Activity trends of lottery companies

Information agency Credinform represents a review of the activity trends of the largest lottery companies in Russia.

The largest lottery companies and lottery distributors (TOP-50) in terms of annual revenue were selected for the analysis according to the data from the Statistical Register and the Federal Tax Service for the latest available financial accounts (2010 - 2019). The analysis was based on the data from the Information and Analytical system Globas.

Net assets is an indicator that reflects the real value of the property of an enterprise. It is calculated as a net worth between total assets and total liabilities. When the company’s debt exceeds the value of its property, the indicator is considered negative (insufficiency of property).

The largest company of the industry by the net assets value is NAO TECHNOLOGICAL COMPANY CENTER, INN 7715918994, Moscow. In 2019 company’s net assets amounted to 1,7 billion RUB.

LLC RUSSKOE LOTO POBEDA, INN 7719527590, Moscow, had the lowest net assets value among TOP-50 companies. Insufficiency of property of this company in 2019 was indicated by the negative value – 1,0 billion RUB.

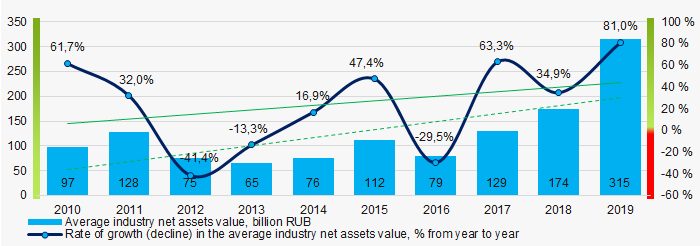

For the decade, the average industry net assets values had a trend to increase, with the positive dynamics of the growth rates (Picture 1).

Picture 1. Changes in average industry net assets value in 2010 - 2019

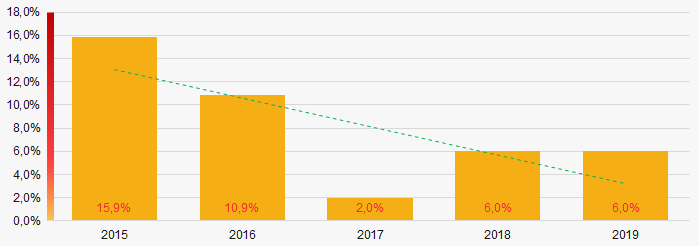

Picture 1. Changes in average industry net assets value in 2010 - 2019The shares of TOP-50 companies with insufficient property were decreasing in the last five years (Picture 2).

Picture 2. Shares of companies with negative net assets value in TOP-50 in 2015 - 2019

Picture 2. Shares of companies with negative net assets value in TOP-50 in 2015 - 2019Sales revenue

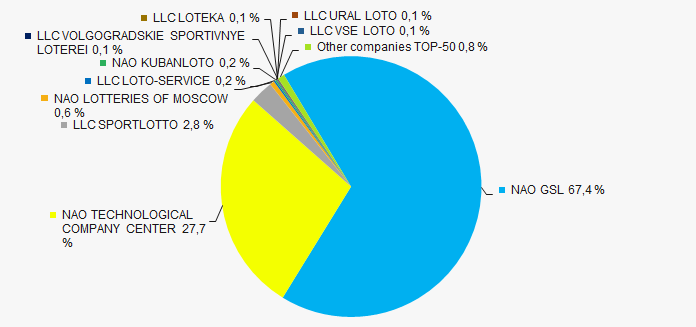

Revenue of only two leading industry companies amounted to 95% of the total revenue of TOP-50 companies. (Picture 3). It gives evidence to the highest level of monopolization in this industry.

Picture 3. Shares of TOP-10 companies in the total revenue of 2019 TOP-1000

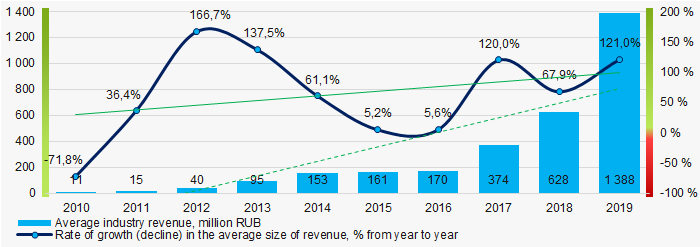

Picture 3. Shares of TOP-10 companies in the total revenue of 2019 TOP-1000 In general, there is a trend to increase in revenue with the positive dynamics of the growth rates (Picture 4.)

