TOP 1000 companies of 10 cities with a million-plus population

In Russia there are 15 cities with a million-plus population. During 2021 we have published researches about companies in 10 largest cities with a million-plus population. This publication completes the cycle. Activity analysis of 1000 largest companies demonstrates the prevalence of negative trends in 2016 – 2020.

The most significant of them: increase in the share of enterprises with negative net assets value, high level of capital concentration in the largest companies, decline in values of profit, increase in unprofitableness, and decrease in values of total liquidity and assets turnover ratios. Among the positive trends: growth in average net assets and revenue values, increase in return on investments and high financial stability.

For this activity trends analysis information agency Credinform selected 100 largest companies in terms of annual revenue according to the data from the Statistical Register and the Federal Tax Service for the latest available periods (2015-2020) in 10 (Picture 11) largest cities with a million-plus population in Russia (TOP 1000). The analysis was based on the data of the Information and Analytical system Globas.

Net assets are total assets less total liabilities. This indicator reflects the real value of the property of an enterprise. When the company’s debt exceeds the value of its property, the indicator is considered negative (insufficiency of property).

The largest company in term of net assets is JSC GAZPROM, INN 7736050003, Saint Petersburg, wholesale of solid, liquid and gaseous fuels and related products. In 2020 net assets of the company exceeded 10 trillion RUB.

The lowest net assets value among TOP 1000 belonged to JSC UNITED CHEMICAL COMPANY URALCHEM, INN 7703647595, Moscow, manufacture of fertilizers and nitrogen compounds. Insufficient property figured out negative value -109 billion RUB.

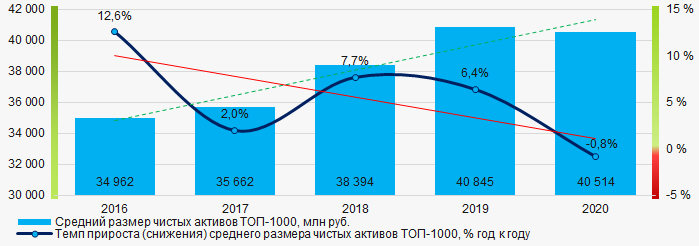

For the five-year period the average net assets values of TOP 1000 tend to increase with decreasing rate of its growth. (Picture 1).

Picture 1. Change in average net assets value of TOP 1000 in 2016– 2020

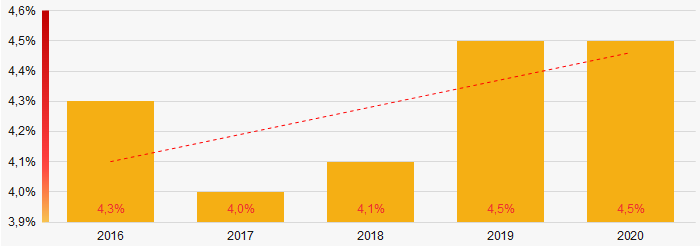

Picture 1. Change in average net assets value of TOP 1000 in 2016– 2020Shares of the companies with insufficient property had a negative trend to increase. (Picture 2).

Picture 2. Shares of TOP 1000 companies with negative net assets value in 2016-2020

Picture 2. Shares of TOP 1000 companies with negative net assets value in 2016-2020Sales revenue

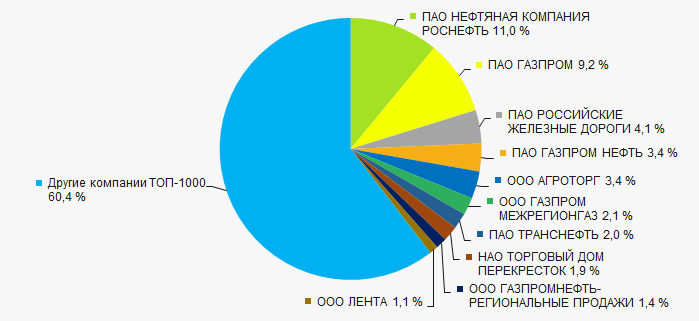

In 2020, the revenue volume of the ten largest companies was about 40% of total TOP 1000 revenue (Picture 3). This indicates a high level of capital concentration in the largest companies.

