Return on sales of the largest Russian food retailers

Information agency Credinform prepared a ranking of the largest Russian food retailers. Companies with the highest volume of revenue (TOP-10) were selected for this ranking according to the data from the Statistical Register for the latest available periods (2016 and 2015). The enterprises were ranked by return on sales ratio (Table 1). The analysis was based on data from the Information and Analytical system Globas.

Return on sales (%) is calculated as a share of operating revenue in total sales of the company. Return on sales ratio indicates the efficiency of production and commercial activity, and shows funds volume resulting from sales of products after production costs, taxes and loan interests.

Difference in competitive strategies and product ranges defines the variety of return on sales of companies within the industry. That is why return on sales of two different companies at equal values of revenue, operating costs and profit before tax could vary influenced by interest payments on net profit value.

Taking into account the actual situation both in economy in general and in the sector, the experts of the Information agency Credinform have developed and implemented in the Information and Analytical system Globas the calculation of practical values of financial ratios, which can be recognized as normal for a particular industry. The practical value for food retailers in 2016 is up to 2,87%.

For the most complete and objective view of the financial condition of the enterprise it is necessary to pay attention to the complex indicators and financial ratios of the company.

| Name, INN, region | Net profit, mln RUB | Revenue, mln RUB | Return on sales, % | Solvency index Globas | |||

| 2015 | 2016 | 2015 | 2016 | 2015 | 2016 | ||

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| LLC VKUSVILL INN 7734675810 Moscow |

278,3 | 432,6 | 5 585,6 | 18 052,5 | 3,95 | 7,10 | 218 Strong |

| LLC TAMERLAN INN 3442050010 Volgograd region |

563,1 | 670,4 | 19 233,9 | 19 533,9 | 3,02 | 2,63 | 180 High |

| LLC AGROASPEKT INN 7715277300 Moscow |

1 373,0 | 4 957,1 | 96 793,1 | 101 200,6 | 6,98 | 2,12 | 136 Superior |

| LLC COMPANY HOLIDAY INN 5406277570 Novosibirsk region |

241,4 | 25,9 | 58 781,2 | 56 469,2 | 1,61 | 1,35 | 235 Strong |

| LLC MAYAK INN 3811125221 Irkutsk region |

163,7 | 307,4 | 11 370,5 | 15 338,1 | 1,75 | 0,96 | 228 Strong |

| ОLLC TRADING HOLDING SIBIRSKIY GIGANT INN 5405289421 Novosibirsk region |

227,1 | 150,2 | 12 713,8 | 14 355,2 | -1,03 | 0,09 | 225 Strong |

| LLC SLADKAYA ZHIZN N.N. INN 5257041777 Nizhniy Novgorod region |

2 108,5 | 1 642,8 | 72 701,1 | 73 438,7 | -0,96 | -0,32 | 188 High |

| LLC INVESTPROEKT INN 5047081220 Moscow region |

15,3 | -260,4 | 13 370,5 | 12 829,6 | -2,64 | -0,64 | 320 Adequate |

| LLC BETA-M INN 7715437850 Moscow |

-21,9 | -12,2 | 2 689,7 | 11 970,1 | 0,75 | -1,70 | 316 Adequate |

| LLC ALBION-2002 INN 5257056036 Nizhniy Novgorod region |

-1 268,3 | -435,6 | 22 929,1 | 42 150,5 | -0,79 | -17,96 | 278 Medium |

| Total for TOP-10 | 368,0 | 747,8 | 31 616,9 | 36 533,8 | |||

| Average value for TOP-10 companies | 36,8 | 74,8 | 3 161,7 | 3 653,4 | 1,26 | -0,64 | |