Picture 4. Changes in average industry revenue in 2010 - 2019

Picture 4. Changes in average industry revenue in 2010 - 2019Profit and losses

The largest industry company by the net profit value is also NAO TECHNOLOGICAL COMPANY CENTER, INN 7715918994, Moscow. The company’s profit in 2019 amounted to 1,7 billion RUB.

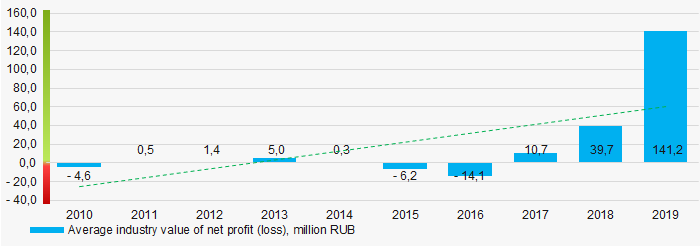

For the decade, the average industry profit values have a trend to increase (Picture 5).

Picture 5. Changes in average industry profit (loss) in 2010 -2019

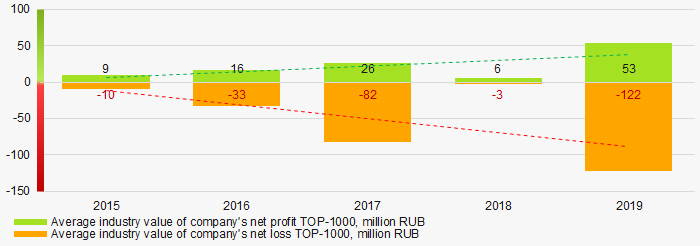

Picture 5. Changes in average industry profit (loss) in 2010 -2019For the five-year period, the average net profit values of TOP-50 companies have a trend to increase, the average net loss value increases as well. (Picture 6).

Picture 6. Change in average net profit and net loss of TOP-50 companies in 2015 - 2019

Picture 6. Change in average net profit and net loss of TOP-50 companies in 2015 - 2019Key financial ratios

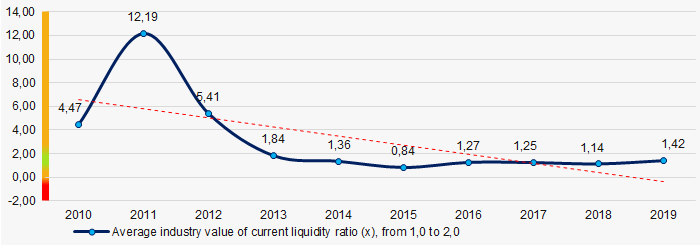

For the decade, the average industry values of current liquidity ratio were in general within the interval of the recommended values – from 1,0 to 2,0, with a trend to decrease. (Picture 7).

Current liquidity ratio (current assets to short-term liabilities) shows the sufficiency of company’s assets to repay on its short-term liabilities.

Picture 7. Change in average industry values of current liquidity ratio in 2010 - 2019

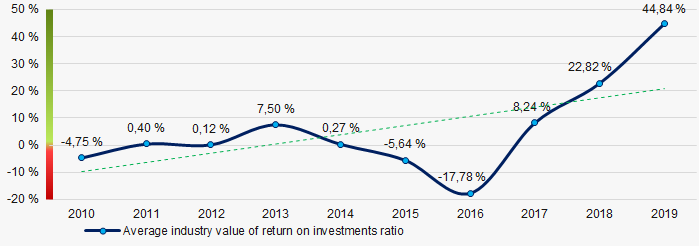

Picture 7. Change in average industry values of current liquidity ratio in 2010 - 2019For the decade, there is a trend to increase in the average industry values of return on investments ratio. (Picture 8).

ROI ratio is calculated as net profit to sum of shareholders equity and long-term liabilities, and shows the return of equity involved in commercial activities and long-term borrowed funds.

