Production and processing of fish in the Far Eastern Federal District of Russia

Information agency Credinform represents an overview of activity trends of the largest marine capture fisheries and seafood processing companies in the Far Eastern Federal District of Russia.

Seafood companies with the largest volume of annual revenue (TOP-500) were selected for the analysis, according to the data from the Statistical Register for the latest available periods (for 2013 – 2018). The analysis was made on the basis of the data of the Information and Analytical system Globas.

Net assets value is an indicator, reflecting the real value of company’s property, is calculated annually as the difference between assets on the enterprise balance and its debt obligations. The indicator of net assets is considered negative (insufficiency of property), if company’s debt exceeds the value of its property.

The largest enterprise in the Far Eastern region in terms of net assets is KURILSKII RYBAK NJSC, INN 6511000178, Sakhalin region (in process of reorganization in the form of acquisition of other legal entities, 26.12.2019). In 2018, its net assets amounted to 15,3 billion rubles.

The smallest amount of net assets in the TOP-500 list was hold by TUNAYCHA COMPANY LLC, INN 6504018880, Sakhalin region. The insufficiency of property of this company in 2018 was expressed as a negative value of -2 billion rubles.

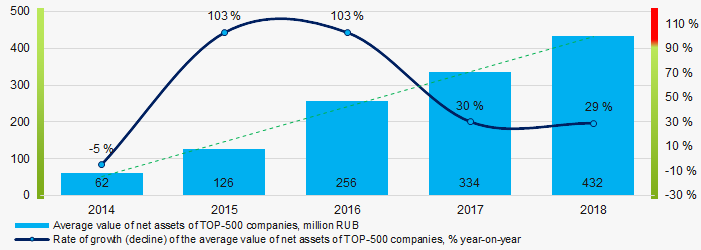

The average values of net assets of TOP-500 enterprises tend to increase over the five-year period (Picture 1).

Picture 1. Change in average indicators of the net asset value of TOP-500 enterprises in 2014 – 2018

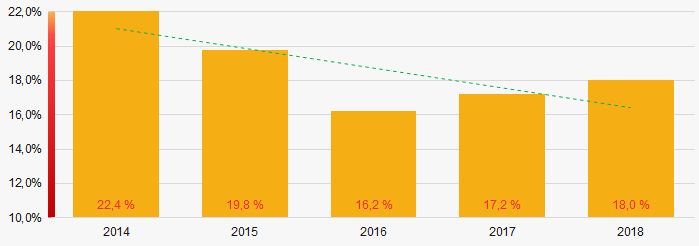

Picture 1. Change in average indicators of the net asset value of TOP-500 enterprises in 2014 – 2018The shares of TOP-500 enterprises with insufficiency of assets have a tendency to decrease in the last five years (Picture 2).

Picture 2. Shares of enterprises with negative values of net assets in TOP-500

Picture 2. Shares of enterprises with negative values of net assets in TOP-500Sales revenue

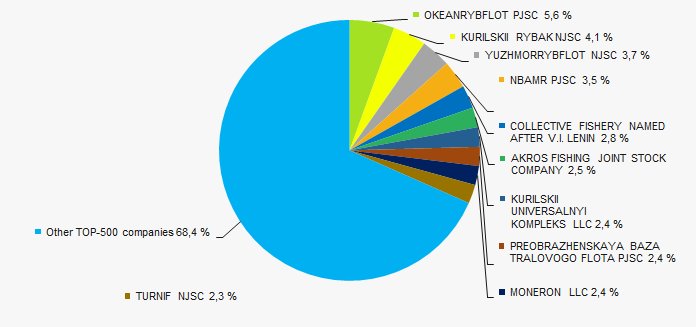

The revenue volume of 10 leading companies in 2018 made almost 32% of the total revenue of TOP-500. (Picture 3). It points to a high level of intra-industry competition in the region.

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-500 enterprises for 2018

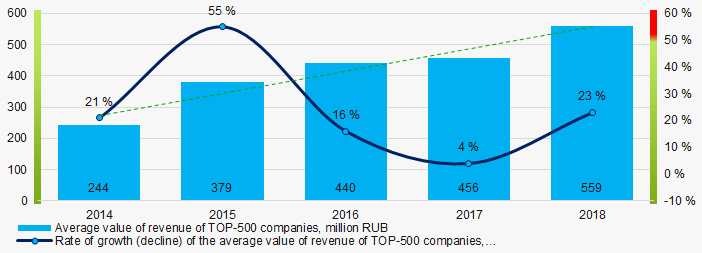

Picture 3. Shares of participation of TOP-10 companies in the total revenue of TOP-500 enterprises for 2018In general, there is a trend towards an increase in sales result (Picture 4).

