How to improve efficiency of own business under high inflation and expensive dollar?

The year 2015, difficult in relation to economy, is coming to an end. Some difficulties were caused by such factors as decline in market price on oil and gas – main sources of Russian budgeting; depreciation of national currency in relation to USD; GDP negative growth as a result of decrease in production volume, work and services, earnings of export operations; reduction of investments; unreasonable prices growth; decline in demand and purchasing capacity; high credit rates and others.

The state of the economy in 2016 does not seem to be rosy. Next year proceeding of inflation growth is expected on the back of further reservation (or decline) of market price on oil and gas and depreciation of RUB to USD; decrease in consumer demand and investments; lack of liquidity; delay of credit provision; growth of payment delay and other factors that typical for stagnating economy.

Under such conditions the Central Bank of the RF believes that it is possible to change the economic situation with the help of stable prices. In this case mega-regulator focuses its efforts on solving two main tasks: inflation targeting* on 4% rate to 2017 and control of poverty, that is control of decline in real salary of citizens.

* Inflation targeting — complex of measures taken by the state authorities to control the inflation rate in the country. Measures include establishment of plan inflation indicator for some period and selection of proper monetary instruments to control the inflation rate.

Currently experts mark out several stability trends. They include: military-industrial complex; government order and government support; food industry of economy-class and industries produce goods for import substitution.

Business analytics consider those companies successful that find high demanded in crisis services; provide consumers and partners with interesting options, thus becoming more customer-oriented. Practice shows that companies could overcome difficult period in economy with using strict financial tactics.

What measures for business under conditions of high inflation and expensive dollar should be taken for overcoming negative trends in economic development?

Experts list following measures:

- to make an audit of expenses, to define main effective ways of company development and to take reasonable austerity measures;

- to minimize costs on industrial, management and other activities;

- refuse from non-core, unpromising, costly assets;

- to develop efficient business-projects;

- to reduce a prime cost of output products and provided services;

- to focus on consumer demands;

- to consider low-income consumers while choosing the price or raise prices only on high quality products;

- to implement instruments for increase in labor productivity;

- to take different business tasks on outsourcing;

- to increase market share with the help of other regions;

- to employ funds under profitable/noteworthy conditions, in case of having accumulated funds;

- to apply for splitting company into several parts, that let to minimize taxation and use existing preferences and others.

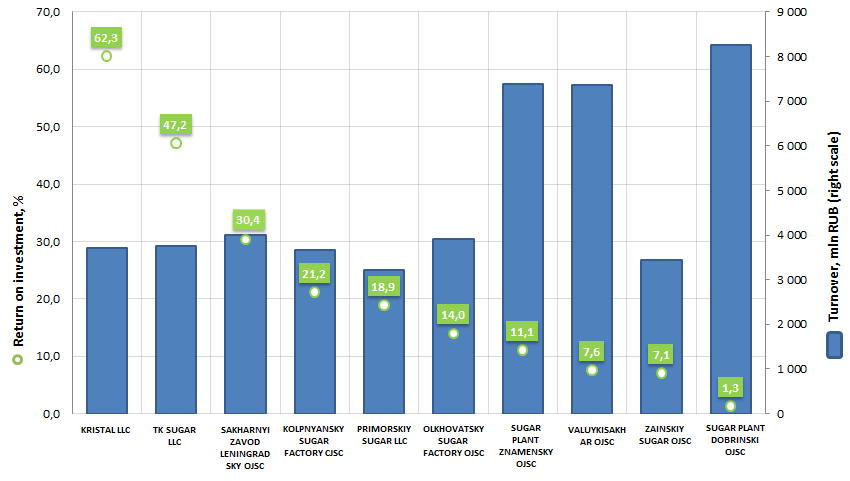

Return on investment of the largest Russian sugar manufacturers

Information Agency Credinform has prepared the ranking of the largest sugar manufacturers.

Top-10 enterprises in terms of revenue were selected according to the data from the Statistical Register for the latest available period (for the year 2014). The enterprises were ranked by decrease in return on investment; besides, revenue trend data relative to previous period and solvency index GLOBAS-i® is also represented (see table 1).

Return on investment (%) is the ratio of net profit (loss) and net assets value. It shows how many monetary units the company used to obtain one monetary unit of net profit. In other words, the ratio demonstrates the return level from each ruble, received from the investment.

For the most full and fair opinion about the company’s financial situation, not only investment profitability level should be taken into account, but also the whole set of financial indicators and ratios.

| № | Name | Region | Revenue, mln RUB, 2014 | Revenue growth,% | Return on investment, % | solvency index GLOBAS-i® |

|---|---|---|---|---|---|---|

| 1 | KRISTAL LLC INN 6824004406 |

Tambov region | 3 712,1 | 18,0 | 62,3 | 247 high |

| 2 | TK SUGAR LLC INN 0411095062 |

Altai Republic | 3 755,3 | 18,5 | 47,2 | 254 high |

| 3 | SAKHARNYI ZAVOD LENINGRADSKY OJSC INN 2341006687 |

Krasnodar region | 4 011,7 | 41,2 | 30,4 | 202 high |

| 4 | KOLPNYANSKY SUGAR FACTORY CJSC INN 5711002822 |

Orel region | 3 660,3 | 37,2 | 21,2 | 227 high |

| 5 | PRIMORSKIY SUGAR LLC INN 2511005010 |

Primorski territory | 3 211,6 | 98,5 | 18,9 | 266 high |

| 6 | OLKHOVATSKY SUGAR FACTORY OJSC INN 3618003708 |

Voronezh region | 3 910,3 | 67,9 | 14,0 | 224 high |

| 7 | SUGAR PLANT ZNAMENSKY OJSC INN 6804000019 |

Tambov region | 7 395,4 | 6,5 | 11,1 | 245 high |

| 8 | VALUYKISAKHAR OJSC INN 3126000974 |

Belgorod region | 7 360,2 | 37,8 | 7,6 | 207 high |

| 9 | ZAINSKIY SUGAR OJSC INN 1647008721 |

Republic of Tatarstan | 3 442,9 | 41,5 | 7,1 | 217 high |

| 10 | SUGAR PLANT DOBRINSKI OJSC INN 4804000086 |

Lipetsk region | 8 255,6 | 187,0 | 1,3 | 237 high |