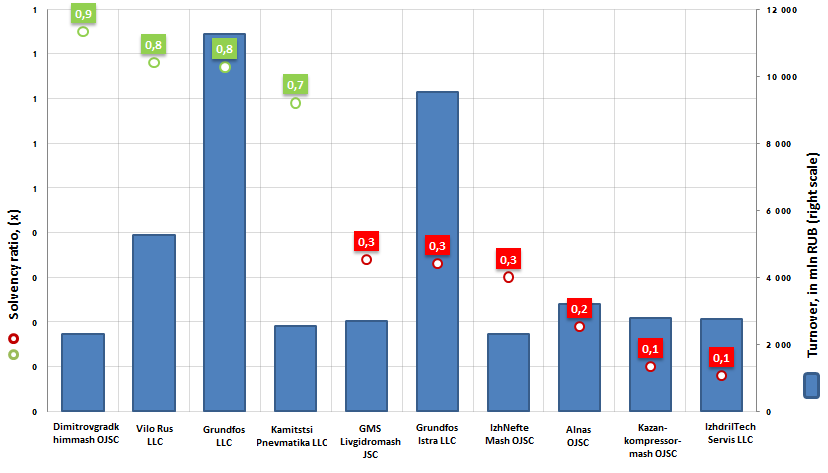

Solvency ratio of the largest manufacturers of pumping equipment

Information agency Credinform prepared a ranking of the largest Russian companies, producing pumping equipment.

The TOP-10 list of enterprises was drawn up for the ranking on the volume of annual revenue, according to the data from the Statistical Register for the latest available period (for the year 2014).

Solvency ratio (х) is the relation of own capital to the balance sum. It shows company’s dependence on foreign loans.

Recommended value is: >0,5.

If the parameter has dropped below the minimum permissible limit, than it means that a company is highly dependent on external sources of borrowings, and by the worsening of conjecture in the market it may lead to liquidity crisis, to unstable financial position.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention not only to industry-average indicators, but also to all presented combination of financial indicators and company’s ratios.

| № | Name | Registration area | Revenue, in mln RUB, for 2014 | Solvency ratio, (х) | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | Dimitrovgradkhimmash OJSC INN 7302000070 |

Ulyanovsk region | 2 317 | 0,9 | 192 the highest |

| 2 | Vilo Rus LLC INN 7702176142 |

Moscow | 5 267 | 0,8 | 178 the highest |

| 3 | Grundfos LLC INN 5042054367 |

Moscow | 11 249 | 0,8 | 159 the highest |

| 4 | Kamitstsi Pnevmatika LLC INN 7710028420 |

Moscow | 2 541 | 0,7 | 192 the highest |

| 5 | GMS Livgidromash JSC INN 5702000265 |

Orel Region | 2 685 | 0,3 | 271 high |

| 6 | Grundfos Istra LLC INN 5017047704 |

Moscowregion | 9 510 | 0,3 | 272 high |

| 7 | IzhNefteMash OJSC INN 1835012826 |

Udmurt Republic | 2 301 | 0,3 | 229 high |

| 8 | Alnas OJSC INN 1607000081 |

Republic of Tatarstan | 3 198 | 0,2 | 271 high |

| 9 | Kazankompressormash OJSC INN 1660004878 |

Republic of Tatarstan | 2 775 | 0,1 | 290 high |

| 10 | IzhdrilTechServis LLC INN 1831114320 |

Udmurt Republic | 2 762 | 0,1 | 221 high |

The solvency ratio of the leading manufacturers of pumping equipment (top-10) ranges from 0,1 (IzhdrilTechServis LLC) up to 0,9 (Dimitrovgradkhimmash OJSC).

Thus, a number of companies got shortlisted in the Top-10 list has a high degree of dependence on borrowed funds (the solvency ratio is less than 0,5). Their capital doesn’t cover the amount of obligations incurred, and by one-time claiming credit amounts the enterprises will have difficulties with their repayment. Therefore, business needs to maintain a balance between the desire to expand its presence in the market and the ability to cope with a high debt load.

Picture 1. Solvency ratio and revenue of the largest Russian manufacturers of pumping equipment (TOP-10)

Annual revenue of the TOP-10 companies, according to the latest published annual financial statement (for 2014), made 44,6 bln RUB, that is by 11,4% higher than the revenue of the same enterprises for the previous reporting period (40 bln RUB).

The largest company in the industry – Grundfos LLC – shows good financial results, including in terms of solvency level: the ratio of capital sum to the volume of borrowed funds is 0,8, that points to a rather low dependence of the firm on foreign loans.

The company Grundfos is the world leader in the production of high-tech pumping equipment and sets the trends in the sphere of water technology.

The pumps Grundfos have been known to domestic consumers since 60-ies of the last century. The representation of the concern in Moscow was opened in 1992. In 1998 was found the subsidiary Grundfos LLC.

Consistent high quality of products, reliability and energy efficiency of manufactured pumps, as well as well-developed network of branches and service centers in the regions of Russia help the company maintain the leadership position in the market of pumping equipment.