Picture 4. Change in the average revenue of TOP-500 companies in 2014 – 2018

Picture 4. Change in the average revenue of TOP-500 companies in 2014 – 2018Profit and losses

The largest company of the industry in terms of net profit value is KURILSKII UNIVERSALNYI KOMPLEKS LLC, INN 6501231095, Sakhalin region (in process of reorganization by spin-off, 04.09.2019). The company's profit amounted to 13,2 billion rubles for 2018.

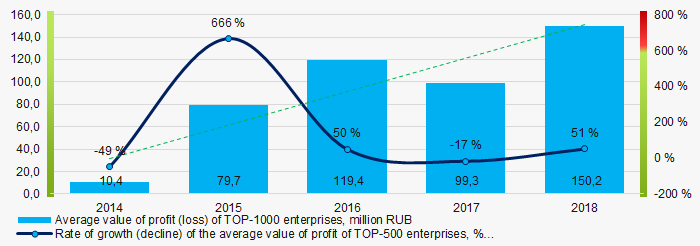

The profit of TOP-500 enterprises trend to increase over the five-year period (Picture 5).

Picture 5. Change in the average indicators of net profit (loss) of TOP-500 companies in 2014 – 2018

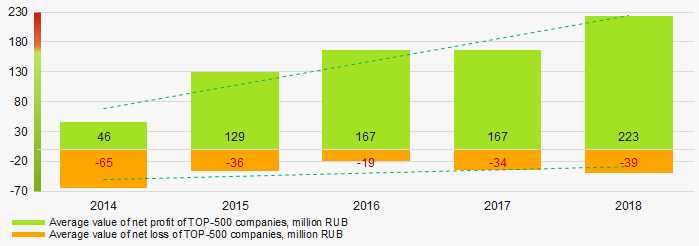

Picture 5. Change in the average indicators of net profit (loss) of TOP-500 companies in 2014 – 2018Average values of net profit’s indicators of TOP-500 companies trend to increase for the five-year period, at the same time the average value of net loss decreases. (Picture 6).

Picture 6. Change in the average values of indicators of net profit and net loss of TOP-500 companies in 2014 – 2018

Picture 6. Change in the average values of indicators of net profit and net loss of TOP-500 companies in 2014 – 2018Key financial ratios

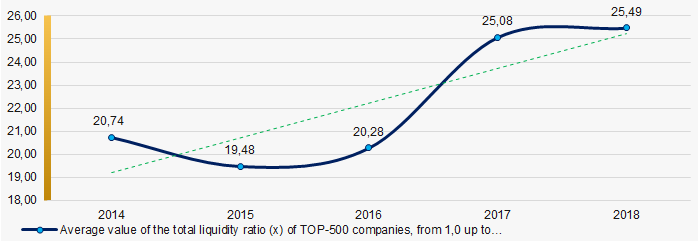

Over the five-year period the average indicators of the total liquidity ratio of TOP-500 enterprises were well above the range of recommended values - from 1,0 up to 2,0, with a tendency to increase (Picture 7).

The total liquidity ratio (the relation of the amount of current assets to short-term liabilities) shows the sufficiency of company’s funds for repayment of its short-term liabilities.

Picture 7. Change in the average values of the total liquidity ratio of TOP-500 companies in 2014 – 2018

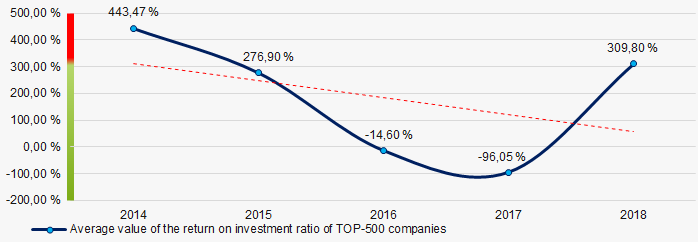

Picture 7. Change in the average values of the total liquidity ratio of TOP-500 companies in 2014 – 2018There has been a downward trend in average values of the return on investment ratio over the course of five years (Picture 8).

