Return on sales of tobacco manufacturers of Russia

Information agency Credinform prepared a ranking of tobacco manufacturers of Russia.

The companies with the highest volume of revenue were selected for this ranking according to the data from the Statistical Register for the latest available period (for the year 2013). These enterprises were ranked by decrease in the return on sales ratio. Moreover, for the companies from the TOP-10 list it is given the assessment of the market share based on the volume of annual revenue from main activity.

Return on sales (%) shows the share of operating income in sales volume of a company (share of profit in each ruble earned).

Return on sales demonstrates a shareholder and potential investor if company’s operations are profitable or not. The higher is this indicator, the better; the ratio with «minus» sign testifies to that there is an operating loss - expenses are not covered by current sales.

There is no recommended or specified value determined for the mentioned ratio, because it varies strongly depending on the industry and macroeconomic conditions, where each concrete enterprise conducts business.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention not only to average values of indicators in the industry, but also to presented combination of financial data and ratios of the enterprise.

| № | Name | Region | Revenue, in mln RUB, for 2013 | Return on sales, % | Solvency index GLOBAS-i® | Market share, % |

|---|---|---|---|---|---|---|

| 1 | Philip Morris Izhora CJSC INN 4720007247 |

Leningrad region | 66 229,4 | 49,1 | 174 the highest | 31,6 |

| 2 | Philip Morris Kuban OJSC INN 2311010485 |

Krasnodar territory | 12 851,0 | 44,3 | 223 high | 6,1 |

| 3 | Liggett-DukatCJSC INN 7710064121 |

Moscow | 16 448,6 | 30,3 | 222 high | 7,9 |

| 4 | DonskoyTabakCJSC INN 6162063051 |

Rostov region | 10 541,8 | 29,2 | 238 high | 5,0 |

| 5 | Petro LLC INN 7834005168 |

Saint-Petersburg | 39 306,0 | 28,0 | 225 high | 18,8 |

| 6 | British American tobacco-SPB CJSC INN 7809008119 |

Saint-Petersburg | 31 948,2 | 17,5 | 208 high | 15,3 |

| 7 | Imperial Tobakko Volga LLC INN 3443033593 |

Volgogradregion | 7 689,9 | 14,2 | 235 high | 3,7 |

| 8 | Kres Neva LLC INN 4720011412 |

Leningrad region | 3 815,0 | 14,0 | 186 the highest | 1,8 |

| 9 | DonskoyTabakOJSC INN 6163012571 |

Rostov region | 7 528,3 | 7,4 | 215 high | 3,6 |

| 10 | Imperial Tobakko Yaroslavl CJSC INN 7601000015 |

Yaroslavlregion | 3 059,2 | 7,4 | 231 high | 1,5 |

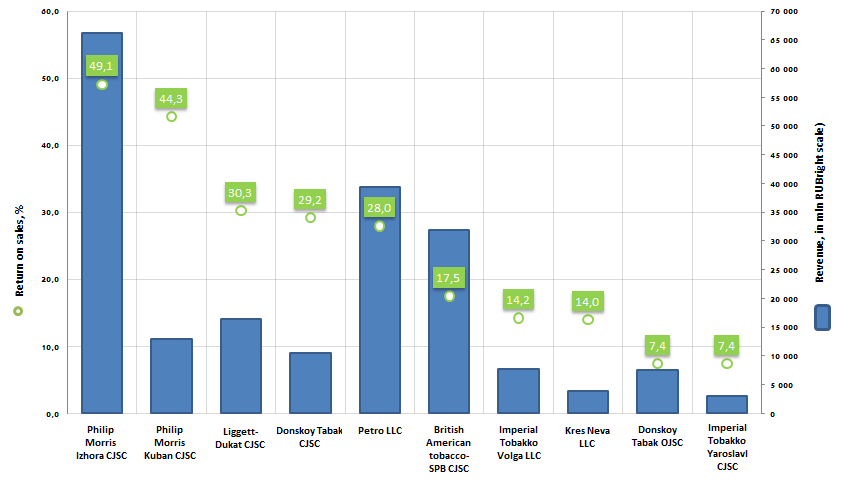

The largest tobacco manufacturers of Russia record a positive return on sales, and the market leader - Philip Morris Izhora CJSC - showed the highest ratio value – 49,1%. The closest competitor in terms of annual revenue, Petro LLC, has a much lower return on sales – 28%.

Picture 1. Return on sales and revenue of the largest tobacco manufacturers of Russia (TOP-10)

The revenue of the largest tobacco manufacturers (TOP-10) made 199,4 bln RUB, according to the last published annual financial statement (for 2013), that is by 6,4% higher, than the ratio of the previous period (187,4 bln RUB).

The three leaders of the Russian tobacco industry: Philip Morris Izhora CJSC, Petro LLC and British American tobacco-SPB CJSC, accumulate 66% of all revenue of the industry.

Today the cumulative investment in the factory Philip Morris Izhora CLSC, which was opened in the Leningrad region in early 2000, exceeds 1,1 bln USD.