In 2005 it was completed the construction of the first stage of the plant «Grundfos Istra». Own production allows to produce high-quality pumps on the territory of Russia, as well as to reduce delivery times and logistical costs of customers. Today the total area of the factory is 30 000 sq. m.

Several types of equipment are set up in the plant: vertical, centrifugal, cantilever-monoblock pumps with variable-frequency motors; water booster systems and fire-fighting units; control cabinets.

The pumps Grundfos are working in water and wastewater treatment plants of Moscow, St. Petersburg, Rostov-on-Don, Voronezh, Khabarovsk, Syktyvkar, Podolsk, Ivanovo, Yaroslavl and a number of other cities. Also, company’s equipment has been installed on objects of housing and communal services and the largest industrial enterprises of Russia, on life-support systems of airports and sports facilities.

This one and other participants of the ranking of the largest TOP-10 manufacturers of pumping equipment got high and the highest solvency index. This fact points to companies’ ability to pay off their debts in time and fully, while risk of default is minimal.

Patent system of taxation in 2015

Patent system of taxation operates in Russia since January 1st 2013. The system was created for the individual entrepreneurs, conducting their business activity in the regions where it was introduced by the law of a subject of the Russian Federation.

The following services are subject to the tax: rendering of different repair and consumer services for citizens; motor vehicle servicing; carriage of passengers and cargo by road and by sea; tutoring, caring for children, sick, aged and disabled people; renting of residential and non-residential properties, summer houses, land lots; vending and catering; foodstuff manufacturing and many other things. «Classification of Business Activities, concerning which the law of a subject of the Russian Federation prescribes the application of the patent system of taxation», passed by the Order of Ministry for Taxes and Levies of the Russian Federation as of 02.06.2003 № BG-3-13/285, stipulate for only 63 business activities. It is possible to look through the Order on the Internet portal of the Federal Tax Service of the Russian Federation.

The patent system of taxation is voluntary. It may be brought in coincidence with other taxation schemes. Individual entrepreneurs are entitled the right not to keep standard accounting records, not to use cash-register equipment in the course of operations with cash and payment cards, are excused from paying value-added tax, individual income tax and personal property tax.

The tax rate is fixed. It doesn’t depend on the real income level of the individual entrepreneur. The calculation of the tax to be paid is made by the tax authority in the patent directly. The tax is paid in the tax authority where the entity was registered not later than the patent expiry date.

Thus the simplicity, transparency and common practice for many kinds of activity are the obvious advantages of the patent system of taxation.

The significant changes took place in the application practice of the patent system since 2015. It happened as a result of coming into effect of the Federal laws as of 21.07.2014 №244-FZ «Concerning the Introduction of Amendments to Articles 346.43 and 346.45, part two of the Tax Code of the Russian Federation» and as of 13.07.2015 №232-FZ «Concerning the Introduction of Amendments to Article 12, part one and to the part two of the Tax Code of the Russian Federation».

At the present time the patent system of taxation may be used by the individual entrepreneurs whose average number of wage and salary workers for all kinds of business activity doesn’t exceed 15 employees for the tax period and the sales income amounts to no more than RUB 60 million.

The application of the patent system doesn’t come under the activity within the terms of the simple partnership agreements (joint operation agreements) and fiduciary in property management agreements.

Patent on conducting one kind of business activity effects only within the territory of the administrative subject of the Russian Federation, stated in the patent. By conducting several kinds of business activity it is necessary to have the patent for each activity separately.

The patent may be filed from any date for the period from 1 to 12 months within the calendar year.

The tax for the individual entrepreneurs being under the patent system of taxation is fixed at the rate of 6% of the potentially-enable receivable annual income for the business activity. The level of this income is set by the law of a subject of the Russian Federation for the calendar year.

Till 2020 the laws of a subject of the Russian Federation may set the exemption from taxes for two years for the individual entrepreneurs being registered for the first time and operating in the industrial, social and scientific spheres.

The tax is paid fully not later than the patent expiry date, in case the patent duration is less than 6 months or at the value of 1/3 of the tax amount not later than 90 calendar days after commence of patent or at the value of 2/3 of the tax amount not later than the patent expiry date – in case the duration of patent is from 6 to 12 months.

Sales income accounting is kept in the income ledger of the individual entrepreneur using the patent system of taxation separately on each patent. At the same time no provision exists for the submission of the tax declaration.

For the record:

According to United Interdepartmental Statistical Information System the income of the individual entrepreneurs being under the patent system of taxation amounted to RUB 30,19 billion for 2013.

In Saint Petersburg the patent system of taxation is introduced from January 1st 2014 by the Law of Saint Petersburg as of 30.10.2013 №551-98.

For the first 6 months of the system’s effect 486 individual entrepreneurs exercised the right to use it by 37 business activities. The most requested type of business activity by the patent appeared to be renting of residential and non-residential properties, summer houses, land lots, belonging to the individual entrepreneur on the basis of the ownership right – 343 patents or 59% of the total number of issued patents. Taking into account the application of the patent system of taxation, RUB 26 million of taxes went into the Saint Petersburg budget. Thus the average cost of the patent amounted to just over RUB 53 thousand.