| Average value for industry | 0,5 | 0,5 | 31,6 | 35,8 | 2,83 | 2,87 | |

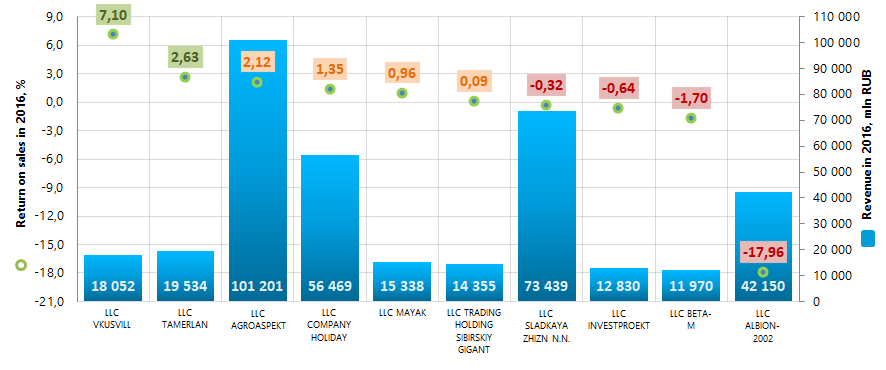

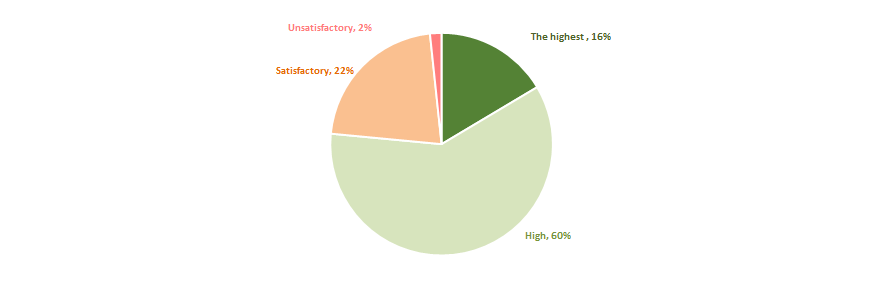

Average value of return on sales ratio for the TOP-10 in 2016 is negative and lower than for the practical average. Two companies in TOP-10 have values higher than practical in 2016, four companies – lower, and four have negative values (marked with green, orange and red in columns 6 and 7 of Table 1 and on Picture 1 respectively). Six companies have reduced net profit or revenue figures in 2016 compared to the previous period, or have losses (filled with red in columns 3 and 5 of Table 1).

Picture 1. Return on sales ratio and revenue of the largest Russian food retailers (TOP-10)

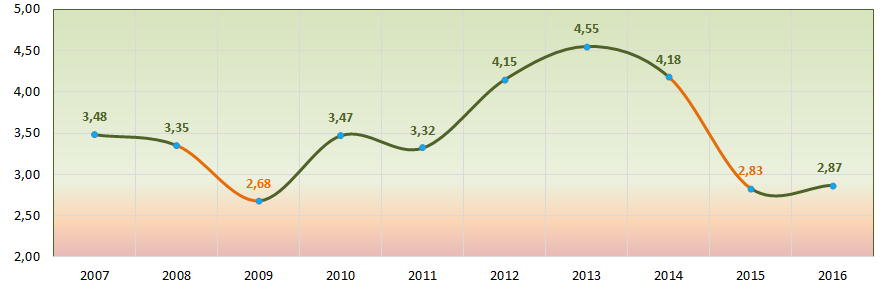

Picture 1. Return on sales ratio and revenue of the largest Russian food retailers (TOP-10)The average industry indicators of return on sales ratio over the past ten years demonstrate instability. In 2009 and 2015, the indicators were below the practical value of 2016. This may indicate a certain decrease in economic efficiency in this area of activity during periods of crisis in the economy (Picture 2).

Picture 2. Change in average industry values of return on sales ratio of the Russian food retailers in 2007 – 2016

Picture 2. Change in average industry values of return on sales ratio of the Russian food retailers in 2007 – 2016Eight companies in TOP-10 got high, strong, medium and superior indexes Globas that indicates their ability to timely and fully fulfill debt liabilities.

LLC INVESTPROEKT and LLC BETA-M has got adequate Solvency index Globas https://globas.credinform.ru/en-GB/home/auth due to the presence of information about participating as a defendant in arbitration cases, delays in implementation of liabilities and losses in balance sheet structure. Indexes development forecast is stable.

Moreover, following the results of the Federal Tax Service of the RF (FTS) check, LLC BETA-M has a record as of 21.08.2017 on unreliability of the legal address.

Trends in the field of supporting activities in air transport

Information agency Credinformrepresents an overview of trends in the field of supporting activities in air transport.

The enterprises with the largest volume of annual revenue were selected for the analysis, according to the data from the Statistical Register for the latest available periods (for 2015 and 2016), which are engaged in supporting activities in air transport, including airports (TOP-10 and TOP-300). The analysis was made on the basis of the data of the Information and analytical system Globas.

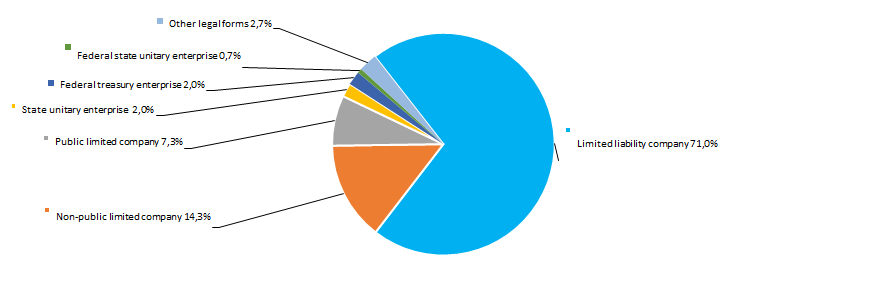

Legal forms

The most spread legal form of enterprises in the field of supporting activities in air transport is a limited liability company. Public and non-public joint-stock companies also make a significant part. (Picture 1).