The ratio is calculated as the relation of net profit to the sum of own capital and long-term liabilities and demonstrates the return on the equity of own capital involved in the commercial activity and the long-term borrowed funds of an organization.

Picture 8. Change in the average values of the return on investment ratio of TOP-500 companies in 2014 – 2018

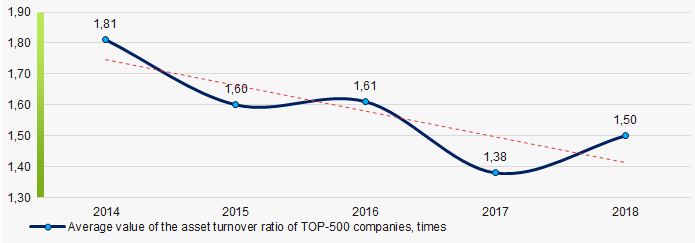

Picture 8. Change in the average values of the return on investment ratio of TOP-500 companies in 2014 – 2018 Asset turnover ratio is calculated as the relation of sales proceeds to the average value of total assets for a period and characterizes the efficiency of use of all available resources, regardless of the sources of their attraction. The ratio shows how many times a year a complete cycle of production and circulation is made, yielding profit.

This ratio of business activity showed a tendency to decrease over the five-year period (Picture 9).

Picture 9. Change in the average values of the asset turnover ratio of TOP-500 companies in 2014 – 2018

Picture 9. Change in the average values of the asset turnover ratio of TOP-500 companies in 2014 – 2018Small business

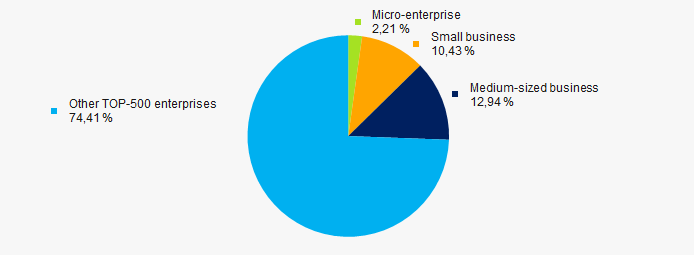

41% of TOP-500 companies are registered in the Register of small and medium-sized enterprises of the Federal Tax Service of the RF. At the same time, their share in the total revenue of TOP-500 amounts to 25,6%, that is higher than the national average (Picture 10).

Picture 10. Shares of proceeds of small and medium-sized enterprises in TOP-500 companies

Picture 10. Shares of proceeds of small and medium-sized enterprises in TOP-500 companiesMain regions of activity

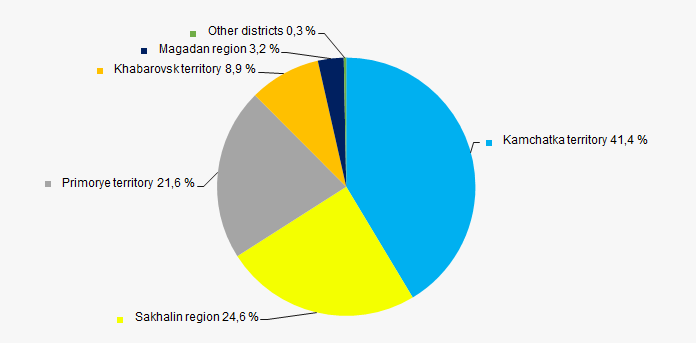

The TOP-500 companies are registered in all 8 regions of the federal district and distributed unequal across the territory, in accordance with the geographical location of seafood production sites. Almost 88% of enterprises with the largest volume of revenue in the industry are concentrated in Kamchatka and Primorye territories and in Sakhalin region (Picture 11).