Picture 8. Change in average industry values of return on investments ratio in 2010 - 2019

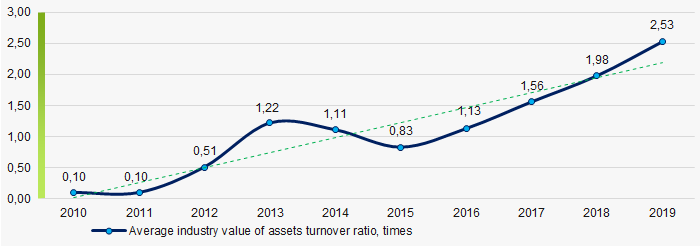

Picture 8. Change in average industry values of return on investments ratio in 2010 - 2019Assets turnover ratio is calculated as a ratio of sales revenue to average total assets for a period and defines the efficiency of use of all the available resources, regardless source of their attraction. The ratio shows how many times per year the full cycle of production and circulation generating profit is performed.

For the decade, there was a trend to increase (Picture 9).

Picture 9. Change in average industry values of assets turnover ratio in 2010 - 2019

Picture 9. Change in average industry values of assets turnover ratio in 2010 - 2019Small enterprises

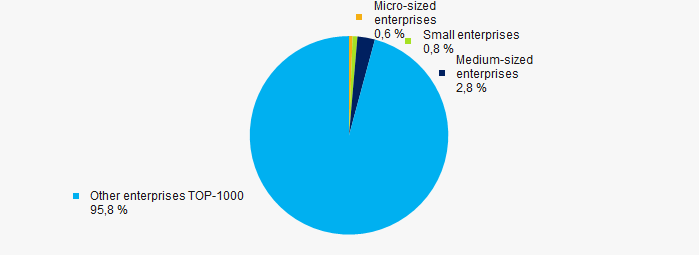

90% of the TOP-50 companies are registered in the Register of small and medium-sized enterprises of the Federal Tax Service of the Russian Federation. However, their share in the total revenue of TOP-50 amounts to only 4%, which is significantly lower than the average country value in 2018 – 2019 (Picture 10).

Picture 10. Shares of small and medium business enterprises revenue in TOP-1000

Picture 10. Shares of small and medium business enterprises revenue in TOP-1000Main regions of activity

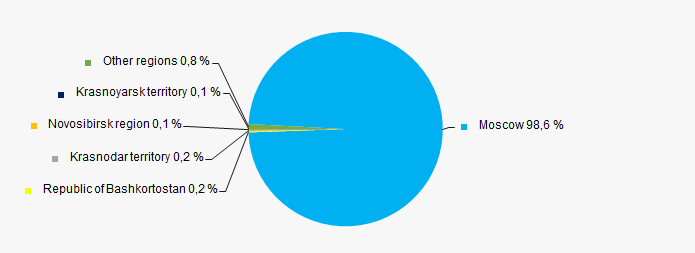

TOP-50 companies are registered in 33 regions and spread in an uneven manner within the country. Almost 99% of the largest by the revenue companies consolidate in Moscow (Picture 11).

Picture 11. Revenue distribution of TOP-50 companies by regions in Russia

Picture 11. Revenue distribution of TOP-50 companies by regions in RussiaFinancial position score

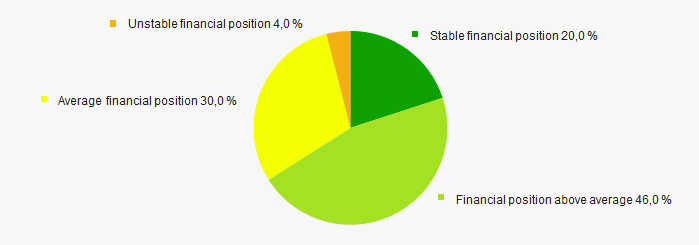

According to the assessment, the financial position of most TOP-50 companies is above average (Picture 12).