Picture 1. Distribution of TOP-300 companies by legal forms

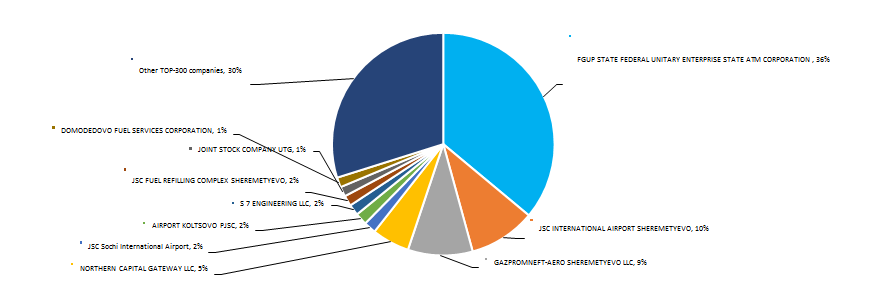

Picture 1. Distribution of TOP-300 companies by legal formsRevenue from sales

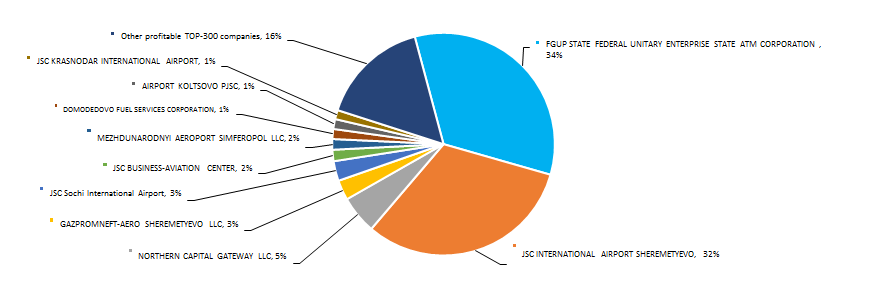

The revenue of 10 industry leaders made 70% of the total revenue of 300 the largest companies in 2016. It points to a high level of monopolization in the industry. The largest company in terms of revenue in 2016 was FGUP STATE FEDERAL UNITARY ENTERPRISE STATE ATM CORPORATION (Picture 2).

Picture 2. The share of participation of TOP-10 enterprises in the total revenue of TOP-300 companies for 2016, %

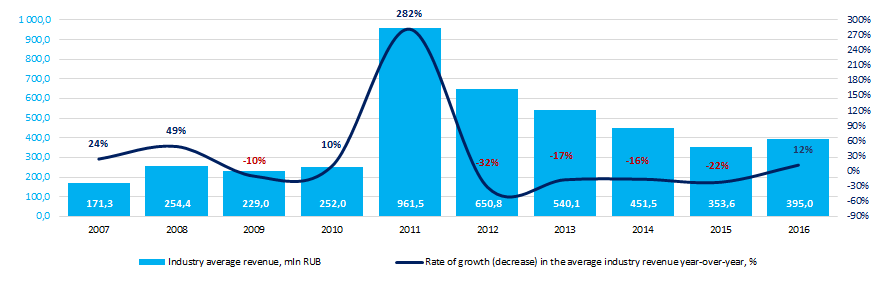

Picture 2. The share of participation of TOP-10 enterprises in the total revenue of TOP-300 companies for 2016, %The best results in the industry in terms of revenue for the ten-year period were achieved in 2011. During the crisis periods in the economy in 2009 and from 2012 up to 2015, there was a decline observed in the industry average indicators. (Picture 3).

Picture 3. Change in the industry average indicators of revenue of companies in the field of supporting activities in air transport in 2007-2016х

Picture 3. Change in the industry average indicators of revenue of companies in the field of supporting activities in air transport in 2007-2016хProfit and losses

The profit of 10 industry leaders made 84% of the total profit of TOP-300 companies in 2016. The leading position in terms of profit volume in 2016 is taken also by FGUP STATE FEDERAL UNITARY ENTERPRISE STATE ATM CORPORATION (Picture 4).