Picture 11. Distribution of the revenue of TOP-500 companies by the regions of the Far Eastern Federal District of Russia

Picture 11. Distribution of the revenue of TOP-500 companies by the regions of the Far Eastern Federal District of RussiaFinancial position score

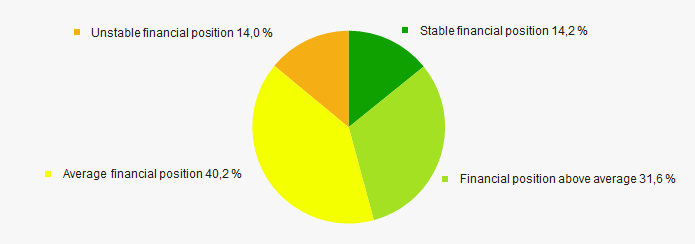

An assessment of the financial position of TOP-500 companies shows that most of them are in average financial position (Picture 12).

Picture 12. Distribution of TOP-500 companies by financial position score

Picture 12. Distribution of TOP-500 companies by financial position scoreSolvency index Globas

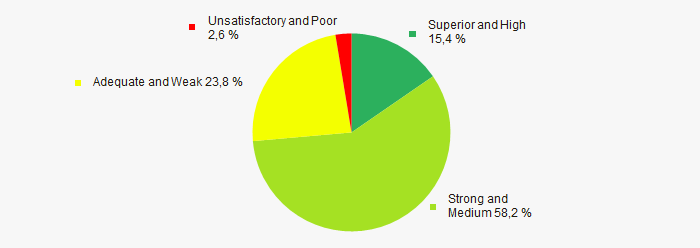

The vast majority of TOP-500 companies got Superior/High or Strong/Medium Solvency index Globas, that points to their ability to pay off their debts in time and fully (Picture 13).

Picture 13. Distribution of TOP-500 companies by solvency index Globas

Picture 13. Distribution of TOP-500 companies by solvency index GlobasConclusion

A comprehensive assessment of activity of the largest marine capture fisheries and seafood processing companies in the Far Eastern Federal District, taking into account the main indices, financial indicators and ratios, points to the prevalence of positive trends (Table 1).

| Trends and evaluation factors of TOP-500 companies | Specific share of factor, % |

| Rate of growth (decline) in the average size of net assets |  10 10 |

| Increase / decrease in the share of enterprises with negative values of net assets |  10 10 |

| Level of competition / monopolization |  10 10 |

| Rate of growth (decline) in the average size of revenue |  10 10 |

| Rate of growth (decline) in the average size of profit (loss) |  10 10 |

| Growth / decline in average values of net profit of companies |  10 10 |

| Growth / decline in average values of net loss of companies |  10 10 |

| Increase / decrease in average values of total liquidity ratio |  5 5 |

| Increase / decrease in average values of return on investment ratio |  -10 -10 |

| Increase / decrease in average values of asset turnover ratio, times |  -10 -10 |

| Share of small and medium-sized enterprises in the industry in terms of revenue being more than 22% |  10 10 |

| Regional concentration |  5 5 |

| Financial position (the largest share) |  5 5 |

| Solvency index Globas (the largest share) |  10 10 |

| Average value of factors |  6,1 6,1 |

positive trend (factor),

positive trend (factor),  negative trend (factor).

negative trend (factor).

Amendments to the Law «On financial accounts»

Since January 01, 2020 the Federal Law No. 444-FZ from November 28, 2018 «On Amendments to the Federal Law «On financial accounts» came into force.

According to the amendments, the State information resource of accounting (financial) statements will be organized in Russia. The Federal Tax Service (FTS of Russia) is authorized to maintain the resource.

In accordance with the Federal Law, beginning from the financial accounts for 2019, all companies are obliged to file accounts only in electronic form. Small business entities will file accounts in electronic form since 2020.

Along with this, now the companies are not obliged to submit the accounts to the State statistics authorities.

The accounts should be submitted to the tax authorities at the place of registration of the taxpayer no later than three months after the end of the reporting period.

Besides, the Law defined that the Central Bank of the Russian Federation submits the annual accounts (annual balance and profit and loss account) until 15 May of the year following the reporting period.

Interested parties can get information from the State information resource of accounting (financial) statements for a fee.

According to the Information and Analytical system Globas, during 2016 – 2018 about 2,2 million of financial accounts at average have been filed with the State statistics authorities annually. After the creation of the State information resource of accounting (financial) statements, the number of accounts collected by the FTS of Russia will be close to 4 million and will be comparable to the number of entities registered in the Unified State Register of Legal Entities.

Financial accounts for 2019 as well as for previous periods will be fully represented in the Globas.