Why would the Federal Treasury need the Federal Service for Fiscal and Budgetary Supervision?

In order to reform the system of the collection of fiscal payments, optimize the system of financial control and supervisory agencies within the structural transformations of the Government of the RF the Federal Service for Fiscal and Budgetary Supervision (Rosfinnadzor) was abolished by the Decree №41 of the President of the RF from 02.02.2016 «On some issues of state control and supervision in the financial and budgetary sphere».

Following functions of control and supervision were laid upon the Service:

1) in the financial and budgetary sphere the Federal Service for Fiscal and Budgetary Supervision was empowered to monitor the compliance with the budget legislation of the RF, reporting on implementation of government programs, compliance with the valuation rules in the field of procurement, substantiation of an initial price of a contract, imposition of penalties by a customer, compliance with delivered goods, supply report and use of it or provided services as intended etc.;

2) compliance with the currency legislation of the RF, accordance of foreign exchange operations with conditions of licenses and permits;

3) quality of work of audit firms;

4) analysis of the execution of the budget powers of the bodies of state financial control;

5) analysis of the conduction of internal financial control and internal financial audit by chief administrators of the federal funds;

6) compliance with the requirements of financial control in the area of procurement, goods, works and services

According to the law, all control and supervisory powers of the Federal Service for Fiscal and Budgetary Supervision should go to the Federal Treasury. The main functions of the Treasury are:

- organization of the system of relationships with banks;

- operational planning and optimization of cash flows;

- controlling;

- financial risk management.

The Federal Service for Fiscal and Budgetary Supervision and the Treasury complete similar tasks, for example, concerning the supervision of the financial discipline, execution of the budget, budget postings. Therefore, the amalgamation of the Federal Service for Fiscal and Budgetary Supervision and the Treasury, which are included structurally in the Ministry of Finance, by joining of the first organization to the second one, with the transfer of control and supervisory powers of the Federal Service for Fiscal and Budgetary Supervision to the system of the Treasury, seems to be logical and meets the requirements of today's time. The functions of currency control in this case are decided to allocate between the Federal Tax Service and the Customs Service of the RF.

The control of expenditure of budgetary funds in today’s difficult conditions is remaining a very important task. As much as this control must be effective, the Treasury should fully adopt the functions of the abolishable Rossfinnadzor until the end of the current year. According to the decree of the Government of the RF, the Federal Service for Financial and Budget Supervision would be eliminated before September 1, 2016.

Thus, all departments responsible for budget revenues will be collected in the structure of the Ministry of Finance: the Federal Tax Service of the RF, the Federal Service for Fiscal and Budgetary Supervision and the Federal Treasury, Federal Customs Service of the RF and the Federal Service for Alcohol Market Regulation (Rosalkogolregulirovanie).

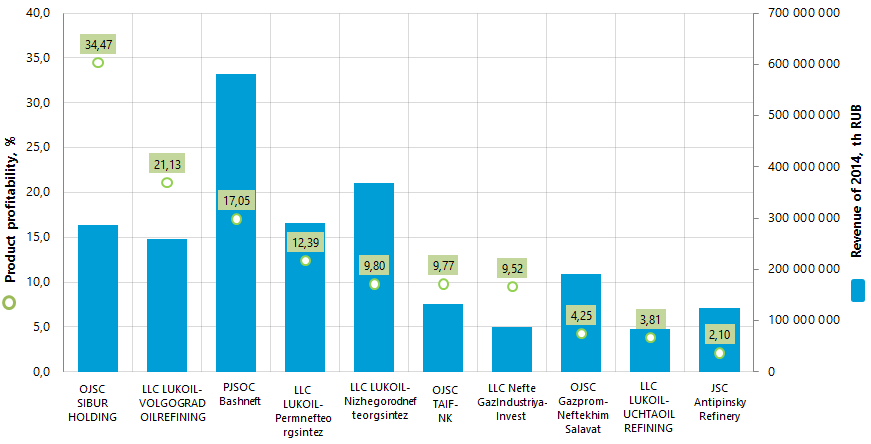

Product profitability ratio of the Russian oil refining companies

Information Agency Credinform has prepared the ranking of the Russian oil refining companies` products. Top-10 enterprises in terms of annual revenue were selected by experts according to the data from the Statistical Register for the latest available period (2014) with oil refining activity. The enterprises were ranked by decrease in the product profitability ratio.