Picture 4. Shares of participation of TOP-10 enterprises in the total volume of profit of TOP-300 companies for 2016, %

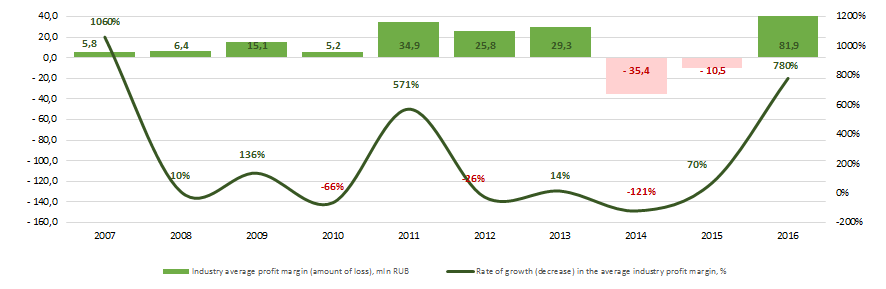

Picture 4. Shares of participation of TOP-10 enterprises in the total volume of profit of TOP-300 companies for 2016, % Industry values of the profit indicators of air transport companies for the ten-year period are not stable. Decrease in indicators was observed in 2010, 2012 and in 2014 against the background of crisis phenomena in the economy. At the same time, the industry average indicators of profit were negative in 2014 - 2015. The industry showed the best results in 2016 (Picture 5).

Picture 5. Change in the industry average indicators of profit of companies in the field of supporting activities in air transport in 2007 - 2016

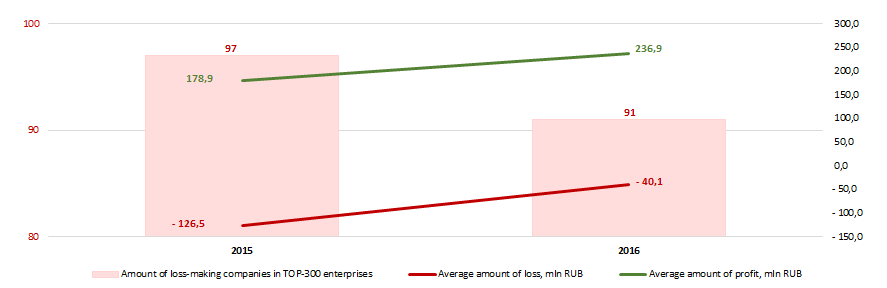

Picture 5. Change in the industry average indicators of profit of companies in the field of supporting activities in air transport in 2007 - 2016There were 97 loss-making enterprises observed in 2015 among TOP-300 companies. In 2016 their number reduced to 91 or by 6%. At the same time, the average size of their loss decreased by 68%. For the rest of TOP-300 companies the average profit margin increased by 32% during the same period (Picture 6).

Picture 6. Amount of loss-making companies, average value of loss and profit of TOP-300 enterprises in 2015-2016

Picture 6. Amount of loss-making companies, average value of loss and profit of TOP-300 enterprises in 2015-2016 Capital and reserves

At year-end 2016 the largest amount of capital and reserves among TOP-300 companies was by FGUP STATE FEDERAL UNITARY ENTERPRISE STATE ATM CORPORATION. The worst position for this indicator was by TSENTR UPRAVLENIYA NAZEMNYM OBSLUZHIVANIEM LLC(Table 1).