Picture 3. The share of TOP 10 companies in total 2020 revenue of TOP 1000

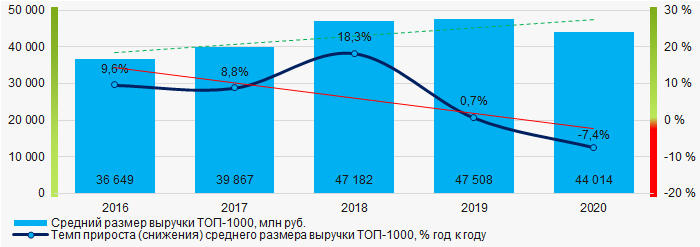

Picture 3. The share of TOP 10 companies in total 2020 revenue of TOP 1000 For five years average revenue values of TOP 100 increase with decreasing rates of its growth with every year. (Picture 4).

Picture 4. Change in average revenue of TOP 1000 in 2016 – 2020

Picture 4. Change in average revenue of TOP 1000 in 2016 – 2020Profit and loss

In 2020, the largest organization in term of profit was JSC Oil Company LUKOIL, INN 7708004767, Moscow, exploration geophysical and geochemical works related to mineral resources and the reproduction of the mineral resource base study. The company’s profit was 198 billion RUB.

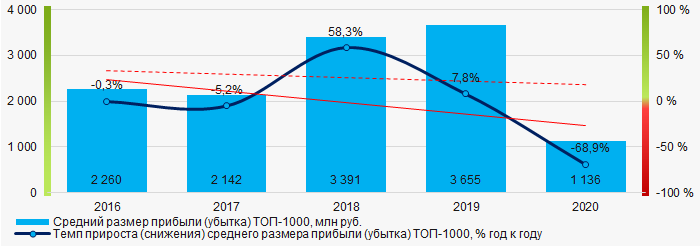

For the five-year period there is a trend to decrease in average net profit of TOP 1000. It became more noticeable in 2020. (Picture 5).

Picture 5. Change in average profit (loss) of TOP 1000 in 2016 - 2020

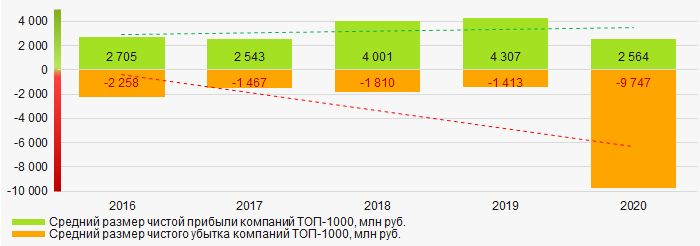

Picture 5. Change in average profit (loss) of TOP 1000 in 2016 - 2020For the five-year period average net profit of TOP 1000 have a decreasing trend with increasing net loss (Picture 6).

Picture 6. Change in average net profit and average net loss of TOP 1000 companies in 2016 - 2020

Picture 6. Change in average net profit and average net loss of TOP 1000 companies in 2016 - 2020Key financial ratios

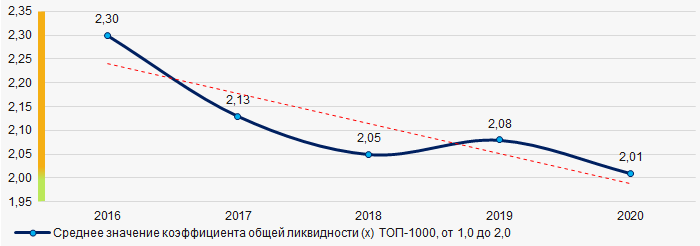

For the five-year period average values of current liquidity ratio of TOP 1000 were above the recommended one - from 1,0 to 2,0 with a trend to decrease. (Picture 7).

Current liquidity ratio (current assets to short-term liabilities) shows the sufficiency of company’s assets to repay on short-term liabilities.

Picture 7. Change in average value of current liquidity ratio of TOP 1000 in 2016 - 2020

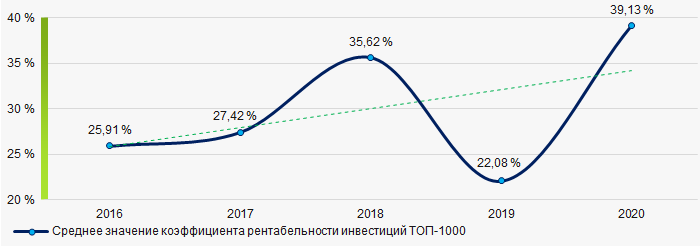

Picture 7. Change in average value of current liquidity ratio of TOP 1000 in 2016 - 2020For the five-year period average values of ROI ratio of TOP 1000 showed increasing trend. (Picture 8).

ROI ratio is calculated as net profit to sum of shareholders equity and long-term liabilities, and shows the return of equity involved in commercial activities and long-term borrowed funds.