Product profitability is calculated as the ratio of revenue to amount of expenses from ordinary activities. Generally, profitability reflects economic efficiency of production, and product profitability index helps to understand whether output of one or another product is reasonable. There are no specified values for indicators of this group, because they vary strongly depending on the industry.

| № | Name | Revenue of 2014, th RUB | Revenue of 2014 to 2013, %% | Product profitability ratio, % | Solvency index GLOBAS-i® |

|---|---|---|---|---|---|

| 1 | OJSC SIBUR HOLDING INN 7727547261 |

285 545 215 | 117 | 34,47 | 261 High |

| 2 | LLC LUKOIL-VOLGOGRADOILREFINING INN 3448017919 |

259 702 962 | 106 | 21,13 | 158 The highest |

| 3 | PJSOC Bashneft INN 0274051582 |

582 128 345 | 112 | 17,05 | 189 The highest |

| 4 | LLC LUKOIL-Permnefteorgsintez INN 5905099475 |

291 049 782 | 105 | 12,39 | 165 The highest |

| 5 | LLC LUKOIL-Nizhegorodnefteorgsintez INN 5250043567 |

369 313 857 | 105 | 9,80 | 153 The highest |

| 6 | OJSC TAIF-NK INN 1651025328 |

132 010 468 | 104 | 9,77 | 219 High |

| 7 | LLC NefteGazIndustriya-Invest INN 277105194 |

87 281 447 | 126 | 9,52 | 260 High |

| 8 | OJSC Gazprom-Neftekhim Salavat INN 266008329 |

190 633 900 | 114 | 4,25 | 280 High |

| 9 | LLC LUKOIL-UCHTAOILREFINING INN 1102057865 |

83 214 664 | 104 | 3,81 | 221 High |

| 10 | JSC Antipinsky Refinery INN 7204084481 |

124 624 801 | 179 | 2,10 | 315 Satisfactory |

OJSC SIBUR HOLDING takes the lead in the ranking with the product profitability index 34,47%. This is high result twice exceeding industry average index 15,78% and showing the smallest primecost of products in the industry. The company has got high solvency index Globas-i® that shows the ability of the company to pay off the debts in time and to the full extent.

PJSOC Bashneft, showed at the end of 2014 the highest in the industry results according to the revenue value, takes the third place of the ranking with the product profitability index 17,05%, that is close to the industry average index. The enterprise has got the highest solvency index Globas-i® that is a characteristic of high ability to pay off the debts.

However, it worth mentioning that enterprises of the LUKOIL group take the leading position according to the total revenue volume in the industry. This group is represented in the TOP-10 list with four enterprises. The total revenue volume is more than 1,3 trillion RUB that is almost 42% of the TOP-10 total revenue volume. Product profitability indexes of the LUKOIL group range from 21,13% to 3,81%.

JSC Antipinsky Refinery has got the lowest product profitability index among TOP-10 enterprises. Summarizing financial and nonfinancial data, the company has got satisfactory solvency index Globas-i® that is not a guarantee for paying the debts in time and to the full extent. However, this particular enterprise has shown the largest revenue value of 2014 to 2013. Nevertheless, this achievement is negated by the 34 bln RUB loss of 2014 and decreasing product profitability index from 6,29% in 2012 to 2,1% - in 2014.

In general, oil refining companies operate profitably, but demonstrate soft decrease in the average product profitability index: 22,41% - in 2010; 18,7% - in 2011; 15,99% - in 2012; 15,71% - in 2013, with small increase to 15,78% - in 2014. This happened on the back of relatively stable average revenue indexes and high (up to the middle of 2014) global oil prices.

According to the Federal State Statistics Service (Rosstat), in 2015, first in the last few years, 2,4% decrease in primary crude oil processing was observed. Further scenario remains to be seen. According to experts, reserves of the industry are in structural changes and more advanced oil refining.