| Sequence number in TOP-300 | Name | Capital and reserves, Bln RUB * | |

| 2015 | 2016 | ||

| 1. | FGUP STATE FEDERAL UNITARY ENTERPRISE STATE ATM CORPORATION | 98,23 | 115,75 |

| 2. | JSC INTERNATIONAL AIRPORT VNUKOVO | 1,93 | 18,81 |

| 3. | LLC SABETTA INTERNATIONAL AIRPORT | 15,25 | 16,96 |

| 4. | AIRPORT KOLTSOVO PJSC | 9,13 | 14,85 |

| 5. | NORTHERN CAPITAL GATEWAY LLC | 10,73 | 10,73 |

| 6. | MEZHDUNARODNYI AEROPORT KAZAN NAO | 5,57 | 5,89 |

| 7. | SUE DOMODEDOVO AIRPORT ADMINISTRATION | 5,61 | 5,73 |

| 8. | LLC AIRPORT NORILSK | 5,72 | 5,39 |

| 9. | JSC KRASNODAR INTERNATIONAL AIRPORT | 4,21 | 4,86 |

| 10. | JSC UZHNO-SAKHALINSK AIRPORT | 3,45 | 3,89 |

| 291. | TZK KIROV LLC | -20,10 | -23,36 |

| 292. | SIBIR CARGO SERVICE LIMITED | -41,08 | -24,45 |

| 293. | BASEL AERO LLC | -34,53 | -34,10 |

| 294. | AEROPORT PJSC | -80,19 | -34,77 |

| 295. | BALTIK GRAUND SERVISES RU LLC | -11,00 | -50,76 |

| 296. | BALTIK GRAUND SERVISES RU LLC | -50,12 | -56,99 |

| 297. | TSENTR AVIA LLC | -123,21 | -136,68 |

| 298. | AVIASERVIS LLC | -141,00 | -177,75 |

| 299. | JSC BELGORODAVIA | -877,92 | -924,42 |

| 300. | TSENTR UPRAVLENIYA NAZEMNYM OBSLUZHIVANIEM LLC | 8,83 | -989,11 |

*) The companies with positive dynamics of the indicator in 2016 compared to the previous year are marked with green filling in Table 1, with negative dynamics - with red filling.

There were 45 enterprises with a negative value of capital and reserves observed among TOP-300 companies in 2015. In 2016 their number increased up to 50 or by 11%. At the same time, the average size of capital and reserves increased by 36% for the same period (Picture 7).

Picture 7. Amount of companies with a negative value of capital and reserves and average size of capital reserves of TOP-300 enterprises in 2015 – 2016

Picture 7. Amount of companies with a negative value of capital and reserves and average size of capital reserves of TOP-300 enterprises in 2015 – 2016Key financial ratios

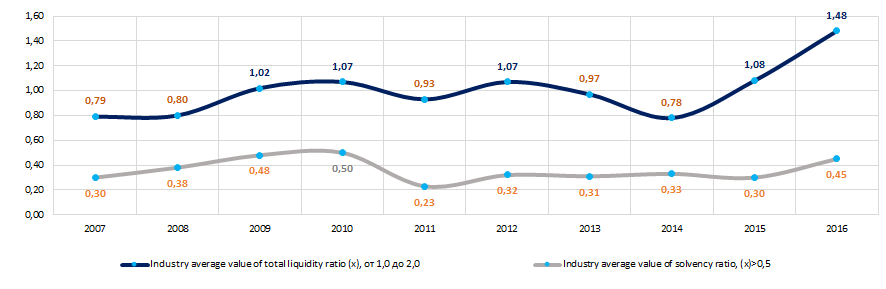

Over the ten-year period the average industry indicators of the total liquidity ratio were below the range of recommended values from 1,0 to 2,0 during 5 years.(marked in yellow in Picture 8).

The total liquidity ratio (the relation of the amount of current assets to short-term liabilities) shows the sufficiency of company’s funds for repayment of its short-term liabilities.

The solvency ratio (the relation of the amount of own capital to the balance sum) shows the company's dependence on external borrowings. Recommended value is > 0.5. The value of the coefficient below the minimum value means a strong dependence on external sources of funds’ receipt.

The experts of the Information Agency Credinform, taking into account the actual situation both in the economy as a whole and in sectors, has developed and implemented in the Information and analytical system Globas the calculation of practical values of financial ratios that can be recognized as normal for a particular industry. For companies in the field of supporting activities in air transport the practical value of the solvency ratio ranges from 0,02 up to 0,82.

Over the ten-year period the industry average indicators of the coefficient were below the recommended value and in the interval of practical values (Picture 8).

Picture 8. Change in the industry average values of the total liquidity and solvency ratios of companies in the field of supporting activities in air transport in 2007–2016

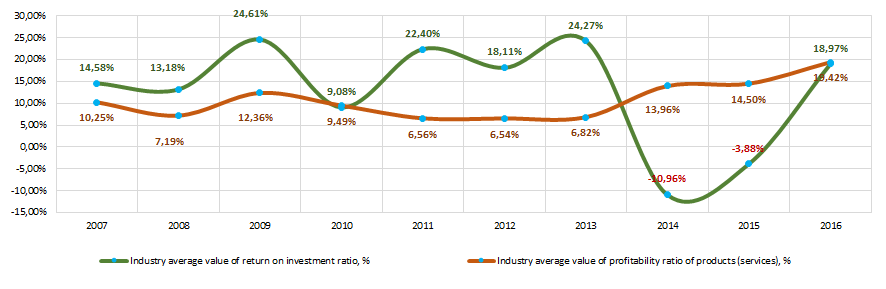

Picture 8. Change in the industry average values of the total liquidity and solvency ratios of companies in the field of supporting activities in air transport in 2007–2016There has been an instability observed in indicators of the return on investment ratio during ten years. In periods of crisis phenomena in the economy (in 2014, 2015) the indicators decreased to negative values (Picture 9). The ratio is calculated as the relation of net profit to the sum of own capital and long-term liabilities and demonstrates the return on the equity involved in the commercial activity and the long-term borrowed funds of an organization.

