Changes in legislation

The Federal law of 11.06.2021 №174-FL imposes a duty to form the Enterprise Group Register on the Federal State Statistics Service (Rosstat). In this regard, group head companies are to give information on subsidiaries and its investment activity. At the same time, there is no need to report to Rosstat on the primary statistics, being sent by the companies to the Central Bank of Russia in order to form the balance of international payments, foreign trade statistics, external debt and private equity investment.

In the future, the Government of the RF will set the criteria of subsuming under the enterprise groups and group head companies, the rules of notification of legal entities on making an entry about them in the Register.

Moreover, share registrars have the responsibility to submit to the Register the information on shareholders and their shares each year up to July, 5th:

- list of legal entities - shareholders

- their interest in the share capital,

- data, making it possible to identify shareholders,

- data on total shares of other shareholders in share capital.

This data should be prepared on the basis on the last list of entities, having a right to take part in the general shareholders meeting.

Rosstat should improve its information resources in order to form the Register. Due to this, extra money amounting to more than RUB 176 million will be allocated from the budget.

The law will come into force since September 1st, 2021. The data for the current year should be provided by share registrars up to September 10th.

Trends in the field of computer production

Information agency Credinform presents activity trends review of the largest companies in the production of computers, electronic and optical products.

The largest enterprises engaged in the production of computers and peripherals, communication and information protection devices, consumer electronics, measuring, testing, servicing, radar and medical equipment, optical devices, magnetic and optical information carriers, information and telecommunications systems and production of components in terms of annual revenue for the last reporting periods available in the state statistics bodies and the Federal Tax Service (2011 – 2020) were selected for this analysis (TOP 1000). The selection of companies and the analysis were carried out based on data from the Information and Analytical system Globas.

Net assets – is a ratio that reflects the real value of the company's property that is calculated annually as the difference between the assets on the company's balance sheet and its debt obligations. Net asset ratio is negative (insufficient property) if the company's debt exceeds the value of its property.

The largest company in the industry in terms of net assets is SAMSUNG ELECTRONICS RUS KALUGA LLC, INN 4025413896, Kaluga Region, production of television receivers, including video monitors and video projectors. In 2020, net assets of the company amounted to over 66 billion rubles.

TECHNOSERV AS LLC had the smallest amount of net assets in the TOP 1000, INN 7722286471, Moscow, production of computers and peripheral equipment. Property insufficiency in 2020 was expressed by a negative value of -9 billion rubles.

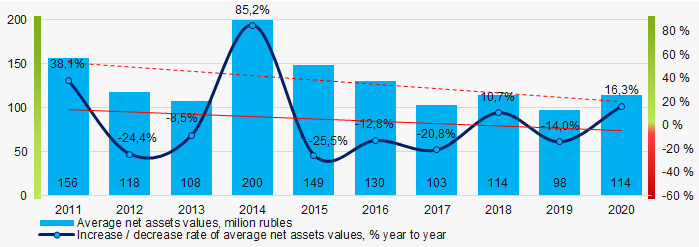

Covering the ten-year period, average net assets of the industry and their growth rates have a downward trend (Picture 1).

Picture 1. Change in average net assets values of the TOP 1000 in 2011-2020

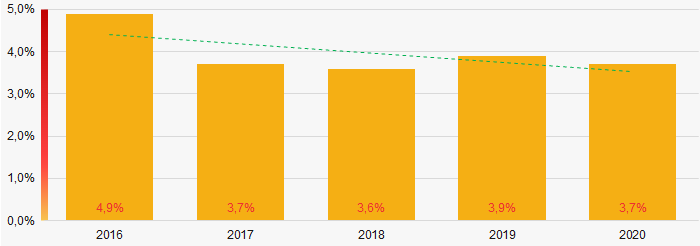

Picture 1. Change in average net assets values of the TOP 1000 in 2011-2020Shares of companies with property insufficiency in the TOP 1000 had a positive downward trend over the past five years (Picture 2).

