Tax code changes

The significant changes in the Russian Tax Code were made in accordance with the Federal Law №63-FZ as of April 15, 2019.

The amendments improve the procedure of income and property tax collection, granting benefits on transport and land taxes as well as simplify fiscal management, reduce tax return and the administrative burden on taxpayers.

In particular, since January 1, 2020 mandatory declarations on transport and land taxes will be canceled. Tax authorities will inform entities, which have vehicles and land plots, about the charged taxes. The Tax service gets such information automatically from registration authorities. Notifications must be sent no later than 6 months after the due date for tax payment. In case of difference between the tax amount and actually paid taxes, entities may submit the explanations and relevant documents within 10 days after receiving such notifications. After the consideration of explanations, the tax authorities may update the notifications within a month or will require to pay taxes.

The mandatory settlements of advance payments on property tax are cancelled. Besides, the entities are given the right to choose the authority, in which they can submit the unified tax return, in case the entity has multiple objects in the same region.

In addition, a VAT deduction is provided for the "export" of services and works. In case Russia is not recognized as the place of sale of works or services, "input" VAT can be deducted.

The transfer of property on a free-of-charge basis to the ownership of the Russian Federation for the purposes of organization or for scientific research in Antarctica is also exempt from VAT payment.

The property transferred to the treasury of the region, municipality or to the ownership of the Russian Federation is not the subject to VAT.

Provisions regarding the investment tax deduction on income tax were clarified. This refers to deductions for expenditure on infrastructure.

Since 2020, individual entrepreneurs will not be obligated to submit a preliminary declaration 4-NDFL (personal income tax). Instead of it, there will be advance payments on the basis of the actual income. The Federal law came into force on April 15, 2019, with the exception of some provisions that will come into force on other dates.

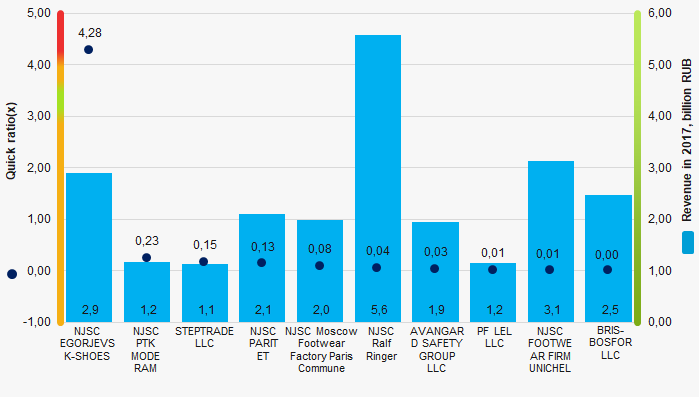

Quick ratio of footwear manuracturers

Information agency Credinform has prepared a ranking of the largest Russian footwear manufacturers. Companies with the largest annual revenue (Top-10) were selected for the ranking, according to the data from the Statistical Register for the latest available accounting periods (2015 - 2017). Then they were ranked by quick ratio (Table 1). The analysis was based on the data from the Information and Analytical system Globas.

Quick ratio (x) characterizes company’s solvency in the short and medium term. The indicator is illustrative of the possibility of an enterprise to repay its short-term liabilities by its most liquid assets: cash, short-term receivables and short-term financial investment. Recommended value of the ratio is from 0,5 to 0,8.

Too high ratio value may indicate irrational capital structure. It may be connected with a slow turnover of funds invested in stocks and an increase in accounts receivable. A low level of the indicator means that the funds and the upcoming income from current operations do not cover company’s current liabilities.