Picture 12. Distribution of TOP-50 companies by financial position score

Picture 12. Distribution of TOP-50 companies by financial position scoreSolvency index Globas

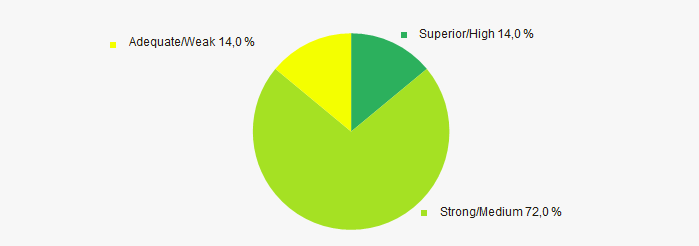

The major part of TOP-50 companies was awarded with the Superior/High or Strong/Medium Solvency index Globas, which gives evidence to their ability to meet their obligations fully and in time (Picture 13).

Picture 13. Distribution of TOP-50 companies by Solvency index Globas

Picture 13. Distribution of TOP-50 companies by Solvency index GlobasConclusion

The complex assessment of the activity of the largest lottery companies in Russia, taking into account the main indexes, financial indicators and ratios, demonstrates the prevalence of positive trends in 2010 - 2019 (Table 1).

| Trends and evaluation factors | Relative share of factor, % |

| Dynamics of the average net assets value |  10 10 |

| Rate of growth (decline) in the average size of net assets |  10 10 |

| Increase / decrease in the share of enterprises with negative values of net assets |  10 10 |

| Level of competition / monopolization |  -10 -10 |

| Dynamics of the average revenue |  10 10 |

| Rate of growth (decline) in the average size of revenue |  10 10 |

| Dynamics of the average profit (loss) |  10 10 |

| Growth / decline in average values of companies’ net profit |  10 10 |

| Growth / decline in average values of companies’ net loss |  -10 -10 |

| Increase / decrease in average values of current liquidity ratio |  -5 -5 |

| Increase / decrease in average values of return on investment ratio |  10 10 |

| Increase / decrease in average values of asset turnover ratio, times |  10 10 |

| Share of small and medium-sized businesses in terms of revenue being more than 20% |  -10 -10 |

| Regional concentration |  -10 -10 |

| Financial position (the largest share) |  10 10 |

| Solvency index Globas (the largest share) |  10 10 |

| Average value of relative share of factors |  4,1 4,1 |

positive trend (factor),

positive trend (factor),  negative trend (factor).

negative trend (factor).

The profit level of the lottery companies

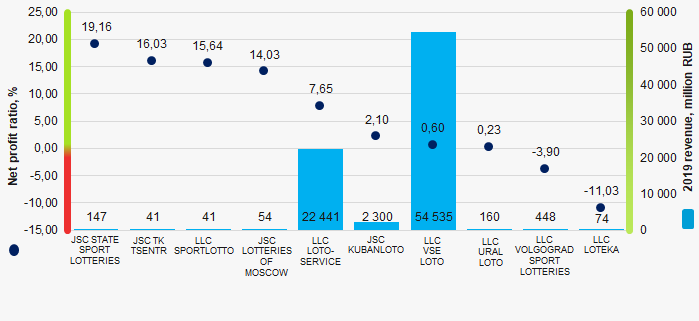

Information agency Credinform has prepared a ranking of the largest Russian lottery companies. The largest enterprises (TOP-10) in terms of annual revenue were selected according to the data from the Statistical Register and the Federal Tax Service for the available periods (2017-2019). Then the companies were ranged by net profit ratio (Table 1). The analysis was based on the data from the Information and Analytical system Globas.

Net profit ratio (%) is calculated as a ratio of net profit (loss) to sales revenue. The ratio reflects the company’s level of sales profit.

The ratio doesn’t have the standard value. It is recommended to compare the companies within the industry or the change of a ratio in time for a certain company. The negative value of the ratio indicates about net loss. The higher is the ratio value, the better the company operates.