The indicators of the profitability ratio of products (services) were relatively stable in the same period (Picture 9). The growth of indicators is observed in 2014 - 2016. The ratio is calculated as the relation of profit from sales to expenses for ordinary activity. In general, profitability reflects the economic efficiency of production.

Picture 9. Change in the industry average values of the return on investment and profitability ratio of services of companies in the field of supporting activities in air transport in 2007 – 2016

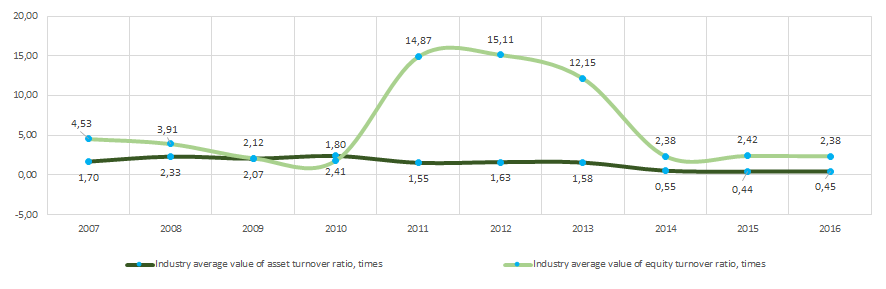

Picture 9. Change in the industry average values of the return on investment and profitability ratio of services of companies in the field of supporting activities in air transport in 2007 – 2016 Indicators of the asset turnover ratio over a ten-year period demonstrate instability with a sharp increase in 2011 - 2013 and a decline in 2014 - 216 (Picture 10).

Asset turnover ratio is calculated as the relation of sales proceeds to the average value of total assets for a period and characterizes the efficiency of use of all available resources, regardless of the sources of their attraction. The coefficient shows how many times a year a complete cycle of production and circulation is made, yielding profit.

Equity turnover ratio is calculated as the relation of revenue to average annual amount of equity and shows the intensity of use of the whole part of assets.

There is a significant decrease in the indicators of this coefficient observed in 2014-2016 (Picture 10).

Picture 10. Change in the industry average values of the activity ratios of companies in the field of supporting activities in air transport in 2007 – 2016

Picture 10. Change in the industry average values of the activity ratios of companies in the field of supporting activities in air transport in 2007 – 2016Structure of services

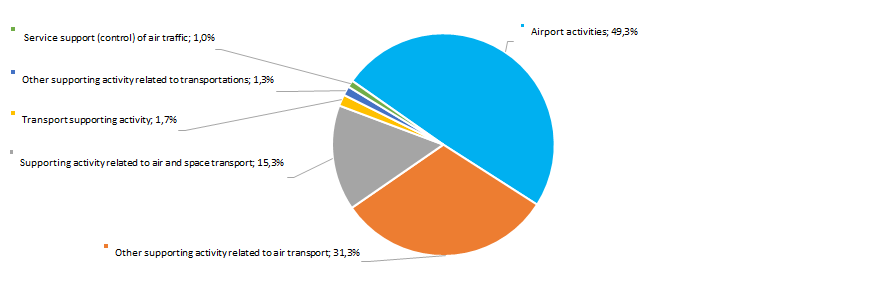

Almost half of companies in the TOP-300 list specialize in airport services (Picture 11).

Picture 11. Distribution of TOP-300 companies by types of services provided, %

Picture 11. Distribution of TOP-300 companies by types of services provided, %Dynamics of business’ activity

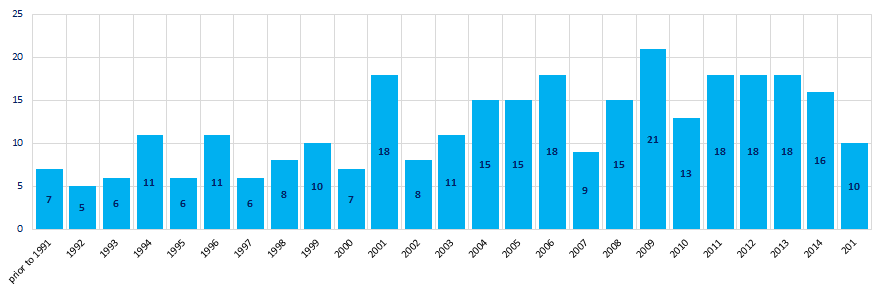

Over the 25-year period the number of registered companies from the TOP-300 list is distributed by years of their foundation non uniform. The largest number of enterprises in the field of supporting activities in air transport was established in 2009 (Picture 12).