Picture 8. Change in average value of ROI ratio of TOP 1000 in 2016 - 2020

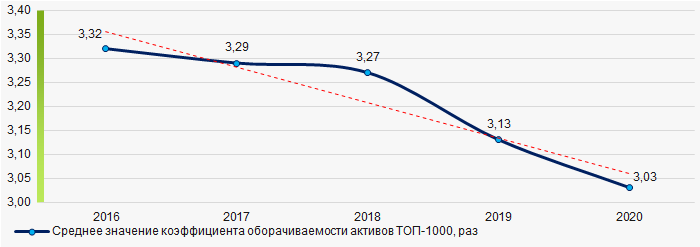

Picture 8. Change in average value of ROI ratio of TOP 1000 in 2016 - 2020Assets turnover ratio is the ratio of sales revenue and company’s average total assets for a period. It characterizes the effectiveness of using of all available resources, regardless the source of their attraction. The ratio shows how many times per year the full cycle of production and circulation is performed, generating the corresponding effect in the form of profit.

For the five-year period average values of assets turnover ratio of TOP 1000 had a trend to decrease. (Picture 9).

Picture 9. Change in average value of assets turnover ratio of TOP 1000 in 2016 – 2020

Picture 9. Change in average value of assets turnover ratio of TOP 1000 in 2016 – 2020Small business

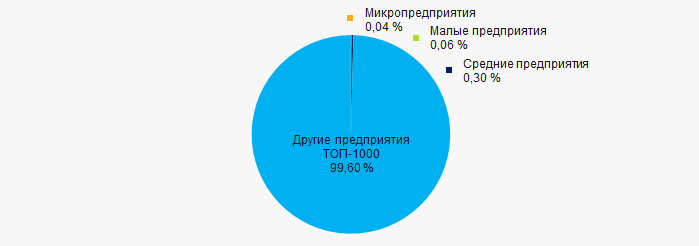

Only 7,5% of the TOP 1000 companies are registered in the Register of small and medium-sized enterprises of the Federal Tax Service of the Russian Federation. Moreover their share in total revenue of the TOP 1000 in 2020 is only 0,4% that is way below the average values over the country in 2018 - 2019. (Picture 10).

Picture 10. Shares of small and medium-sized enterprises in TOP 1000

Picture 10. Shares of small and medium-sized enterprises in TOP 1000Cities of activity

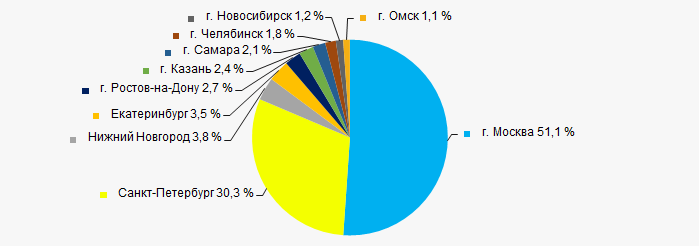

Distribution of revenue of the TOP 1000 companies shows, that more than 81% of the total volume accrue to Moscow and Saint Petersburg. (Picture 11).

Picture 11. Distribution of TOP 1000 revenue by 10 largest cities of Russia

Picture 11. Distribution of TOP 1000 revenue by 10 largest cities of RussiaFinancial position score

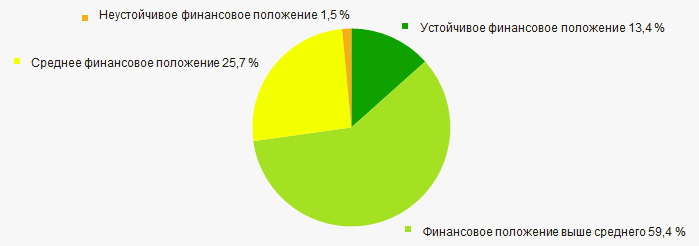

Assessment of the financial position of TOP 1000 companies shows that the majority of them have above average financial position (Picture 12).

Picture 12. Distribution of TOP 1000 companies by financial position score

Picture 12. Distribution of TOP 1000 companies by financial position scoreSolvency index Globas

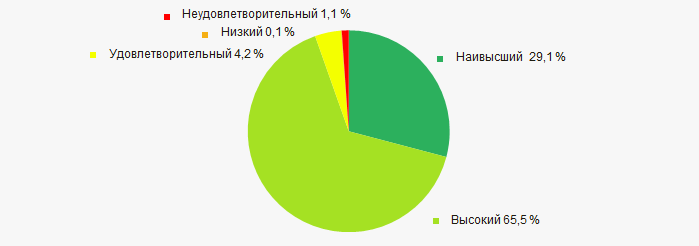

Most of TOP 100 companies got Superior / High indexes Globas. This fact shows their ability to meet their obligations on time and in full (Picture 13).