For the most full and fair opinion about the company’s financial position the whole set of financial indicators and ratios should be taken into account.

| Name, INN, region | Revenue, million RUB | Net profit (loss), million RUB | Net profit ratio, % | Solvency index Globas | |||

| 2018 | 2019 | 2018 | 2019 | 2018 | 2019 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| JSC STATE SPORT LOTTERIES INN 7728795958 Krasnodar region |

116,4 116,4 |

146,9 146,9 |

33,6 33,6 |

28,1 28,1 |

28,83 28,83 |

19,16 19,16 |

180 High |

| JSC TK TSENTR INN 7715918994 Sverdlovsk region |

39,0 39,0 |

40,8 40,8 |

5,7 5,7 |

6,5 6,5 |

14,63 14,63 |

16,03 16,03 |

212 Strong |

| LLC SPORTLOTTO INN 7743771091 Volgograd region |

36,5 36,5 |

40,9 40,9 |

4,4 4,4 |

6,4 6,4 |

12,09 12,09 |

15,64 15,64 |

214 Strong |

| JSC LOTTERIES OF MOSCOW INN 7715215381 Chelyabinsk region |

49,6 49,6 |

54,0 54,0 |

8,8 8,8 |

7,6 7,6 |

17,78 17,78 |

14,03 14,03 |

237 Strong |

| LLC LOTO-SERVICE INN 0274075431 Moscow |

18 729,0 18 729,0 |

22 440,7 22 440,7 |

7,7 7,7 |

1 717,5 1 717,5 |

0,04 0,04 |

7,65 7,65 |

255 Medium |

| JSC KUBANLOTO INN 2309020380 Moscow |

1 625,4 1 625,4 |

2 300,0 2 300,0 |

21,3 21,3 |

48,4 48,4 |

1,31 1,31 |

2,10 2,10 |

260 Medium |

| LLC VSE LOTO INN 7743783273 Moscow |

46 078,1 46 078,1 |

54 535,3 54 535,3 |

118,0 118,0 |

326,1 326,1 |

0,26 0,26 |

0,60 0,60 |

243 Strong |

| LLC URAL LOTO INN 7447081901 Republic of Bashkortostan |

155,7 155,7 |

159,5 159,5 |

0,6 0,6 |

0,4 0,4 |

0,40 0,40 |

0,23 0,23 |

262 Medium |

| LLC VOLGOGRAD SPORT LOTTERIES INN 3444099477 Moscow |

218,9 218,9 |

447,7 447,7 |

-16,9 -16,9 |

-17,4 -17,4 |

-7,74 -7,74 |

-3,90 -3,90 |

283 Medium |

| LLC LOTEKA INN 6670287952 Moscow |

70,8 70,8 |

73,5 73,5 |

1,4 1,4 |

-8,1 -8,1 |

1,91 1,91 |

-11,03 -11,03 |

287 Medium |

| Average value for TOP-10 companies |  6 711,9 6 711,9 |

8 023,9 8 023,9 |

18,5 18,5 |

211,5 211,5 |

6,95 6,95 |

6,05 6,05 |

|

| Average industry value |  800,3 800,3 |

931,9 931,9 |

2,6 2,6 |

-13,8 -13,8 |

0,32 0,32 |

-1,48 -1,48 |

|

growth of indicator in comparison with prior period,

growth of indicator in comparison with prior period,  decline of indicator in comparison with prior period

decline of indicator in comparison with prior period

The average value of net profit ratio for TOP-10 companies is higher than average industry value: in 2019, six companies improved the results.

Picture 1. Net profit ratio and revenue of the largest Russian lottery companies (ТОP-10)

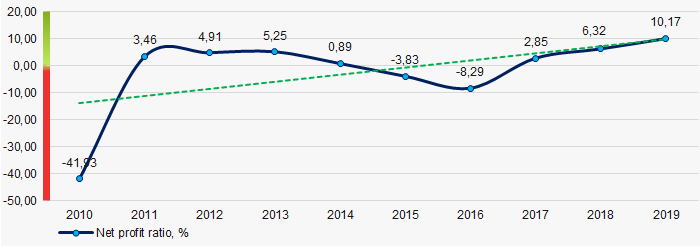

Picture 1. Net profit ratio and revenue of the largest Russian lottery companies (ТОP-10) Within 10 years, the average industry indicators of net profit ratio showed the growing tendency. (Picture 2).

Picture 2. Change in average industry values of net profit ratio of Russian lottery companies in 2010 – 2019

Picture 2. Change in average industry values of net profit ratio of Russian lottery companies in 2010 – 2019