The factory produces more than 60 names of such world famous brands of cigarettes as Marlboro, Parliament, Chesterfield, L&M, Bond Street and Next. Currently, the cigarettes manufactured by Philip Morris Izhora CJSC are delivered not only to the Russian market, but also are exported to such countries as Armenia, Kazakhstan, Kyrgyzstan, Moldova, Mongolia, Serbia and Japan.

Petersburg Petro LLC also manufactures products under well-known brands:

- filtered cigarettes: Winston, Camel, Salem, More, Wings by Winston, Mild Seven, Monte Carlo, North Star, Epique, «Russky stil», «Petr 1», «Nasha Prima», «Zolotoy list», «Nevskie», «Kosmos»;

- plain cigarettes: «Prima», «Luch»

- Russian cigarettes: «Belomorkanal».

British American Tobacco Russia closes the Top-3 of the Russian tobacco industry. The portfolio of brands of the company includes such well-known international and domestic brands as Dunhill, Kent, Vogue, Pall Mall, Rothmans of London, Lucky Strike, Viceroy, Yava Zolotaya, Alliance and Yava.

All participants of the TOP-10 list got high and the highest solvency index. This fact signals to potential investors, that the organizations can pay off their debts in time and fully, while risk of default is minimal.

Runaway prices rise

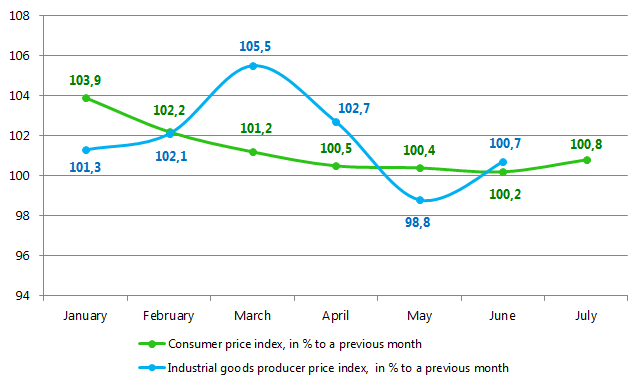

According to Rosstat, consumer price index in June 2015 dropped by 0,2 percentage points in comparison with May 2015, when the index amounted to 0,4% (graph 1). Over a period of the first half of 2015 the inflationary indicator has been reducing. The dynamics of industrial goods producer price index has a differently directed curve.

Graph 1. Change in index of consumer and producer prices for January-June 2015.

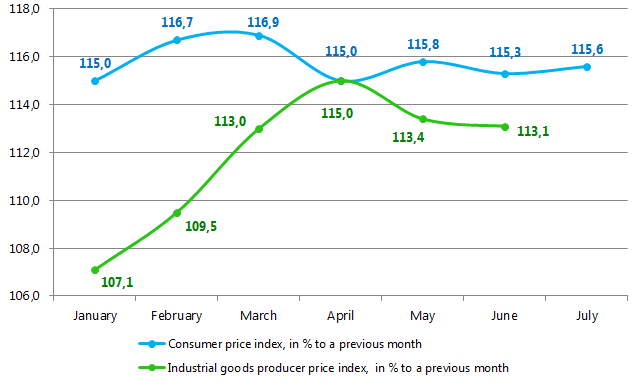

In whole the annual inflation by consumer price index as of July 1st, 2015 is noted at the level of 15,3% (graph 2), following the results of 6 months – 8,4%. Producer price index achieved the level of 13,1% at an annual rate, following the results of 6 months – 11,1%.

Graph 2. Change in index of consumer and producer prices at an annual rate

The information concerning consumer prices index appeared in the beginning of August 2015 bears evidence to the fact that inflation in Russia accelerated to 0,8% against 0,2% in June. Accordingly the consumer prices at an annual rate increased by 15,6% and since the beginning of this year the inflation amounted to 9,2%.

According to experts of the Information agency Credinform, the key factor of the growth acceleration is the increase of housing and community amenities rate happened as of July 1st, 2015. The communal services costs went up at least by 6,0%-7,5%, in particular: hot water – by 6,3%, electricity - by 6,1%, cold water – by 6,0%, heating system – by 5,4%.

The analysts put on the second place the expected tendencies of the ruble devaluation in relation to dollar as a result of declining oil prices. In June the average price of Urals oil descended by 2,3 percentage points. At the moment the oil price is lower than 50 USD/bl. In this context Russian manufacturers raise the prices on petrol in order to compensate for losses appeared after sale of oil abroad. By doing so, they make their contribution to widening of inflation spiral.

The actions of the Central Bank of Russia led to the ruble devaluation in June-July 2015, too. The Bank started replenishing the exchange reserves, having considered that the ruble was strengthening too fast. However in the beginning of August 2015 the Bank of Russia announced the stopping of purchasing due to significant devaluation of ruble being under strong pressure of falling oil price.

Among other risks capable of cooling down the inflation, the experts of Information agency Credinform note the following ones:

- further devaluation of ruble;

- restocking of wholesalers’ products at the new price, that customarily happens in the third quarter of the year;

- upselling of currency for clearing of taken credits, payments of deposits etc. ;

- burst of consumption against the backdrop of reduction in import deliveries volume in Russia and fall-off domestic production level.