Picture 13. Distribution of TOP 1000 companies by Solvency index Globas

Picture 13. Distribution of TOP 1000 companies by Solvency index GlobasConclusion

Complex assessment of activity of the largest companies of 10 cities with a million-plus population in Russia demonstrates the prevalence of negative trends in 2016 - 2020 (Table 1).

| Trends and evaluation factors | Relative share of factors, % |

| Dynamics of the average net assets value |  10 10 |

| Rate of growth (decline) in the average size of net assets |  -10 -10 |

| Increase / decrease in the share of enterprises with negative values of net assets |  -10 -10 |

| Level of competition / monopolization |  -10 -10 |

| Dynamics of the average revenue |  10 10 |

| Rate of growth (decrease) in the average size of revenue |  -10 -10 |

| Dynamics of the average profit (loss) |  -10 -10 |

| Rate of growth (decrease) in the average size of profit (loss) |  -10 -10 |

| Growth / decline in average values of companies’ net profit |  10 10 |

| Growth / decline in average values of companies’ net loss |  -10 -10 |

| Increase / decrease in average values of total liquidity ratio |  -5 -5 |

| Increase / decrease in average values of return on investment ratio |  10 10 |

| Increase / decrease in average values of asset turnover ratio, times |  -10 -10 |

| Share of small and medium-sized businesses in terms of revenue being more than 20% |  -10 -10 |

| Regional concentration |  -10 -10 |

| Financial position (the largest share) |  10 10 |

| Solvency index Globas (the largest share) |  10 10 |

| Average value of relative share of factors |  -2,6 -2,6 |

positive trend (factor),

positive trend (factor),  negative trend (factor)

negative trend (factor)

Changes in legislation in 2021

In 2021, the Federal laws came into force concerning: changes in administrative, criminal and tax legislation, the scopes of state control, licensing and audit of reporting, the creation of new information systems, the activities of foreign companies.

Administrative and criminal legislation

The Federal Law No. 206-FL of June 11, 2021 introduced amendments to the Code of Administrative Offenses of the Russian Federation, tightening the liability for disclosing the limited access information and establishing administrative liability for illegal obtaining limited access information. Moreover, the Federal Law No. 216-FL of June 11, 2021 amended Art. 183 and 320 of the Criminal Code of the Russian Federation, clarifying the rules on the illegal disclosure of commercial and tax secrecy, and banking confidentiality, as well as information on security measures in relation to officials of law enforcement or regulatory agencies.

Federal Tax Service

From January 1st, 2021 the Chapter 26.3 of the Tax Code of the Russian Federation “Tax system in the form of the unified tax on imputed income for certain activities” is declared to be no longer in force, in accordance with the Federal law as of June 29, 2012 №97-FL.

Legal entities, having paid the unified tax on imputed income (UTII), have a right to use the simplified tax system (STS) in future as one of the tax regimes, meaning special procedure of tax payment and focused on small and medium business.

From April 24, 2021 the Federal Law No. 350-FL of October 27, 2020 came into force with amendments to Article 5 of the Federal Law “On State Registration of Legal Entities and Individual Entrepreneurs”. The law clarified the content of the Unified State Register of Legal Entities in relation to limited liability companies and joint stock companies. Some information about legal entities and individual entrepreneurs is now entered into the Unified State Register of Legal Entities by the registration authorities independently. The period within which legal entities and individual entrepreneurs are obliged to notify the registration authorities about changes in the information contained in the Unified State Register of Legal Entities has been increased from 3 to 7 working days.

The Federal Law No. 374-FL of November 23, 2020 amended parts one and two of the Tax Code of the Russian Federation and certain legislative acts. The main changes concerning legal entities are as follows:

- since January 1, 2021 it is established that in respect of a dead or destroyed taxable object, the calculation of property tax is terminated from the 1st day of the month of death/destruction on the basis of the relevant application submitted by the taxpayer to the tax authority by its own choice

- since July 1, 2021, the tax returns will be considered as unreported if the fact of signing by unauthorized persons or non-complaining of their indicators with standards will be found. For such cases, the features of termination and resumption of desk audit were established.

