Who owns the information, owns the world

At the present time the governments of different countries are engaged in intensive activities on the introduction of the concept of open data, which are destined to ensure free access to the information, gathered by the state bodies and being not confidential. As of today more than 5000 open data sets are published. Among disclosed information are the data from the sphere of education, housing and communal sector, health care service, state purchases, as well as statistical data.

The importance of open data for entrepreneurship and development has become one of the subjects being active discussed during The XVIII St. Petersburg International Economic Forum (SPIEF – 2014). As a reminder, in May 2012 the President of the RF set a task to ensure the access to open data of all state bodies in Internet. As the result of conducted work above 1000 data sets of government authorities and organs of local self-government were opened by July 2013, and by now their amount has exceed 5000. Following structures have turned out to be the most open: the Federal State Statistics Service, the Federal Service for Alcohol Market Regulation, the Federal Marine and River Transport Agency, the Federal Customs Service, as well as the Ministry of Education and Science of the RF.

In spite of marked progress in accessing to the data, Russia takes only the 30th place among 70 investigated countries of the world and the 7th place among G8 group of countries on the accessibility level of governmental information in the form of open data, as is evidenced by the rating prepared by British «Open Knowledge Foundation» (United Kingdom). First places in the rating belong to the USA and Great Britain, having become the pioneers in the sphere of open data in their time. From 1000 points possible within the rating they have scored 940 and 870 respectively - against 425 points by Russia. However, it is also worth noting that at the initial stage of realization of the initiative the indicators on disclosure of information of the state bodies in Russia exceeded the indicators of the USA more than 17 times: 800 data sets against 47.

Within the rating of open data the experts have estimated the accessibility of most important social information: election returns, government budget, government spending (state purchases), registration data of companies (company register), cartographic information (national map), statistical data, transport timetables, legislation, database of postcodes, data on major pollution sources (emissions of pollutants).

Russia has got good scores on disclosure in the sphere of state purchases: the experts have estimated the accessibility level at 70%, thereby set the RF among five world leaders on this indicator. Also the percent of disclosure in the sphere of the budget and national statistics has turned out to be high enough, here the index of our country makes 60%. As for the rest spheres there is a visible lag: data availability about transport timetables, in legislation, about registered companies and election returns the experts have estimated at 45%, and the availability of cartographic information – at 10%.

| Place | Country | Registra-tion data | Statistics | Legis-lation | Govern-ment spending | Govern-ment budget | <…> | Total score |

|---|---|---|---|---|---|---|---|---|

|

1 |

Great Britain |

100% | 100% | 90% | 100% | 90% | <…> | 940 |

| 2 | USA | 5% | 100% | 85% | 90% | 100% | <…> | 855 |

| 3 | Denmark | 100% | 100% | 100% | 40% | 100% | <…> | 835 |

| 4 | Norway | 90% | 100% | 30% | 10% | 90% | <…> | 755 |

| 5 | Netherlands | 45% | 60% | 100% | 10% | 100% | <…> | 740 |

| 6 | Finland | 55% | 85% | 70% | 30% | 45% | <…> | 700 |

| 7 | Switzerland | 45% | 100% | 45% | 5% | 100% | <…> | 670 |

| 8 | New Zealand | 70% | 100% | 100% | 0% | 100% | <…> | 660 |

| 9 | Australia | 45% | 100% | 45% | 0% | 75% | <…> | 660 |

| 10 | Canada | 45% | 40% | 60% | 10% | 100% | <…> | 590 |

| <…> | ||||||||

| 15 | Italy | 30% | 100% | 50% | 20% | 100% | <…> | 515 |

| 16 | France | 35% | 75% | 50% | 10% | 90% | <…> | 510 |

| <…> | ||||||||

| 27 | Japan | 10% | 40% | 35% | 5% | 70% | <…> | 440 |

| <…> | ||||||||

| 30 | Russia | 45% | 60% | 45% | 70% | 60% | <…> | 425 |

| <…> | ||||||||

| 34 | China | 45% | 60% | 55% | 0% | 55% | <…> | 415 |

| <…> | ||||||||

| 38 | Germany | 25% | 60% | 45% | 10% | 60% | <…> | 410 |

| <…> | ||||||||

| 58 | Belgium | 30% | 35% | 35% | 0% | 45% | <…> | 265 |

| <…> | ||||||||

| 70 | Cyprus | 10% | 20% | 0% | 0% | 0% | <…> | 30 |

At the moment Great Britain is the only one country from G8, earned the highest score (100%) on the level of openness of companies’ registration data. Also Denmark has the maximal score on this point.

Germany has become the least open one from G8 countries, on the accessibility of governmental information taken as a whole, and the overall rating is closed, expected, by Cyprus.