Picture 12. Distribution of TOP-300 companies by years of their foundation

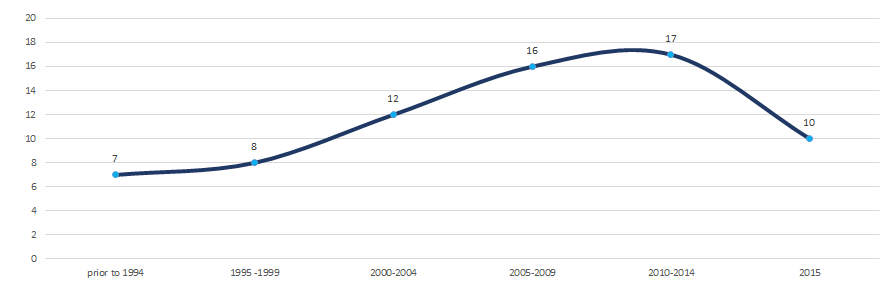

Picture 12. Distribution of TOP-300 companies by years of their foundationBusiness took the greatest interest to supporting activities in air transport during the period 2010-2014, when on average 17 new companies were registered per annum. (Picture 13).

Picture 13. Average number of TOP-300 companies registered within the year, by periods of their foundation

Picture 13. Average number of TOP-300 companies registered within the year, by periods of their foundationMain regions of activity

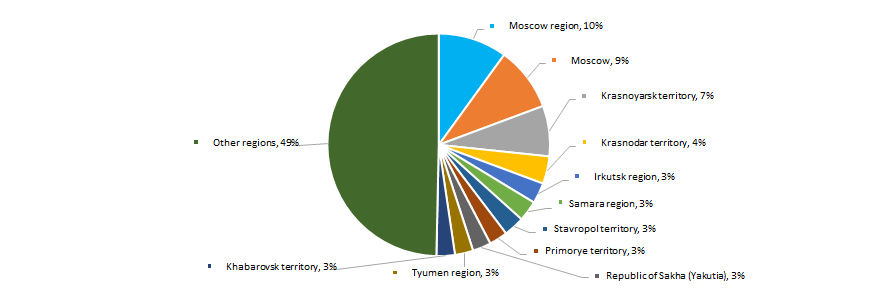

Companies in the field of supporting activities in air transport are distributed throughout the country non uniform. Their largest number is registered in Moscow region and Moscow city - the biggest regions of the country in terms of population size with a developed transport infrastructure (Picture 14). TOP-300 companies are registered in 61 regions of Russia.

Picture 14. Distribution of TOP-300 companies by regions of Russia

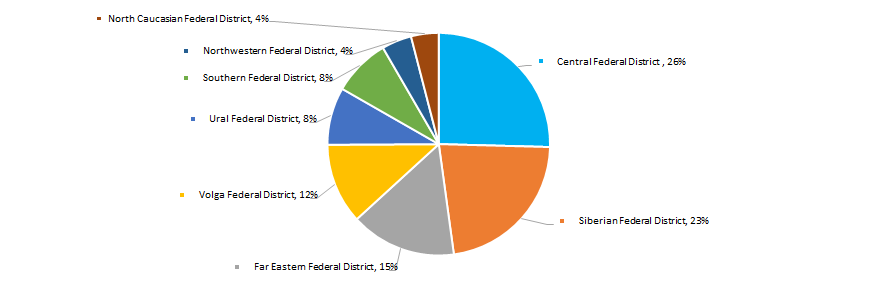

Picture 14. Distribution of TOP-300 companies by regions of RussiaThe largest number of companies in the field of supporting activities in air transport is concentrated in the Central Federal District of the country (Picture 15).

Picture 15. Distribution of TOP-300 companies by federal regions of Russia

Picture 15. Distribution of TOP-300 companies by federal regions of RussiaThe share of companies with branches or representative offices, from TOP-300 enterprises, is 12%.

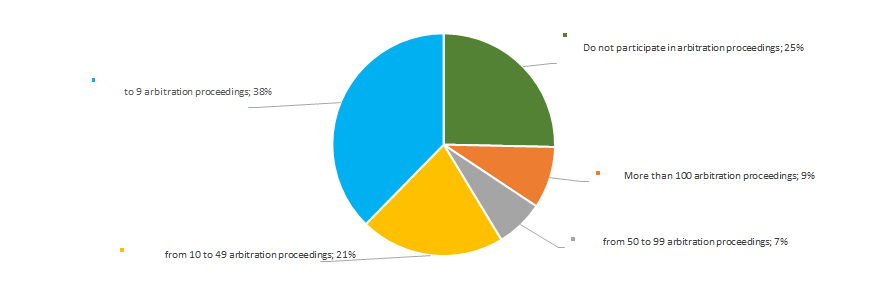

Activity of participation in arbitration proceedings

The fourth part of companies of the industry does not participate in arbitration proceedings. A significant share is taken by enterprises, which are relatively actively involved in arbitration processes, that may be due to the specifics of the provision of transportation services (Picture 16).

