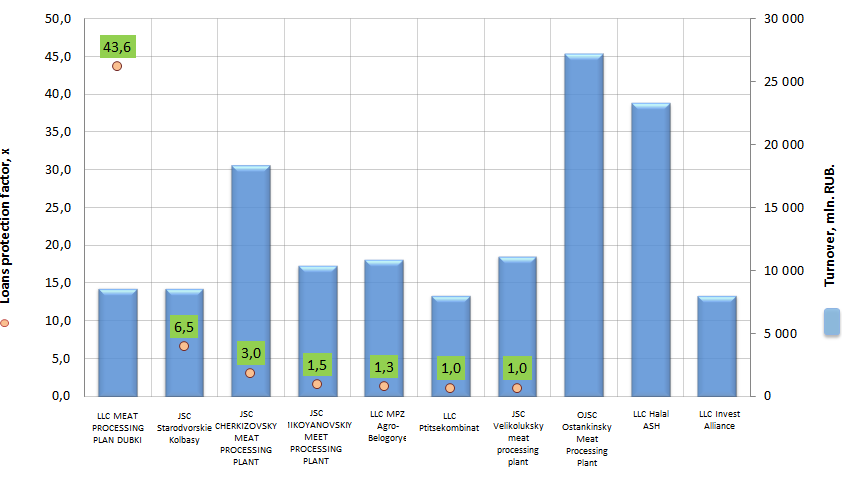

Loans protection factor of the leading Russian meat processing companies

Information Agency Credinform has prepared the ranking of the largest meat processing companies in Russia by decrease in loans protection factor.

The largest enterprises in terms of revenue were selected according to the data from the Statistical Register for the latest available period for the year 2013; the companies are engaged in meat and poultry processing, manufacture of finished products (sausages, semi-finished products, meat fillings etc.). Loans protection factor and solvency index GLOBAS-i® of the Information Agency Credinform were calculated for each company.

Loans protection factor (x) – is a ratio of pre-tax earnings and loan interest to the sum of interest payable. It characterizes the security level of creditors from non-payment of interest for the granted loan and shows how many times during the reporting period the company earned means to pay the interest on loans.

The recommended value is >1. If the protection factor is not calculated, then, according to the company’s financials, there is no interest payable to creditors.

For the most full and fair opinion about the company’s financial condition, not only the average revenue values should be taken into account, but also the whole set of financial data.

The negative value of the protection factor indicates about the company’s loss for the last analyzed period.

| № | Name | Region | Revenue, mln. RUB., 2013 г. | Loans protection factor, x | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | LLC MEAT PROCESSING PLAN DUBKI INN 6432013128 |

Saratov region | 8 662,9 | 43,6 | 216 high |

| 2 | JSC Starodvorskie Kolbasy INN 3328426780 |

Vladimir region | 8 634,1 | 6,5 | 229 high |

| 3 | JSC CHERKIZOVSKY MEAT PROCESSING PLANT INN 7718013714 |

Moscow | 18 396,9 | 3,0 | 188 the highest |

| 4 | JSC MIKOYANOVSKIY MEET PROCESSING PLANT INN 7722169626 |

Moscow | 10 437,1 | 1,5 | 205 high |

| 5 | LLC MPZ Agro-Belogorye INN 3123183960 |

Belgorod region | 10 907,0 | 1,3 | 270 high |

| 6 | LLC Ptitsekombinat INN 2631029799 |

Stavropol region | 8 083,2 | 1,0 | 235 high |

| 7 | JSC Velikoluksky meat processing plant INN 6025009824 |

Pskov region | 11 187,7 | 1,0 | 275 high |

| 8 | OJSC Ostankinsky Meat Processing Plant INN 7715034360 |

Moscow | 27 240,2 | - | 197 the highest |

| 9 | LLC Halal ASH INN 5050046264 |

Moscow region | 23 342,2 | - | 293 high |

| 10 | LLC Invest Alliance INN 5074028377 |

Kaluga region | 8 039,0 | - | 193 the highest |

According to the latest financial statements (2013), the revenue of the leading meat processing companies in Russia (Top-10) amounted to 134,9 bln. RUB., that is 13,4% higher that total revenue of the enterprises in 2012 (118,4 bln. RUB.).

Picture 1. Loans protection factor and revenue of the leading meat processing companies in Russian Federation (Топ-10)

According to the financial statements, 3 out of 10 participants from the Top-10 list had no interest payable to creditors; that can be considered from the positive side. These are - OJSC Ostankinsky Meat Processing Plant, LLC Halal ASH and LLC Invest Alliance.