The Federal Law No. 470-FL of December 29, 2020 amended the RF Tax Code providing for a significant reduction in the criteria for tax monitoring.

The Federal Law No. 6-FL of February 17, 2021 amended the Article 86 of Part I of the Tax Code of the Russian Federation to oblige credit institutions to provide tax authorities with documentation upon their requests.

As amended by the Federal Law No. 368-FL of November 9, 2020, from July 1, 2021 the tax authorities will receive the right to inform the taxpayers in advance on upcoming suspension of bank accounts.

Financial statements

The Federal Law No. 476-FL of December 29, 2020 introduced the amendments to the Law “On audit activities” concerning the conditions for the mandatory audit of financial statements.

Starting from January 1, 2021 financial indicators, exceeding the threshold values of which is the basis for conducting a mandatory audit of financial statements, have been increased. Non-profit organizations are exempted from the obligation to audit financial statements if certain conditions are met.

State statistics

The Federal Law No. 174-FL of June 11, 2021 imposes a duty to form the Enterprise Group Register on the Federal State Statistics Service (Rosstat).The Rosstat Order No. 566 of September 16, 2021 defined the list of information on investment activity of group companies.

State control, licensing

According to the Federal Law No. 247-FL of July 31, 2020 "On mandatory requirements in the Russian Federation", regardless of the recognition as invalid, not effective in the territory of the Russian Federation or canceled regulatory legal acts within the framework of the "regulatory guillotine", from January 1, 2021, when exercising state control, it is not allowed to assess compliance with mandatory requirements if they entered into force before January 1, 2020 It was also established that from January 1, 2021, non-compliance with the requirements contained in such acts will not be the basis for bringing to administrative responsibility if they entered into force before January 1, 2020.

From January 1, 2021, when exercising state control, granting licenses and other permits, accreditations, it is not allowed to assess compliance with the mandatory requirements contained in officially unpublished regulatory legal acts (with the exception of requirements constituting state secrets, related to legally protected or restricted information).

These provisions are not applied in the electric power industry, as well as in the implementation of public-private partnership projects with the participation of the Russian Federation.

The Federal Law No. 478-FL of December 27, 2019 established a transition from January 1, 2021 to a "registry model" in licensing, aimed at cessation of the paper-form licensing. Licenses are now confirmed by entries in the relevant register. Access to the license registers is publicly available.

In accordance with the Law above and the Decree of the Government of the Russian Federation No. 652 from April 26, 2021, a public not-for-profit organization "Unified Gambling Regulator" was founded; the organization is established to ensure the implementation of the legislation on state regulation of this activity. In this regard, according to the Decree of the Government of the Russian Federation No. 638 from April 24, 2021, regulations that oblige the Federal Tax Service of the Russian Federation to oversee this area will become invalid from September 27, 2021 .

The order of formation, maintenance, operation and development of the Unified Register of types of federal state control (supervision), regional state control (supervision) and municipal control was approved by the Russian Federation Government Decree No. 528 dated April 2, 2021. Inspections will be possible only in case when there are appropriate entries in the Register, which is maintained by the Prosecutor General's Office of the Russian Federation, starting July 1, 2021.

Information systems

In accordance with the Federal Law No. 488-FL of December 25, 2018, the State Information System for Monitoring the Turnover of Goods subject to mandatory labeling by means of identification was created, where the following goods are recorded and monitored: tobacco products, fur products, footwear, medicines, cameras (except for cinematographic cameras), photo flashes and flashlights, tires and tire casing, clothing and linen, perfume and eau de toilette, wheelchairs for the disabled, bicycles and bicycle frames, dairy products.

The turnover of unmarked goods will be forbidden since January 01, 2021. Unsold leftover stock must be marked by the participants till February 01, 2021.

The Federal Law No. 219-FL of June 28,2021 amended the Law of the Russian Federation "On Employment of the Population in the Russian Federation". The law came into force on July 1, 2021. The employers of all legal forms of ownership, state and municipal authorities, state and municipal institutions, unitary enterprises, organizations with state participation are required to post the following information on the Unified digital employment and labor relations platform "Work in Russia".

Foreign companies

The Federal Law No. 27-FL of February 24, 2021 amended the Article 21 of the Federal Law "On Foreign Investments in the Russian Federation", concerning the rules of accreditation of branches and representative offices of foreign legal entities.

The Federal Law No. 236-FL of July 1, 2021 establishes the procedure and conditions for foreign persons to operate on the Internet in Russia using information resources with an audience of more than 500 thousand Russian users per day.