Deoffshorization of Russian economy is in progress

Within the package of measures for deoffshorization of the economy, which the President V.V.Putin has commissioned the Government to prepare by the 15th of July, the Ministry of Finance offers to supplement the law about controlled foreign companies (CFC) with the norm, according to which Russian natural and legal persons, having a share directly or indirectly in an offshore enterprise more than or equal to 10% from its capital, are obliged to report to Russian tax authorities. Countries, which are considered as offshores, will be set in the law about CFC separately.

Taxes in Russia should be paid as well by Russian companies from income of foreign «daughters», as by natural persons - from income of their offshore structures. If an organization doesn’t return the income to the country as dividends, the tax is paid from the part of its undistributed profit, which falls on Russian resident. It is assumed, that the tax rate for legal entities will be 20%, for citizens – 13% from taxable amount, and the rate for dividends is lower – 9%.

A number of experts have found hidden pitfalls in good initiative of the Ministry of Finance; the main problem is that the norm 10% is a low threshold in the ownership of a company. Because in order to dodge taxes, an enterprise, founded for these tasks, should belong logically to a resident for a minimum of 50%, but it will so happen, that we’ll consider those structures as offshores, where market players have invested for investment purposes and which don’t belong to them.

Information agency Credinform is developing the transfer pricing module, which will allow the market players to put a fair market price in controlled companies abroad.

Return on investment of oil and gas companies in Russia

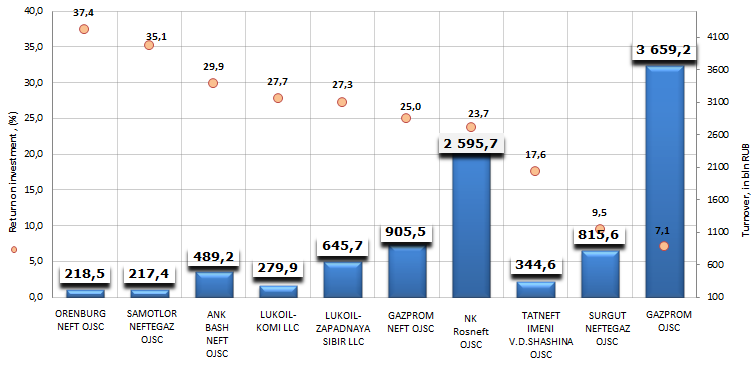

Information agency Credinform prepared a ranking «Return on investment of oil and gas companies in Russia». The companies with highest volume of revenue were selected for this research according to data from the Statistical Register for the latest available period (for the year 2012). Selected enterprises were ranked firstly by turnover, then by return of investment.

Return on investment is the indicator of the benefit from own capital of an organization, involved in business activities, and borrowed funds at a long date. It is calculated as the ratio of net profit to the sum of own capital and long-term liabilities.

As is known, there are no specified values prescribed for profitability ratios, because they vary strongly depending on the branch, where an enterprise operates. Therefore, each concrete company should be investigated in comparison with industry indicators. The importance of the return on investment ratio is not only that it shows benefit from invested assets, but also that, based on this ratio, it is possible to estimate the advisability of borrowing funds at certain interest. The company should take credits, the interest on which is lower, than profitability of investment capital.

| № | Name, INN | Region | Turnover for 2012, in bln RUB | Return on investment,(%) | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | ORENBURGNEFT OJSC INN 5612002469 |

Orenburg region | 219 | 37,44 | 234 (high) |

| 2 | SAMOTLORNEFTEGAZ OJSC INN 8603089934 |

Khanty-Mansijsk Autonomous District | 217 | 35,14 | 210 (high) |

| 3 | AKTSIONERNAYA NEFTYANAYA KOMPANIYA BASHNEFT OJSC INN 0274051582 |

Republic of Bashkortostan | 489 | 29,89 | 194 (the highest) |

| 4 | LUKOIL-KOMI LLC INN 1106014140 |

Republic of Komi | 280 | 27,74 | 211 (high) |

| 5 | LUKOIL-ZAPADNAYA SIBIR LLC INN 8608048498 |

Khanty-Mansijsk Autonomous District | 646 | 27,28 | 202 (high) |

| 6 | GAZPROMNEFTOJSC INN 5504036333 |

Saint-Petersburg | 906 | 25 | 187 (the highest) |

| 7 | Neftyanaya kompaniya Rosneft OJSC INN 7706107510 |

Moscow | 2596 | 23,74 | 165 (the highest) |

| 8 | TATNEFT IMENI V.D.SHASHINA OJSC INN 1644003838 |

Republic of Tatarstan | 345 | 17,62 | 163 (the highest) |

| 9 | SURGUTNEFTEGAZ OJSC INN 8602060555 |

Khanty-Mansijsk Autonomous District | 816 | 9,52 | 164 (the highest) |

| 10 | GAZPROM OJSC INN 7736050003 |

Moscow | 3659 | 7,06 | 177 (the highest) |

The role of oil and gas sector in the national economy is remaining high. So that, according to data of the Ministry of Energy of the RF, the share of oil and gas incomes in the nation's budget made 50% in 2013, by the contribution to the GDP about 1/3, and to export – about 2/3.

The first three companies in the ranking list are represented by following enterprises: ORENBURGNEFT OJSC with the return on investment 37,44%, SAMOTLORNEFTEGAZ OJSC (35,14%) and AKTSIONERNAYA NEFTYANAYA KOMPANIYA BASHNEFT OJSC (29,89%), by average indicator value for industry leaders - 24,04%. Similar results testify to favorable investment climate, i.e. the enterprises have more alternatives for borrowing funds and their further use to own benefit. This fact is supported by a high and the highest solvency indexes GLOBAS-i®.

Return on investment of the largest oil and gas companies in Russia, TOP-10

Three more companies also showed the return on investment value higher, than the average value for industry leaders: Lukoil-Komi LLC (27,74%), Lukoil-Zapadnaya Sibir LLC (27,28%) and Gazprom neft OJSC (25%).

The last place in the ranking list belongs to industry leader on turnover Gazprom OJSC with the return on investment value 7,06%, that is 3,4 times less, than the average value for market leaders. However, the company got the highest solvency index GLOBAS-i®, because the comprehensive approach is taken for an objective assessment of solvency and financial stability, which considers the combination of financial or non-financial indicators.