OJSC Ostankinsky Meat Processing Plant – is the leading manufacturer of meat processing and semi-finished products in Russia. The enterprise was founded in 1954.

The company owns 13 trade houses, 7 brand shops in Moscow and one of the most modern pig farms in the country.

7,700 employees, each of which is a professional in its field, work at plant (manufactures 500 tons of products per day). All production facilities are equipped with the latest German and Austrian equipment. The combination of these factors allows to adhere to the international standards in manufacture of products, the quality, naturalness and taste of which are held in esteem among buyers.

Since 2006 the plant is officially recognized as a leader of meat-processing industry.

According to 2011 results, the plant kept the leading positions among manufacturers of sausage and meat production. Sales volume in 2011 amounted to 156 th. tons.

Sales volume in 2014 exceeded 180 th. tons.

LLC Halal ASH – is a professional refiner and manufacturer of meat, sausage and semi-finished products under «Halal» trade mark. In order to meet the needs of the Muslim population of the capital and the region, in 1997 under the spiritual patronage of the Muslim community in Moscow and the Moscow region, the sausages shop «Halal Ash» was opened. It allowed significantly expand the range of meat products. Today the company’s products are represented in all stores.

LLC Invest Alliance manufactures meat semi-finished products and other processed meat products; the company's production facility is located in Ermolino city (Kaluga region).

The debt load level of other companies from the Top-10 list does not exceed the permissible parameters; the loans protection factor is above 1; in other words, in case of simultaneous demand by creditors of all invested funds, the companies will be able to pay them at the expense of available profit (before tax). Usually, such situations do not happen in the market, so the financial condition of the industry’s largest companies is stable at the moment.

It is proved by the independent assessment of the Information Agency Credinform – all participants of Top-10 list have the highest and high solvency index, this fact shows the ability of market participants to meet their obligations in time and fully; the risk of unfulfillment is low.

China enhances its positions with help of the Asian Infrastructure Investment Bank

The Asian Infrastructure Investment Bank (AIIB) is an international financial institution, which is focused on promoting of financial cooperation in the Asia-Pacific region and on financing of various infrastructure projects in Asia. Foundation of AIIB was initiated by the People's Republic of China, in particular, also for increase of its role in the economic development of this territory.

According to words of the senior officials, AIIB is not treated as a potential rival to the International Monetary Fund (IMF), World Bank (WB) and the Asian Development Bank (ADB). However, low rates of reforms of existing financial organizations, as well as their focus on the USA, Japan and Europe have pushed China into creation of an alternative institution.

As a result of lengthy discussions and negotiations, 57 countries have decided to become the founders of a new bank, and signed a basic document on the establishment of AIIB on June 29, 2015. This document has secured legally the reached agreements, among them: the size of the authorized capital (100 bln $); proportions of countries in the number of votes and shares; management and structure of the bank, decision-making procedures, the fundamental conditions of functioning and operations.

The largest holders of votes and shares has become: China, India and Russia, received 26.06%, 7,5% and 5,92% of votes, respectively.

Because China is the country-founder of AIIB and holder of majority of votes and shares, so the first tasks will be focused on:

- strengthening of China’s position in the international stage and in the economy;

- response to the global influence of the USA;

- occurrence of free-trade zones in the Asia-Pacific region;

- development and construction of infrastructure in Asia, especially in border areas etc.

Along with that, China does not pretend to priority in AIIB, because the rest 73,94% of votes, distributed among the other countries, give a lot of room for maneuver. In this regard, the principles in the work of the new bank will be significantly different from the work of the IMF and WB, which are controlled by the USA and, accordingly, realize the financial policy of the USA in the world. Moreover, the Asian Development Bank (ADB) operates in Asia, which has similar functions and pursues similar aims as AIIB. However, ADB is under the control of Japan and does not meet the needs of China's implementation of modern politics in the field of economy.

AIIB was initially created as an investment bank of countries of Asian region. The Russian government has decided to enter to the new bank rather recently - in March 2015. This decision was contributed by the growing economic interest of Russia to Asian region. Within realization of the development strategy eastwards the Russian government has already signed with China more than 40 agreements on bilateral cooperation in various fields.

In particular, the Asian Infrastructure Investment Bank may participate in financing of the Russian part of «New Silk Road». And this is thousands of kilometers of high-speed highways and railways, modernization of the Black Sea and Caspian ports and much more.

Taking into account of the large scale of Russian projects with China, as well as the ban of the USA, the EU and a number of countries on credit financing of Russia in the world within sanctions, the participation of the Russian government in AIIB will have a significant geopolitical importance and may well become an effective mutually beneficial cooperation.