Picture 16. Distribution of TOP-300 companies by the activity of participation in arbitration proceedings, %

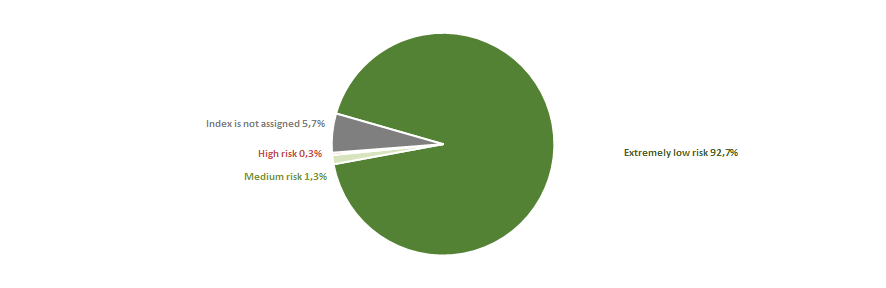

Picture 16. Distribution of TOP-300 companies by the activity of participation in arbitration proceedings, %Reliability index

In terms of the presence of signs of «fly-by-night companies» or unreliable organizations, the great majority of enterprises of the industry demonstrate an extremely low risk of cooperation (Picture 17).

Picture 17. Distribution of TOP-300 companies by reliability index, %

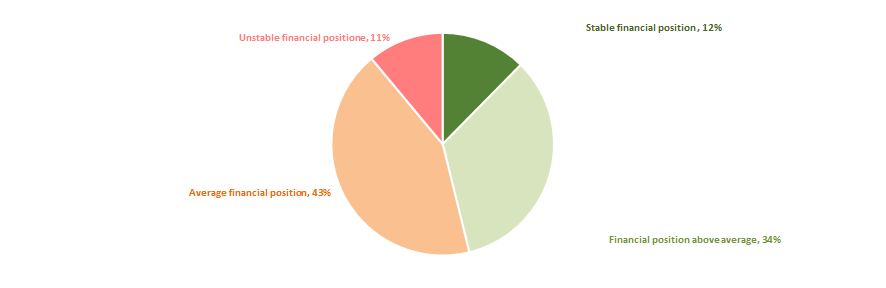

Picture 17. Distribution of TOP-300 companies by reliability index, %Scoring index

An assessment of the financial position of companies in the industry shows that the largest number of enterprises is in a stable financial position or at a level above the average (Picture 18).

Picture 18. Distribution of TOP-300 companies by scoring index, %

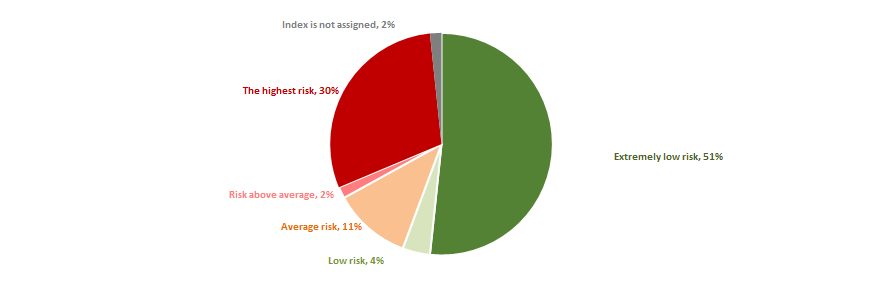

Picture 18. Distribution of TOP-300 companies by scoring index, %Liquidity index

Most of companies of the industry (55%) show a minimal or insignificant level of bankruptcy risk in the short-term period. However, the share of enterprises with the highest level of risk is at substantial figure of 30% (Picture 19).

Picture 19. Distribution of TOP-300 companies by liquidity index, %

Picture 19. Distribution of TOP-300 companies by liquidity index, %Solvency index Globas

76% of companies in the field of supporting activities in air transport from among 300 the largest enterprises got the highest or high Solvency index Globas (Picture 20).

As a whole, taking into account the main indices, financial indicators and ratios, this may point to relatively favorable trends in this field of activity.

Picture 20. Distribution of TOP-300 companies by Solvency index Globas

Picture 20. Distribution of TOP-300 companies by Solvency index Globas