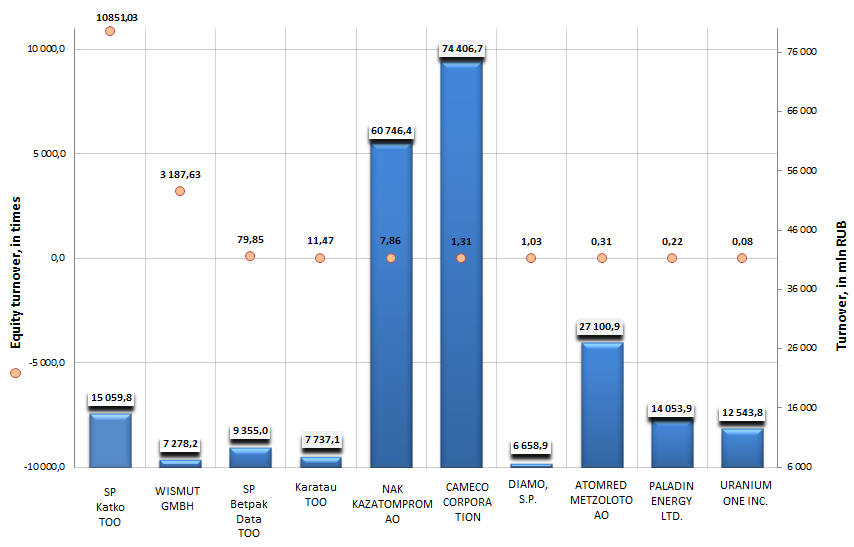

Equity turnover of the world's largest enterprises engaged in mining and processing of uranium ore

Information agency Credinform prepared a ranking on equity turnover of world's largest enterprises engaged in mining and processing of uranium ore. The companies with the highest volume of revenue for 2013 were selected for the investigation. Then, the enterprises were ranked by number of equity turnover per annum.

Equity turnover reflects the equity turnover rate, that means - in particular, for joint stock companies – activity of money, which are ventured by company’s owners. Low value of this indicator testifies to inactivity of a part of equity. Increase in turnover means that company’s equity is put into turnover.

| № | Company name | Country | Turnover for 2013, in mln RUB | Equity turnover, times |

|---|---|---|---|---|

| 1 | SP Katko TOO | Kazakhstan | 15 060 | 10 851,03 |

| 2 | WISMUT GMBH | Germany | 7278 | 3187,63 |

| 3 | SP Betpak Dala TOO | Kazakhstan | 9355 | 79,85 |

| 4 | KaratauTOO | Kazakhstan | 7737 | 11,47 |

| 5 | NAK KAZATOMPROM AO | Kazakhstan | 60 746 | 7,86 |

| 6 | CAMECO CORPORATION | Canada | 74 407 | 1,31 |

| 7 | DIAMO, S.P. | Czech Republic | 6659 | 1,03 |

| 8 | ATOMREDMETZOLOTO AO | Russia | 27 101 | 0,31 |

| 9 | PALADIN ENERGY LTD. | Australia | 14 054 | 0,22 |

| 10 | URANIUM ONE INC. | Canada | 12 544 | 0,08 |

Uranium is the main energy source of nuclear power, which accounts for about 20% of the world's electricity. The uranium industry covers all stages of uranium production, including exploration, mining and ore processing. Russia owns 9% of the world's uranium reserves, being behind Australia (31% of world reserves) and Kazakhstan (12% of world reserves) on this indicator.

In Russia uranium is mined by the Uranium Holding Atomredmetzoloto, which is a part of Atomenergoprom OJSC. The Holding manages all uranium mining companies in Russia, and also controls over 20% of Kazakhstan's uranium reserves.

At the year-end 2013 Atomredmetzoloto JSC became the 3rd company on turnover in the world, given way to CAMECO CORPORATION (Canada) and NAK Kazatomprom JSC (Kazakhstan). However, on equity turnover the enterprise takes just only the 8th place among the top-10 largest companies in the world.

The Kazakh-French joint venture SP Katko TOO took the 1st place in the presented ranking, with the value of equity turnover 10 851,03 times, that testifies to an active use of equity of the enterprise in its operations. The firm is the 4th company on turnover in the world. SP Katko TOO was founded in 1996 and mines uranium by drillhole in situ leaching in the field Moiynkum located in South-Kazakhstan region. Company’s shareholders are «NAK «Kazatomprom» OJSC and the French company AREVA.

Equity turnover of the world's largest enterprises engaged in mining and processing of uranium ore, TOP-10

The Canadian company Uranium One Inc. rounds out the ranking with the equity turnover 0,08 times. Note, that in 2013 the Russian Uranium Holding Atomredmetzoloto made a deal on the consolidation of 100% of shares of Uranium One Inc. In accordance with the terms of the agreement, all ordinary shares of the Canadian company were acquired, which at that time did not belong to Atomredmetzoloto JSC and affiliated persons. The management of foreign assets was transferred to the company Uranium One Holding N.V.

Equity turnover directly influences the company’s solvency. Moreover, the increase in equity turnover rate reflects under otherwise equal conditions the growth of production and technical potential of organization.

The Ministry of Finance tells to bite the bullet

According to the Minister of Finance Anton Siluanov, the Ministry proposes to slacken the budget rule while putting a maximum limit of federal budget expenses for a year. Prior to this it is necessary to refuse the deficit characteristic of 1% GDP. It is offered to give up the current mechanism for two years.

According to the current budget rule, the maximum expenses volume of the budget for a year is determined by the formula: revenues calculated on the basis of 10-year oil price plus 1% GDP.

Earlier the Prime Minister Dmitry Medvedev stated that it is necessary to reconsider the current budget rule.

It will be difficult to set the treasury for the nearest two years following the current budget rules. Besides, in order to stabilize and bring the budget into balance, the reduction of the state expenses is inevitable.

The State sets out the foreground items, which can’t be reduced in 2016-2017 by reference to former solutions of the nation’s leadership. These are public obligations to the citizens, transfers to non-budgetary funds, expenses for defense and security, provision of medicines, agriculture support, world football championship preparations, occupational training, labor compensation to Russian ambassadors, judges and members of judiciary and legislative bodies. It is proposed that the Government House is to provide the general 5% reduction of the reasonable expenses required by the President using the rest of the budget expenditures.

In order to achieve such reduction, the authority of Alexey Ulyukaev proposes to restructure the expenditure budget, to overhaul the adopted state programs and to change the goals of the social and economic development of the Russian Federation.

- At the same time, the four blocks of the state programs are set to reduce the budget expenses as much as possible:

- As for the block «Balanced regional development» it is planned to reduce the expenses by 9% in 2016 and by 9,4% in 2017.

- As for the block «Innovative development and modernization of the economy» it is proposed to allocate 4% less in 2016 and 5,7% less in 2017.

- The reduction related to the block «New living standards» will amount to 3,1% in 2016 and 6,2% in 2017.

- Expenses for the block «Effective state» are proposed to be reduced by 2,6% in 2016 and by 5,6% in 2017.

As envisioned by the Ministry of Economic Affairs, the period of the economy will end in 2018 when the recovery to the budget rule on the background of the whole consolidation of the economics allows adding to the stated programs about RUB 600 billion in reference to the rate of 2017.

At the same time the role of the financial bodies in determining of the guiding lines for the country development in the new macroeconomic and geopolitical environment remains not clear. Meanwhile we see the reduction of the expenditure budget post factum, without offering of new growing points and structural reforms of the economics.