Picture 2. Shares of companies with negative net assets of the TOP 1000 in 2016-2020

Picture 2. Shares of companies with negative net assets of the TOP 1000 in 2016-2020Sales revenue

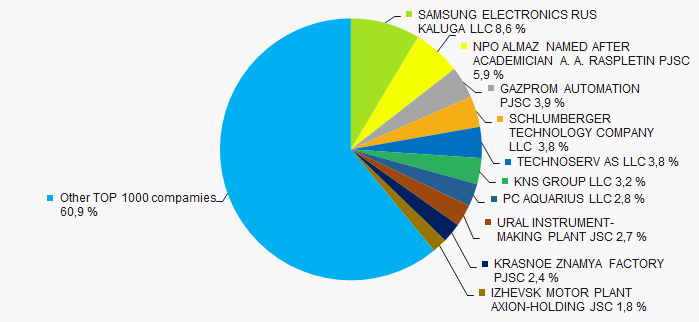

The revenue of the top ten companies in 2020 amounted to almost 39% of the total revenue of the TOP 1000 companies. (Picture 3). This indicates a high level of monopolization in the industry.

Picture 3. Shares of the TOP 10 companies in the total revenue of the TOP 1000 in 2019

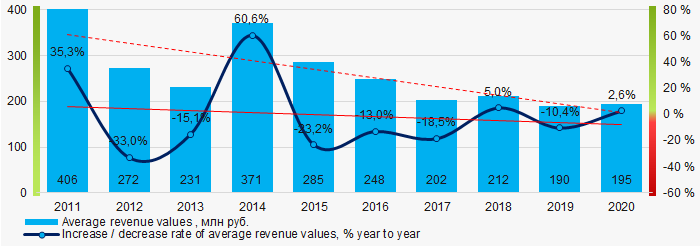

Picture 3. Shares of the TOP 10 companies in the total revenue of the TOP 1000 in 2019In general, there is a trend in revenue and growth rates decreasing. (Picture 4).

Picture 4. Changes in average revenue values in the industry in 2011-2020

Picture 4. Changes in average revenue values in the industry in 2011-2020Profit and loss

The largest company in the industry in terms of net profit in 2020 is SCHLUMBERGER TECHNOLOGY COMPANY LLC, INN 7709413265, Tyumen Region, production of other devices, sensors, equipment, measuring, controlling and testing tools. The profit of the company amounted to over 6 billion rubles.

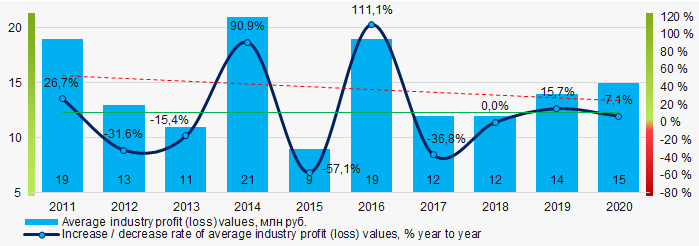

Covering the ten-year period, average profit values in the industry tends to decrease with a stable growth rate about 11% per year on average. (Picture 5).

Picture 5. Change in average profit (loss) values of the TOP 1000 in 2011-2020

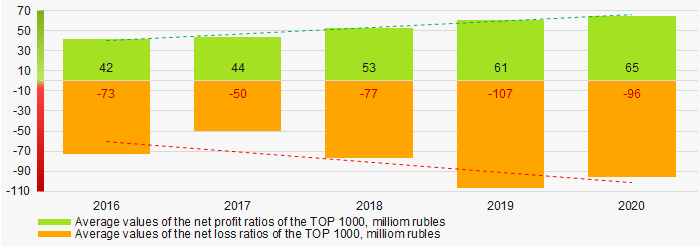

Picture 5. Change in average profit (loss) values of the TOP 1000 in 2011-2020Covering the five-year period, average values of net profit of the TOP 1000 companies are increasing, while average net loss is also growing (Picture 6).