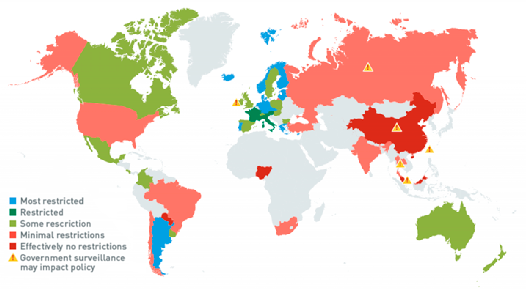

However, the government agencies of different countries demonstrate contradictory relation to the protection of data and their confidentiality. According to the research data of American consulting company Forrester Research in 2013, China and Malaysia have the least level of legal protection. There are minimal restrictions in Russia, as well as in the USA, Brazil, Chile and India. And maximal restrictions are set in Norway, Finland, Germany and other European countries, as well as in Argentine.

Picture. Security and protection level of confidential data in countries of the world according to Forrester Research, the USA, 2013.

The experts note that as of today Russia is integrated into the global process of open data publication. The world economic effect from the introduction of open data makes $3–5 trillion per annum. Such economy is connected with the increase of economic potential due to the increase of effectiveness of new products and services creation, as well as to the reduction of risks. Investment attractiveness of the information sector is rising at the present time, because the knowledge of true and the most updated information gives competitive advantages independent of the line of activity. Like they say, who owns the information, owns the world.

Industrial production shows signs of recovery?

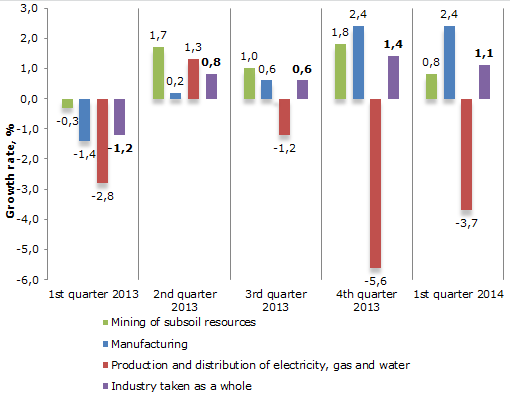

Following the results of the 1st quarter 2014 the growth of industrial production in the RF made 1,1%, what is by 0,3 percentage points less, than in the 4th quarter 2013. The industrial production index, taken as a whole for the year 2013, was about zero values – 100,4% - the most limited success for all time after financial crisis of the year 2008. Thus, the stagnation in domestic economy persists. However, there is a number of criteria at the present time, which point indirectly at the breaking of negative trend.

In Russia in the 1st quarter 2014 the mining of subsoil resources increased by 0,8%, manufacturing - by 2,4%, and in the sphere of the distribution of electricity, gas and water there was fixed the decrease by 3,7%. Considering that in the 1st quarter 2013 the industry showed the negative result (-1,2%), then present figures should be considered with cautious share of optimism. Firstly, it is observed a positive trend in the dynamics of the manufacturing industry, what on its own is a positive sign, and considering unstable external-economic background, connected with events in Ukraine and later sanctions from the side of a number of countries, the growth in these conditions is an achievement; secondly, the significant decrease of power-generating sector during three straight quarters has had an impact on limited success in industrial production, that is explained by lengthy and warm autumn and a short winter period, when in November-January in the European part of Russia the positive temperature regime was observed most of the time.

Regarding positive figures of the growth of manufacturing industry, it may be noted the significant increase of production output in the segment of paper and cardboard, the growth made 530%, organic pigments – 120%, bodies for vehicle - 93,8%. The highest decrease is ever fixed in the supply of combine harvesters (-58,2%), gas turbines (-48,2%) and AC generators (-44%) to the market.

In the mining of subsoil resources the growth was noticed in the production of bauxite – 4,3%, and oil – 0,7%, gas recovery decreased by (-1,4%), coal - by (-1,7%).

Picture. Growth of industrial production to the relevant period of the previous year, %

The future of the dynamics of the manufacturing will depend mainly on tempo of the arrangement of the conflict in Ukraine, because Russia is the main foreign trade partner for this state, the reduction of our export by the collapse of Ukrainian economy will have a direct impact on us; there is a risk that the uncertainty over payments for gas leads to significant decline of energy supply to the country, by that the importance of transit role of Ukraine in gas providing for European continent must be considered. Sanctions of western countries will lead to increase of capital outflow and scare away potential investors, and the devaluation of the rouble, remarkable since the beginning of the year, will have an effect on accelerating inflation, the fight with which has been set as high-priority problem for the whole economic bloc of the government and the Central Bank for a number of recent years.

On the other hand, the annexation of Crimea has already showed, that for integration of the half-island it will be necessary to carry out a number of large infrastructure projects (bridge building trough the Kerch Strait, building of new generating capacities, fresh water delivery etc.), what, finally, will give a new impulse to the industrial sector. The policy on isolation of Russia, conducting by the USA, will backfire – foreign trade cooperation with neighboring China will grow rapidly, including on gas supplies from Eastern Siberia, as well as with such large countries as India and Iran. Diversification of market outlets and decrease of import dependence on a number of key products, what they have been talking about in governmental authorities for all recent years, will go on this background at a growing rate.

In summary, Russia has come into the area of increased external political and economic risks today, which will have its effect on industrial development of the country more or less. But, having high human potential and unique natural and geographical location, Russia remains to be an attractive market for long-term investments, what must have an impact on volumes of industrial production soon or late.