For getting of the most comprehensive and fair picture of the financial standing of an enterprise it is necessary to pay attention to all indicators and financial ratios.

| Name, INN, region | Sales revenue, million RUB | Net profit (loss), million RUB | Quick ratio (x), from 0,5 to 0,8 | Solvency index Globas | |||

| 2016 | 2017 | 2016 | 2017 | 2016 | 2017 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| NJSC EGORJEVSK-SHOES INN 5011017647 Moscow region |

3289,9 3289,9 |

2910,1 2910,1 |

541,1 541,1 |

436,6 436,6 |

3,44 3,44 |

4,28 4,28 |

156 Superior |

| NJSC PTK MODERAM INN 7816057195 Saint Petersburg |

1323,8 1323,8 |

1165,8 1165,8 |

2,8 2,8 |

3,3 3,3 |

0,16 0,16 |

0,23 0,23 |

214 Strong |

| STEPTRADE LLC INN 6901034920 Tver region |

1072,5 1072,5 |

1130,6 1130,6 |

10,9 10,9 |

8,8 8,8 |

0,10 0,10 |

0,15 0,15 |

273 Medium |

| NJSC PARITET INN 5020080885 Moscow region |

825,3 825,3 |

2110,7 2110,7 |

3,1 3,1 |

10,5 10,5 |

0,04 0,04 |

0,13 0,13 |

236 Strong |

| NJSC Moscow Footwear Factory Paris Commune INN 7705032967 Moscow |

1839,4 1839,4 |

1994,5 1994,5 |

11,8 11,8 |

9,4 9,4 |

0,06 0,06 |

0,08 0,08 |

237 Strong |

| NJSC Ralf Ringer INN 7718160370 Moscow |

4911,7 4911,7 |

5578,0 5578,0 |

570,5 570,5 |

224,1 224,1 |

0,02 0,02 |

0,04 0,04 |

205 Strong |

| AVANGARD SAFETY GROUP LLC INN 7721753959 Moscow |

1909,7 1909,7 |

1948,5 1948,5 |

95,9 95,9 |

41,3 41,3 |

0,01 0,01 |

0,03 0,03 |

249 Strong |

| PF LEL LLC INN 4329004775 Kirov region |

1050,6 1050,6 |

1157,7 1157,7 |

139,2 139,2 |

114,9 114,9 |

0,06 0,06 |

0,01 0,01 |

175 High |

| NJSC FOOTWEAR FIRM UNICHEL INN 7448008453 Chelyabinsk region |

2992,7 2992,7 |

3137,9 3137,9 |

109,9 109,9 |

126,1 126,1 |

0,00 0,00 |

0,01 0,01 |

184 High |

| BRIS-BOSFOR LLC INN 7705344035 Krasnodar territory Bankruptcy claim was filed against the company |

2472,9 2472,9 |

2473,2 2473,2 |

12,7 12,7 |

14,1 14,1 |

0,01 0,01 |

0,00 0,00 |

350 Adequate |

| Total for Top-10 companies |  21688,3 21688,3 |

23606,9 23606,9 |

1498,0 1498,0 |

989,0 989,0 |

|||

| Average for Top-10 companies |  2168,8 2168,8 |

2360,7 2360,7 |

149,8 149,8 |

98,9 98,9 |

0,39 0,39 |

0,50 0,50 |

|

| Average industry value |  59,8 59,8 |

70,9 70,9 |

4,2 4,2 |

3,4 3,4 |

0,17 0,17 |

0,16 0,16 |

|

— improvement compared to prior period,

— improvement compared to prior period,  — decline compared to prior period.

— decline compared to prior period.

Average value of quick ratio of Top-10 companies is much higher than the average industry one. In 2017 no company had this ratio within the recommended values.

Picture 1. Quick ratio and revenue of the largest Russian footwear manufacturers (Top-10)

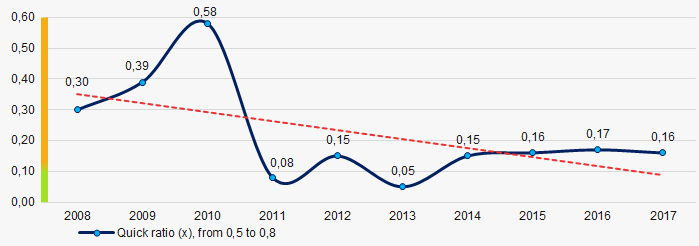

Picture 1. Quick ratio and revenue of the largest Russian footwear manufacturers (Top-10)During the decade average industry quick ratio tended to decrease (Picture 2).

Picture 2. Change in average industry quick ratio of Russian footwear manufacturers in 2008 – 2017

Picture 2. Change in average industry quick ratio of Russian footwear manufacturers in 2008 – 2017