Picture 6. Changes in average values of the net profit and net loss ratios of the TOP 1000 companies in 2016-2020

Picture 6. Changes in average values of the net profit and net loss ratios of the TOP 1000 companies in 2016-2020Key financial ratios

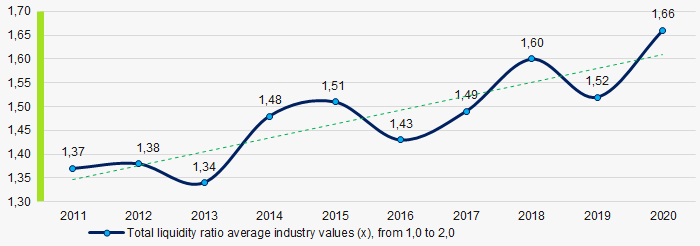

Covering the ten-year period, total liquidity ratio average values were in the range of recommended values - from 1.0 to 2.0, with a trend to grow. (Picture 7).

Total liquidity ratio (current assets to short-term liabilities) shows sufficiency of a company’s assets to settle short-term liabilities.

Picture 7. Changes in the total liquidity ratio average industry values in 2011-2020

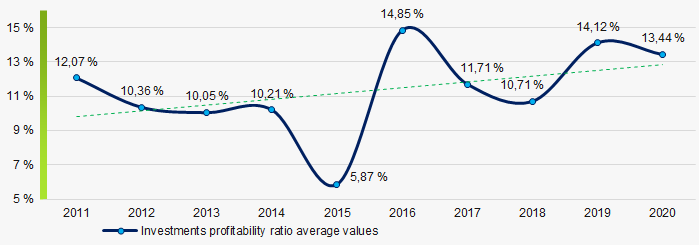

Picture 7. Changes in the total liquidity ratio average industry values in 2011-2020For ten years period, investments profitability ratio average values showed a tendency to increase (Picture 8).

This ratio is calculated as the ratio of net profit to amount of equity and long-term liabilities and demonstrates return on equity capital involved in commercial activities and the long-term funds raised by the organization.

Picture 8. Changes in investments profitability ratio average values in 2011-2020

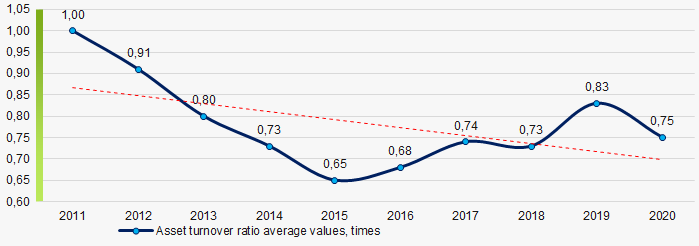

Picture 8. Changes in investments profitability ratio average values in 2011-2020Asset turnover ratio is calculated as ratio of sales revenue to average value of total assets for a period and implicates the efficiency of use of all available resources, regardless of the sources they were raised. The ratio shows how many times per year the full cycle of production and turnover is performed generating corresponding effect in the form of profit.

Covering the ten years period, values of the said business activity ratio showed a trend to decrease (Picture 9).

Picture 9. Changes in asset turnover ratio average values in 2011-2020

Picture 9. Changes in asset turnover ratio average values in 2011-2020Small enterprises

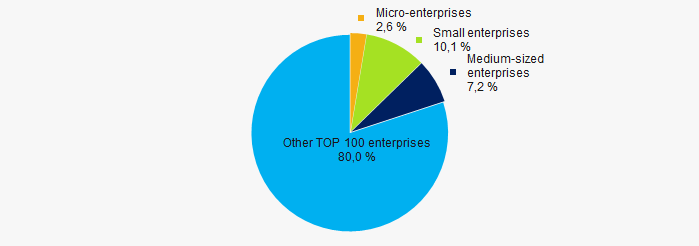

83% of the TOP 1000 companies are registered in the Unified Register of Small and Medium-Sized Enterprises of the Federal Tax Service of the Russian Federation. At the same time, the share of their revenue in the total amount of the TOP 1000 in 2020 is 20%, which is the average value in the country in 2018-2019. (Picture 10).

Picture 10. Revenue shares of small and medium-sized enterprises in the TOP-1000

Picture 10. Revenue shares of small and medium-sized enterprises in the TOP-1000Main regions of activity

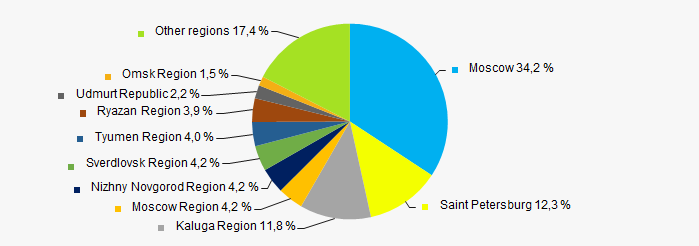

The TOP 1000 companies are registered in 62 regions and are distributed unevenly across the country. Over 58% of the TOP 1000 companies' total revenue in 2020 is concentrated in Moscow, St. Petersburg and the Kaluga Region (Picture 11).

Picture 11. Distribution of the TOP 1000 companies' revenue by Russian regions

Picture 11. Distribution of the TOP 1000 companies' revenue by Russian regionsFinancial position score

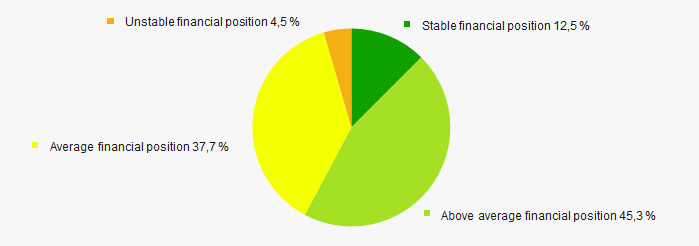

Financial position assessment of the TOP 1000 companies shows that the largest part of them is in financial position above average. (Picture 12).

Picture 12. Distribution of the TOP 1000 companies by accounting report scoring

Picture 12. Distribution of the TOP 1000 companies by accounting report scoringGlobas Solvency Index

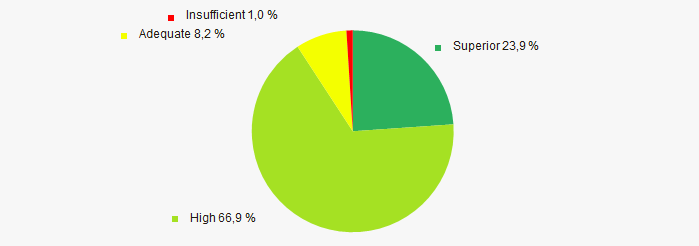

The vast majority of the TOP 1000 companies are assigned the highest and high Globas Solvency Index. This indicates their ability to repay their debt liabilities on time and fully (Picture 13).

Picture 13. Distribution of the TOP 1000 companies according to the Globas Solvency Index

Picture 13. Distribution of the TOP 1000 companies according to the Globas Solvency Index Conclusion

The comprehensive assessment of activities of the largest companies in the field of computers, electronic and optical products manifacture that includes the main indexes, financial indicators and ratios shows predominance of negative trends in their activities in the period from 2015 to 2020. (Table 1).

| Trends and evaluation factors | Share of factor, % |

| Dynamics of average net assets values |  -10 -10 |

| Increase (decline) rate in average size of net assets |  -10 -10 |

| Enterprises' share increase / decrease with net assets negative values |  10 10 |

| Level of equity concentration |  -10 -10 |

| Dynamics of average revenue values |  -10 -10 |

| Increase / decline rate in the average size of revenue |  -10 -10 |

| Dynamics of the average profit (loss) |  -10 -10 |

| Increase / decline rate in the average size of profit (loss) |  5 5 |

| Increase / decline in average values of net profit |  10 10 |

| Increase / decline in average values of net loss |  -10 -10 |

| Increase / decrease in average values of total liquidity ratio |  10 10 |

| Increase / decrease in average values of return on investment ratio |  10 10 |

| Increase / decrease in average values of asset turnover ratio, times |  -10 -10 |

| The share of small and medium-sized enterprises in revenue is more than 20% |  10 10 |

| Regional concentration |  -10 -10 |

| Financial position (the largest share) |  10 10 |

| Globas Solvency Index (the largest share) |  10 10 |

| Average value of factors share |  -0,9 -0,9 |

<span st